Price leadership is a critical strategy for any CEO to master in today's competitive business landscape. In an era of constant market flux and evolving customer expectations, pricing decisions play a pivotal role in shaping a company's profitability and market position. After all, pricing is the biggest profit lever for every corporation. This masterclass explores five essential elements that CEOs should consider when aiming to become price leaders in their respective industries.

1. Define your goals and what you won't do:

Effective price leadership begins with clear and well-defined goals. CEOs must make strategic tradeoffs between profit, revenue, volume, product mix, customer satisfaction, and market share.

It's crucial to remember that true leadership often involves knowing what you won't do: define the lines you won’t cross. For example, articulate when to avoid pursuing market share that your company doesn't deserve. Many internally may argue that lowering price is essential to be competitive, but remember cutting prices indiscriminately may not guarantee success. There is always a significant risk that your competitors won’t let you get away with it.

Be careful with these decisions. Seek data not anecdotes and avoid being too mercurial in the long run. Make sure that objectives are clear within leadership and there are proper forums to align on discrepancies in an open and transparent way. CEOs are naturally fighting conflicting goals, and confusion is guaranteed if the CEO’s aims don’t align with other leaders.

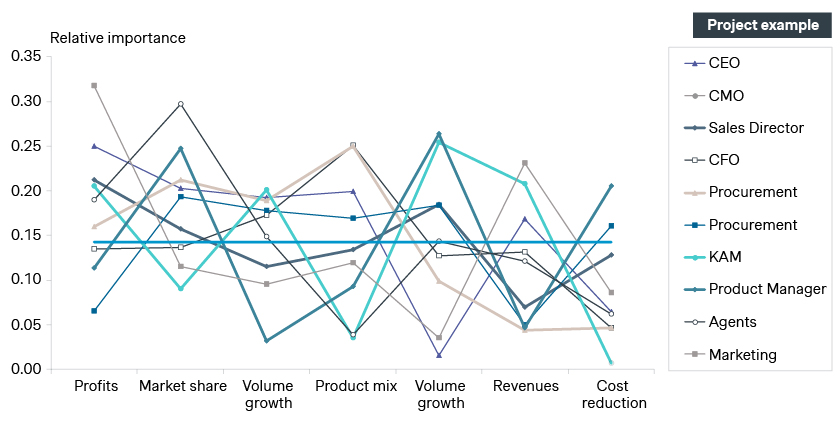

Here's an example of how confusing and misaligned goals can be among different stakeholders:

2. Understand and charge the value of your products:

CEOs must accurately assess the value of their products and services. Avoid the common tendency to undervalue legacy products (to existing clients) while overestimating the value of new innovations. Oftentimes leadership is swayed by the potential for the “next big thing” when in reality it is “a solution looking for a problem”. Instead, seek impartial market-based research to validate your perceptions. Many innovations don’t make it beyond that point, but if they do, they require a differentiated, intentional approach.

Refrain from implementing a uniform pricing strategy across all offerings; differentiate pricing for new and legacy products based on the unique value proposition for each product, market segment, and customer group. Willingness to pay is typically undervalued in B2B markets, especially for legacy products, because existing relations, technical exit barriers, or “peace of mind” are not accurately accounted for internally. Sales and product teams will claim implicit knowledge of these principles: make them write them down and substantiate them with real evidence. Leaders need to challenge assumptions and ensure that their team’s value perceptions are truly aligned with customer needs and the firm’s strategic objectives.

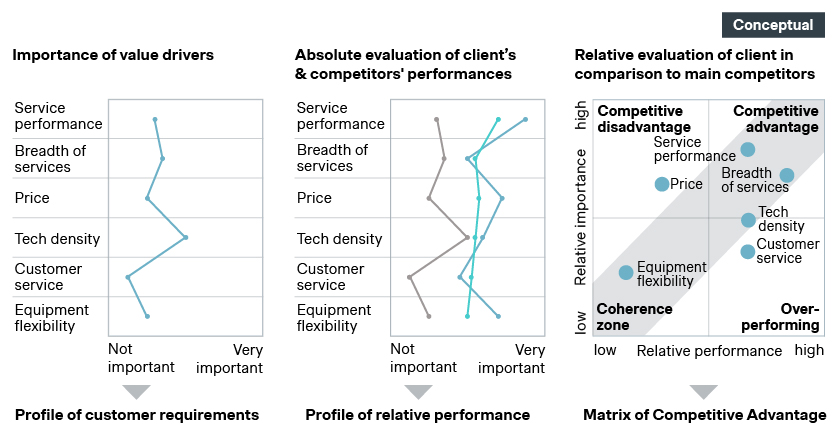

What’s really driving value and customer willingness to pay?

3. Create one consistent message to all stakeholders and act on it:

Consistency in messaging is paramount. What you communicate to stakeholders, including employees, competitors, investors, and customers, shapes perceptions and reactions in the market. Your strategic intentions and pricing strategies should be conveyed clearly. Leaving certain groups in the dark about your positioning does not help. Sending different messages even can be harmful, diminishing focus and self-confidence among the sales force. Demonstrate your commitment to price management as a critical profit lever and convey pride in the value your products and services offer. Avoid feeling ashamed of your pricing decisions. A typical mistake for a CEO is to provide self-fulfilling prophecies to the public that can harm the pricing quality. Public thought around (future or current) price declines and fights over market share or overcapacities in the market do no one any good.

4. Understand that pricing is an ongoing effort:

Pricing should not be seen as a one-time effort during budget cycles. Engage with pricing throughout the year, especially when market conditions change significantly. Key triggers for pricing review include supply constraints, external financial shocks (such as inflation), substantial deviations from the plan, and new product launches or changes in product lineups. However, avoid micromanaging pricing decisions while maintaining active engagement and assign appropriate owners to key functions. In fact, too many price moves are as bad as too few. For instance, knee-jerk price cuts as a response to temporary volume declines can do a lot of harm to the bottom line if they “contaminate” the price image and set expectations for the future.

5. Create formal accountability, establish monitoring, and reward mechanisms:

Too often, everyone touches pricing but no one owns it. Designate a pricing leader within your organization to avoid this challenge. This individual doesn't necessarily require a dedicated team but should be responsible for overseeing pricing strategies and execution. Then, implement formal accountability and reward mechanisms that incentivize your teams to achieve pricing excellence. Even measures as simple as sales leaderboards against KPIs (e.g., profitability, # of deals) can go a long way to ensure success.

Robust performance monitoring is crucial to establishing accountability. Stakeholders need to buy-in to what they are measured on and how well those data track true performance. In B2B contexts, it’s common that the expected adherence to key processes doesn’t always manifest in KPIs. Be mindful of process adherence, encourage teams to frankly address process concerns, and add additional mechanisms to track compliance if necessary. This visibility is crucial to validating whether your firm’s strategy is sound or whether it is simply being implemented incorrectly.

Conclusion: Mastering price leadership is a multifaceted endeavor

It requires strategic vision, continuous engagement, and a commitment to delivering value. CEOs who understand their goals, recognize product value, maintain consistency in messaging, remain proactive in pricing efforts, and establish formal accountability mechanisms are better positioned to succeed in today's competitive business landscape. By following these guidelines, CEOs can lead their organizations to thrive as price leaders in their respective industries, fostering sustainable growth and profitability.

Simon-Kucher has deep roots in the Industrials sector. From chemicals to construction, industrial goods to oil and gas, and business services, we are here to support you on your journey to sustainable, profitable growth. Get in touch to discuss your journey and how we can support you.

Explore all the insights from our B2B Masterclass

Unlock practical strategies in B2B pricing, sales, and marketing