In economic textbooks, you’ll find scientific/mathematical information about pricing, including price-response-curves, price elasticities, and, of course, the profit equation.

And they are all highly relevant – good pricing is the application of this science.

But for many B2B pricing situations, a lot of this science is very difficult, if not impossible, to apply. You cannot simply run huge customer surveys and extract customer value and customer willingness to pay with sophisticated market research methodologies like in a B2C environment. And in many cases, you do not have thousands of transactional data sets to apply advanced statistical and machine learning algorithms to determine and forecast your customers’ behavior.

That’s why we developed a set of methodologies for B2B pricing that allows you to work with the information you have and set superior prices without huge surveys or data analyses – while still applying all the “science” possible.

Factors influencing optimal pricing in economic theory

To do so, we work with the three basic input factors that determine the “optimal” price in economic theory:

- Customer value

- Competitors’ prices and products

- Product/service costs

It’s important to assess each of these factors accurately. And our B2B pricing methodologies rely on a systematic approach to identify and utilize these factors to find a superior price.

Let me give you three examples:

1. Smart cost plus:

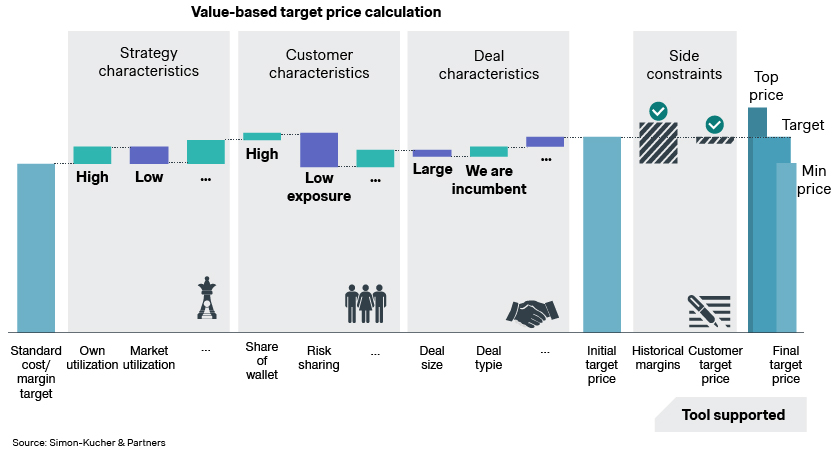

Setting prices for standard products based on costs AND customer value. Here we start with the manufacturing cost per unit/a minimum margin target. So far, so “traditional cost-plus”. But instead of adding a standardized target margin, we determine all relevant customer value dimensions of the product – strategic, customer and deal specific – and apply margin factors accordingly. This will lead to a target price that is as customer-value-oriented as possible – in a traditional “cost-plus” calculation.

2. Peer pricing:

In cases where we have enough data points – think about situations where a sales manager creates and sends multiple quotes per day – we can use a very interesting reference for pricing: the quotes of the other/the best sales managers in similar situations. To make this peer pricing approach work, you first need to define what characterizes a similar situation: same product, similar deal size, same region, etc. Then you can investigate what prices have been successfully achieved and use that as a benchmark for the rest.

3. Value-based (innovation) pricing:

For new and innovative products in a B2B environment, we are not able to run all the nice research exercises that are possible in B2C. Still, a clear customer value perspective needs to be applied. What benefits does our customer get from our innovation compared to existing solutions? These can be benefits for the customer himself (technical performance, production efficiency, energy savings, etc.) but also benefits for our customer’s customers. A detailed determination of these customer benefits is needed, followed by the question “how much of this additional customer value can we charge for – what is our value share?” Ultimately, this will lead to a target price for the innovation/a value-based mark-up compared to existing technologies. This approach is also highly relevant for all software (enhanced) products, as costs are not a meaningful starting point for pricing here.

These three examples illustrate how textbook economics can be applied in a pure B2B environment and that you can prioritize customer value and willingness to pay without extensive research or data analysis.

B2B-specific pricing strategies for specific situations

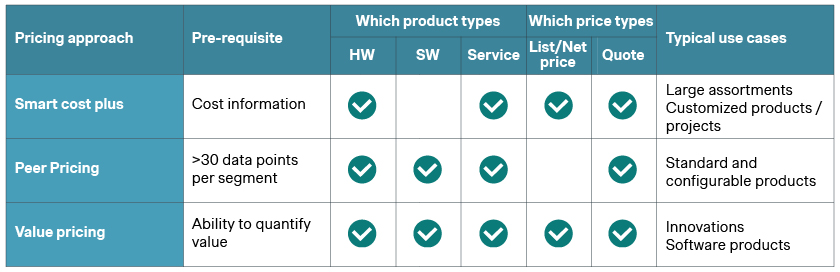

Based on our extensive project experience in B2B, we outlined which pricing approach to use in different situations:

Our experience clearly shows this will lead to significant margin improvements and positively impact the classic profit equation of the economic textbooks.

At Simon-Kucher, our expertise in B2B pricing enables us to support you in your pursuit of sustainable and profitable growth. Reach out to our specialist teams today.

Explore all the insights from our B2B Masterclass

Unlock practical strategies in B2B pricing, sales, and marketing