The SaaS industry enters 2025 with renewed optimism. After years of economic challenges, the focus has shifted back to growth, anchored in strategic adjustments and hard-earned lessons. Success this year will require balancing a growth mindset with disciplined execution. The early 2020s saw relentless growth and soaring valuations, as companies raced to capture market share at all costs. However, by 2023, economic headwinds and cautious investors prompted a pivot to profitability and operational discipline, with businesses emphasizing leaner operations and prioritized strategic goals.

Now, confidence is growing. Lower interest rates, profitability gains, and AI-driven innovation are creating fresh opportunities. Salesforce, for example, showcased AI’s revenue potential with Agentforce AI, securing 1,000 paid deals. Optimism is also evident in rebounding venture capital, SaaS & Cloud stocks rising 30-60% in H2 2024, and record net ARR for US-listed SaaS companies in Q4 2024.

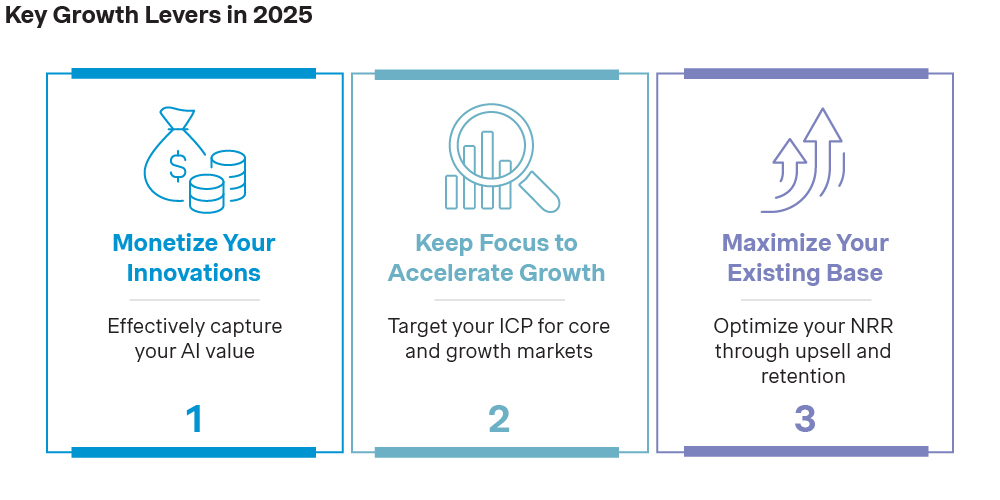

As the SaaS sector re-embraces growth, retaining past lessons is vital. This article highlights the 3 key growth levers for SaaS leaders in 2025, based on these key lessons learned.

Growth lever 1: Monetize your innovations

Generative AI has moved from a buzzword to a baseline expectation in the SaaS world. Most SaaS companies have launched or will launch new Gen AI innovations this year, we know from experience that over 50% of innovations never meet their financial goals. Gen AI innovations bring a new challenge, high operational costs reducing gross margins for SaaS solutions. Strikingly, even the highly priced pro version of ChatGPT is not profitable. Building on such examples, the next challenge is clear: how can companies effectively implement AI-driven features and translate them into sustainable revenue streams, while taking costs into account? A recent case comes from GitHub, which initially launched GitHub CoPilot under a single pricing plan but later adopted a tiered pricing approach to better capture value and address diverse customer needs. This shift highlights the need to continually refine value propositions and align pricing strategies with models like usage-based or outcome-based pricing. By doing so, companies can ensure they effectively capture AI value while managing cost. Early adopters who navigate this phase well will set themselves apart in increasingly competitive markets.

Growth lever 2: Keep focus to accelerate growth

If there is something we have learned from 2023, it’s that growth isn’t just about doing more; it’s about doing the right things. And with the rise in customer acquisition costs, this focus is more important than ever. A well-defined Ideal Customer Profile (ICP) is the cornerstone of this strategy, yet still 4 in 5 companies do not have a clearly defined ICP or fail to move beyond superficial characteristics without diving deeper into specific needs. Companies with clear ICPs see a 68% higher win rate in sales and have more effective resource allocation, making this a crucial area for improvement. Not only is an ICP important in your core market, but also in your growth markets. For example, Shopify’s success can be attributed to its focused approach in identifying and targeting the right markets, allowing it to dominate the e-commerce SaaS space. By leveraging data-driven insights and aligning expansion plans with their ICPs, SaaS companies can strategically choose the right markets. This might involve entering untapped industries, doubling down on high-performing segments, or diversifying their product offerings. Maintaining this focus ensures that resources are directed toward opportunities with the greatest potential value.

Growth lever 3: Maximize your existing customer base

Recent years underscored a hard truth for SaaS companies: focusing solely on acquiring new customers is not a sustainable growth strategy. Knowing that keeping existing customers is 5x cheaper than acquiring new ones, it’s no surprise that retention has become a key driver of success. Net Revenue Retention (NRR) has emerged as one of the most important metrics in SaaS, reflecting the importance of expanding and maintaining existing customer relationships. Although average NRR rates have slightly declined due to increased churn in some sectors, top performers like Snowflake continue to achieve impressive benchmarks exceeding 120%. Even companies that surpass 100% NRR grow at twice the rate of their peers who fall below this threshold by generating additional revenue through expansions and up- and cross-sell opportunities within their existing base. Improving customer retention and upsell rates requires a combination of exceptional customer success strategies, personalized product experiences, and innovative pricing models. By segmenting their customer base and addressing specific pain points proactively, SaaS companies can tailor retention strategies to different groups and unlock upselling opportunities.

A promising year ahead

This year, we’re excited to dive deeper into these topics. Our upcoming articles will explore each of these three key growth levers in detail, providing actionable insights for SaaS leaders.

For those looking to connect with the brightest minds in tech, our upcoming Tech Summit in May promises to be a highlight of the year—a space to share ideas, spark innovation, and shape the future of SaaS.

Let’s make 2025 a year to remember for SaaS.

The authors wish to thank Noor Houben (Senior Consultant) for her contribution to this article.