A common question from publishers and wider consumer subscription businesses is “How can we make sure we are set up for success when it comes to acquisition?” Subscription companies must focus on acquiring new subscribers while also optimising for retention and monetisation.

At Simon-Kucher, we break subscriber acquisition down into two questions:

- What to sell?

- What to charge?

Packaging – What to sell?

Packaging is a fundamental topic, underpinning every monetisation lever available. However, businesses often adopt a “set and forget” approach. Even the best-designed packaging line up will look worse for wear after a few years of subscription feature development that is haphazardly distributed between existing packages.

Packaging is crucial because it allows you to offer differentiated products. Potential customers don’t all have the same willingness to pay or the same need for premium features, so offering a range of packages allows you to serve different segments.

It’s important to distinguish packages. Your packages can be differentiated on three broad dimensions:

- Platform

- Content verticals

- Features

- Platform differentiation: Versioning packages on access via mobile app, tablet, website etc.

Although previously widespread in digital media subscriptions, today we see an increasing number of publishers moving away from this approach. Consumers expect to be able to access content where they want, when they want. Access across all devices is increasingly perceived as a “table stakes” feature, and restricting access can signal a lack of digital savviness. This approach can also create usage barriers, inhibiting habit formation and increasing churn risk of newly-acquired subscribers.

- Content vertical differentiation: Versioning packages by access to topic areas

Content vertical differentiation is hard to get right. Prospective subscribers haven't experienced the product yet. So, unless it is clear exactly what content the packages contain, it will be hard to convince them to opt for a more premium package purely on the strength of the content included.

There is also the danger of cherry-picking, where consumers were only ever interested in one type of content. This leads to downtrading to a cheaper, content-restricted package, cannibalising revenue.

Portioning out content can also lead to unintended consequences on overall value proposition and retention: if a subscriber isn't able to browse different types of content and discover new areas they didn't know they would value, this can hurt product engagement, value perception, and ultimately retention.

- Feature differentiation: Distinguishing product versions based on the specific functionality or capabilities offered

The drawbacks of the approaches above mean that consumer publishers are increasingly standardising on a feature differentiation approach. Examples in premium subscription tiers include “gifting” a certain number of articles or providing exclusive access to e.g., premium newsletters, podcasts, partner discounts, comment functions, or access to a digital archive of historical articles.

The challenge is sorting the wheat from the chaff - understanding which features are valuable to your prospective customers. This involves targeted and scientific use of consumer research. Only then can you make an informed decision on which features should be used to differentiate packages, which should be included in all tiers, and which are better left on the cutting room floor.

Introductory offers – What to charge?

Once you’ve calibrated your packaging at acquisition, next you need to set the price point newly acquired subscribers will pay. This is most commonly a time-fenced introductory offer price.

It's important to note that introductory offers are only one form of sampling mechanic you might use as a subscription business. Other approaches are freemium - where you offer a free tier of membership that doesn't include full access to the product - or pay-as-you-go - a repeatable, transactional approach that allows access limited by time or usage.

Introductory offers are by far the most widely used sampling mechanic among consumer publishers. They balance fencing of access (normally time limited, one-use) with the flexibility of a discounted price level needed to attract prospective customers. In recent research we conducted with a client's subscriber base, around 70% of subscribers said that the introductory offer was an important factor in their decision to initially subscribe.

However, introductory offers do come with certain risks. If used incorrectly, they can undermine the value perception of your headline subscription price. In other research, around 50% of a client's subscriber base agreed that “the intro offer makes me question whether paying full price is good value for money.”

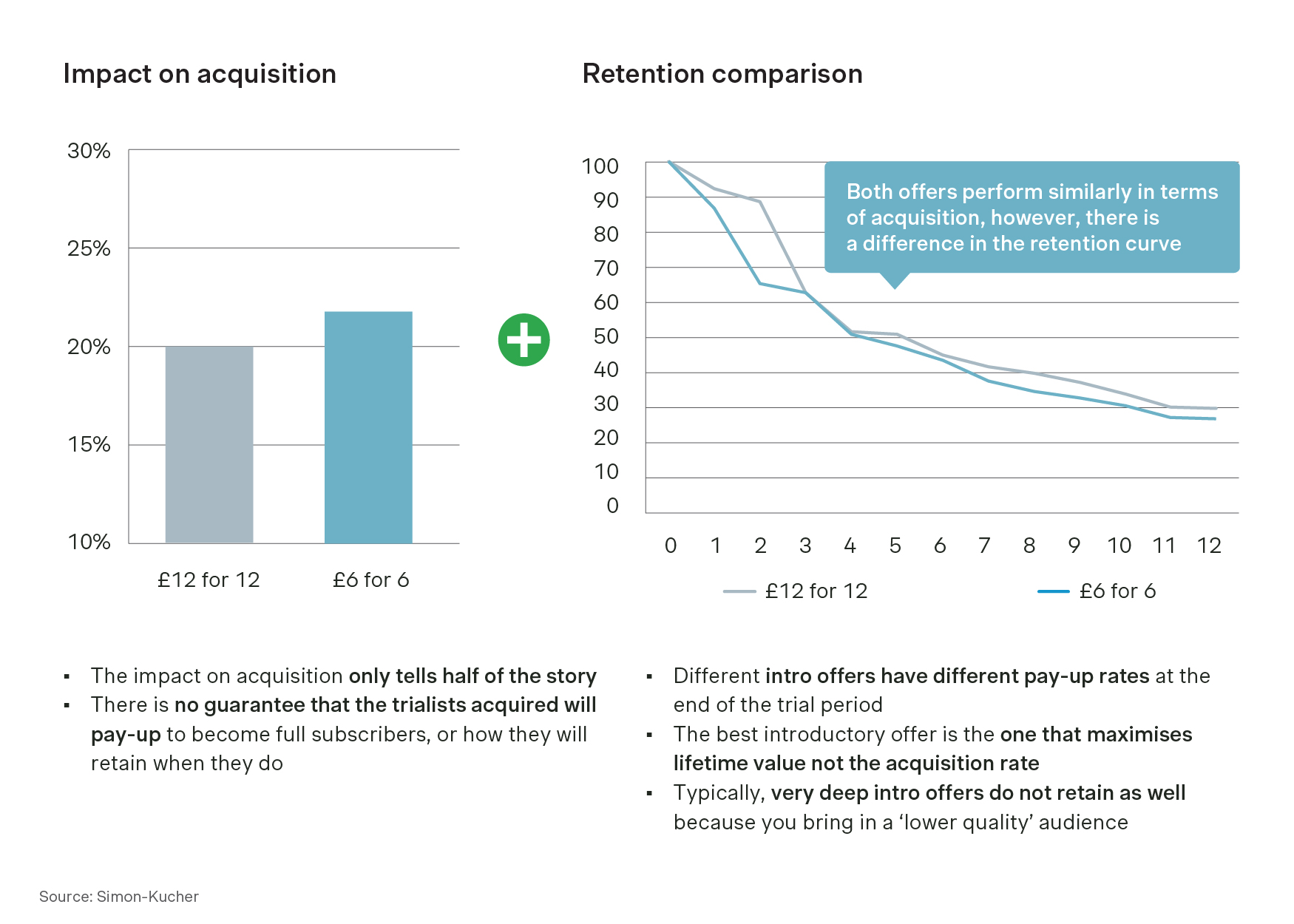

The other challenge is assessing if a particular approach is working or not. Performance needs to be evaluated on two dimensions: conversion impact and retention. AND both need to be looked at comparatively versus other introductory offers. Consumer research can help in understanding the likely conversion impact (and potential impact on existing customer value perception.) However, without A/B tests of different intro offers with at least 12 months of cohort churn data, meaningful evaluation of different introductory offer approaches is difficult.

Here are the four dimensions on which introductory offers can be differentiated:

- Deployment: The extent to which introductory offers are available to all new customers, on all packages. Impacted KPIs include average revenue per subscriber (ARPS) and conversion.

- Length: How long the introductory offer lasts (often driven by how long you believe it takes to build habit). Impacted KPIs include ARPS and retention.

- Price level: How much a customer pays. Impacted KPIs include ARPS, conversion, and retention.

- Price communication: E.g., per week, per month, per length, free. Impacted KPIs include conversion.

For example, based on our benchmarking the “average” newspaper subscription introductory offer in the UK is:

- Available on all packages

- One month long

- Priced at £1

- Communicated as absolute £ per length of trial

Finding the right combination requires consideration of each of the KPIs impacted and their alignment with your objectives, as well as gathering the consumer perspective via research and testing to understand how your target prospects and current customers will react.

Bringing it together

What to sell and what to charge? These simple questions are often highly complex to answer! However, investing in optimising these two levers will dramatically impact your ability to acquire new customers and maintain a healthy subscriber base.

At Simon-Kucher, we specialize in helping consumer publishing businesses like yours navigate these challenges with precision. Reach out to us today to unlock new growth opportunities and maximize your revenue potential. Let's work together to turn complexity into clarity and success.