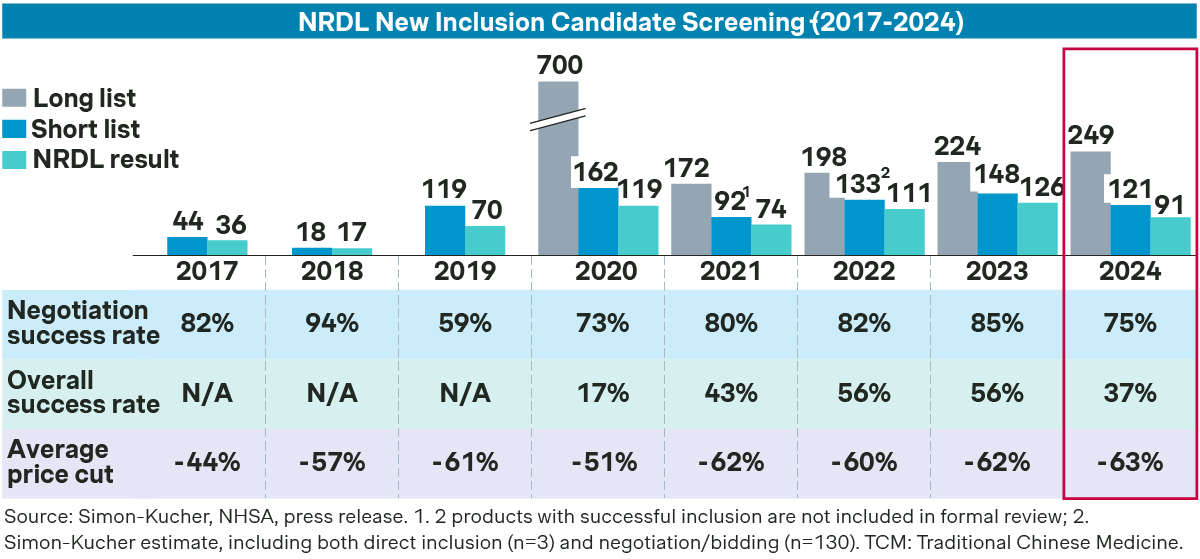

With 37 percent success rate and 63 percent average price cut for new listings, 2024 NRDL was a tough balancing act with competing priorities, and may very well be a turning point for future years.

The results for the 2024 National Reimbursement Drug List (NRDL) were released on Thanksgiving Day, and the drugs that made it to the final list have much to celebrate indeed.

This is one of the tougher years, as evident from the lower success rate of 37 percent for new listings, compared to 56 percent in the past two years. The average price cut stood at 63 percent, also the highest in recent years.

Several factors were at play: the National Healthcare Security Administration (NHSA) must take precautions to ensure the sustainability of Basic Medical Insurance amid an aging population and a slowing economy. Meanwhile, competition from multinationals and local players intensifies across most of the therapeutic areas, as Chinese biopharma companies are increasingly moving up along the innovation ladder.

Oncology, chronic diseases, and rare diseases have the largest numbers of new listings, and innovativeness is considered as one of the increasingly important criteria for NRDL inclusion. In fact, there were 38 new listings singled out as “global first-in-class” therapies, and the success rate for this category fared much better than average.

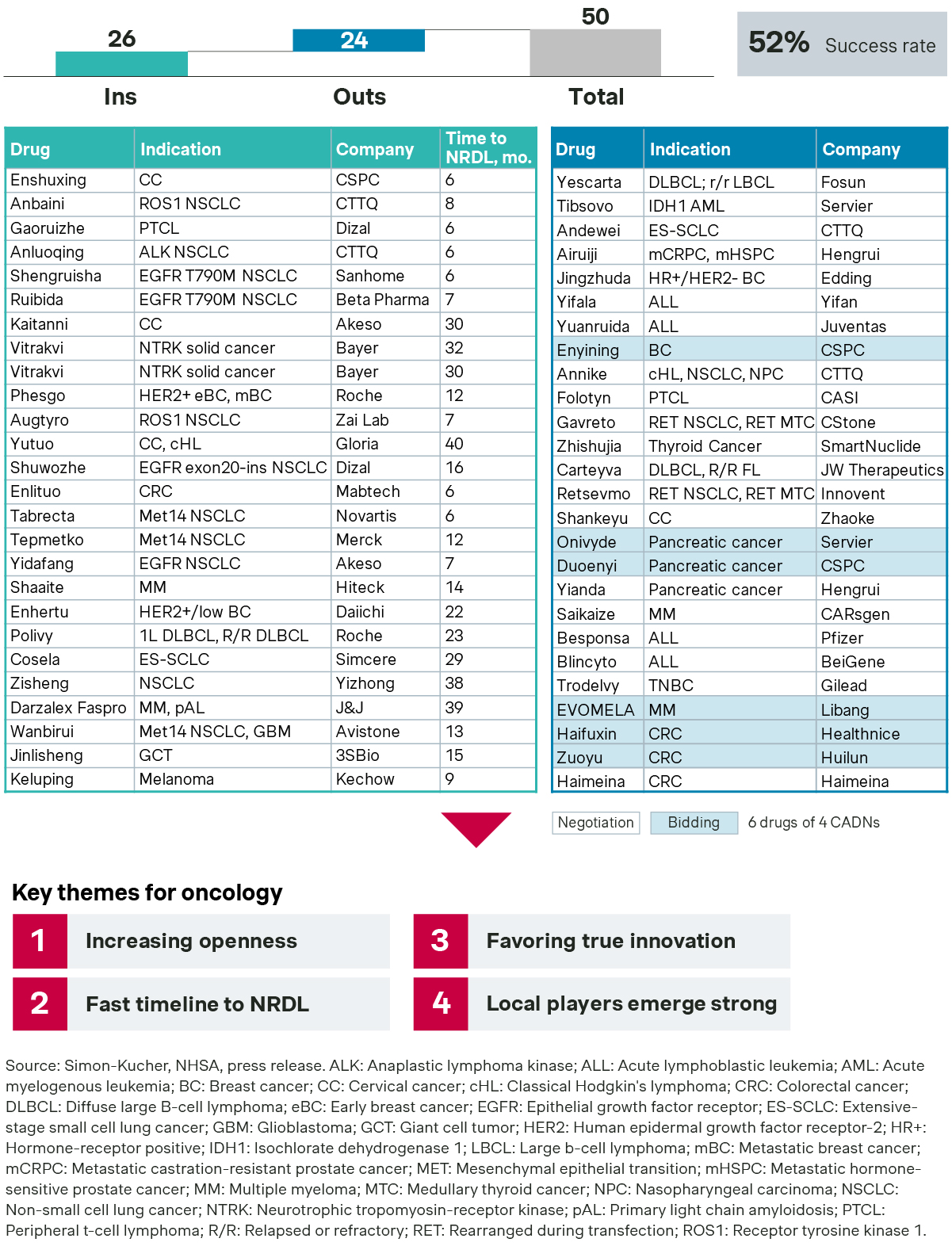

Oncology saw a record number of 26 new listings, with many successfully listed for lung cancer, cervical cancer, and multiple myeloma.

- In non-small cell lung cancer alone, there are three new listings for MET exon 14 mutation, including tepotinib and capmatinib from multinationals and bozitinib from a local player. What they all have in common was the strong emphasis on clinical and RWE data from Chinese patients. At the same time, they strived to differentiate from each other as well as the incumbents, savolitinib and glumetinib, with every conceivable angle. Another new star, sunvozertinib, targets a rare mutation know as EGFR exon 20 insertion, filling the void left by the exit of mobocertinib the year before.

- In cervical cancer, three local players made it to the finish line. Akesobio’s bi-specific antibody cadonilimab stood out as a high-profile example of local innovation, while CSPC’s enlonstobart and Gloria’s zimberelimab also secured their spots on this year’s NRDL with timely regulatory approval.

- The multiple myeloma space saw the recent entry of aponermin, a locally developed recombinant human tumor necrosis factor-related apoptosis-inducing ligand (TRAIL), that targets death receptors 4 and 5 on tumor cells. In parallel, the subcutaneous version of daratumumab, Darzalex Faspro, was also included in the NRDL, highlighting its benefits in healthcare resource utilization. Its additional indication for primary light chain amyloidosis, a rare disease with poor prognosis and high unmet needs, also helped it cross the finish line.

- Enhertu and Polivy are among the few successful comebacks after their setbacks last year. Enhertu’s success was particularly notable as it came with a new indication in HER2-Low patients, hence larger budget impact and more pricing pressure. Polivy, in contrast, proactively restricted the treatment duration for first-line and relapse/refractory DLBCL patients strictly to six cycles in its recently updated China regulatory label, to pre-empt payer concerns about potential budget impact.

- The success rate in oncology stands at 52 percent, significantly higher than the overall average of 37 percent. The average inclusion time is 17 months, with half of them being added to the listing within 12 months of their China regulatory approvals, underscoring the increasing sense of urgency for early listing.

Chronic diseases saw a number of successes in diabetes and immunology.

- Novo Nordisk’s once-weekly basal insulin Icodec, aptly named Awiqli, received China regulatory approval in June 2024, ahead of US FDA approval. That afforded it the recognition as a global first-in-class therapy going into NRDL. Highlighting the innovativeness as well as its three-pronged value propositions—superior HbA1c control, excellent safety profile among Chinese patients, and better adherence compared to daily injections—it made to the final list with little suspense.

- Similarly, Rezurock highlighted its innovative mechanism of action as the only ROCK2 inhibitor, addressing the unmet need in cGVHD with superior efficacy and limited budget impact. The compelling RWE from its Hainan Boao early access program also went a long way with the eventual listing.

- Livtencity is considered a major breakthrough per the latest NRDL value rating system. With first-in-class orphan drug status in the US and breakthrough designations from both the US and China, it also convincingly demonstrated the critical unmet needs for CMV patients following solid organ or hematopoietic stem cell transplantation, as well as its novel target, impressive efficacy, and a manageable budget impact.

- Despite the early listing of multiple therapies in plaque psoriasis, Sotyktu was successful in proving its unique value propositions, setting itself apart from incumbent biologics and small molecules, and made the final list as another global first-in-class therapy.

- There were also a few major disappointments in cardiovascular and neurology. Leqvio was among the ones that didn’t make good on the promise, despite its innovativeness as the first RNA therapy for hyperlipidemia, and the strong traction throughout the early access programs and China launch. Similarly, neither Nurtec and Emgality, aimed at migraine treatment and prevention respectively, made it to the finish line.

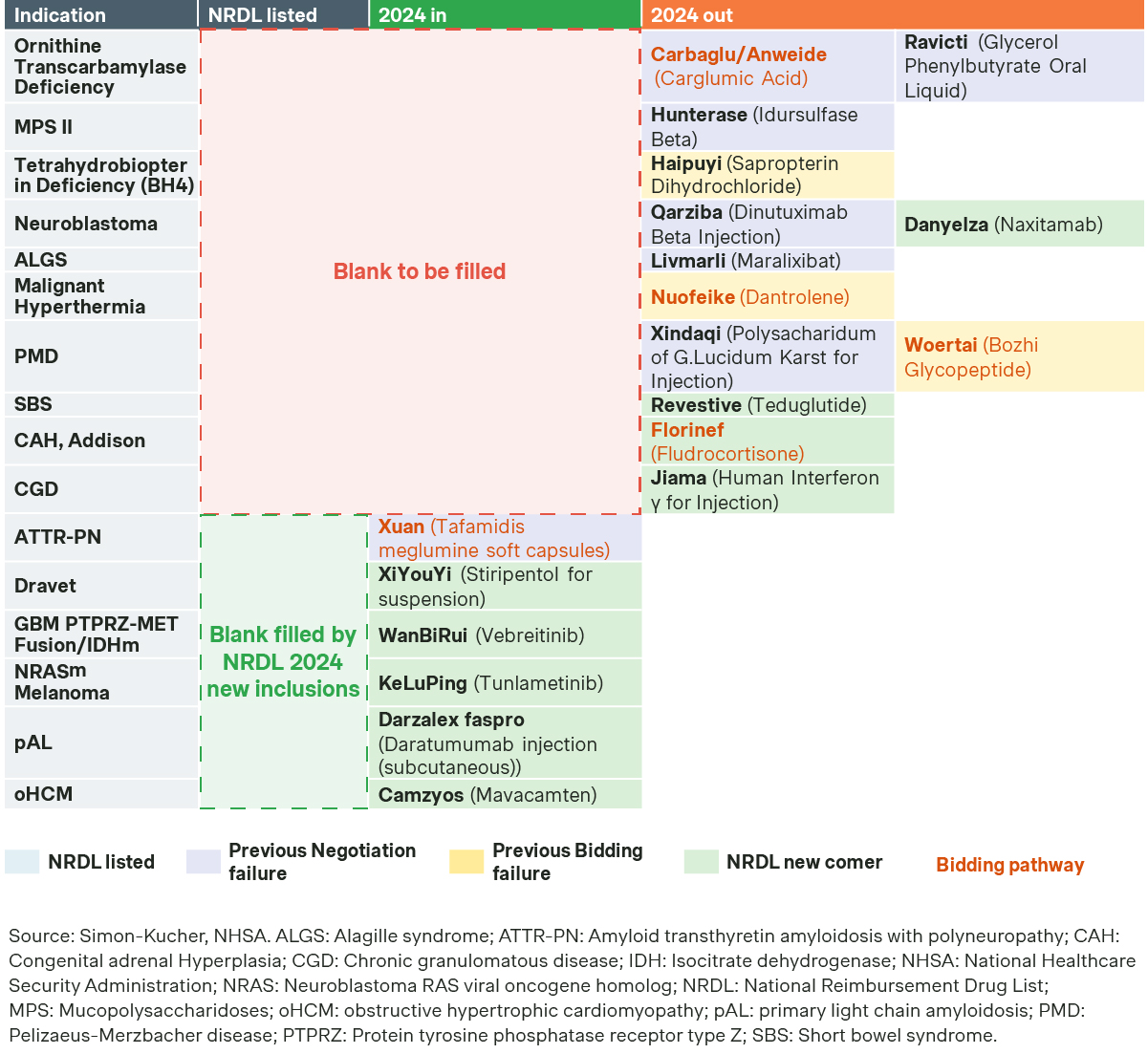

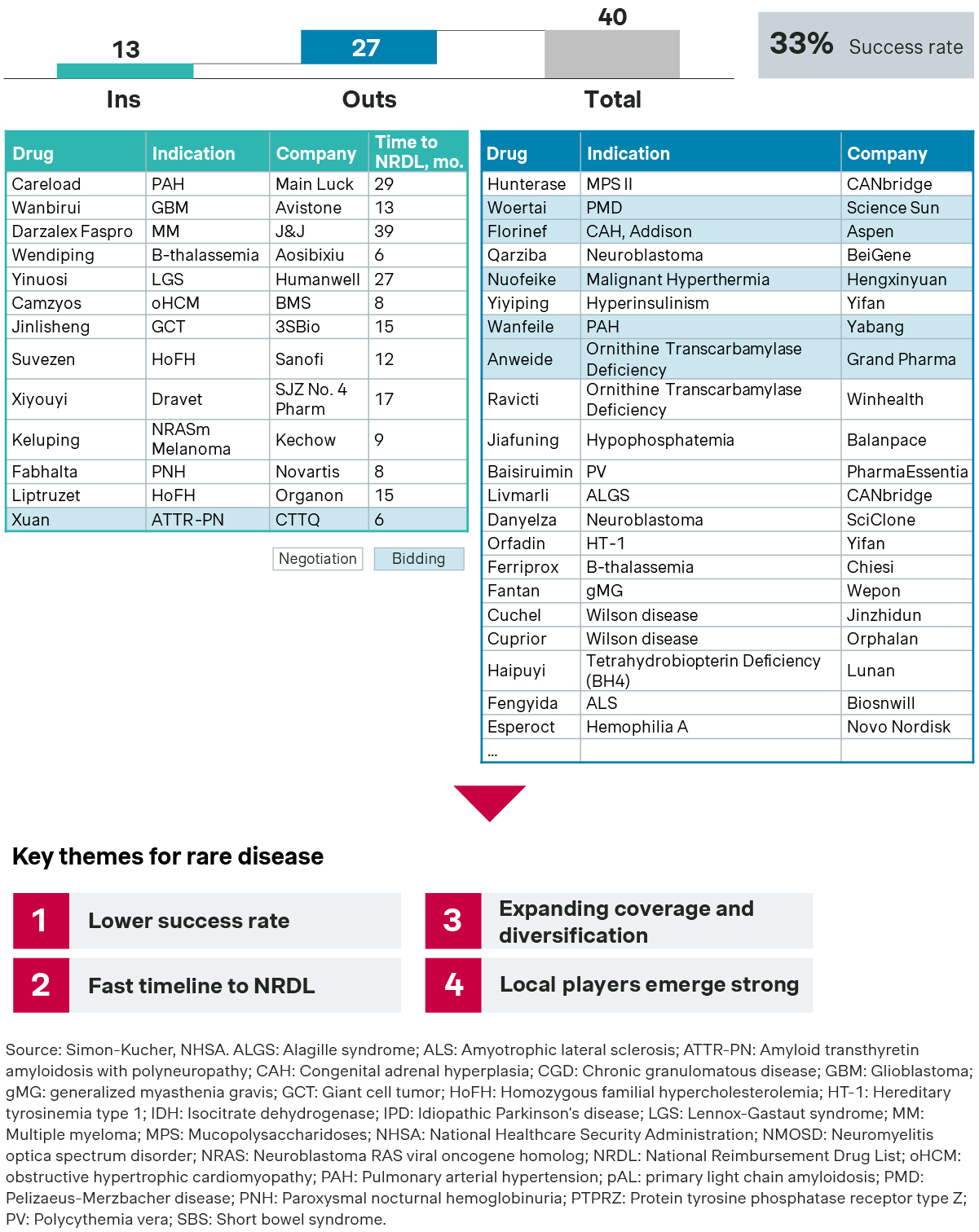

Rare diseases saw 13 new listings, compared with 15 new listings last year.

- Notable successes include tafamidis meglumine for ATTR-PN, stiripentol for Dravet syndrome, vebreltinib for GBM PTPRZ1-MET Fusion/IDHm, tunlametinib for NRAS-mutant melanoma, and mavacamten for oHCM, all addressing rare diseases with no existing therapies.

- Iptacopan, the world’s first and only oral inhibitor of complement factor B, was successful in demonstrating the significant unmet needs of paroxysmal nocturnal hemoglobinuria (PNH) in China, despite earlier listing of eculizumab. Its strong clinical data and real-world evidence are also instrumental in earning it a spot on the new formulary.

This year, however, saw more disappointments than successes. Out of 40 candidates for NRDL inclusion, many like teduglutide for SBS, dinutuximab for neuroblastoma, idursulfase beta for MPS II, and maralixibat for ALGS did not make it—some after repeated attempts. Many drugs were still largely constrained by the implicit price ceiling for NRDL listing and had to struggle to find their niches in the self-pay market.

![graph]()

NRDL renewals also saw increasing pressure. 44 drugs were up for re-negotiation, with their prices reduced by an average of 11.6 percent.

- In addition, a number of drugs failed in their bids for indication expansion. Dupilumab, for example, only managed to renew its NRDL coverage for atopic dermatitis but failed with indication expansion to asthma. It will face more competition from mepolizumab, which succeeded in its expansion thrust, as well as strong challenges from several biosimilars looming on the horizon.

- Chidamide, which failed to expand NRDL coverage to breast cancer last year, succeeded in expansion to DLBCL this year due to lower budget impact. Baricitinib took a similar approach, prioritizing juvenile idiopathic arthritis over alopecia areata this year, which expanded its NRDL coverage to the former which features much higher perceived unmet needs and less budget pressure.

Key takeaways

2024 is a tough year for NRDL listing and renewal, and could very well be a turning point going forward. An in-depth understanding of evolving payer priorities would be a key first step going into NRDL, followed by strategic positioning and proactive tailoring of China value propositions, and effective engagement with key stakeholders to pre-empt concerns and garner support. By failing to prepare, one would be preparing to fail, especially in the increasingly tougher game like the NRDL.

With contributions from Duo Xu, Shiying He and Justinian Liu.

Better Market Access

The role of better market access is to remove any hurdle that prevents or hinders patients from receiving available treatments. In the right place, and at the right time.

Today, the impact of market access spans clinical development, regional commercial activities, patient engagement, and post-launch compliance. Yet, for many pharmaceutical companies, planning for commercialization only truly begins when a drug has been submitted for approval — far too late in the process.

Get to know our insights on local trends, regional and global developments and global to local excellence.