What are the key strategies for customer retention in the 2024 global telecommunications sector? In the second chapter of our three-part blog series, we explore customer base management and FMC/MMC convergence as critical telco growth trends.

Growing with the customer base is essential, as telcos are no longer in a blue ocean and acquisition costs are increasing. Effective customer retention calls for cross and upsell strategies that are needed to grow business and increase ARPU sustainably.

In our latest Global Telecommunications Study, we surveyed around 9,000 telco consumers in 21 countries. The results highlight the value of customer satisfaction in relation to developing CLTV, where cross-selling and upselling are the key retention strategies to build credibility with customers and accelerate revenue growth.

But what can telcos do to address these three elements in the best way?

Happy, loyal, paying customers: The blueprint for telcos’ success

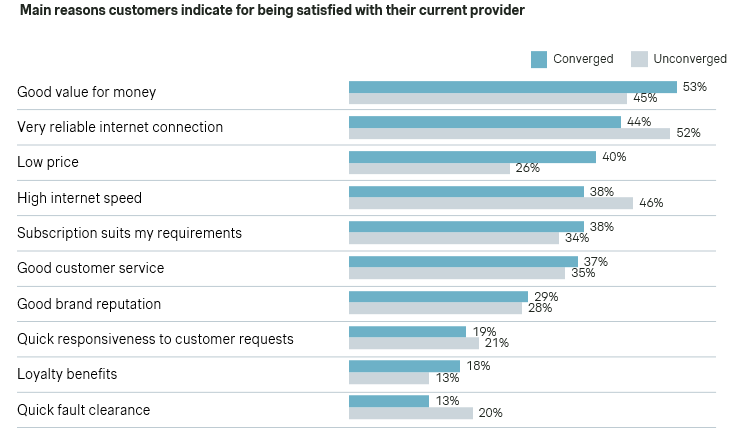

Happy: According to our study, the key satisfaction drivers are good value-for-money (49 percent), reliability (48 percent), tailored offerings, and speed (both 36 percent). Interestingly, premium- and mid-market customers tend to aim for value-for-money, while budget customers prioritize good service over everything else. To meet customer expectations of a “good deal”, mid- and premium players need to optimize their price-value ratio and enhance flexibility of their offerings to meet diverse customer needs.

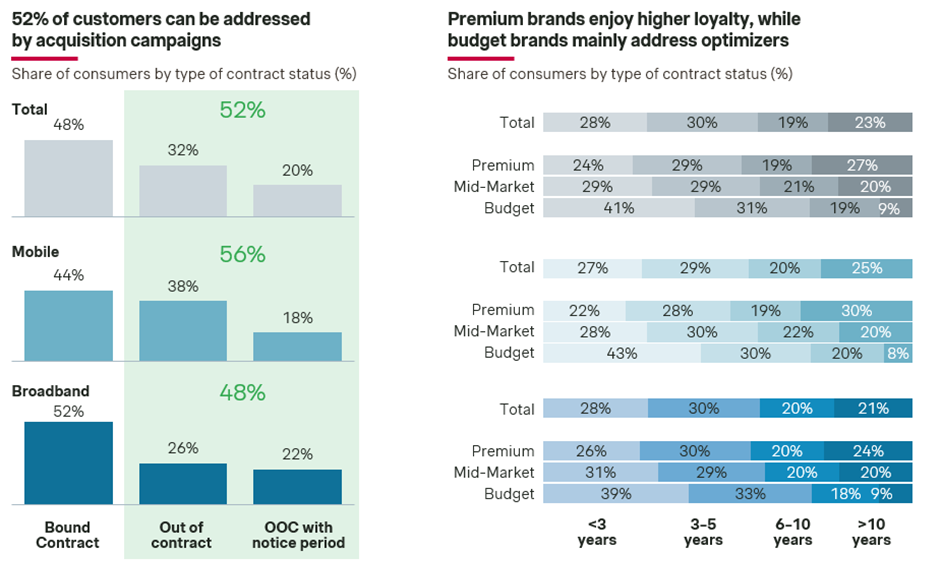

Loyal: When it comes to driving customer stickiness, our 2024 study shows that although half of customers could switch providers and be targeted in campaigns, 42 percent show high loyalty, having been with their provider for over six years.

Premium brands, in particular, manage to attract more loyal customers, as 46 percent have been with them over six years. In contrast, budget players mainly attract “opportunity seekers” (only 28 percent of customers have a tenure of over six years).

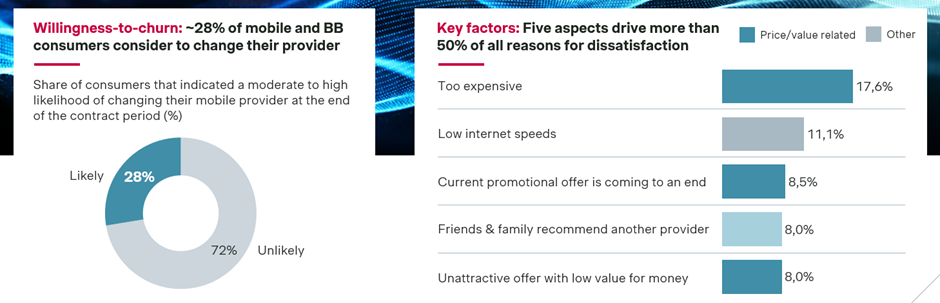

Driving loyalty also directly correlates with customers’ willingness to churn, which significantly decreases the longer a customer stays with a provider, dropping by around 20 percent after five years and another 15 percent after 10 years.

Paying: To increase ARPUs telcos should drive cross- and upselling for which the most effective strategies include advanced customer base management and leveraging FMC and MMC initiatives.

360° customer base management

Customer base management is commercially more important than new customer acquisition. Our research indicates it is five times cheaper to retain existing customers, who are also 50 percent more likely to try new products. Current customers spend four times more than new ones, contributing to 95 percent of profits.

But there’s a tough road ahead. The churn risk is sizeable, with one-third of mobile and broadband customers contemplating switching providers due to negative price-value perceptions.

This negatively affects all telco providers, but premium players face a 40 percent higher churn risk compared to budget brands. High-ARPU customers pose the greatest risk, as they are more inclined to seek better deals elsewhere.

Telcos should leverage various anti-churn measures tailored to varying impacts and timelines. Short-term tactics include selected promotions and segment-based pushes, while mid- to longer-term strategies involve portfolio adjustments and loyalty programs.

Additionally, curbing market aggressiveness can significantly boost long-term customer retention. By emphasizing unique value propositions instead of competing solely on price, telcos can foster enduring loyalty and contribute to market stability.

Winning in an era of a highly converged world

Mobile and broadband convergence through FMC and MMC also creates value and customer stickiness. With around 50 percent of households globally still unconverged, there are significant opportunities for growth.

However, pushing convergence to “lock-in” customers doesn’t suffice anymore. Our study shows a visible loyalty effect is only evident in around 40 percent of countries, with willingness to churn currently even higher for converged customers compared to unconverged ones.

Telcos should still continue promoting FMC and MMC offerings, as they generate on average 25 percent higher blended ARPUs vs. standalone fixed and mobile services. This strategy also supports cross-and upselling, which enhances understanding of CLTV, a key metric for boosting loyalty and customer retention in telco.

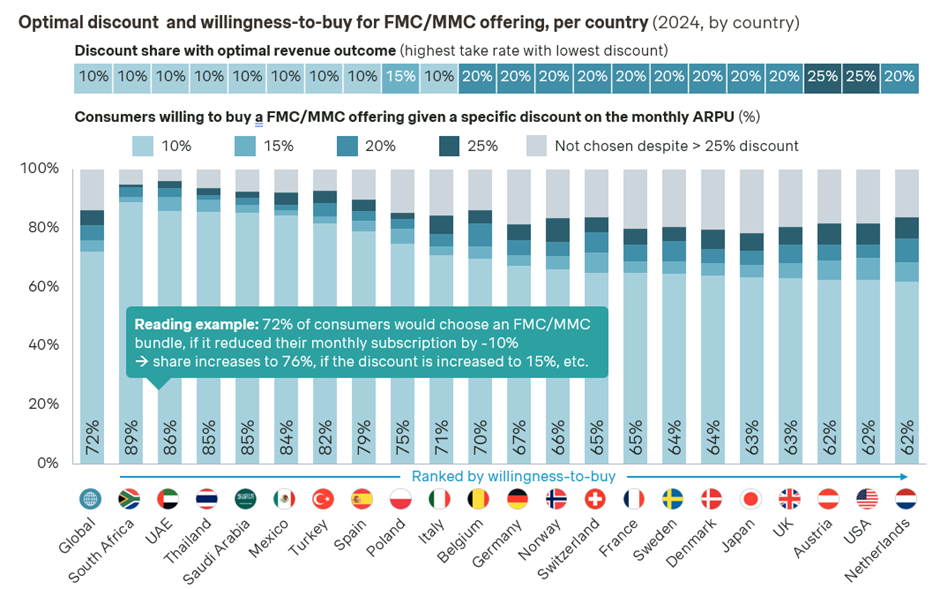

The key is to strengthen FMC value propositions and increase innovative products offerings through various VAS initiatives, both monetary and non-monetary. Overall, customers are very responsive to FMC/MMC discounts, with 72 percent willing to choose a bundle that cuts their monthly subscription by 10 percent, which is the optimal discount percentage from a revenue-maximization perspective.

MyBase Framework: Your solution for customer base management and margin improvement

Acquiring and retaining customers has never been more challenging. Best-in-class telco providers are moving away from a transaction-driven approach to customer-centric strategies focused on customer loyalty and long-term relationships.

How effective is your current customer base management? At Simon-Kucher, we understand its importance deeply. Our proprietary MyBase solution can help you leverage your existing customer base. We have worked with numerous clients to optimize their customer base management and reduce churn.

Using MyBase, we take a data-driven approach to improve customer segmentation, build trust and loyalty, and create lock-in effects through targeted cross- and upselling campaigns. Our experienced team has helped numerous telco clients implement churn reduction measures, resulting in churn reductions between 3-6 percent.

Download our MyBase framework for free

Read our Global Telecommunications Study 2024 here

Contact us to discuss our 2024 Global Telecommunications Study in more detail.