With potential tariffs looming, industrial companies are facing a familiar but complex challenge: how to adjust prices without alienating customers or losing ground to competitors. Should tariff-related costs be passed through as a separate surcharge or incorporated into a general price increase? Should price hikes happen before, during, or after the tariffs take effect? And how much of the cost should be absorbed versus passed along?

There’s no one-size-fits-all answer and the right pricing strategy depends on market dynamics, customer expectations, and your long-term positioning.

Surcharge vs. general price increase: which makes more sense?

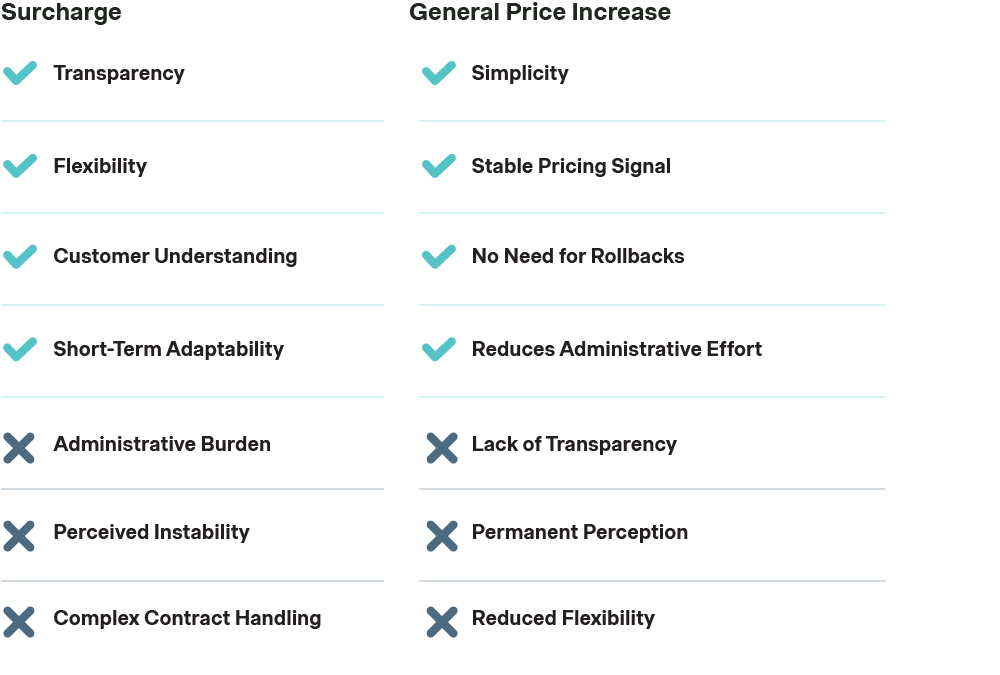

When tariffs drive up costs, businesses have two main options —adding a surcharge or folding the cost into a general price increase. Each comes with advantages and trade-offs. The right approach depends on factors like customer expectations, industry norms, and pricing flexibility.

Below, we break down the key considerations to help you decide which approach best aligns with your business strategy and customer expectations.

Adding a Surcharge

A tariff surcharge keeps price increases transparent and reversible, helping customers understand that higher costs stem from external factors rather than arbitrary pricing decisions. By listing the surcharge as a separate line item, businesses clearly communicate that price adjustments are tied to tariffs.

This approach offers flexibility, allowing companies to adjust or remove the surcharge if tariffs change. Customers are more likely to perceive it as fair since it directly reflects a specific cost driver. It’s also ideal for short-term adaptability, particularly when tariffs are temporary or fluctuating due to policy changes.

However, there are drawbacks. Competitors who absorb costs or remove surcharges sooner may make your pricing seem uncompetitive, potentially eroding customer trust. Frequent changes can create uncertainty, leading to perceived instability. Additionally, surcharges add an administrative burden, requiring separate tracking, billing, and future adjustments. Businesses must also ensure contract clarity, as customers may require justification for additional charges and clear terms on when they might be removed.

Folding Costs into a General Price Increase

Folding tariff-related costs into a general price increase keeps pricing stable and avoids the hassle of tracking separate surcharges. It simplifies invoicing and financial management while signaling a long-term cost adjustment. Plus, it removes the need for future rollbacks that could devalue pricing.

However, this approach can make it harder for customers to see the direct impact of tariffs. It may also create the impression that the price hike is permanent, even if tariffs are later removed, and offers less flexibility if costs change unexpectedly.

So, which approach is best?

Consider the following:

- Industry Norms – Are competitors using surcharges or adjusting base prices?

- Customer Sensitivity – Will a surcharge be seen as fairer, or will it spark more negotiations?

- Tariff Duration – If tariffs are long-term, a base price increase may be more sustainable.

In some cases, a hybrid approach—starting with a surcharge and later folding it into base pricing—can provide flexibility while managing customer expectations.

When should you raise prices?

Timing is everything when it comes to tariff-driven price increases. Should you raise prices before, at the same time, or after the tariffs take effect? Let’s look at each option and assess the trade-offs.

1. Raising Prices Before the Tariff Hits

This approach allows businesses to recover costs early and prepare customers for the impact. However, if tariffs are delayed or don’t happen, customers will push back.

2. Aligning Increases with the Tariff Start Date

Adjusting prices when the tariff takes effect keeps things transparent. However, this can create a scramble, especially if customers haven’t been adequately informed of the effective price increase or surcharge implementation date.

3. Waiting Until After the Tariff Takes Effect

Delaying price increases can help maintain goodwill in the short term, but it risks margin erosion and may lead to abrupt, steeper hikes later. It can also put you behind competitors who adjusted sooner.

Finding the Right Timing

The best approach depends on:

- Customer Expectations – Are they prepared for price changes?

- Competitive Moves – Are others raising prices early, or waiting?

- Contract Structures – Are long-term agreements in place?

In many cases, a phased or gradual approach, combined with proactive customer communication, helps minimize resistance.

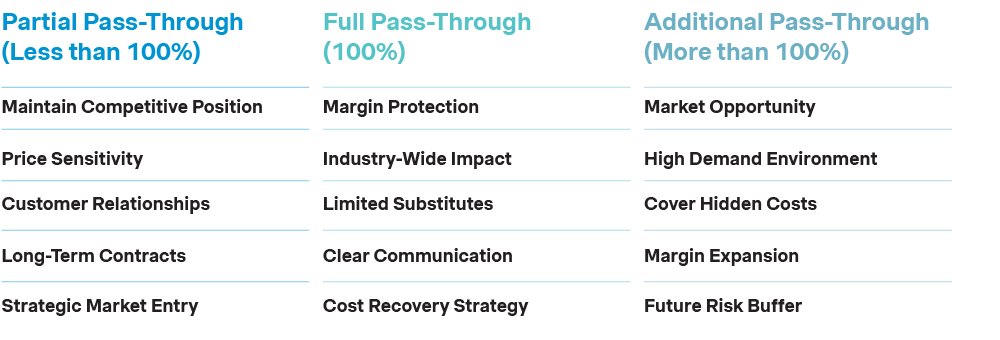

How much of the tariff cost should you pass through?

Once you’ve decided when and how to increase prices, the next question is: how much of the cost should you pass along? This decision can take several forms—from absorbing part of the cost to maintain competitiveness, to shifting the entire burden, or even going further and raising prices beyond the direct increase.

Each approach offers its own set of advantages and trade-offs, which we'll explore in detail, below.

Partial Pass-Through

In highly competitive markets, companies often absorb part of the tariff increase to maintain market share and avoid customer churn. This is especially important in industries with high price sensitivity, where even a small increase could lead to lost business. By passing on a partial cost increase, companies demonstrate goodwill and partnership, which strengthens customer relationships. However, long-term contracts can limit the ability to fully pass on costs, and companies trying to enter or expand in new markets might absorb some of the burden to remain attractive to customers. While this strategy helps maintain competitive positioning, it compresses margins, making effective cost control and supplier negotiations essential.

Full Pass-Through

For businesses in industries where all competitors face similar tariff impacts, passing on the full cost increase can be a viable option. If customers have limited alternatives or the entire market is affected by the tariff, they are more likely to accept the full pass-through. Full cost pass-through also helps preserve margins and ensures profitability. Additionally, clear communication about the tariff’s direct impact helps customers understand the rationale behind the price increase, fostering transparency. In cases where there are few substitutes, the increased costs are often more acceptable. This strategy also serves as a cost recovery measure, ensuring that businesses don’t absorb unnecessary expenses.

More than just covering costs

In some cases, companies use tariffs as an opportunity to reset pricing benchmarks. This approach involves raising prices beyond the direct cost increase, especially when customers expect rising costs industry-wide. In periods of high demand, customers are often more receptive to price hikes. This additional pass-through strategy can help cover not only the tariff costs but also hidden costs such as increased logistics or administrative expenses. It also provides an opportunity for margin expansion, as strategic price increases can improve profitability without negatively impacting sales. Finally, it helps build a cushion for future risks, offering protection against potential cost increases or market disruptions.

What’s the right approach?

Consider:

- Customer Price Sensitivity – Will customers accept a full pass-through, or do you risk losing business?

- Market Positioning – Are you a price leader or following competitors?

- Long-Term Impact – Can your pricing strategy strengthen your overall pricing discipline?

By taking a strategic, data-driven approach to tariff-related cost increases, businesses can protect margins, maintain customer trust, and reinforce market positioning.

Final thoughts: turn tariff challenges into pricing opportunities

Navigating tariffs requires a thoughtful pricing strategy that balances cost recovery with customer relationships and competitive positioning. Whether you choose a surcharge, a base price adjustment, or a phased approach, success depends on aligning your strategy with industry norms, customer expectations, and market conditions. Timing also plays a critical role—raising prices too early or too late can impact profitability and market perception. By leveraging a structured, data-driven approach, industrial companies can turn tariff challenges into opportunities for stronger pricing discipline and long-term growth.

Industrials pricing is complex—throw tariffs into the mix, and it becomes even more challenging. At Simon-Kucher, we help businesses cut through the uncertainty with tailored pricing strategies that protect margins while maintaining customer trust.

Contact our experts to find the right pricing approach for your Industrials business.