Explore how Gross-to-Net (GtN) optimization can boost growth opportunities for pharma companies. Simon-Kucher’s GtN excellence programs help unlock both short and long-term performance with meaningful improvements to Return on Sales.

Strategic optimization of Gross-to-Net (GtN) investments can unlock growth for the pharmaceutical industry, yet commercial and pricing teams frequently overlook its impact in driving profitable growth.

GtN optimization refers to the process of measuring and optimizing the difference between a product’s initial gross sales and its net revenue after sales deductions and adjustments. This process evaluates the actual economic impact of a pharma company’s offerings by taking all price deductions into account, including discounts, rebates, clawbacks, and free goods.

At Simon-Kucher, our GtN excellence programs thoroughly assess every lever leading to net revenue deductions, unlocking pharmaceutical pricing potential by identifying areas of improvement to increase sales while maximizing margin.

The importance of GtN and its relevance in pharma

By optimizing GtN processes, businesses can gain transparency and control over their investments and revenue streams, addressing issues such as hidden profit leakage and inadequate performance metrics.

GtN optimization applies across diverse market situations, price agreements, and product categories, spanning all stages of the product lifecycle. Therefore, strategic investment in GtN processes is crucial to prevent revenue leakage and capitalize on growth opportunities in both private and public channels.

Despite its importance, many pharma companies still underestimate its value. In this article, we explore how businesses can leverage GtN to drive value, optimize revenue, and overcome common pitfalls associated with its implementation.

Common pitfalls in GtN management and how to optimize for them

Inefficient management of GtN processes can lead to decreased profitability and missed opportunities to further grow sales. Through our experience working with leading global pharma Multinational Corporations, we observe several common pitfalls in areas that contribute to inefficiencies in GtN processes:

- Inconsistent customer investment

- Product strategy misaligned with competitive situation and/or life-cycle state

- Inconsistent GtN per product across similar accounts

- Suboptimal and ineffective commercial policy setup

- Lack of meaningful customer counter-performance

- Poor tracking of performance (data management)

In this article, we will explore two examples of poor GtN management in pharma and potential solutions to overcome these shortfalls.

Inconsistent customer investment

One of the most common pitfalls we observe is the poor correlation of GtN investments with customer value or potential. In an ideal situation, there should be a clear and systematic differentiation of GtN investments, taking into account factors such as customer size. This ensures efficient allocation of resources, maximizing overall return on investment.

However, we observe that GtN investment levels are often poorly correlated in reality. For example, two customers with similar gross sales may receive vastly different levels of GtN investments, while two different customers with significantly different gross sales may receive similar GtN investments. This disparity in GtN discounts within similar customer sizes reveals inconsistences in a pharma company’s GtN strategy, presenting significant opportunities to boost margins or increase gross sales by aligning GtN investments with gross sales. Therefore, a systematic differentiation of GtN investments is crucial to make differences clear, both internally and externally to clients. If a large customer receives the same price as a small customer, the large one will leverage this to negotiate more discounts. The end goal here is to correlate GtN investments with gross sales, rewarding the largest customers with the largest investments and incentivizing smaller customers to increase gross sales for higher discounts.

One of the ways that best-in-class manufacturers manage GtN systematically is by using a customer segmentation framework that assesses value or potential across multiple criteria. This approach optimizes GtN performance by rewarding performance across various metrics and ensuring flexible adaptation to market changes. Different criteria are selected to represent an account’s value, and GtN investments are calibrated accordingly to allocate discount levels based on an account’s overall value. By adopting these methodologies, pharma companies can look beyond historical sales growth and include other factors such as sales growth potential, strategic account management, and market share.

How to achieve this

- Align GtN investments with an account’s value or potential using a systematic differentiation approach to ensure the differences are explainable

- Reward largest customers with highest GtN investments to sustain their performance

- Ensure GtN investments for smallest customers are proportionate to their sales performance, and incentivize sales growth for larger discounts

- Implement multi-variate GtN setups to systematically allocate investments to high-value customers, looking beyond just gross-sales value

Inconsistent GtN per product similar accounts

Another common pitfall is uneven GtN investments at the brand level across comparable customers with similar price sensitivities. In cases where comparably similar accounts have similar products, discounts for these products should ideally follow a consistent trend. However, we often observe inconsistencies with GtN investments following different directionality (e.g., products within a portfolio have different directions of GtN ratios). This indicates a lack of systematic product differentiation at the account level and failure to manage gross-to-net investments.

Such an absence poses several risks. For starters, insufficient investments may lead to reduced competitiveness for products and customers. On the other hand, overinvesting in specific products or customers could unnecessarily erode margins. Unequal pricing across similar products may also result in unhappy customers who perceive unfair treatment. Additionally, without a clear system in place, the sales team may struggle to effectively justify or defend pricing strategies.

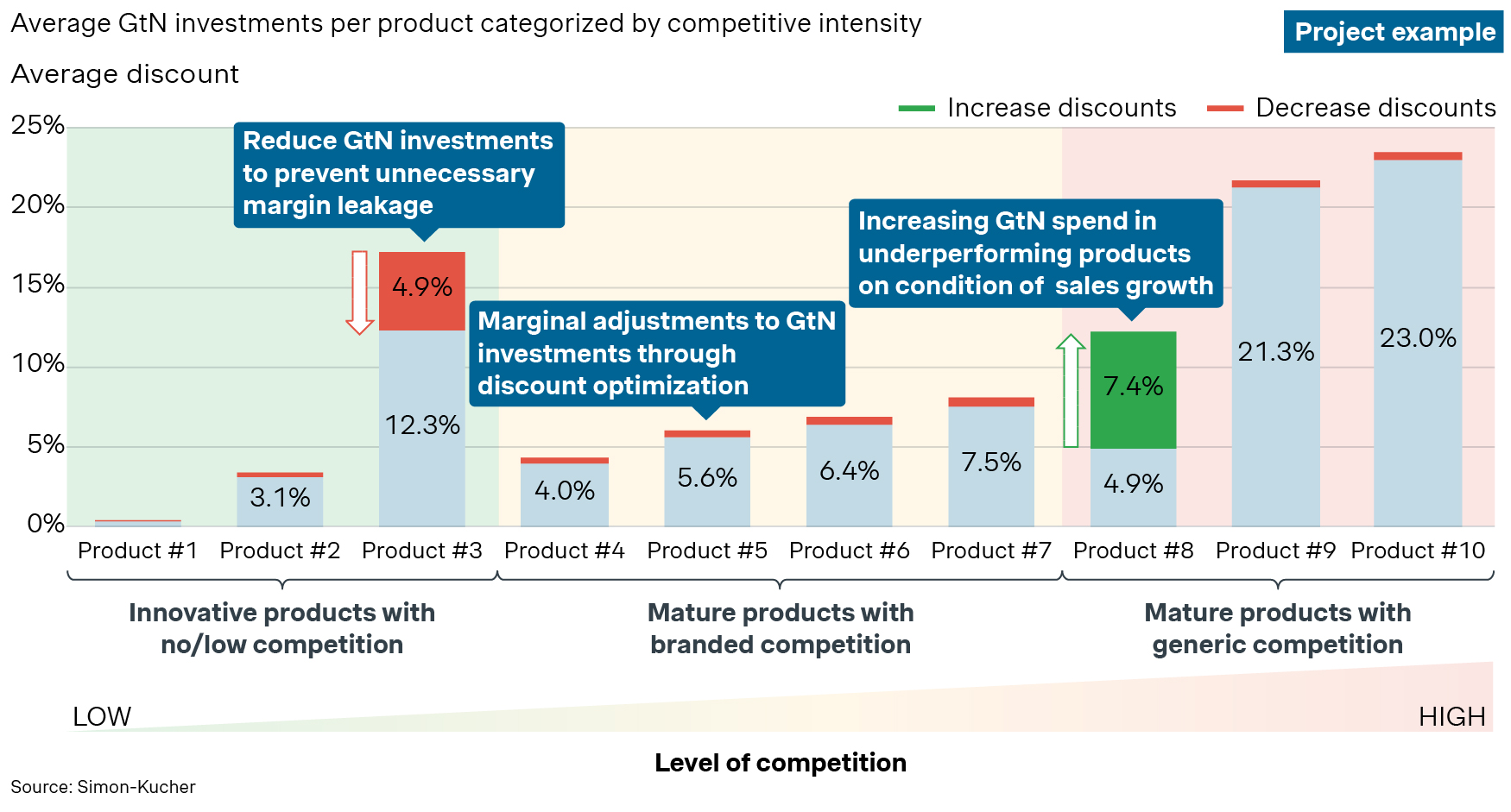

Best-in-class pharma companies today utilize systematic product differentiation to objectively assess and define product-level GtN investments in line with various criteria. For example, level of competition amongst other criteria may be used to differentiate GtN investments per product type.

Similar to the customer segmentation framework discussed in the first example, product differentiation allows pharma companies to objectively differentiate GtN investments based on defined criteria. This ensures that directionality of discounts across products remains consistent for all customers. Adopting this systematic approach allows logical definition of GtN investments in line with level of competition.

How to achieve this

- Maintain consistency in the directionality of GtN investments across products when applied to different customers

- Identify inconsistencies in product discount directionality indicating a suboptimal product differentiation strategy

- Adopt a product differentiation to systematically differentiate GtN investments across products, using objective criteria to assess competition level

- Aim to optimize product-level GtN investments to avoid unnecessary discounting in low-competition therapeutic areas, while increasing it in highly competitive situations

Simon-Kucher’s Gross-to-Net capability framework

Managing GtN investments poses significant challenges for pharma companies, which typically prioritize reimbursement price levels over net prices. However, effective GtN optimization is crucial for preserving net prices by minimizing leakage beyond reimbursed prices.

Pharma companies face various strategic, data-related, and execution challenges when managing their GtN investments. A comprehensive strategy, including data transparency and aligned execution, is crucial to address challenges and optimize Gross-to-Net investments, complemented by extensive change-management initiatives.

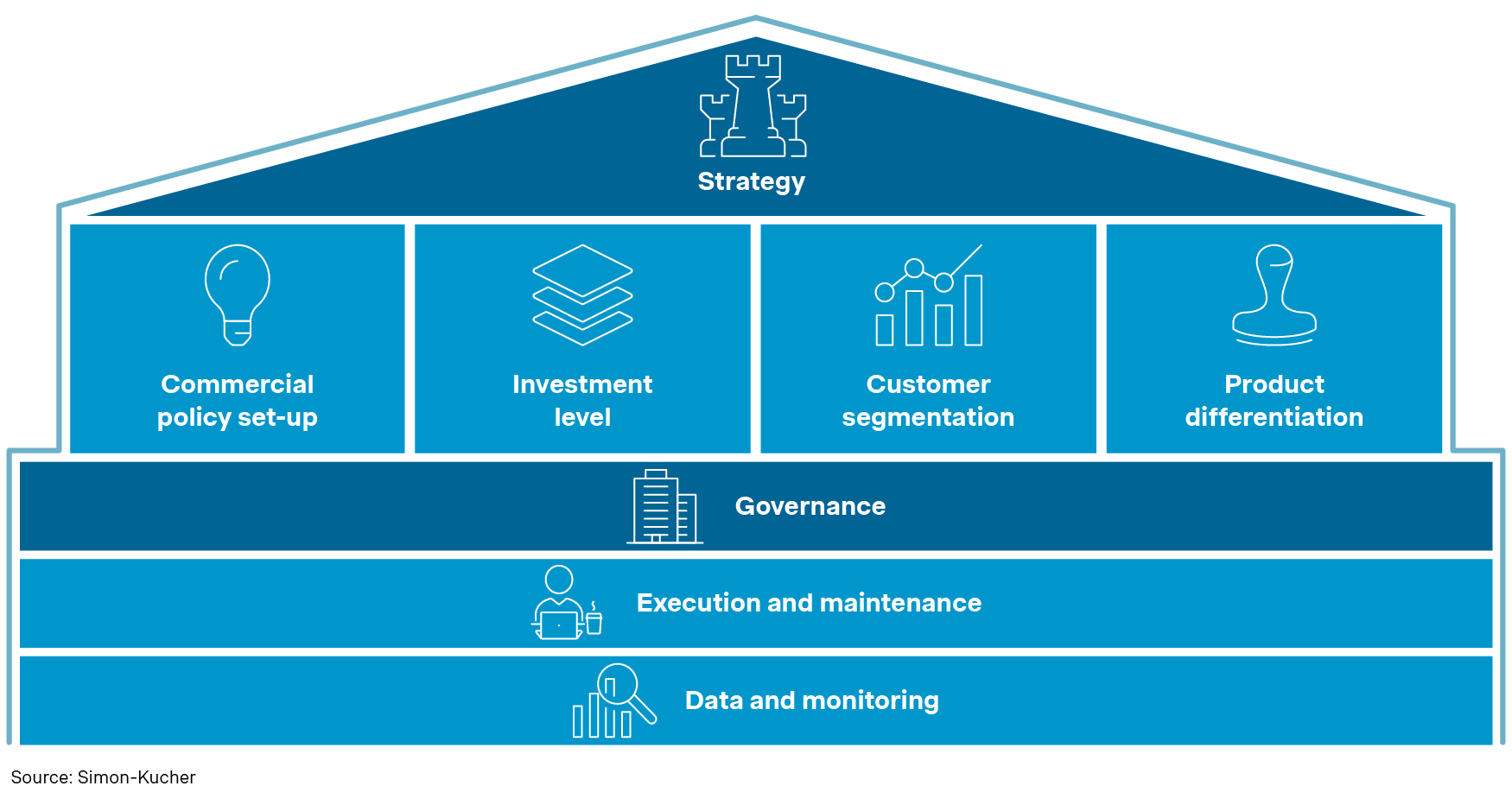

Our Simon-Kucher GtN capability framework looks at all levers of a well-rounded GtN strategy and enables pharma companies to develop commercial policies tailored to diverse customer segments and channels while optimizing GtN investments.

By categorizing customer groups and product types based on discount distribution and resource prioritization, we tailor investment strategies for maximum impact. For long-term Gross-to-Net success, teams must be empowered so they can adapt to market, competition, and product changes. Effective governance, supported by data transparency and monitoring, is crucial for successful GtN execution and maintenance.

Ready to unlock the value of GtN?

Gross-to-Net excellence programs drive performance and profit improvements through strategic initiatives, supporting tools and dashboards, and customer-centric investments.

The impact of GtN processes depends on the timeline. Quick wins offer immediate returns, while long-term changes require time and planning. It often takes time for many solutions to become effective. Therefore, migration plans, detailed risk assessments, and transparent discussions among teams are crucial for the effective execution of GtN strategies. On average, successful companies see a 1-5 percent rise in Return on Sales when implementing these solutions.

At Simon-Kucher, we excel in optimizing GtN processes through our GtN capability framework, empowering teams and building capabilities to realize opportunities and unlock sustainable growth. Our consultants are experienced in guiding pharma companies through short-term to long-term solutions that are tailored to local market contexts and nuances.

Developing your pricing strategy must align with all ethical and regulatory frameworks to ensure fairness and drive transparency. This approach guarantees that all stakeholders, especially the crucially important customer, view your pricing strategy as fair and equitable.

Are you ready to discover how Gross-to-Net is relevant for your pharma business? Reach out to us to set up a discussion on how you can start optimizing your GtN performance today.