Our latest Global Streaming Study reveals that people are not increasing their streaming hours any more. And consumers are not only stepping back from streaming ‘more’ but also battling subscription fatigue and increasing price sensitivity. Can streaming service providers prevent subscription churn and still gain customers in this market?

At a glance

- Global growth in time consumers spend streaming has slowed

- Consumer budgets are falling

- Subscription fatigue is on the rise

- Price is the most important factor driving consumer choice, followed by the breadth of content available

Consumer streaming habits are changing

The results are in – people are not increasing their streaming hours despite easy access to a vast range of content.

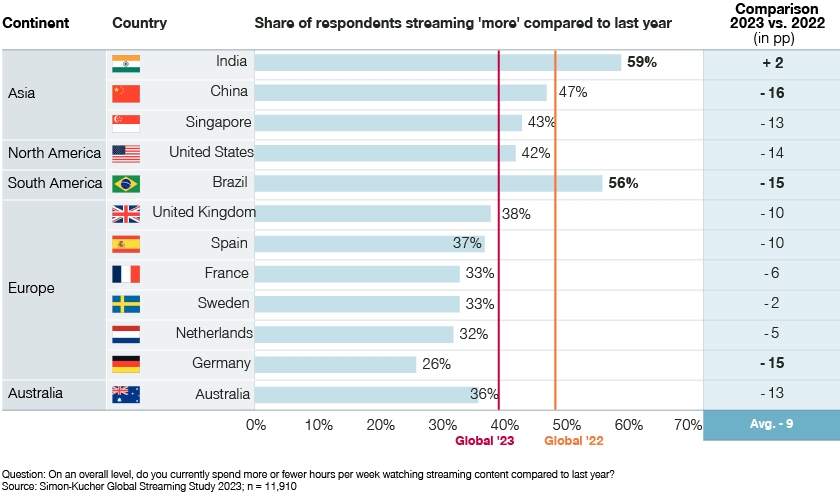

If half of respondents last year were spending more time streaming than the year before, this year that number is down to 40 percent. However, consumer streaming behavior has remained fairly consistent as there’s no major changes in the time or type of content being streamed. For example, both films and series are still the most watched content. 78 percent of consumers spend more than two hours per week watching films while 70 percent spend the equal amount of time watching TV shows. Only live events are significantly lower at 41 percent.

Our Global Streaming Study for 2023 reveals that India is the only country where the number of people streaming ‘more’ has increased. On the other end, China has the sharpest decline in respondents streaming ‘more’, followed by Brazil and Germany.

So, what has brought about this change in people’s streaming habits? Different factors could be tied to this: people going out more post-pandemic, cutting down subscriptions due to the cost-of-living crisis, perceived lack of quality content, etc.

Free online services, such as Amazon’s ad-supported Freevee, are also becoming increasingly popular with free services now accounting for 36 percent of total time spent streaming (up from 29 percent last year). It is slowly catching up to paid subscriptions which, at 41 percent, is still the most popular provider category, regardless of content type.

Increased competition leading to market saturation and loss of subscribers

Lockdown led to a tremendous growth in streaming as the number of video streaming services exploded. Netflix and Amazon Prime Video aside, people now have a wide array of options to choose from in the form of Disney+, Apple TV+, and Paramount+, among others.

But while there are plenty of streaming platforms for viewers, competition is intense for providers who must hold consumer attention with engaging content and attempt to prevent subscription churn.

And our research indicates that the overall budget that consumers are willing to spend on streaming services has gone down. People are more inclined to cancel their existing subscriptions when they add a new service. 62 percent of respondents would either cancel a subscription or make savings elsewhere if they were to sign up to a new streaming platform.

All these suggest market saturation. In fact, the signs have been there since last year with record subscriber loss, staff layoffs, slow growth for those platforms, etc., all pointing to a challenging period for streaming service providers.

Consumer budgets are dropping, and price sensitivity remains high

1. Subscription fatigue

This is reflected in our research that shows the average number of streaming subscriptions held per consumer is down by 14 percent. At 43 percent, China has the biggest drop in streaming subscriptions with more respondents considering canceling a subscription in the next year. Brazil and Spain are the only countries that have not seen a decline in streaming subscriptions.

This year, too, price remains a leading reason for cancellation, indicating high price sensitivity in customers. Two out of five respondents mentioned saving money as the biggest reason for canceling their streaming subscription, and a third of respondents who cancelled said they did so because of the high price. A further 26 percent said they cancelled their subscriptions because they had too many.

Unsurprisingly, those considering cancellations next year had the same reasons – saving money (43 percent), too high prices (41 percent), or too many subscriptions (30 percent). It is interesting to note here that 20 percent of those considering canceling are doing so because of a perception of low content quality. Other reasons include poor user experience and content overload at 15 percent each.

Chinese respondents, as previously mentioned with the largest share of likely cancellations, indicated that finishing content they signed up to watch was the main churn reason.

2. Drop in streaming budgets

Streaming budgets are also declining. The US has the highest willingness to pay (WTP) per subscription while China has the lowest. On a global level, WTP per subscription decreased on average by almost 30 percent from the previous year while total WTP on streaming subscriptions declined by almost 10 percent.

This significant drop in WTP per subscription relative to the overall streaming budget highlights a major drawback of content fragmentation. Consumers feel the need to pay for more streaming services to access a wider range of content that restricts how much they can spend on individual streaming services.

If we compare streaming budgets by region:

1. Asia

- Singapore and India – almost used up

- China – exceeded

Singapore’s WTP for both one and all subscriptions has decreased by five Singapore dollars. India is in a similar position as WTP has reduced by 101 Indian rupees (INR) for one subscription and 100 INR for all subscriptions. China displays the sharpest decline as WTP for one subscription is down by 24 Chinese Yuan (CNY) and all subscriptions by 10 CNY.

2. North and South America, and Australia

- Australia – almost used up

- US and Brazil – exceeded

Respondents’ WTP in Brazil for one subscription decreased by five Brazilian reals while it remained constant for all subscriptions. It was similar in Australia as WTP for one subscription was down by five Australian dollars, and WTP for all subscriptions remained consistent. In the US, WTP for both one and all subscriptions decreased by five US dollars.

3. Europe

- Germany, the Netherlands, the UK, and France – almost used up

- Sweden and Spain – exceeded

Germany’s WTP for both one and all subscriptions have decreased by five euros (EUR). The streaming budget was comparable for consumers in the UK, the Netherlands, and France. Consumers’ WTP for one subscription went down by three pounds sterling and three EUR, respectively, while WTP for all subscriptions remained unchanging when compared to last year.

In Sweden, the budget has already been significantly exceeded. Where WTP for one subscription has declined by five Swedish kronor (SEK), it has fallen by 50 SEK for all subscriptions.

The situation is a bit different in Spain. While WTP for one subscription decreased by five EUR, WTP for all subscriptions increased by one EUR.

What are the key purchasing criteria when choosing a streaming service provider?

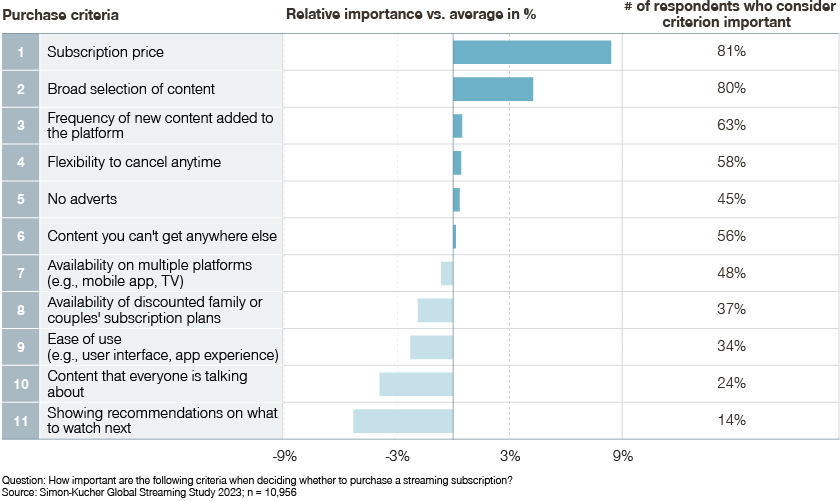

Simply put: Price is the most important purchase criterion, followed by breadth of content available and the frequency of new content added to the platform.

More than four out of five respondents selected subscription price as most important, pushing up its significance by four percent this year. Consumers also showed more inclination toward ad-supported packages. Netflix and Disney+ are two of the streaming providers that have introduced these ad-supported plans. Cheaper than the regular ad-free tiers, these new plans enable people to catch the latest and best films and shows while paying less.

Once again, this highlights the trend of increasing price sensitivity. Additionally, there’s been a rise in the importance of discounted family or couples' subscription plans by five percent. Almost two-fifths of respondents consider this when choosing a new service.

And while a wide variety of content is essential when selecting a streaming service, the frequency of new content is less important this year. This could potentially be due to the quantity of new content and players on the market.

Forging ahead despite challenges

Streaming service providers will continue to contend with market saturation and increasing price sensitivity. But despite these challenges, the core task remains – how to keep customers engaged and prevent subscription churn.

Offer customization appears to be the key to success. The streaming industry can be divided into three user segments: price-sensitive, price-value oriented, and value-oriented. Making up 43 percent of respondents, the price-value oriented user segment is the largest, followed by 38 percent price-sensitive and 19 percent value-oriented user segments. In today’s landscape, streaming service providers must find the balance between price and value when optimizing packages. They can target the price sensitive segment with flexible, low-priced packages. And for those that value content over price, providers can offer premium packages with extensive and frequently renewed content, and flexible streaming options.

While existing players do have some room for price increases in some countries, it’s crucial to provide quality content to match the price hike. For new streaming companies, the volatile market situation makes it imperative to have differentiated offers for different customer segments. .

The bottom line is players must do everything they can to retain existing subscribers by building on a strategic retention management system. If streaming service providers have only limited room to grow prices and are facing an increased churn risk, they need to focus on their existing customer base. Identify those most likely to leave and invest in ways to keep them engaged. Rather than working to constantly procure new clients and increase customer acquisition costs, it’s more beneficial to emphasize on increasing customer lifetime value.

At Simon-Kucher, our MyBase platform has been helping businesses successfully manage and expand their customer base. From helping recognize clients most likely to leave to rewarding loyal customers with sensible upgrades, MyBase maximizes the potential of your customer base.

If you’re looking for some expert support to help navigate this challenging time, reach out to us today.

Embrace your existing customer base

Are you struggling with negative net retention? Are you using your up and cross selling opportunities systematically? It's time to embrace the potential of your customer base with MyBase, a data-based solution with a focus on customer engagement.