A well-thought-out pricing strategy is fundamental to maximizing contract value and ensures you are not leaving money on the table.

At Simon-Kucher, we specialize in helping companies maximize contract value through tailored strategies that address every aspect of your pricing model. Whether you’re a software company or service provider, we understand the importance of structuring contracts that reflect the true worth of your offerings.

This article provides a straightforward approach for identifying and improving the worst-performing price agreements in your customer portfolio. It empowers you to enhance profitability and drive sustainable growth.

Is inconsistent pricing harming your contract value?

Companies frequently grapple with deeply ingrained pricing strategies. Many are disorganized for customers and ambiguous for the business itself. Over the years, customer discount rules and "unique customer exemptions" have accumulated, rendering an objective assessment of price performance across customers virtually unattainable.

A self-made pricing maze, coupled with a common unhealthy fixation on market share, creates an ideal environment for subpar price contracts. These persist in damaging your company's overall profitability.

Negative price outliers can pull down your overall price performance dramatically. The positive aspect is that you can fix these negative anomalies with a simple strategy. Even more encouraging is that rectifying these outliers will swiftly and substantially influence your company's net earnings.

Your first aim is to answer these key questions:

- Where in our customer portfolio are we satisfied with price performance?

- Where can we make substantial improvements?

The absence of transparent pricing terms and customer comparability frequently leads to endless debates between your commercial and finance teams. Nevertheless, adopting a simple, two-step strategy can resolve these perpetual arguments.

Our approach helps you objectively identify negative price outliers so that you can work to repair them. This provides a fast route to enhancing your business's pricing approach, eliminating the necessity to launch extensive pricing schemes. Nonetheless, outlier correction is an excellent initial move in broader, long-term plans for price refinement.

Build the foundation for a clear price structure

First, you must define a foundation of clear pricing conditions. Agreeing on a fresh set of pricing terms that apply to all current and prospective customers is essential. One success factor is the inclusion of representative teams from your sales and finance departments in the process. Ideally, the pricing terms should encompass both customer-specific and deal-specific conditions.

Examples of customer-specific conditions include the size of the customer, wallet share, and conditions of strategic significance. Deal-specific conditions include the volume (of a deal or contract), the cost for the customer to switch, or more internally focused conditions like capacity usage and stock levels.

To ensure a targeted and effective process, we recommend limiting the total number of conditions to five. In certain instances, creating a weighting scheme might be essential to account for potential significant variations.

It would be best to articulate the prerequisites and the measurements supporting conditions clearly and unambiguously. This improves the sales team’s ability to steer future customer behavior. For instance, you can employ pricing strategies to incentivize customers to place larger orders and make timely payments. The updated pricing strategies will aid the sales team in steering customers towards a better "pay for performance" scenario.

After implementing the newly established pricing conditions, you can use them to assess deals and customer performance. "How does each customer fare under the newly established pricing conditions?" The interesting part is your commercial teams will evaluate the customer portfolio in a more structured way than before. They will structurally discuss questions like:

- How strategically important is this customer to us?

- What is a feasible projection of this customer's growth potential?

Identify and “fix” the most unfavorable pricing agreements

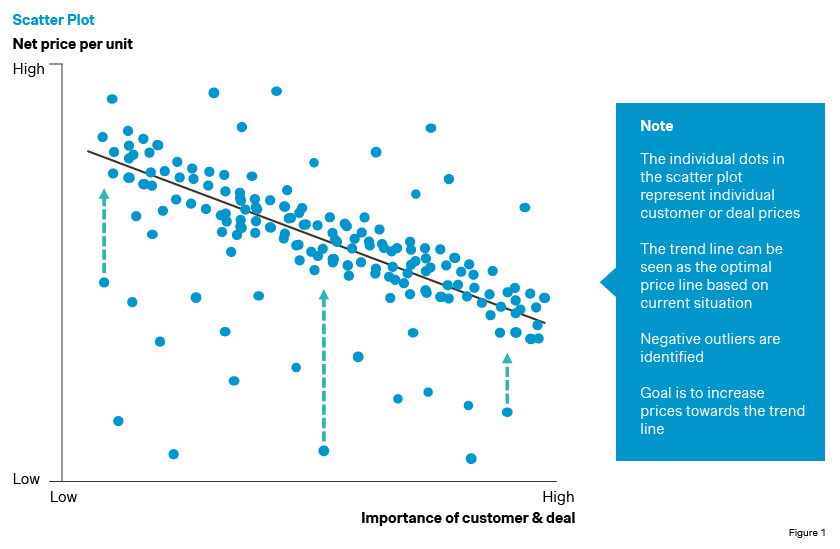

In the second phase, your comprehensive groundwork begins to create promising opportunities. Utilizing the categorization process from phase 1, you can compare each customer or deal performance against the net price. This comparison yields an unbiased categorization of anomalies, as depicted in Figure 1.

A trend line will often emerge when compared with the net price. The more significant a customer or deal is, the more you can rationalize a competitive price. The greater significance could mean a larger, more extensive, strategically more crucial customer with bigger order volumes. The more pronounced the trend line (with the points clustering closer together), the more rational your company’s existing pricing strategy is.

Regardless of the power of the trend line, emphasis should be placed on the negative outliers that are significantly below the line, which are now visible.

The true strength of this method is that it allows for effortless comparison of all pricing contracts side by side. There can be no further justification for the underperformers. Therefore, the sales force aims to improve prices or increase customer performance.

Understanding the total value of a contract helps negotiate better terms and assess the effectiveness of price agreements. When calculating the total contract value, make sure to include all recurring and one-time fees. This comprehensive calculation helps negotiate better terms and identify areas where you can increase charges without compromising customer satisfaction.

Where and how to start repairing?

In many cases, there's a good chance your customers already know they have a superior deal at your company. Only now you know it for sure as well. The knowledge you've acquired will assist the sales team in negotiating price increases.

There are various tactics and techniques for fixing outliers. We briefly touch upon three of them here:

Make prices more conditional.

In certain situations, the price levels may stay as long as you can increase the customer's reciprocal performance. For instance, you inform the customer that if they desire to maintain their existing price rates, they need to boost their business volume with your firm. This is the epitome of "pay for performance."

Improve value selling capabilities.

As a rule, the more negotiations focus on value, the better the price will be. Regrettably, negotiations frequently focus exclusively on price. We advise our clients to enhance their ability to sell value. An effective way to achieve this is to develop a value-selling playbook for the sales force.

![price agreements image 2]()

Take the revenue management perspective.

Long-term contracts provide stability and predictability in revenue streams. Encourage customers to commit to longer contract terms by offering better price agreements and additional incentives. For instance, offering discounts for multi-year agreements can entice customers to lock in their contracts for extended periods, increasing the TCV and reducing churn.

Monthly recurring revenue (MRR) is also a crucial metric for SaaS companies and businesses with subscription models. Optimize your price agreements to maximize MRR. Upselling and cross-selling additional features or services can provide more value to the customer and increase the contract value.

Another key question your commercial function needs to answer is: At what price are we willing to lose a customer when we know we can get a better price elsewhere?

Sometimes, customers choose to accept the proposal. However, in other instances, finding a new customer might be more beneficial.

Continue increasing contract value

Done with the fixes? As previously stated, the achieved quick wins can whet your appetite for more.

Begin contemplating the subsequent measures your business can implement to enhance your pricing authority. Effective price agreements that encourage long-term loyalty and repeat business can significantly increase customer lifetime value. Think about list prices based on value, tools for tracking prices, comprehensive campaigns for raising prices, and strategic repositioning of price/value.

Simon-Kucher is here to help you unlock the full potential of your business. By analyzing your customer segments, we design pricing strategies that cater to diverse needs, boosting overall contract value. Reach out to us today.