For banks, price adjustments are one of the most important levers for generating additional revenue. In many jurisdictions, however, this is only possible with the active consent of customers. There are a number of factors to consider to make this a success.

While some countries allow changes to banks’ price models quite flexibly (e.g. information on account statement deemed sufficient), others require documented, active consent from customers. Even when such consent is required, our project experience shows that price adjustments can still work very well. However, certain rules must be adhered to. In the following, we explain seven success factors for a “soft customer migration,” i.e., switching to new pricing models when the active consent of customers is required.

Success factor #1: attractive new models with added value

Now more than ever, the new offering must trigger a “wow” effect among customers and sales reps. Broad price increases without considering customers’ perception and without a good story are not possible. This is because customers must actively agree to the new pricing model. So they have to be convinced to change, and before that, the bank’s own sales team, too. Customer advisors must not hesitate to approach customers. For banks, this means understanding exactly which new service elements customers can’t say “No” to.

The added values should be bundled into simple and attractive value-added packages. For example, services such as a banking app, a digital bank card, real-time transfers at the point-of-sale, WhatsApp service, account alarm clocks, or mobile payments could be combined into a handy Smart Mobile Banking package. Other bundles combining multi-banking, security, and regional offerings are conceivable, so that a set of four to five value-added packages can be presented that can be included in the new account models. This way, banks are able to cater to innovative trends and show that they have invested in many new and attractive services since the last price adjustment.

Success factor #2: simple, segment-specific communication and migration

Value communication based on a value driver analysis is of particular importance. However, our experience also shows that price acceptance can be further increased by a cost argumentation and a reference to changes in the macro environment. This is especially true for factors that banks themselves cannot influence (e.g. central bank low or negative interest rate policies).

In communication, transparency and simplicity are crucial. It is key for banks to convey two to three core messages about the planned changes and make the approval process for customers as simple as possible. Concise communication materials are essential in this regard, supplemented by QR codes that lead to short videos for further explanation and the digital consent form.

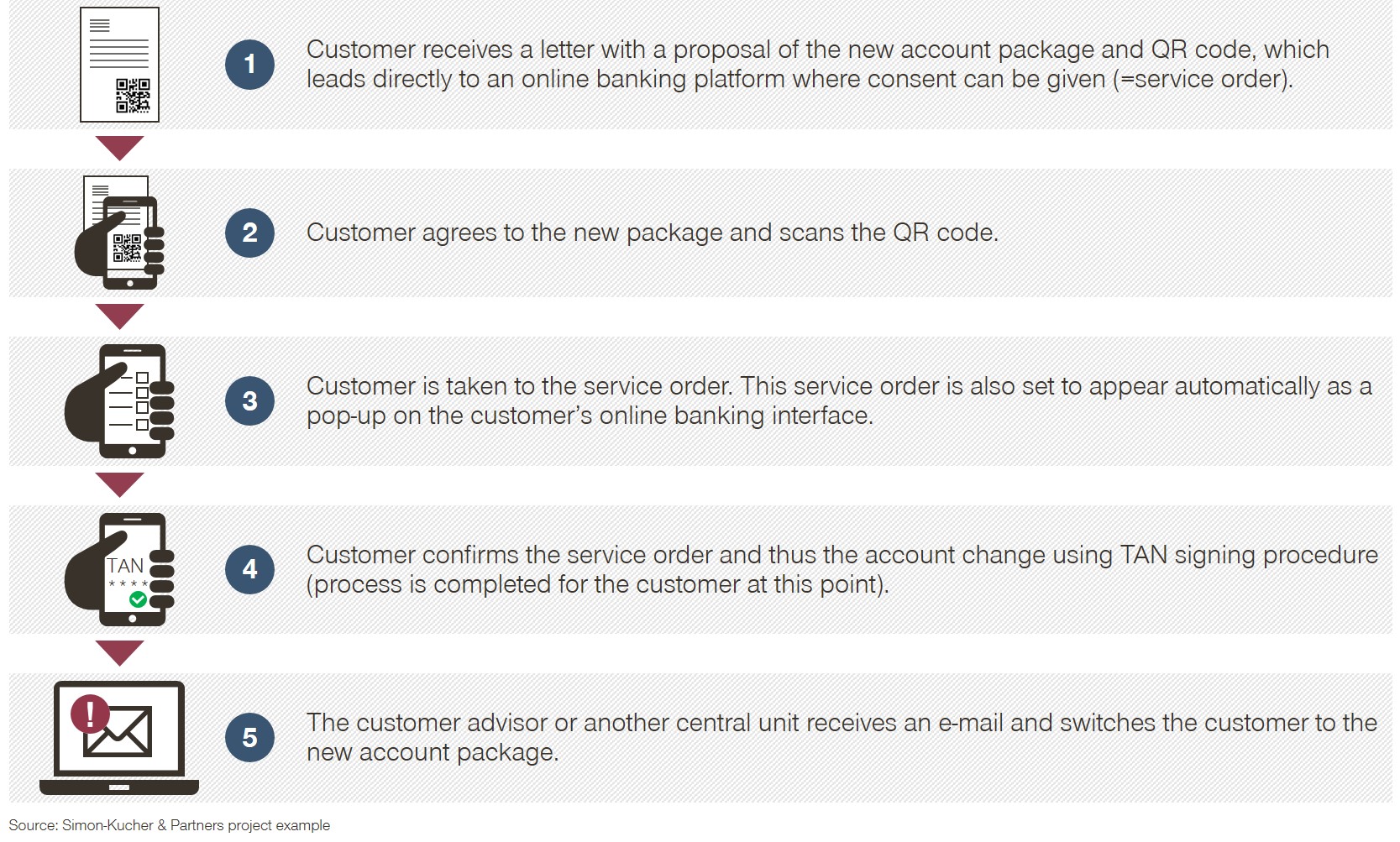

The ability to digitally consent to the price adjustment makes the process much easier. While in high-potential segments with good cross-selling opportunities a face-to-face conversation is often sought after, digital consent is an efficient solution for lower-potential segments. Another point to consider is the amount of additional burden the new pricing model places on the respective customer. In general, the lower the contribution margin potential and the lower the additional burden, the more impersonal the consent process can be (via call center or bank counter instead of personal advisor, or even purely digital). An established process for obtaining digital consent for a new current account package can be found in Figure 1.

There are also a variety of behavioral science aspects to consider. Additional incentives such as raffles when switching directly in the first eight weeks can accelerate acceptance. Erste Bank in Austria, for example, fueled a switch to its new online banking “George” with a draw for a trip to New York. To make these kind of things work, banks need to find out which incentives work best. Just because something costs more doesn’t automatically mean it will be better received by customers. One experiment, for example, showed that a lottery for all customers with the chance to win one single Tesla had a similarly strong effect as an expensive switching bonus per customer, even though the former is much more favorable from the bank’s points of view.

Success factor #3: provide “internal emergency exits”

For price-sensitive customers who are considering refusing the price adjustment, banks should create options to escape a price increase without having to switch banks right away. This is what we call “internal emergency exits,” which have to be integrated directly into the new pricing landscape. Such an emergency exit could be, for example, a new price tariff with a favorable basic price that excludes certain services. The other extreme of the service range would be particularly attractive premium account packages. Thanks to these options, price-sensitive customers can switch to lower new rates with less cost-intensive services and thus stay at their bank. Less price-sensitive customers choose convenience above costs and remain in their existing price-adjusted models. Both are good outcomes for banks.

In order to respond to different customer types and their willingness to pay most effectively, a well-differentiated rather than a one-size-fits-all pricing model is mandatory. This gives customers the opportunity to choose a model that suits them personally instead of being faced with a fait accompli that prompts them to use an external emergency exit towards the competition. The fact that price-sensitive customers have a choice and need to take action has proved particularly successful in the case of consent-requiring price adjustments.

#Even within existing account models (i.e., without switching to a direct or premium account), internal emergency exits can be useful. Relationship pricing models, where the account price depends on product usage, work particularly well here. With these pricing models, we achieve a consent rate close to 100 percent in countries where consent is mandatory.

Instead of telling customers “Your account is 3 euros more expensive now, it costs 7 euros instead of the previous 4,” the communication should be “The account now costs between 0 and 7 euros. Currently, you would have to pay 3 euros more. But let me show what you could do to pay less than before. For example, all you need is XYZ.” And XYZ is a recommendation for a product that is highly relevant to the customer (according to smart data). The recommendation relates to a gap in the customer’s coverage that they should close anyway in order to be better off financially. The ball is then back in the customer’s court and they can determine the price of their account themselves through their behavior and loyalty to their primary bank, without changing the account model.

Legal protection insurance, for example, is not particularly relevant for most customers. However, if a customer has incurred legal fees in the last twelve weeks, the relevance has massively increased in the customer’s perception and the product moves up in the prioritization of the recommendation algorithm. In this respect, the smart data selection ensures that the steps to the next status level have the highest possible relevance for the customer, so that the next higher status level appears achievable for every customer and worthwhile overall.

To fully realize its potential, relationship pricing models need easy and intuitive digital applications (see Figure 2). They allow customers and advisors to see the customer’s status, the discount resulting from it, and how customers can most easily reach the next level. Each module stands for one financial topic and associated product solutions. Customers access their individual and pre-filled profile via a banking app, an online banking platform, together with their advisor at the bank’s branch, or via QR codes in customer newsletters. They instantly see which modules they are already using and which are still missing. When they have used a certain number of modules, they reach bronze, silver, or gold status. The next status level is usually just around the corner. Customers are motivated to reach the next level, like in a fitness app or an online game. That’s just how people tick, even without monetary incentives. In addition, they can receive attractive bonus payments if they agree to the new pricing model.

Bank advisors also have the option of opening the pre-filled application for each customer and viewing the recommendations with one click via the customer master data. This is the perfect preparation for a successful customer meeting about the new pricing model.

When advisor meetings are held to gain approval for a new pricing model, consultants can combine it easily with the relationship pricing incentives in order to shift the focus away from the price increase and onto other issues like better financial services. This makes it much easier for consultants, as it allows them to escape discussions solely focused on price. The conversations are much more pleasant and the approval rate is significantly higher – as mentioned earlier.

If expensive sales resources have to be invested in obtaining approvals for new price models, relationship pricing models ensure that not only the new price model is being discussed but also additional sales are on the table. Usually, banks want to conduct more holistic customer meetings with high-potential clients anyway. Sales resources are therefore well allocated and consultants are not held up with discussions that serve solely to obtain approval for new prices and do not lead to any sales successes.

If banks have to obtain approval for new pricing models, additional revenues are lower in the first year because the confirmations are received only successively. If a relationship pricing model is used, these lower additional revenues from price adjustments are offset by significantly higher cross-selling revenues. These are much higher with “soft migrations” (with approval) than “hard migrations” (without approval), because significantly more attention is paid to the pricing model.

In particular very cautious banks forego the additional income from payment transactions altogether in the first twelve months by elevating customers to a higher relationship status level via bonus modules until a certain cut-off date (e.g., twelve months after the start of the campaign), which initially means that customers do not have any additional charges at all. This further promotes approval. However, customers must convert these bonus modules into real product modules by the deadline in order to remain at the status level. Their advisors help with specific suggestions and thus generate more cross-selling income in the first twelve months. The earlier customers are migrated, the more time customers and advisors have to keep the price level constant.

More and more institutions are thinking about using bonus programs that go beyond their own banking products. For regional banks in particular, the current trend supporting their region and sustainability offers an opportunity to position themselves favorably. This way, a relationship pricing model can be developed into a future-oriented program where, in addition to customers’ own financial future, the future of the region and the planet are also taken care of. The latter is achieved by rewarding sustainable banking initiatives (electronic inbox, sustainable investments, etc.) or planting trees for each customer’s higher status levels. These are all elements of a modern pricing model in the 20s of the 21st century, to which almost no customer refuses to agree.

Success factor #4: put together a larger package

If banks have to go out of their way to obtain the consent of their customers, then they should directly put together a larger package and present it for approval. This applies at least in customer segments where advisory meetings are held and digital consent is not relied upon.

One example of this could be the introduction of negative interest rates, for which banks would also need approval from their customers. Usually, they are therefore only charged for higher deposits (e.g., 100,000 euros or more). If banks have to have the “consent talk” anyway, they can also use the opportunity to introduce them to customers below these limits. Even if negative interest rates are not planned for the near future, this gives the bank the option of making exemptions in the future, depending on their revenue situation, and then have a direct effect on the majority of deposits very quickly. This option is very valuable, as it puts the bank on a more stable ground in terms of earnings. The value of the advisory services is thus even higher.

Another issue is the extensive use of data (including payment transaction data) for the purpose of providing better advice and identifying relevant product suggestions. The age of open banking platforms is upon us, and in the process, such consent will be obtained by default by new digital providers in order to generate automated sales impulses based on artificial intelligence algorithms.

That’s why banks should use an upcoming “consent talk” to also make significant progress on strategic topics and digitalization. This way, banks can get miles ahead strategically as a result of what may initially be perceived as a “forced” customer interaction. Banks should therefore look more positively at the topic of soft migration and turn the burden of actively approaching customers into an opportunity. However, in order to do this, they need to work out which product package to put together for their customers and figure out underlying processes and transparent communication strategies.

Success factor #5: use digital service configurators

Digital service configurators (e.g., account finders) are a proven success strategy to select the right model for clients. They not only help to highlight the new products’ added value, but also increase up-selling into higher-value products and customers’ willingness to pay. Up-selling into premium accounts becomes a significant incremental revenue driver when banks have to actively seek consent, whereas otherwise, customers mostly stay in their account models and up-selling into premium offers was usually not as successful.

Service configurators can be used either by sales reps together with customers or by customers themselves to find the right product in just a few steps. The benefit of such a model finder increases massively if advisors have to actively obtain the customers’ consent. This is because the applications are designed in such a way that consent rates are high and up-selling as well as cross-selling potentials are maximized. Numerous studies show that customers have a higher willingness to pay for self-configured products than for predefined ones. This is precisely what model finders and configurators are used extensively in the automotive industry, for example – and banks can learn from this.

Success factor #6: comprehensive sales team preparation and training

“Excuse me? We have to talk to every customer?” No, instead: “We get to talk with every customer!” The right sales mindset is critical to success. Key to this, in addition to a fitting new pricing model, are preparation and training. A well-trained sales team is decisive in determining how quickly and successfully a product changeover is carried out, i.e. how high the additional profit from the price increase is and how quickly it is realized. A perfectly prepared sales team not only manages to present the price adjustment in a positive light, but also uses the conversation to talk about other products and gaps in the customer’s profile, thus increasing cross-selling. Various methods have proven effective in sales training: Intensive coaching, small-group exercises to handle objections and present benefits, and training sessions on the use of service configurators. In addition, executive coaching sessions are suitable for getting opinion leaders fully on board.

Success factor #7: clear prioritization and goals for sales and monitoring

Sales is critical to successfully and quickly transitioning customers to the new product/pricing models. Therefore, it is important to define the changeover as a priority for sales and to set targets accordingly. A clear migration strategy and planning (e.g., which customers should be approached first, which segments should be converted primarily in person or digitally) are just as important as strict monitoring of the changeover progress. Gamified incentives can be used to provide additional motivation for sales reps during the changeover phase: From branch rankings and playful competitions to transparent rankings without monetary rewards to monetary sales incentives, a wide variety of incentive models are successfully used by banks in the market.

Conclusion: Customer consent can lead to more than price increases

If banks follow the success factors described in this article, nothing stands in the way of successful price increases even when active customer approval has to be obtained. Price increases and product adjustments must be geared even more to customer benefits, and customer migration must be prepared even better than before and supported with digital tools. If this is the case, there are great opportunities not only to successfully and sustainably implement a price increase, but also to significantly increase cross-selling, thereby tying customers more closely to the bank.