Pharmaceutical companies may face a more complex international reference pricing (IRP) landscape under a new European directive. Article 58a requires specific deadlines for pricing and reimbursement submissions. Our experts explain how this affects launch sequence optimization, the challenges and opportunities, and the strategies pharma companies should adopt.

Context for the proposed directive on medicinal products for human use, replacing Directive 2001/83/EC and Directive 2009/35/EC:

On April 10, 2024, the European Parliament adopted in first reading the “pharmaceutical package,” which includes a new directive and a new regulation to revise the EU Pharmaceutical Legislation. Its overall objectives are to make medicines more available, accessible, and affordable, while supporting the EU pharmaceutical industry’s competitiveness and attractiveness, with higher environmental standards. The package is meant to replace the existing pharmaceutical legislation, including the legislation on medicines for children and rare diseases.

The proposed new directive introduces measures, such as Article 58a, that significantly affect the current pharmaceutical environment. The suggested changes to Article 58a requires the marketing authorization holder, upon request by a Member State where a marketing authorization is valid, to submit an application for pricing and reimbursement (P&R) no later than 12 months from the date the Member State made its request. For some entities, (i.e., small and medium-sized manufacturers, non-profit organizations, and those with fewer than five centralized marketing authorizations, this deadline may be extended to a further 12 months of the request. Non-compliance with these obligations shall be subject to the imposition of “effective, proportionate, and dissuasive” financial penalties, the amount of which would be set by Member States.

The proposal for the directive specifies that certain medicinal products may be completely exempt from these obligations based on their nature or market.

Furthermore, it is stated that the price should be negotiated in good faith and meet the deadlines specified by the Transparency Directive. As per this directive, Members States must reach a decision on reimbursement and price within 180 days of the application for reimbursement.

It should be noted that legislative efforts will continue in the coming months, potentially leading to amendments in pertinent documents.

How can this European directive impact the launch sequence if approved with no changes?

Although there is no standard product launch sequence across countries, typical “launch waves” usually prioritize markets where a price that reflects the value of the innovative product can be obtained. In countries where the value of the drug is not recognized, the launch may need to be delayed or the drug cannot be provided to patients at all. This is necessary to mitigate the risk of affecting the drug’s price potential in other markets due to international reference pricing (IRP). Considering the potential new European directive, launch timelines in EU markets are likely to get further condensed and manufacturers will have less flexibility for defining timelines and optimizing product launch sequence.

Accelerated launch provides opportunities but also poses challenges that must be taken into consideration by pharmaceutical companies:

Opportunities:

- Reputational perspective: Patients have earlier access to innovative therapies.

- Business perspective: Earlier realization of sales and, hence, revenue.

Challenges:

- Resource perspective: Overload for the organization with multiple simultaneous launches (e.g., multiple value dossiers, HTA documentation).

- Supply perspective: Challenge to ramp up manufacturing within a shorter timeframe to be able to quickly supply many countries.

- Strategic perspective: Launch sequence planning and cross-country price optimization to minimize risk of price spillover to other countries and/or regions via IRP, which could impact an asset’s potential even beyond Europe on a global scale.

- Negotiation perspective: Requirement to make concessions to accelerate P&MA process and leading to a price that doesn’t fully reflect the product’s value.

What challenges may IRP pose to a product’s launch sequence under this accelerated and condensed timeline?

International reference pricing, as we stated in a previous article on the subject, is a process in which national decision bodies compare cross-country costs in order to set or influence the price of a product in its own country. IRP can roughly be distinguished in two different ways based on how prices in other countries are used:

- Formal application: Strict maximum price set and regulated by an official law according to a specific formula – it’s a hard stop which companies cannot cross when setting prices.

- Informal application: The reference price is one of several elements in price setting – as such, there is still room to negotiate the final price. Its importance depends on the specific situation (e.g., if a therapeutic area is very competitive with many treatment options and therefore already has set price benchmarks within a country, IRP typically play less of a role; but if there is little to no competition, external prices have more sway).

Of course, IRP is an important factor at product launch of an innovative medicinal product. Strategic launch sequence planning and cross-country price optimization are essential to avoid IRP-related price spillover, which can limit an asset’s value-based pricing in other regions. After assessing the best target launch prices of a product for individual markets, an extensive IRP risk analysis is crucial to successfully implement an optimal global launch sequence. It shows whether the country-specific optimal prices are achievable, and whether the product launch sequence strategy needs adjustment to account for IRP impact.

The new European directive is expected to condense EU market launch timelines, reducing manufacturers’ flexibility in designing optimized launch sequences. Considering that the P&MA process varies between markets, companies may be compelled to launch a product in a country where its value is not fully recognized before launching in a country with higher price potential. Hence, previous “rule of thumb” launch sequences – though not optimal to begin with – may no longer be applicable. This can amplify the risk of a price spillover to other countries and/or regions via IRP, and consequently leading to a decrease in overall revenue potential.

Therefore, in this potential new legislative framework, the correct and careful design of the product launch sequence becomes even more relevant. Manufacturers should be much more forward-thinking in their launch planning in order to mitigate IRP-risks and extract full value recognition of an innovative treatment. Given the shorter time available for launch planning after market authorization, an integrated launch strategy is crucial from the outset. Manufacturers can no longer afford to focus solely on key markets before planning for others; a coordinated, global approach must be in place from the beginning to maximize the product’s potential across all markets.

To highlight the importance of the launch sequence due to the IRP effect, let’s examine how a condensed and different launch sequence affects the overall revenue potential of a hypothetical pharmaceutical product. Optimizing the launch sequence could significantly enhance overall revenue.

Practical example:

This illustrative exercise has been conducted based on a typical launch sequence, considering the duration of the P&R process in each European market, along with the average prices of innovative products over the past 10 years. A timeframe of four years has been taken into account for the calculation of the IRP impact and cumulative net revenue.

The overall volume has been maintained across scenarios, with distribution proportional to Scenario A, to simulate a situation where stock could not be increased in the short term - reflecting one of the additional challenges this new European directive may introduce.

Three different scenarios have been assessed in terms of launch sequence, in order to calculate IRP effect and overall revenue:

- Scenario A: Assuming a typical launch sequence

- Scenario B: Assuming a condensed and accelerated launch sequence, following the potential new European directive

- Scenario C: Optimization of the launch sequence assumed in Scenario B

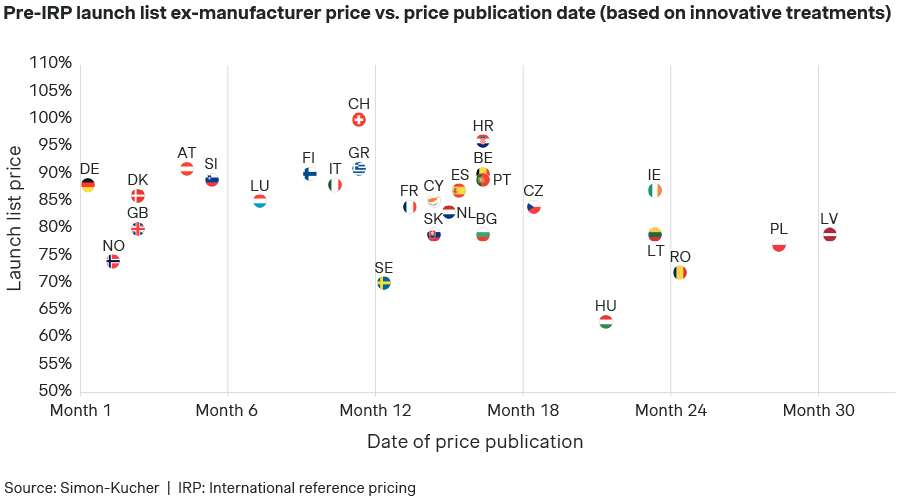

Launch sequence and list prices (pre-IRP) assumed in Scenario A:

Launch sequences vary by product, with typical "launch waves", but for some drugs, a country that is usually first to market may need to launch later, showing these waves aren't always optimal. For instance, countries where the value of the drug is not recognized, the launch may need to be delayed (e.g., Hungary, Latvia, Poland, or Romania, in this illustrative exercise). This is necessary to avoid a risk for the price potential in other markets due to international reference pricing. In contrast, priority is usually assigned to markets in which a price can be obtained that reflects the value of the innovative product (e.g., Austria, Denmark, Germany), or markets considered as key in terms of overall revenue contribution (e.g., United Kingdom).

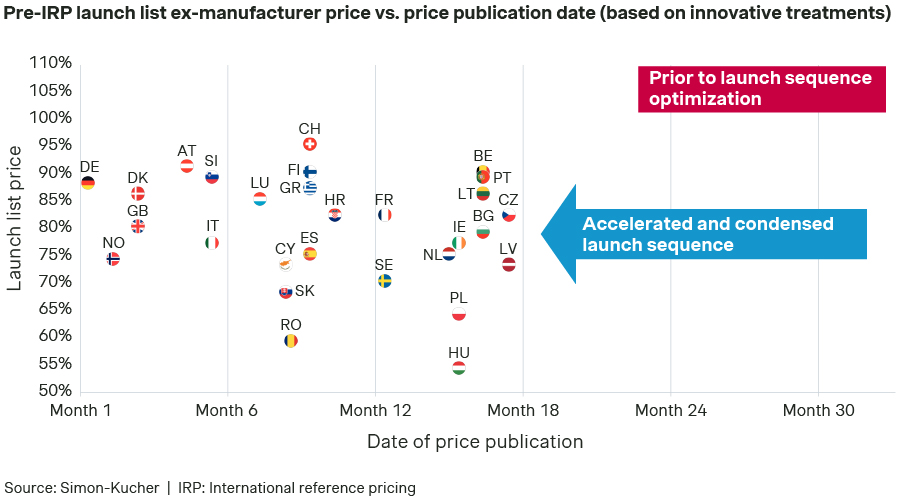

Launch sequence and list prices (pre-IRP) assumed in Scenario B:

To simulate the potential impact of the new European directive, the launch sequence of Scenario A was condensed. In markets where an accelerated launch was applied, a corresponding price concession was also assumed, proportional to the number of months the launch was expedited, up to a maximum of 20 percent reduction. This trade-off is likely to be required in some markets.

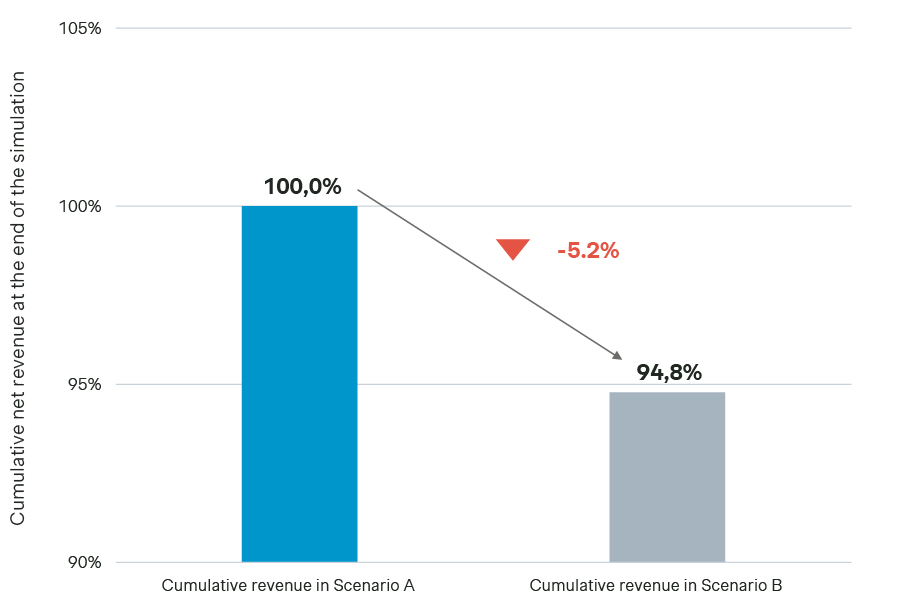

Cumulative net revenue comparison between Scenarios A and B:

In terms of cumulative net revenue, at the end of the simulation (four years), this condensed launch sequence would entail a decrease of -5.2 percent vs. Scenario A, given that IRP plays a considerably larger role, changing the average net price from €0.71 in Scenario A to €0.66 in Scenario B (i.e., -7.0 percent).

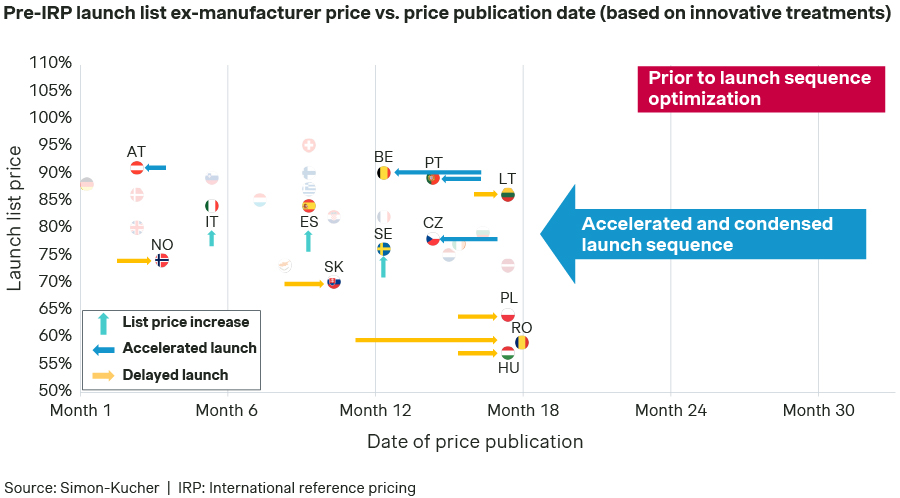

Launch sequence and list prices (pre-IRP) assumed in Scenario C:

How could the manufacturer potentially mitigate the IRP effect of the condensed launch sequence?

- In those markets that do not formally apply IRP as a mechanism to set the price of a product (e.g., Italy, Spain, and Sweden), there would be some room for the manufacturer to negotiate the final list price. In such cases, a list price increase would mitigate IRP risks in other markets. It is important to highlight that the net prices remain completely unchanged in this analysis.

- Additionally, even with the hypothetical implementation of this new European directive, manufacturers would still have some margin to optimize product launch times. The directive stipulates that manufacturers have 12 months from the date a Member State requests a P&R application to submit it. Once submitted, the Member State has six months to reach a decision. This means the manufacturer has up to 18 months from the Member State's request to launch the product. Considering these timelines, strategically accelerating (e.g., in Austria, Belgium, Czech Republic, Portugal) or delaying (e.g., in Hungary, Lithuania, Norway, Poland, Romania, Slovakia) product launches in certain countries could have a positive impact on IRP. This could potentially mitigate price decreases and result in higher revenue for the manufacturer.

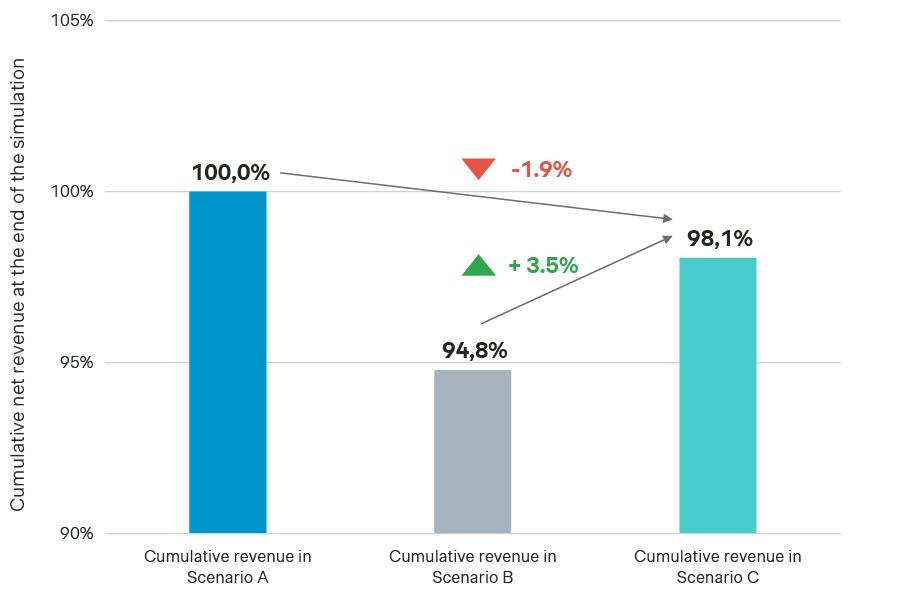

Cumulative net revenue comparison between Scenarios A, B, and C:

When comparing the three scenarios, we find that optimizing the Scenario B launch sequence (i.e., Scenario C) improves its performance relative to Scenario B. Although the cumulative net revenue for this optimized Scenario B remains 1.9 percent lower vs. Scenario A, it significantly reduces the IRP impact compared to the original Scenario B, leading to a net revenue increase of 3.5 percent.

This launch sequence optimization decreases the IRP risk substantially for many countries, leading to a better protection of the net price across markets and achieving an average price of €0.70 at the end of the analysis.

With optimized supply, accelerated launch due to the directive could even increase the overall revenue if IRP is considered in the strategy development. Hence, it is not only an advantage for patients but may also increase the value extraction for the manufacturer.

As a recap, what are the main considerations for a condensed and accelerated launch sequence?

- Accelerating the European launch timelines has potential advantages from a business as well as reputational perspective (e.g., earlier realization of volume and revenue, patients have earlier access to novel therapies)

- However, achievable price levels in individual countries are (partly) dependent on other countries via international reference pricing.

- The complex combination of the earlier start of the P&MA process and the shortened P&MA timelines in Europe could lead to prices becoming available earlier in countries with a lower ability to pay. Those prices could subsequently be referenced by countries with a higher willingness to pay that are typically earlier in the launch timeline.

- Hence, a careful launch price strategy and launch sequence optimization is required to mitigate risks and maximize the value of an innovative treatment.

- Additionally, manufacturers should closely monitor potential political changes across countries. While IRP regulations are constantly changing, the frequent changes may pose a bigger challenge if countries try to adapt their IRP rules to the new European regulatory environment. Changes in policy in a single country can have major global impacts, and effects must be analyzed across all regions, not just the local market.

How can Simon-Kucher support pharmaceutical companies?

At Simon-Kucher, we equip pharma companies with future-ready launch strategies. From real-time decision-making to long-term planning, our approach ensures that drug launches are not just successful in the present but achieve sustainable and long-lasting success.

Our team of experts support clients with a robust IRP strategy and launch sequence optimization for all product innovation launches. We utilize our proprietary IRP solution (Simon-Kucher LS Genius | IRP), which includes a comprehensive IRP rule library that accounts for specific market regulations and reflects current legislations and insights from our local country-experts on their practical application.

Incorporating an advanced Monte-Carlo algorithm, it even adequately reflects informal rules and uncertainties in any assumption to build a robust strategy that considers the complex challenges of IRP. It can also be licensed to clients to help you to set the best prices for your products and to enhance patient access to your innovations.

If you are looking to launch a medicinal product but are worried about international reference pricing implications, reach out to our experts Ana Mozetic and Rainer Opgen-Rhein to discuss your challenges!

For any questions or requests on the proposed European Pharmaceutical Legislation reform as well as other health policy-related topics, please contact the Simon-Kucher Center of Excellence (CoE) on EU JCA and Health Policy (EU.JCA.HealthPolicy@simon-kucher.com).

With contributions from Javier Salcines.

To learn more about our expertise and capabilities, visit our website

Better Market Access

The role of better market access is to remove any hurdle that prevents or hinders patients from receiving available treatments. In the right place, and at the right time.

Today, the impact of market access spans clinical development, regional commercial activities, patient engagement, and post-launch compliance. Yet, for many pharmaceutical companies, planning for commercialization only truly begins when a drug has been submitted for approval — far too late in the process.

Get to know our insights on local trends, regional and global developments and global to local excellence.