The dynamic nature of financial services highlights the crucial, yet underdeveloped, role of pricing within banks. For many financial institutions in Asia, pricing strategies are still fragmented, heavily reliant on manual decision-making, and lacking the analytical depth required to maximize profitability while maintaining client satisfaction.

Dr. Silvio Struebi and Alan Lim, partners at Simon-Kucher Elevate, argue that pricing in banking is undergoing a transformation driven by artificial intelligence and machine learning. AI is no longer just an enabler for risk management and trading algorithms; it is now reshaping the way banks structure their commercial pricing. With the right AI-powered solutions and processes, banks can enhance pricing transparency, improve client retention, and reduce revenue leakage, while also empowering relationship managers with data-driven insights at the point-of-sale.

Despite its commercial importance, pricing remains an area where inefficiencies are deeply embedded within banking structures and processes. One of the biggest obstacles is the lack of a centralized pricing strategy function overseeing and steering the commercial pricing agenda of the bank. Many banks have pricing responsibilities spread across different teams, front office, product teams, risk management, and CFO functions, without a cohesive strategy. This fragmentation often leads to inconsistent pricing strategies and missed revenue opportunities across various business lines.

Another significant challenge is the widespread practice of granting unstructured discounts to clients. While banks prioritize certain high-value products for revenue generation, other offerings are frequently discounted by relationship managers without a clear commercial rationale, even when the cost to serve or capital requirements remain high. In many cases, relationship managers (RMs) apply client-individual discounts without sufficient data or rationale to support these decisions, leading to revenue loss. Without transparency about discount practices or preferential pricing, well-defined pricing policies and streamlined digital discount processes, banks risk eroding margins and weakening their long-term profitability.

The reliance on reactive pricing strategies is another fundamental issue. Many banks adjust headline pricing or discount grids only in response to regulatory changes or competitive pressures rather than proactively shaping the commercial agenda or optimizing client relationships through dynamic, forward-looking pricing models. This lack of future-oriented commercial pricing strategies often means that pricing decisions at point-of-sale fail to reflect evolving client needs and market conditions.

These inefficiencies create a huge opportunity for AI-driven pricing solutions that can introduce better structure in granting discounts, analytical rigour, and predictive capabilities into banks’ commercial strategies.

The AI-powered pricing revolution for discount management

AI and ML are now poised to revolutionize the way banks manage pricing and discounts, offering a level of precision, consistency, and efficiency that traditional RM-centric models simply cannot achieve. By integrating AI into their discount frameworks and discount process workflows, banks can create dynamic and personalized client pricing proposals that respond in real time to customer behavior, market conditions, and competitive pressures.

AI-driven discount decisioning models can process vast amounts of transactional and market data to determine optimal client pricing recommendations based on client profiles, predicted demand, and individual price elasticity. This enables banks to reduce revenue leakage by identifying inconsistencies in discount requests and ensuring that discounting strategies are aligned with overall revenue and strategic goals.

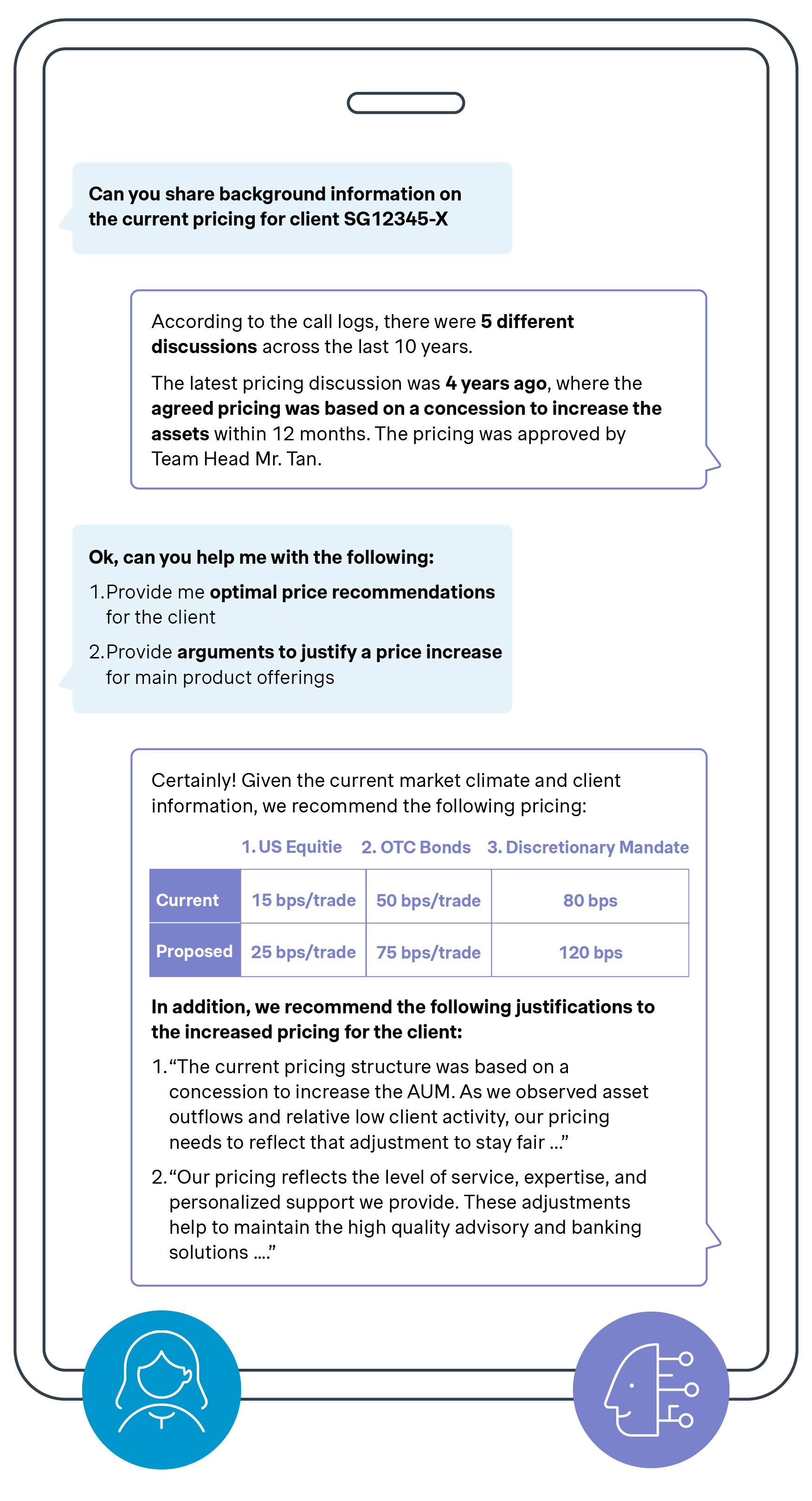

AI also enhances pricing transparency and consistency, which is particularly critical in wealth management and corporate banking, where pricing often lacks standardization. Such solutions can act as co-pilots or decision support tools for relationship managers, offering real-time guidance on pricing recommendations during client discussions, ensuring that clients receive fair and competitive pricing, and reducing the risk of unnecessary concessions.

From an operational and risk management standpoint, AI can help automate pricing controls and overcharging checks that have traditionally been manual and resource intensive. It can also manage price implementations in core banking systems, conduct sales surveillance of pricing-related call logs and CRM notes, and enforce pricing control measures to ensure regulatory compliance.

Three key areas of pricing transformation

AI is driving fundamental changes in banking price management across three primary areas: relationship management, self-service channels, and internal pricing controls.

For relationship managers, AI enhances decision-making by providing intelligent pricing recommendations and talking points to defend pricing that are based on client transaction history, product usage, and market conditions. AI-powered chat assistants help RMs navigate complex client discussions, assess the impact of discounts on client lifetime value, and determine the likelihood of deal closures. By transforming client discussions from voice logs into text and incorporating into language models, Gen AI models can help RMs to better engage with clients in more strategic pricing discussions.

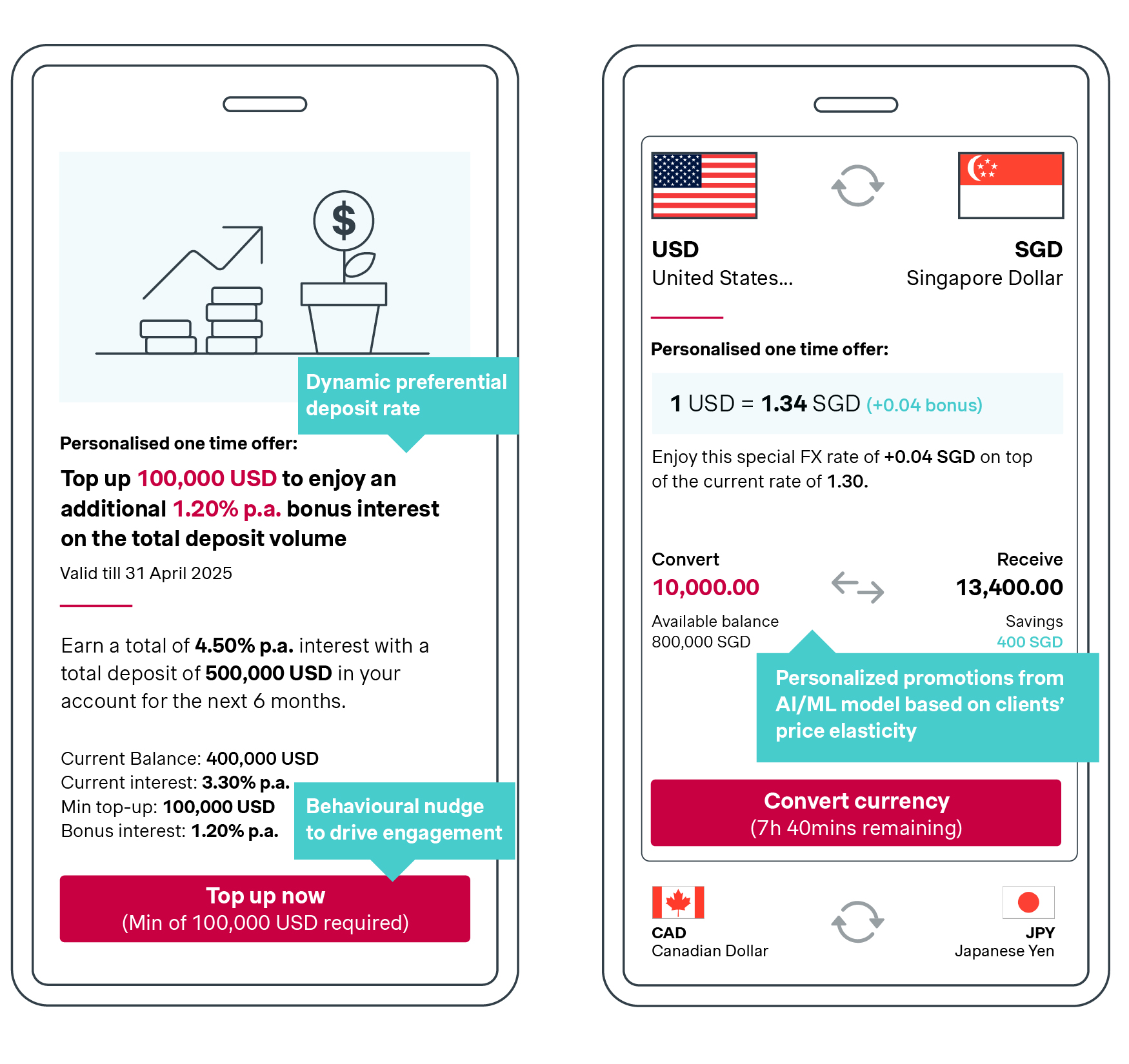

In digital banking and across self-serviced channels, AI is enabling dynamic pricing models that automatically adjust pricing for deposit rates, FX transactions, and loans based on demand and competition. Banks can leverage AI to offer personalized pricing through e-banking platforms, using real-time market data to ensure that clients receive the most relevant and competitive rates. AI-generated simulations allow clients to understand how pricing decisions affect them, improving their overall experience and engagement with banking services.

From an internal governance and pricing compliance perspective, AI is playing a critical role in automating pricing oversight over adherence to bilateral pricing-agreements. AI-powered algorithms can detect patterns of overcharging or unfair client treatment, ensuring that pricing decisions align with regulatory sales guidelines. AI-driven analytics provide real-time pricing insights to management teams, helping them monitor trends and enforce pricing discipline across the organization. The technology also strengthens compliance by analyzing unstructured data from call logs, CRM notes, and other client interactions to identify potential pricing anomalies or errors.

The roadmap to AI-powered pricing adoption

For banks to successfully implement AI-powered pricing strategies, they need a structured roadmap that includes four key steps.

First, they must assess their existing data infrastructure and technology capabilities to ensure they have the necessary resources to support AI-powered pricing. This includes evaluating their ability to integrate transactional, CRM, and market data into AI models.

The next step is to develop and train AI pricing models, using historical data and predictive analytics, to refine pricing algorithms. This stage requires close collaboration between pricing teams, data scientists, and relationship managers to ensure that AI recommendations align with business objectives.

Once AI models are trained, banks must conduct controlled testing and pilot programs, allowing selected relationship managers and digital banking teams to experiment with AI-driven pricing recommendations. The goal is to refine AI outputs and ensure that they are providing meaningful, actionable insights that improve pricing decisions.

The final stage is to scale and automate AI-powered pricing solutions, embedding them across the bank’s digital and advisory channels. This includes integrating AI into e-banking platforms, RM workbenches, and order taking solutions, ensuring seamless adoption and long-term sustainability.

In the overall development process, it’s important to work in parallel on AI governance topics and pricing policies to ensure that the models treat clients fairly and do not exploit vulnerabilities. Furthermore, regulators across the globe issue AI frameworks to ensure fair treatment, which require special attention when developing AI strategies for pricing.

AI is reshaping the future of pricing in banking

As banks across Asia seek to modernize their processes and operations and improve profitability, AI-powered pricing management is emerging as a critical tool for success. By transforming pricing from a fragmented, manual process into a data-driven, AI-enhanced function, banks can optimize margins, reduce inefficiencies, and enhance the client experience.

AI-based pricing is not just about automation; it is about creating a smarter, more strategic approach to pricing that reflects market realities, client needs, and regulatory requirements. With the ability to provide dynamic pricing recommendations, enforce pricing discipline, and enhance operational efficiency, AI-powered pricing solutions are set to become a cornerstone of modern banking and relationship management.

In an era where pricing is no longer just about numbers but about strategic value creation, AI is the key to unlocking sustainable revenue growth, better client outcomes, and long-term competitiveness in the financial industry. Elevate, our digital consulting team, specializes in boosting commercial growth. We use technology, data, and creativity to optimize your business processes. To learn more, contact our experts today.