Core-system providers are vendors that offer policy administration systems, payments and billing solutions, and data and analytics tools for the insurance industry.

Insurtech providers are companies that develop and sell software and data solutions to enable carriers and Managing General Agents (MGAs). This includes core-system providers and carriers and MGAs that are technology focused.

The core-system software market is growing rapidly and expected to grow even further but if current spend on sales and marketing persists, profits will likely be concentrated among only large Insurtech companies. Understanding the drivers for cost of sales and developing a strategy specifically tailored to a company’s situation will be key to driving performance from sales.

Navigating growth in Insurtech: opportunities and challenges

Technical operations of a modern insurance company are complex, requiring highly integrated core-systems to manage regulatory and financial complexity at scale. Core-system providers enable insurance companies to adapt to changes in market conditions, risk, and consumer expectation with reliability and flexibility. As a result, the insurance industry is adopting core-system technology at a higher pace and scale.

The market for core-system providers is projected to grow by ~9 percent each year, increasing from $106 billion in 2024 to $133 billion by 2028. Most of this growth will benefit application software and IT services providers, driven by both established large public Insurtech companies and innovative early-stage companies. However, if early-stage companies continue to overspend on sales and marketing as they have in the past, growth in revenue will have limited impact on growth in profits.

How sales and marketing spend can make or break Insurtech success

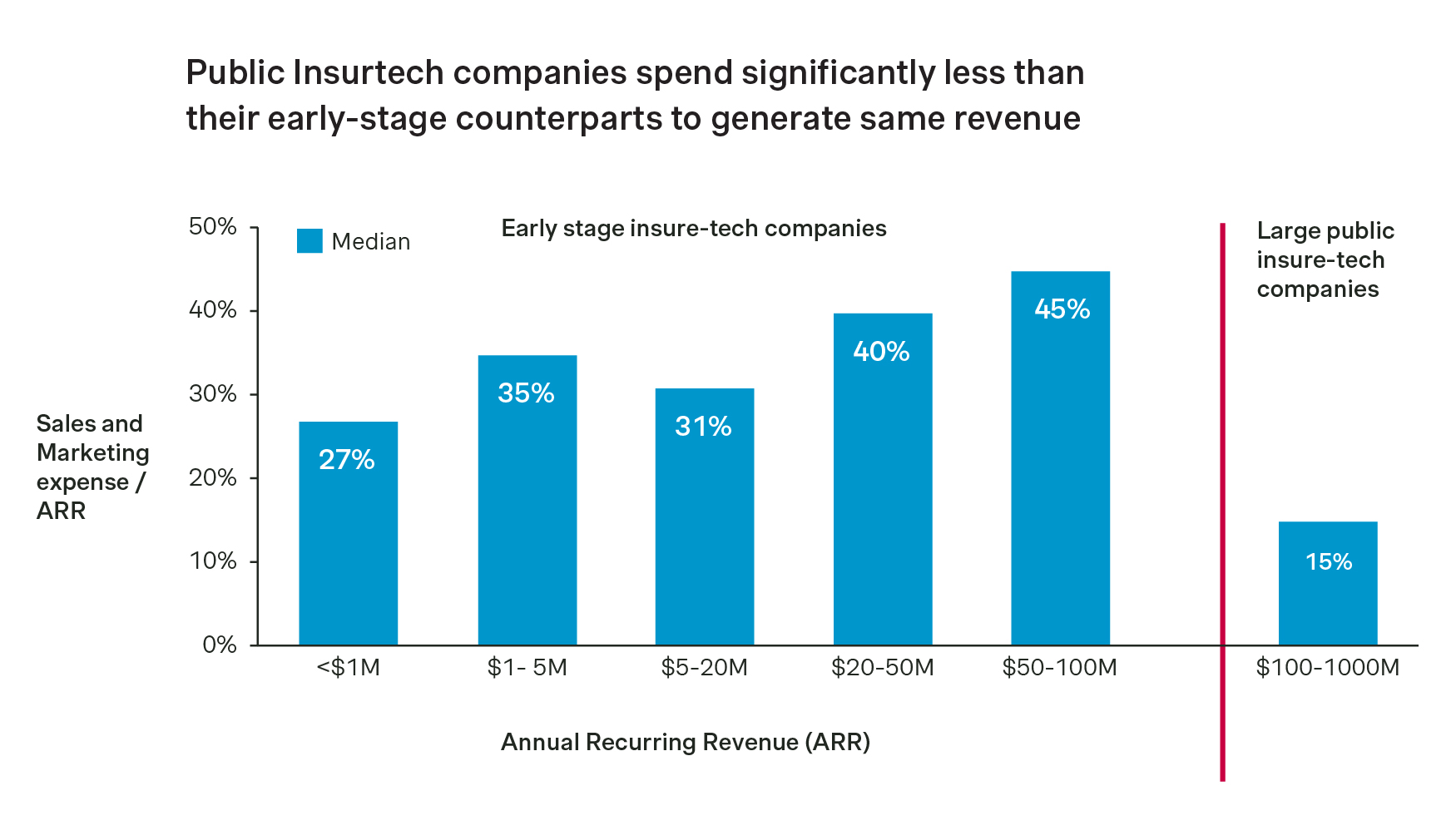

Early-stage Insurtech companies spend ~3-4 times more on sales and marketing than large public Insurtech companies to generate similar revenue.

Early-stage companies (typically <$100M in Annual Recurring Revenue or ARR), focused on fast paced growth, tend to have high sales and marketing costs as they prioritize spend in sales and lead generation to capture market share and build brand awareness. These companies typically spend anywhere between ~30-45 percent of ARR on sales and marketing. In comparison, large public Insurtech companies spend significantly less on sales and marketing, ~ 4-20 percent ARR.

A 30-45 percent spend on sales and marketing means there is less money for Research and Development (R&D) / product development, lower margins, and low runway for early-stage companies, hindering their profit ambitions even amidst a growing market.

For companies under $100M in sales, we see spending 15-20% on sales and marketing as the sweet spot.

Insurtechs can grow profitably by focusing on compensation and turnover

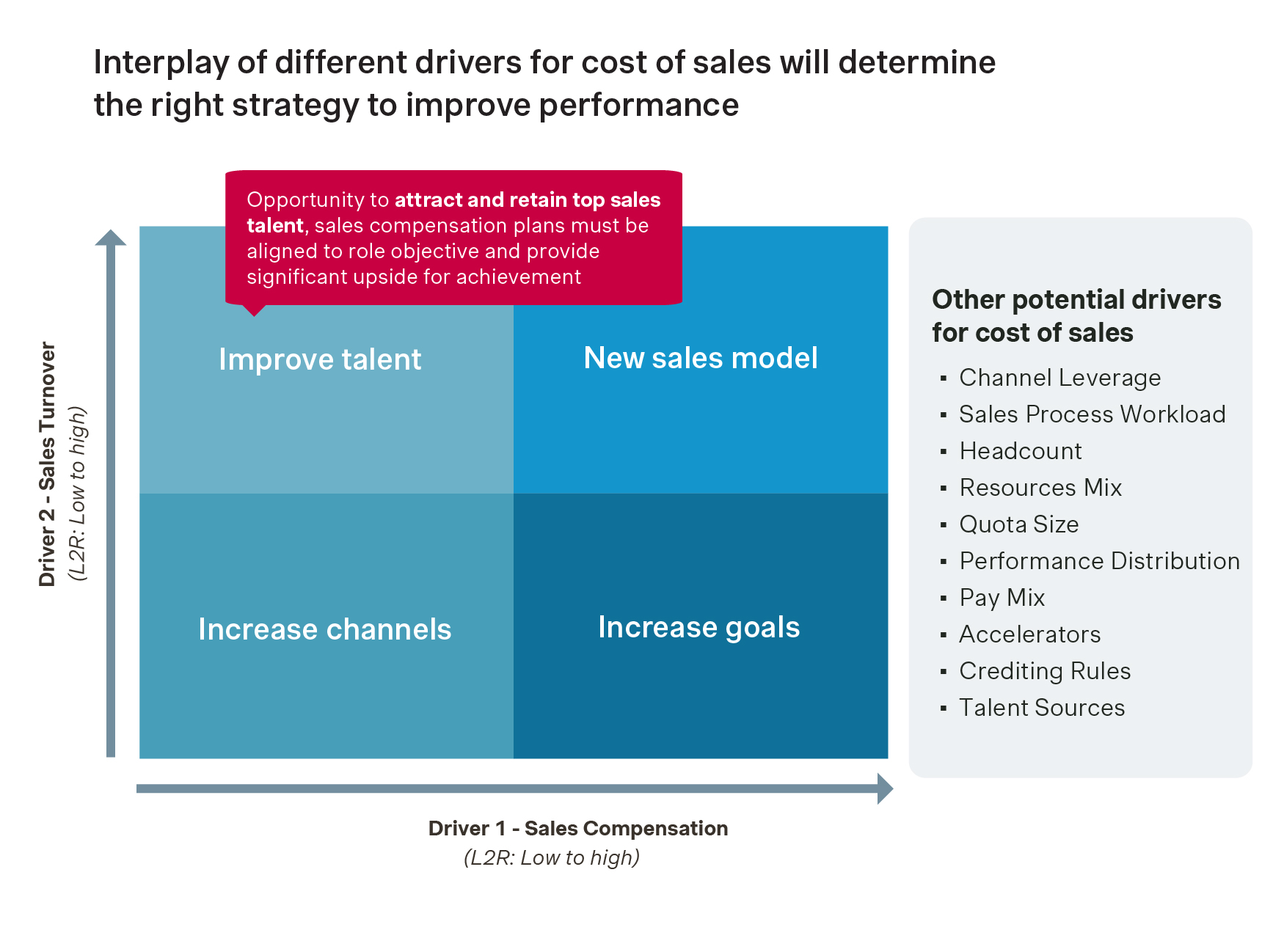

Understanding the interplay between different drivers of cost of sales will be key to driving sales performance.

Simon-Kucher industry experts have worked with multiple clients to address all of the factors that drive cost of sales and performance. There are many different drivers for cost of sales, some of which are within the company’s control while others may be a result of industry conditions.

However, we often see compensation and turnover as two factors which often come up most often in optimizing cost of sales.

Assessing both sales compensation and sales force turnover together, can help develop a strategy which will work best for your company. For example, if cost of sales is high due to high turnover, there is an opportunity to improve talent by aligning compensation with role objectives and providing significant upside for overachievement.

Conclusion

Profitably navigating growth opportunities can be a challenge for early-stage Insurtech companies.

For early-stage Insurtech companies, identifying drivers for cost of sales and adopting a tailored strategy for optimizing sales and marketing cost improves profitability, provides capital for investment in product development, improves investor confidence and provides longer runway to win in a growing but competitive market.

Simon-Kucher’s proven strategies and expertise has helped several companies optimize their sales and marketing costs to unlock full growth potential. Our approach, from identifying opportunity to monitoring results, backed by data-driven insights and extensive expertise, can help core-system providers, especially the ones in their early stages of growth, emerge more profitable in the face of rapid growth opportunities.

When your organization is ready to reach its full potential and create a customized sales effectiveness plan, contact our Simon-Kucher experts.