Mastering B2B sales strategy amidst a shifting market

Leverage AI, customer insights, and sales talent to drive growth amid economic uncertainty.

Fluctuating demand, rising costs and margin volatility necessitate a transformation in B2B sales and present sales organizations with new challenges. As businesses navigate these shifts, refining their B2B sales playbook becomes an essential ingredient for success.

While the impact of the pandemic on the supply chain has improved, sales teams are now grappling with inflation, labor shortages, and interest rate hikes, requiring thoughtful strategies for the new year. Meeting growth targets requires sales organizations to understand customer buying criteria and proactively adapt their go-to-market (GTM) model. Mergers and acquisitions, especially in the last five years, have added complexity, requiring effective integration to unlock operational efficiencies and cross-selling potential. A flexible and efficient B2B sales process is essential for successfully navigating these changes.

The increasing role of artificial intelligence (AI) and digital transformation is reshaping how B2B sales teams operate. AI-driven tools are now central to lead generation, customer engagement, and predictive sales forecasting. By automating tasks like lead scoring and data analysis, sales professionals can work more efficiently and also have the freedom to prioritize building relationships and closing deals.

Yet, adopting AI requires investment in technology and talent development, adding complexity to an already dynamic sales environment. At the same time, organizations face the challenge of attracting and retaining top sales talent capable of selling high-margin products to senior-level buyers.

Success hinges on deploying a data-driven B2B sales strategy that aligns with customer buying preferences and leverages the power of AI and automation.

2024 B2B Sales Insights: Key findings and trends shaping the future

Our latest B2B sales study sheds light on the strategies that separate top-performing sales organizations from the rest.

Discover how manufacturers, wholesalers, and service providers are adapting to market shifts, leveraging technology, and outperforming their peers in key areas like strategic planning, talent development and digitalization.

As the landscape continues to evolve, B2B sales organizations face new hurdles and opportunities. The following insights from our latest B2B sales study explore how top performers are tackling these challenges head-on, from investing in talent to embracing AI and digital transformation. Discover the strategies helping them lead the way in today’s dynamic market.

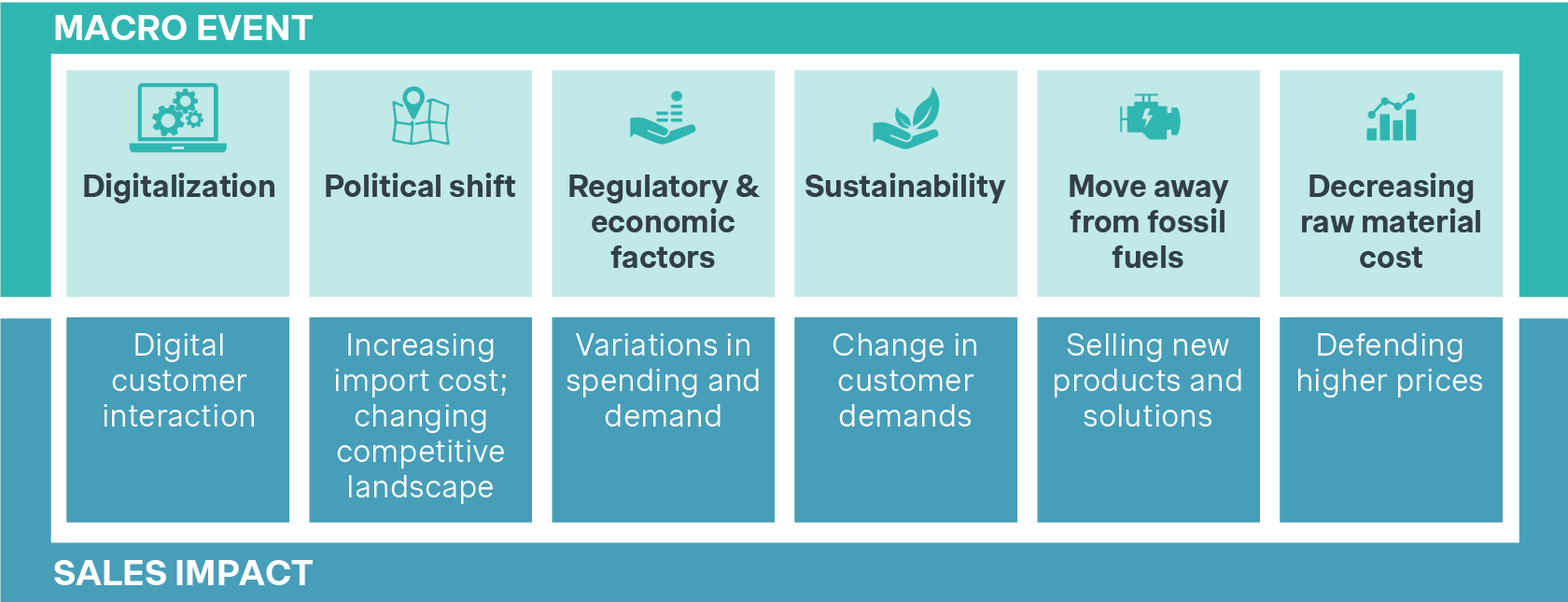

B2B sales organizations are facing challenges that are the product of environmental, economic, and technological pressures.

Allstar companies are significantly outpacing their competitors by investing in sales talent early in their lifecycle. These companies invest more in their sales teams, particularly in the early stages, a gap that grows over time and becomes difficult to close later.

In 2024, Allstars reported a much higher gross margin and stronger revenue growth than other companies. Their focus on new technologies, including AI, allows them to optimize customer interactions and use sales talent where it has the most impact.

AI is becoming a crucial tool for leading B2B companies, with Allstars heavily leveraging AI to optimize sales processes. 44% of Allstars report using AI for customer lifetime value (CLTV) prediction, compared to just 38% of Spectators.

Additionally, Allstars are increasingly adopting AI-driven cross- and upsell recommendations and dynamic pricing optimization to help them stay ahead in the market.

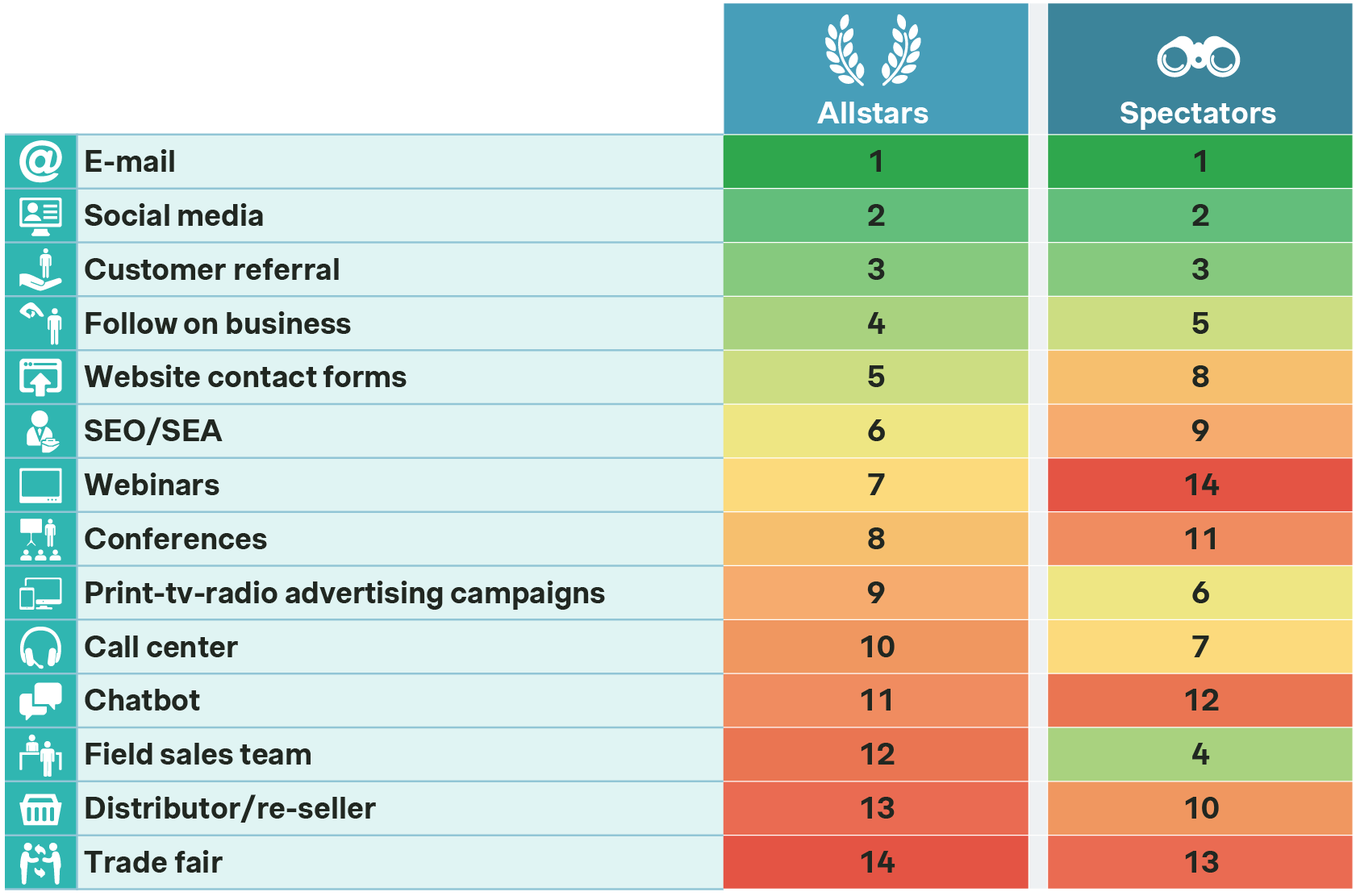

Allstar wholesalers are diversifying their lead generation strategies. While primary channels like email and social media are consistent across both Allstars and Spectators, top performing wholesalers are placing increased importance on secondary channels.

For instance, Allstars rate webinars as 90% more important than Spectators do for generating leads. This focus on digital engagement channels allows them to reach broader audiences and create more robust pipelines.

Allstar service providers are prioritizing enhanced sales steering through KPI-driven strategies and customer acquisition efforts. Notably, 40% of Allstars focus on lead generation via technology-enhanced demos, compared to 29% of Spectators. Furthermore, they are leveraging advanced technology in proposal and negotiation preparation to improve their chances of closing deals.

Stage-specific recommendations for the value chain

It might be challenging to elevate a business from Spectator to Allstar, but it’s worth taking the first step. To help with this undertaking, we have a few recommendations based on our 2024 Global B2B Sales study.

- Wholesalers

- Manufacturers

- Service Providers

Advancing sales in B2B wholesaling

Drive efficiency with AI for customer insights: With 44% of Allstar wholesalers using AI for customer lifetime value prediction and lead qualification, investing in AI can significantly boost sales efficiency and streamline customer acquisition.

Expand market reach with digital lead generation: Allstars are leveraging webinars and digital channels for lead generation, outperforming traditional methods like field sales. Diversifying channels helps reach new markets and improves lead quality.

Boost sales performance through advanced analytics: Improving sales team performance is crucial. Invest in advanced analytics and digital tools enhance efficiency and support the growing complexity of wholesaler sales roles.

Strategies for growth in B2B manufacturing

Gain a competitive edge with early sales investment: Long-term growth starts with investing in sales teams early. Allstar manufacturers prioritize this, gaining a competitive edge that becomes hard for others to close over time.

Enhance sales effectiveness with AI tools: 44% of Allstar manufacturers utilize customer lifetime value (CLTV) prediction, while 41% highlight the importance of cross-& upsell recommendation, improving alignment with customer needs and boosting sales effectiveness.

Transition to solution-based selling: Moving from products to integrated solutions, leading manufacturers position themselves as market problem-solvers, strengthening their appeal to customers.

Optimizing B2B service provider sales

Streamline sales with CPQ and proposal automation: Leading service providers benefit from CPQ software and automation tools, enabling faster, more efficient deal closures.

Improve customer targeting with AI: With 41% of Allstars using AI for CLTV prediction alongside cross- and upsell recommendations, service providers can refine customer acquisition strategies through AI-driven insights.

Expand outreach with modern lead generation strategies: Moving beyond traditional methods, service providers can use SEO, SEA, and automation to scale lead generation and maintain a consistent sales pipeline.

How we've helped

How Simon-Kucher can transform your B2B sales organization

At Simon-Kucher, our extensive sales experience covers multiple industries and size, enabling profitable growth, lower turnover, and more efficient use of selling expenses.

Navigate every kind of commercial challenge and achieve long-term, sustainable growth.

Contact our experts in your region

Simon-Kucher has deep roots in the industrials sector.

We can help you optimize your B2B commercial strategy for better growth.

From chemicals to construction, industrial goods to oil and gas, we are here to support you on your journey to sustainable, profitable growth. Rather than apply a one-size-fits-all approach, we work with you to create a solution tailored to your specific business needs and challenges.