As the global economy continues to shift, the impact of tariffs on consumer sentiment and spending behavior remains critical for businesses as they plan impact. Our 2025 Tariff Consumer Market Study provides valuable insights into how consumers perceive, react to, and adjust their purchasing decisions in response to tariffs. With inflation concerns, supply chain disruptions, and international trade policies evolving, businesses must understand these changing consumer behaviors to remain competitive.

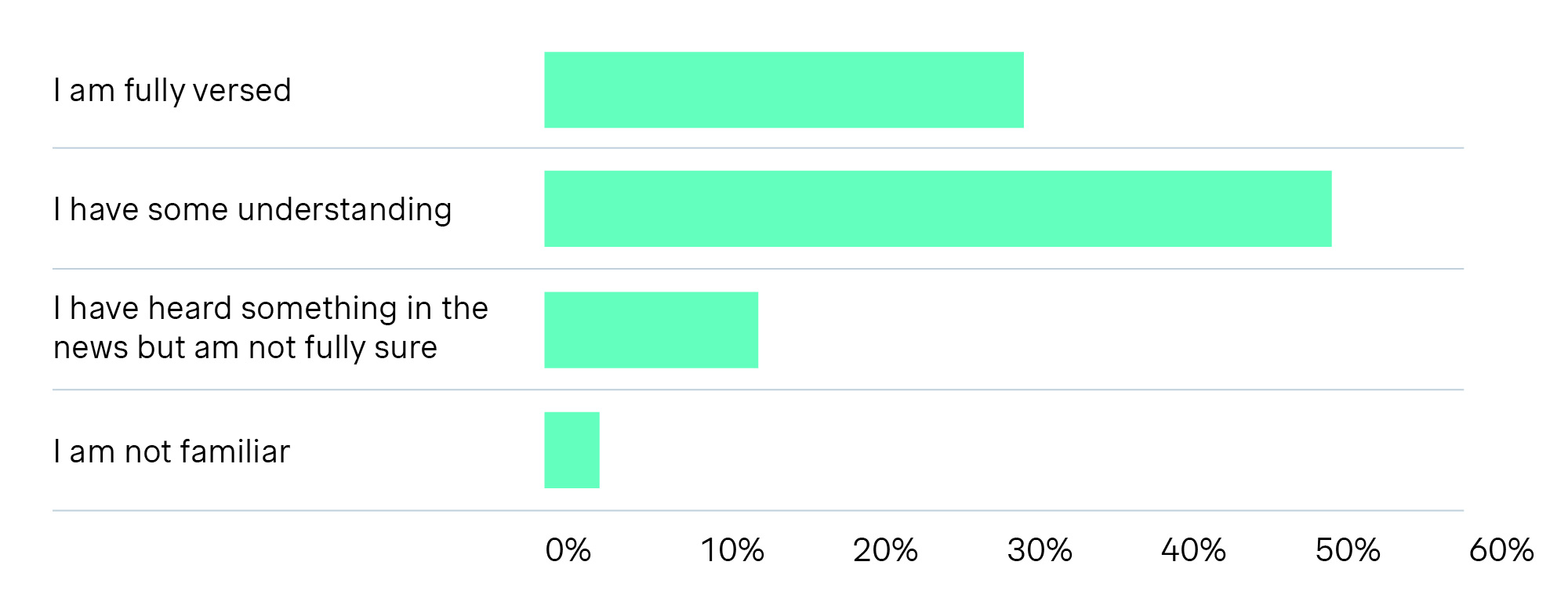

Consumers Are Still Largely Unaware of Tariffs

One of the study’s key findings is that only 33% of consumers report fully understanding tariffs. This limited awareness has major implications for purchasing behavior, as many consumers incorrectly credit price increases to inflation rather than tariff-related costs.

- 80% of consumers see tariffs as a tax that increases prices, while 20% believe they protect domestic jobs and industries.

- Households with higher incomes or dependents are twice as likely to be well-versed in tariff policies.

The knowledge gap creates an opportunity for businesses to educate consumers on import tariffs, supply chain impacts, and pricing transparency to build trust and drive sales.

How Tariffs Affect Consumer Sentiment

While many consumers anticipate tariffs to have a negative impact on their finances, the extent of concern varies by demographics. The study highlights that higher-income households and those with dependents are twice as likely to be well-versed in tariff policies compared to lower-income groups.

- Nearly twice as many men as women believe tariffs are beneficial to the US economy.

- 79% of consumers have felt noticeable inflation in the past three years, influencing their perception of tariffs.

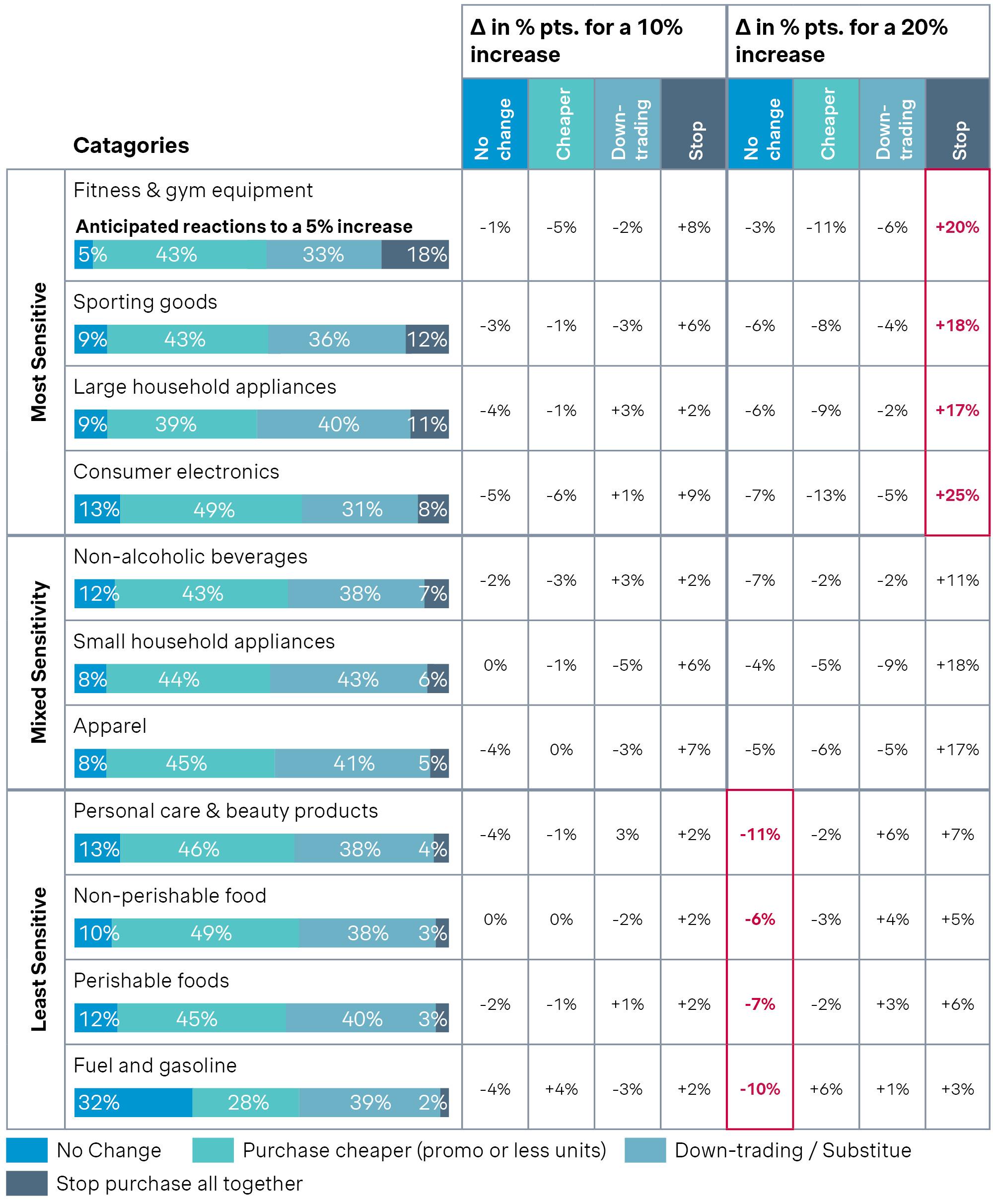

Which Product Categories Are Most Affected?

Not all product categories will be equally impacted by tariffs. The study finds that essential goods like food or gas are experiencing the highest tariff-driven price sensitivity, with consumers prepared to absorb modest price increases. However, discretionary spending categories, such as fitness & sporting goods, large household appliances or consumer electronics, are at greater risk of reduced demand as price hikes drive consumers to cut back or seek alternative options.

- Consumers are more willing to cut back on discretionary spending but will continue purchasing essentials even with price increases.

Consumer Sensitivity to Price Increases by Category

As tariffs drive costs higher, consumers are making more deliberate spending choices, weighing the necessity of their purchases against rising prices. While essential goods such as food, fuel, and healthcare remain largely unaffected by moderate price hikes, discretionary categories like electronics and luxury goods are seeing greater sensitivity. The study reveals that consumer tolerance for price increases varies significantly by product type, highlighting the importance of tailored pricing strategies to maintain customer loyalty and sustain demand.

- Seeking Promotions: Many shoppers are actively looking for discounts, shifting to lower-priced alternatives, and leveraging online deals.

- Switching Brands: Brand loyalty is declining as price-conscious consumers explore private-label and budget-friendly alternatives.

- Delaying Non-Essential Purchases: Higher tariffs on discretionary goods are leading consumers to postpone big-ticket purchases, impacting revenue for premium brands.

- Preference for Domestic Products: The study notes an increased interest in products labeled “Made in the USA”, as consumers react to import tariffs by shifting toward domestic alternatives.

Consumer Reactions to Price Increases: The Path to Escalation

Consumers are adjusting their purchasing behaviors in response to rising costs, making strategic trade-offs as price sensitivity grows. While modest price increases may simply encourage even more cost-conscious shopping, steeper hikes can lead to broader shifts—ranging from brand switching to reduced category spend. Of course, there will always be outliers, but the path to escalation is a reality across industries. Businesses must anticipate these behavioral shifts and implement pricing strategies that balance profitability with consumer retention.

- At 5% price increase: More consumers seek promotions and shift to budget-friendly sizes/offerings.

- At 10% price increase: More consumers trade down to lower-cost alternatives.

- At 20% price increase: More consumers stop purchasing non-essential products entirely.

- Preference for “Made in the USA” products increases when tariffs affect import prices.

How Should Businesses Strategically Respond?

Businesses can take proactive steps to respond to tariff-driven market shifts:

- Enhance Pricing Strategies: With consumers becoming more price-sensitive, businesses should explore dynamic pricing models, value-based pricing, and price segmentation to sustain demand.

- Invest in Consumer Education: Companies that clearly communicate how tariffs affect product costs and supply chains can build stronger consumer trust and brand loyalty.

- Strengthen Assortment and Product Strategy: Businesses can align formats and SKU types with key price points and consumer willingness to pay, develop lower-priced options, and strategically manage the product lifecycle to maximize profitability and market appeal.

- Leverage Local Branding: With a growing preference for domestically made products, businesses should highlight American-made initiatives and ethical sourcing strategies.

- Optimize Promotions: Discounts, loyalty programs, and limited-time offers can help mitigate the perceived impact of price increases, keeping consumers engaged and incentivizing repeat purchases.

The 2025 Tariff Consumer Market Study uncovers how tariffs are reshaping consumer sentiment, price sensitivity, and spending behavior. Businesses that adjust pricing, supply chains, and communication will be best positioned to sustain revenue and loyalty.

Let’s talk. The challenge isn’t just pricing, it’s about optimizing the entire value chain to drive stability and growth. From cost management to consumer trust, the right strategies make all the difference. Reach out for actionable insights tailored to your business.