Over the past decade, principals have been increasingly using third-party distributors across regions and chemical sectors for three key reasons: Expand geographic reach, focus direct sales on core business, and expand reach to small customer at low cost-to-serve. In times of economic uncertainty and slowing growth, principals need a more strategic approach, focusing on the benefits and synergies of distributors to unlock faster growth.

Partnering with the right portfolio of distributors is incredibly important due to the sector’s inherent complexities and reaching target markets. Moreover, stringent regulatory frameworks and safety considerations require close collaboration with knowledgeable distributors, who can help you navigate compliance requirements and ensure product integrity. On top, distributors can be key to driving business in certain regions and cultures where you have limited presence yourself. Without a clear distributor strategy in place, we typically see lower than expected growth with margin leakage due to channel conflict and distributor performance issues being main challenges.

In this article, we explore what distributor strategy entails, its significance in the chemicals industry, and how it aligns with broader market dynamics.

Defining Distributor Portfolio Strategy

We observe a rising tendency of principals to diversify their distributor base: Commodity principals thereby can target different customer segments, while specialty principals seek to leverage the application-specific expertise in specific niches. In both cases, reduced reliance on only a few distributors ensures competitive pricing to end-customers (vs. too high mark-ups) and drives competition on service performance.

To unlock growth through distributors, successful principals think beyond third-party logistics (3PL), management of credit risks or cash flow management. Their distributor strategy encompasses a broader spectrum of activities aimed at maximizing product visibility, technical support, and sales.

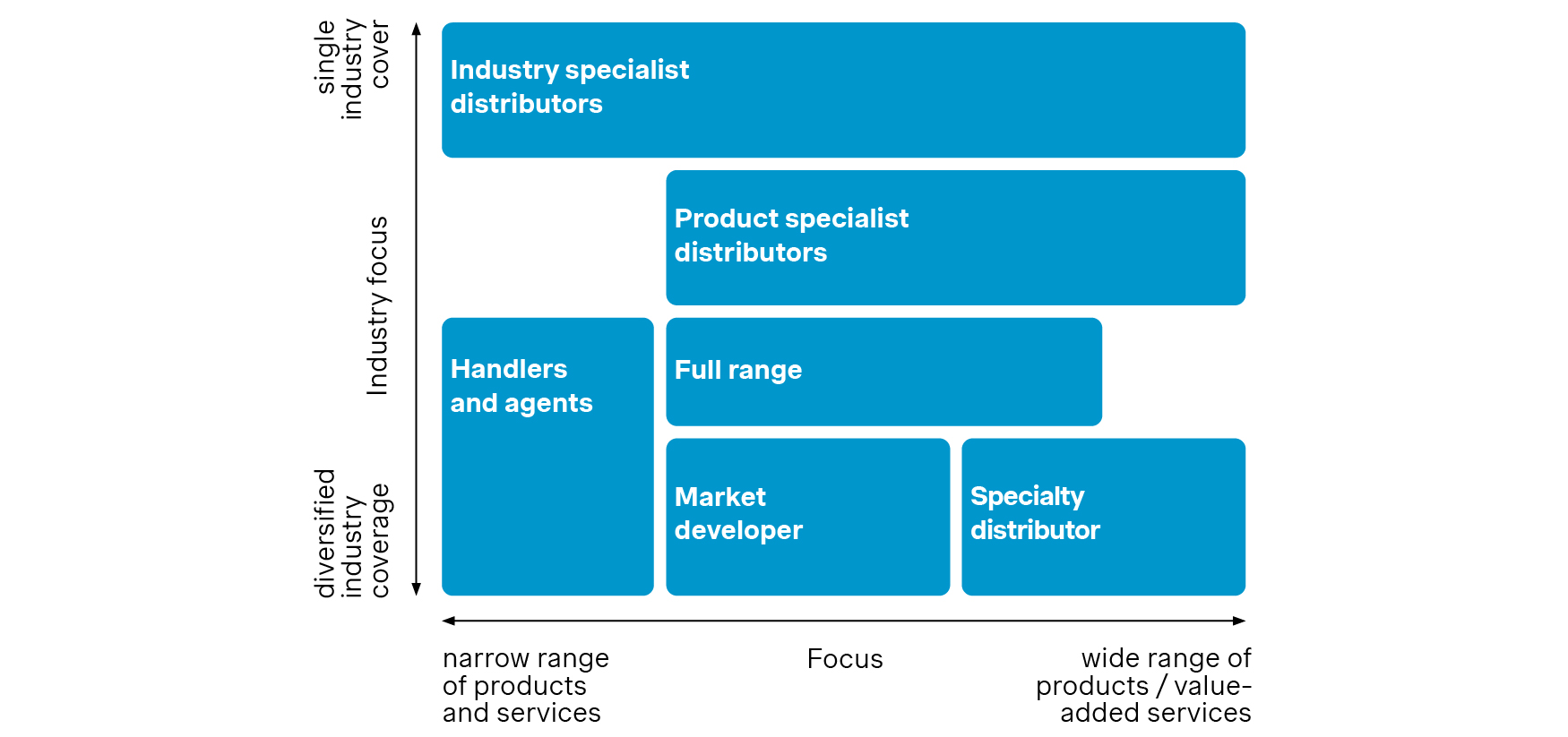

Typically, one distinguishes distributors based on their industry and service focus: The distributor landscape evolved from basic traders & agents towards five distinct types of players:

- Industry specialists with a broad portfolio as one-stop-shop with packaging, quality control, waste management

- Product specialists especially for Polymers with a broad product portfolio of products and services for specific product groups including formulation/pre-mix or system house approach

- Full range distributor with a complete service portfolio from pure trading, quality control, application support, one-stop-shop and supply/warehouse management service

- Market developer with a focus on developing new geographic markets based on local knowledge e.g., of infrastructure and regulatory environment

- Specialty distributors with a broad service portfolio for selected specialty application segments, yet across industries

In our experience, a clear distributor portfolio strategy starts with a deep understanding of the distributor’s capabilities, and how they align with a chemical principal’s strategic objectives. It defines which regions, products, and customer segments you want to serve through each distributor types, and it provides commercial guidelines for your distributors to stimulate the desired behavior towards end customers. Key to this evaluation is the distributor’s ability and performance track record to meet volume and growth targets.

Target market for distributors

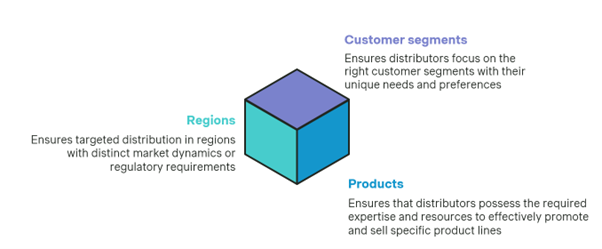

Companies often determine their distributor strategy along three axes, tailoring their efforts to regions, products, and customer segments.

Geographic segmentation allows for targeted distribution in regions with distinct market dynamics or regulatory requirements. Historically, the share of chemicals sales through distribution is highest in North America and China, the former especially due to geographical distances, the latter due to the fragmented customer base with a high number of SMEs. As growth rates slow down, we observe that Asian principals leverage distributors to expand their global reach. This strategy underlines the role of distributors to navigate complexities of international markets and facilitating market entry. On the other hand, especially in Europe, we observe some refocus on direct sales.

Product-based segmentation ensures that distributors possess the required expertise and resources to effectively promote and sell specific product lines. Traditionally, asset-heavy principles have followed this route to align their cost-to-serve to their margin levels. With inflationary increases of cost-to-serve, increased margin pressure on semi-specialty product is a trigger to review and re-prioritize historically grown approaches.

Customer application segmentation enables you to cater to the unique needs and preferences of diverse customer segments, with distributors typically leveraged to cater the ‘smaller’ customers in the market, for which the cost-to-serve is too significant for direct servicing. Amongst different end-use application, we consider this line of thinking is especially relevant for Pharma, Food & Nutrition & Personal Care.

We often see companies trying to define their commercial approach with distributors without properly defining their strategy on these axes. This leads to sub-optimal sales performance through the distributor channel, as well as an increased risk of cannibalization of your direct sales. For this reason, the distributor strategy needs to be preceded by a thorough market analysis to understand forecasted market demand.

Performance-based distributor partnerships

When principals failed to unlock growth through distributors, we repeatedly heard two main reasons: Performance issues of distributors and lack of value-added services. Think about meeting sales targets, financial issues, high quality service or lack of market and customer data. Falling short may undermine your growth objectives, risk profitability, and endanger your customer perception.

As principal, you need a clear expectation of what excellent distributor performance means to you and evaluate the ability to provide value-added service: reducing logistic complexity, offering access to new regions, customer support, and support in product formulation. Altogether, it needs to be a joint effort between you as principals and your distributors.

The best distributor partnerships lead to benefits for both you and your distributors. In our experience there are five dimensions that need to be covered to create a successful partnership with your distributors:

- Define service level priorities: Set-up clear service level agreements covering expectations on marketing & training, supply chain and customer support to ensure customer satisfaction

- Pass-through of cost changes: Secure continued cost competitiveness to customers in line with market dynamics to protect both volume and margin throughout the economic cycle

- Align sustainability practices: Meet your environmental goals along the entire supply chain, as this factor grows in importance across sectors

- Leverage real-time data integration: Ensure timely data transparency e.g. on inventories, compliance etc. to make informed decisions and pro-actively optimize your strategies

- Establish collaborative relationships: Ensure open communication, responsiveness, target commitment, and joint service extensions, e.g. legal, regulatory, sustainability/environmental

Typical approach to define your optimal distribution strategy

In our experience, defining a successful distribution strategy follows a four-step approach.

- Map the market: Outline what regions, products and customer segments you want to serve directly and what parts of the market you collaborate with distributors

- Determine distributor portfolio: Develop performance-evaluation framework and identify the right distribution partners across these markets

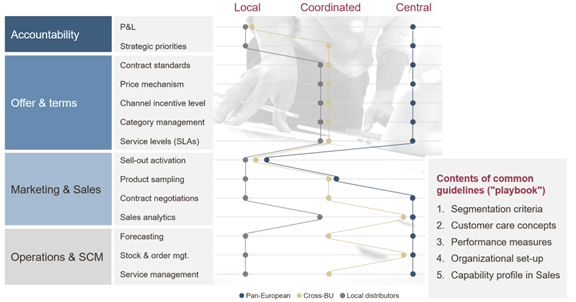

- Install distributor framework: Set-up guidelines (accountability, offer & terms, marketing support, operations & SCM) and determine internal governance (local, coordinated, central)

- Enable sales: Define the right organizational structure for your sales team to manage the distributor people and put the right people in place

Case example: Distributor management framework of a Coating & Adhesives principle

Distributor strategy fundamental for success in the chemicals industry

In conclusion, distributor strategy is fundamental for success in the chemicals industry, enabling companies to navigate complexities, reach diverse markets, and drive sustainable growth. By understanding the nuances of distributor types and benefits, and fostering performance-based partnerships, companies can unlock new avenues for success amidst evolving market dynamics. In a landscape defined by change and competition, mastering your distributor strategy is essential for staying ahead of the curve and seizing opportunities for growth.