Compared to the last three years, 2024 has presented a vastly different pricing environment for consumer goods companies in North America. As we enter 2025, opportunities exist for CPG brands that can get RGM right.

A New Focus on Revenue Growth Management

Many consumer goods companies are currently taking stock of their holistic price-pack architecture. In many cases, companies are realizing that their products have either exceeded key consumer price thresholds, have spread gaps too wide versus competitive SKUs, or have created internal inconsistencies between pack sizes. In other cases, we’ve seen brands accidentally vacate key category price points entirely.

At the same time, as price-pack architectures have drifted out of optimal alignment, consumer spending is pulling back. Retailer acceptance of further pricing action has become very low, and retailers are resisting price increases. It seems that for now, cost inflation is under control, and in some cases, it is even receding. Broad-spectrum price increases are challenging, at least for the time being.

How Did We Get Here: 2021-2023's Unprecedented Demand, Cost Inflation, and Supply Chain Instability

From 2021 to 2023, supply chain disruptions and rapid cost inflation forced many brands to pass sequential price increases through to their retail partners, and then onto consumers. Retailers, keen to keep shelves stocked amid the post-pandemic demand boom, offered little resistance. In many cases, price action notifications were flying at them so quickly that they barely had the bandwidth to acknowledge receipt, let alone evaluate the merits of the increase.

The relentless pace of cost increases put brands in a tough spot. Often, there simply wasn’t enough time to be strategic about how to flow incremental costs through to retailers. Instead, a 'peanut butter spread' approach to pricing was adopted: 6% in this category, 4% in that category—broad, undifferentiated price increases applied across the board.

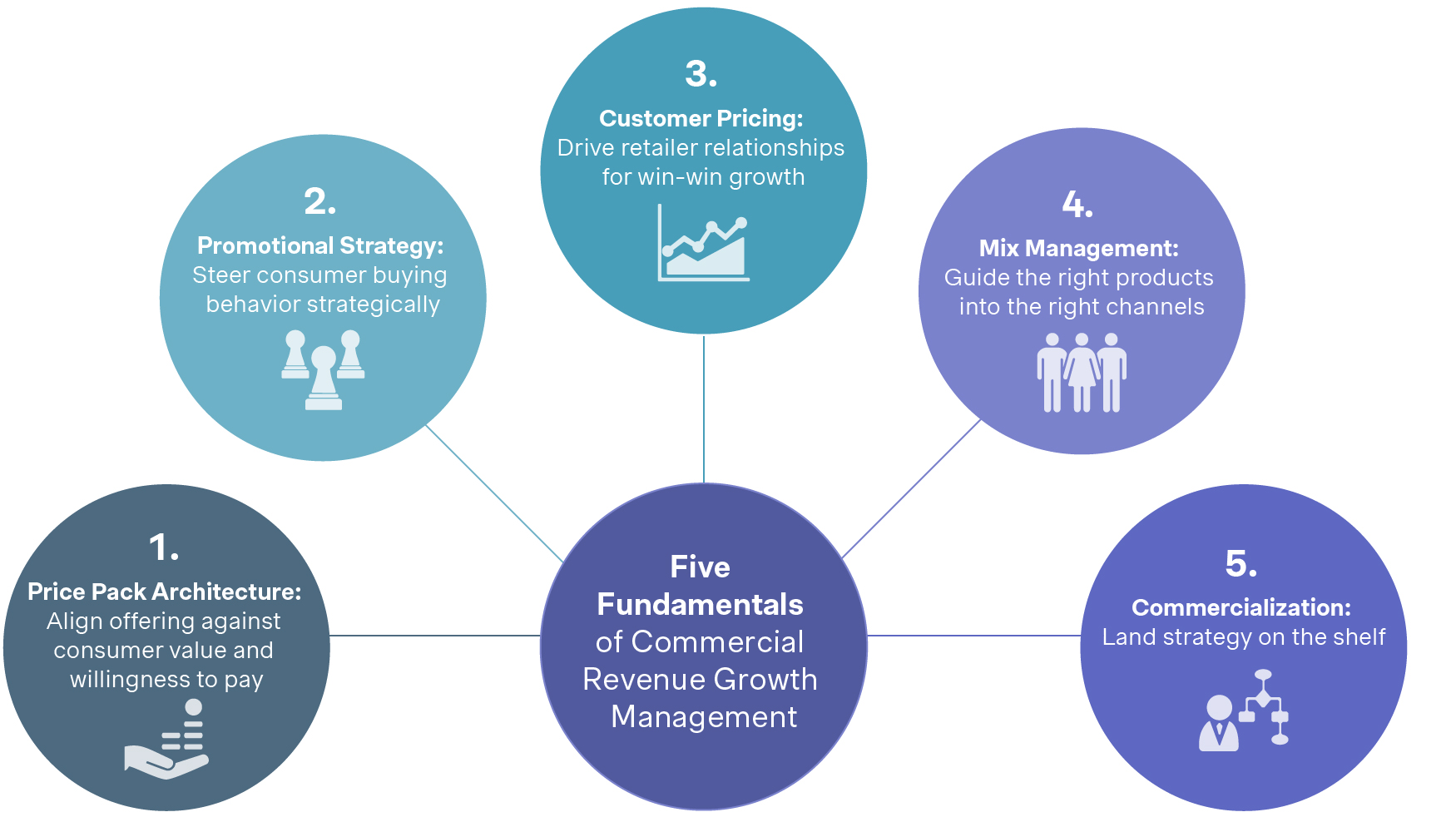

As category growth has stabilized, consumer spend has moderated, and supply chain distribution resolved, we’ve observed a marked shift in revenue growth management (RGM) focus. This shift can be broken down across five key commercial pillars:

- Price-pack architecture

- Promotional Strategy

- Customer Pricing

- Mix Management

- Commercialization

Reactive Pricing

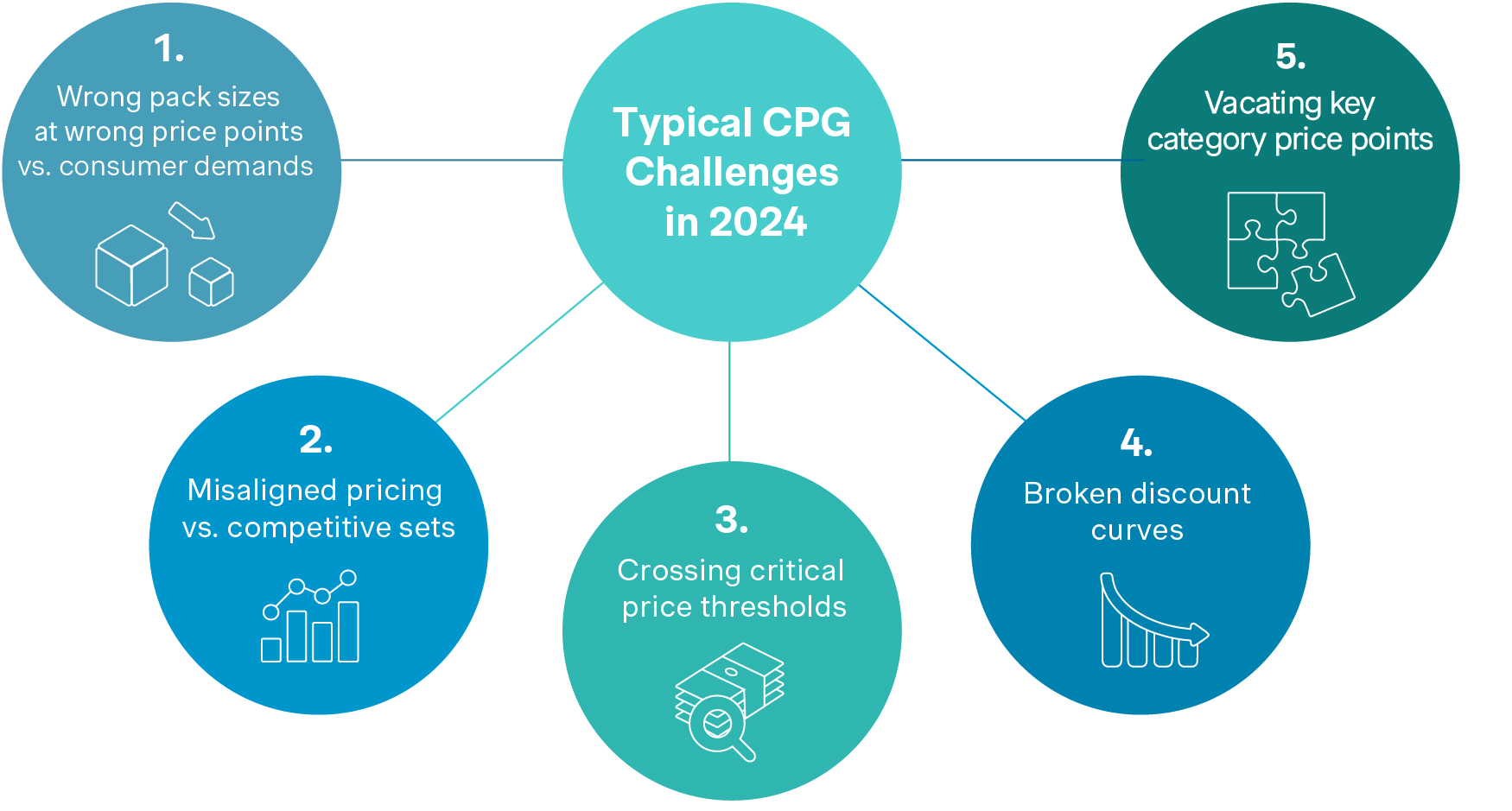

In 2021 to 2023, most of the urgency was on the first pillar, price-pack architecture – and specifically, price increases. This pillar was driven by high consumer pull-through, high retailer acceptance, and sequential periods of cost inflation. RGM teams were primarily occupied with determining how much of their cost increases could be passed through to retailers with limited consideration for pack roles and portfolio strategy. Many of the price increases were implemented using the same "peanut butter spread" approach. The result is that price-architecture drifted out of line:

- Wrong pack sizes at the wrong price points vs. consumer demands

- Misaligned pricing vs. competitive sets

- Crossing psychological price thresholds

- Broken discount curves

- Vacating key category price points (including OPPs)

The other four pillars either took a back seat during this period of high-cost inflation or were misused. Promotional strategy was overused as a lever to smooth successive price increases, and in many cases, additional promotional dollars were applied without attached incrementality.

Trade programs and customer pricing strategies also received limited focus during this time. Many trade programs were pushed out of line with the strategic intentions they were designed to support. The rush to address immediate price pressures often led to a misalignment in these areas.

In mix management, the issue of short supply caused manufacturers and retailers to prioritize available SKUs and deprioritize those that were not currently available. This forced many brands to rationalize their portfolio and focus more on core offerings at the expense of strategic portfolio management.

Finally, commercialization efforts were impacted by damaged retailer relationships. The value chain experienced mixed success in realizing price strategy, with significant dealing back of trade to help smooth through price increases. Operational challenges and short supply strained relationships, putting sales teams in a position where concessions were made to keep SKUs in distribution or to soothe frustrated buyers facing yet another price increase.

A New Focus on Revenue Growth Management

2024 has seen a remarkably different picture and a significant shift in RGM focus. The changing consumer demand landscape and challenging retail environment have put a spotlight on issues across the five RGM pillars. Growth is still available, but to capture it your RGM strategy must be more nuanced, more specific, and more intentional.

Stratetic Realignment Across the Five Pillars

In response, the work that consumer goods companies are doing now is focused on rebalancing their portfolio across key price points by:

- Making surgical price adjustments

- Considering key shopper price thresholds

- Using price indices vs. competitive sets that align with brand-value positioning

- Ensuring that the right packs are on shelves in the right price tiers

The goal is to bring strategic and logical coherence back into the price-pack architecture that balances across brands, packs, price points and channels.

For promotional strategy, there has been a renewed focus on alignment, ROI and incrementality. Manufacturers are directing dollars toward must-win periods and pack roles that drive strategic objectives.

The same is true for trade spend and customer pricing. We’re seeing an increased tightening of proliferated trade spend, a greater requirement for counter-performance, and companies beginning to look at gross-to-net spend as a lever to drive net price increases.

In mix management, companies are determining how to drive mix against key price points and pack sizes. In many cases, they’re taking advantage of consumer trade-downs to promote and position value packs, value brands, and value channels to align with constrained consumer budgets.

Currently, the focus is on regaining trust and securing key customers for future growth. In an environment where trust is low, how brands articulate a vision for category resets to their retail partners is critical. Having a compelling narrative and selling story that helps retail partners understand why:

- Price-pack architecture needs to be realigned

- Promotional dollars need to be redirected

- Trade program needs to be readjusted

This is key to ensuring retail partners buy in to a strategy that creates value for the category, the manufacturer, the retailer, and the overall category.

Ready to take on the complexities of 2025 pricing? Our team of experts is here to help you align your pricing strategies, optimize your revenue growth, and stay competitive in today’s challenging market. Whether you're reassessing your pack price architecture or refining promotional tactics, we have the insights and tools to support your growth goals. Contact us today to start building a strategy that positions your brand for success.