In most countries, national pricing and market access (P&MA) authorities consider the price of the same pharmaceutical in other countries – this is called international reference pricing (IRP). Pharmaceutical companies are facing an increasingly complicated IRP landscape with diverse regulations. How can a company strategically approach the challenges of IRP?

International reference pricing, also known as external reference pricing, is a widespread method of pharmaceutical pricing. It describes the process in which national decision bodies compare cross-country costs in order to set or influence the price of a product in its own country. International reference pricing is becoming more and more important around the globe; the number of markets using IRP as a mechanism for national price control is constantly growing, and those which have already implemented IRP are regularly introducing stricter and more challenging rules.

Get to know LS Genius | IRP

International reference pricing differs across markets

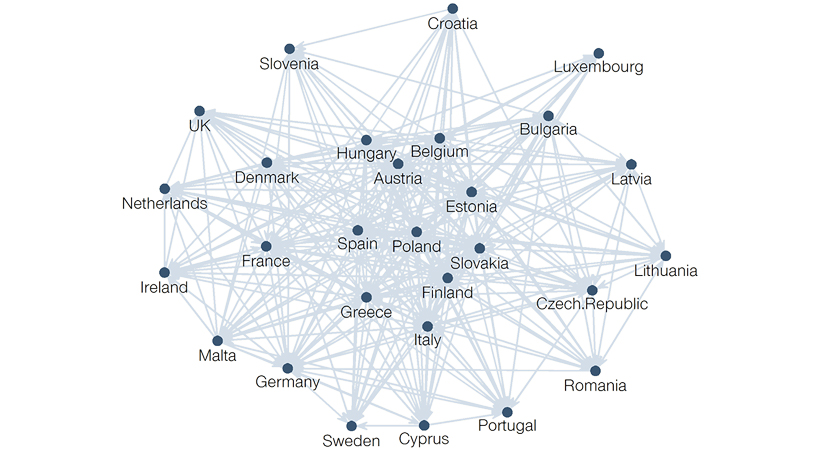

Today, there is a complex system of international reference pricing and re-referencing relationships around the globe:

The number of referenced countries varies significantly. For example, the Netherlands only looks at pricing in four countries while Belgium considers all other EU countries. The referencing process also varies in predictability. Some markets, such as the Netherlands, have clearly defined algorithms. Twice a year, they set prices after referencing the average ex-wholesaler price of the same product in Belgium, France, Norway (which replaced Germany in 2020), and the UK – this case is an example of formal price referencing. Other markets, such as Germany, have more informal and less predictable processes. In the German Pharmaceutical Market Restructuring Act (AMNOG) procedure, the 15 referenced countries only serve as one price anchor among several others during national price negotiations. Although every product and market situation is unique, some IRP implications apply to all contexts.

International reference pricing in the product lifecycle

The first question every pharmaceutical company should answer is: When does international reference pricing matter? Of course, IRP is an important factor at the product launch of an innovative pharmaceutical. After assessing the optimal target launch prices of a pharmaceutical for individual markets, an extensive international reference pricing risk analysis is crucial to successfully implement an optimal global launch sequence and pricing strategy for new pharmaceuticals. It shows whether the country-specific optimal prices are achievable and whether the product’s launch sequence strategy needs to be adapted due to international reference pricing considerations.

However, IRP considerations aren’t only relevant for the launch of a new pharmaceutical. Throughout the product lifecycle, its prices in individual markets change regularly either voluntarily due to local affiliates readjusting their price strategy or mandatorily caused by national pricing authorities implementing price cuts (e.g. renegotiations/administrative adjustments). These new prices are again referenced and re-referenced by other national pricing authorities worldwide. Therefore, pharma companies need to monitor a drug’s IRP risks constantly.

To illustrate this point, let’s take a closer look at the decision of a top-10 multinational pharma company to remove an innovative anti-epilepsy drug from the German market. After the AMNOG process resulted in a “no additional benefit” rating for the drug, the manufacturer had two options:

A. Keep the product on the German market with a 90 percent drop in price. Subsequent international price re-referencing across Europe would then lead to major price cuts across most European markets and ultimately result in a significantly lower international pricing corridor for the drug

B. Remove the product from the German market and, in doing so, protect the achieved price levels in the other EU markets

Our analysis revealed that the five-year net present value (NPV) is almost 20 percent higher for scenario B than for scenario A – as a consequence, the manufacturer withdrew the product from the German market. In order to weigh the pros and cons of strategic decisions, pharmaceutical companies need to fully integrate IRP into the company’s global price governance process.

Strategically integrating international reference pricing in your company

But how does that work? Here are five steps to successfully integrate IRP management into a P&MA department’s daily business:

1. Establish an IRP library and keep it up to date

Many different countries, many different international reference pricing rules. The basic requirement for successful IRP management is detailed information collection that is constantly updated. For us at Simon-Kucher, this means tracking IRP details in more than 100 countries worldwide and storing these in a sophisticated IRP library. In addition to containing referencing connections, a well-designed IRP library should include:

- Exact referencing method

- Referencing process (formal vs. informal)

- Referencing metric (e.g. ex manufacturer vs. public price vs. wholesaler price)

- Timing of referencing

- Referenced products (reimbursed vs. non-reimbursed, retail vs. hospital, over-the-counter [OTC] products, patented vs. generics vs. biosimilars, etc.)

- How the rules are applied in real life

2. Develop a detailed pricing lexicon

The next challenge for P&MA stakeholders is to create a common understanding of different price metrics within the company and its affiliates and to find the right pricing metric that IRP applies to for a specific market. A company-wide pricing lexicon is therefore another prerequisite for successful IRP management to ensure all internal stakeholders “speak the same language” when it comes to price and different price metrics.

3. Have in-depth knowledge of product characteristics

International reference pricing rules are product specific. P&MA managers need to consider which IRP rules apply to a certain product and how they apply:

- Is it a retail or a hospital product?

- Is it reimbursed, non-reimbursed, or partially reimbursed? Or is it an OTC product?

- What is the perceived benefit of the product by health technology assessment (HTA) bodies?

- Does it have a special drug status, e.g. blood-derived products for diseases such as hemophilia?

4. Create an IRP matrix

An IRP matrix aggregates IRP complexities for a specific product in the clearest way possible. It provides a clear structure to look up potential price impacts across countries when a price for a pharmaceutical in a specific market is set or changes.

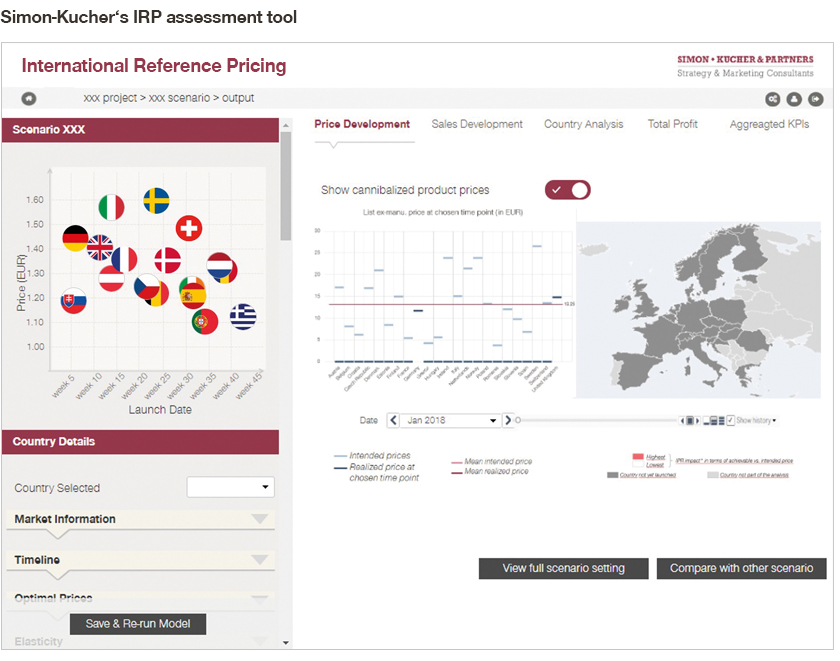

5. Incorporate a state-of-the-art, advanced analytics IRP model

Many companies try to develop their own IPR tool because off-the-shelf solutions fail to capture the full complexities of international reference pricing. However, our project experience shows that very few have successfully established a manageable, intuitive analytics model that contains all the mandatory components:

- Correct and comprehensive international price referencing rules, including re-referencing and non-deterministic price referencing

- Different price metrics to guarantee referencing is based on the same calculation as that of national authorities

- P&MA negotiation timelines

- Volume and price elasticity assumptions

- External events with an impact on price and volume

- Algorithms to optimize launch sequence and a product’s price corridor

The Simon-Kucher Advanced Analytics IRP Model contains all of the above; it takes all real-life IRP complexities into account to enable best-in-class management of the potential impacts of international reference pricing.

Conclusion: The dos and don’ts of international reference pricing