What do Private Equity and Taylor Swift have in common? Both have experienced a series of defining eras and both have leveraged these for financial success. Just as Swift’s musical evolution reflects shifts in style and tone, private equity has gone through distinct phases, each characterized by evolving strategies and approaches to value creation.

Our recent 2024 study on Value Creation in Industrials and B2B Services tells this story of transformation, with the private equity industry making key shifts that have shaped how returns are made today.

So, let's take a Swift-like journey through the stages of PE's evolution, arriving at the current growth-driven era and understanding what it means for the future.

1. The beginning: Modern-day PE is born (late 70s–1980s)

The modern private equity era began with the rise of the leveraged buyout model, a strategy notably exemplified by William Simon's acquisition of Gibson Greetings in 1981. This deal marked a turning point for private equity, showcasing how firms could thrive on debt-financed acquisitions. In this stage, all it took was money —no need for complex operations or growth strategies, just some aggressive balance sheet action. It was an era defined by boldness, where big money and big debt made big returns.

2. The financial engineering era (1990s)

Next, we stepped into the 90s, where the focus was on financial engineering. This era was all about optimizing the balance sheet with some accounting magic. Here, value creation didn’t necessarily come from growing the business or cutting costs. Instead, it was about unlocking value through financial restructuring.

3. Cost-cutting era (early 2000s)

Then came the chainsaw Al era, an ode to the nickname earned by Al Dunlap for his extreme cost-cutting tactics. The private equity industry became focused on radical cost reduction. In this era, cost control was king, with companies slimming down and slashing expenses as a way to boost profitability.

4. The multiple arbitrage era (2000s–2010s)

As low interest rates fueled the market and multiples just knew one way (up), PE entered the multiple arbitrage era. Firms would buy it, hold it, and sell it for more. The financial markets, not operations, did much of the heavy lifting. But with interest rates rising and multiples having hit unprecedented heights – this era may have also passed its peak.

5. The growth era: A new dawn?

So, what’s next? With unprecedented amounts of dry powder, aging assets, heightened interest rates, and increasing pressure from LPs, the landscape has become more challenging. Focus returns to the underlying lever, the EBITDA. Firms are forced to pivot toward profitable real business growth to drive returns—and this is where things get interesting.

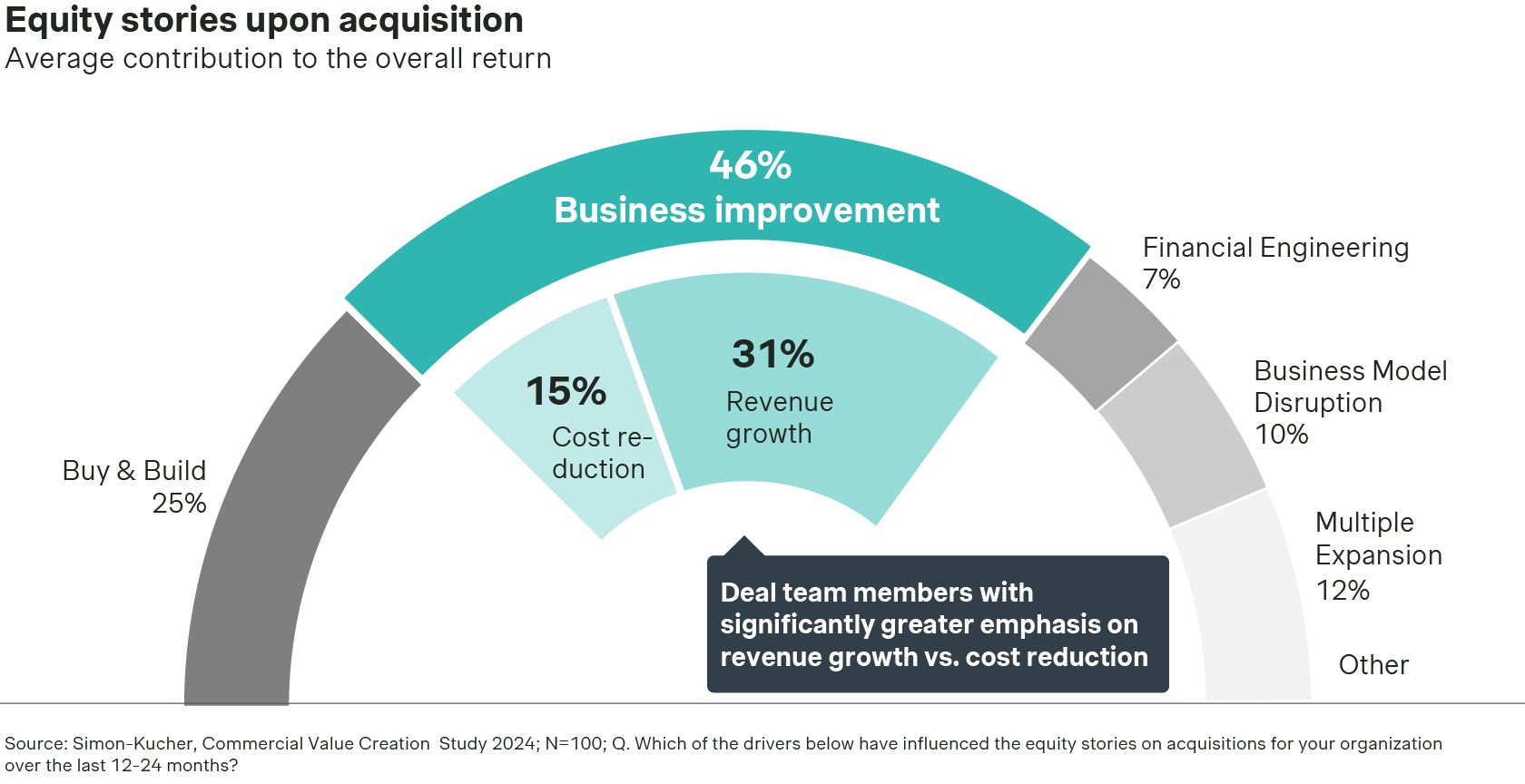

Our 2024 study confirms this shift: profitable, revenue-growth-driven value creation is now the biggest lever for private equity returns. Improving core business operations has emerged as the number one driver of targeted returns at the point of investment, far outpacing older strategies like buy-and-build or financial engineering.

Findings: A deep dive into business improvement

Here’s what our study revealed about the current state of value creation:

46% of overall returns are now driven by business improvement. This figure overshadows buy-and-build strategies, financial engineering, and multiple arbitrage. The key here? Topline revenue improvement accounts for two-thirds of that business improvement, marking a clear shift toward organic growth.

58% of PE executives expect growth-driven value creation to further increase in the near future.

Business improvement levers

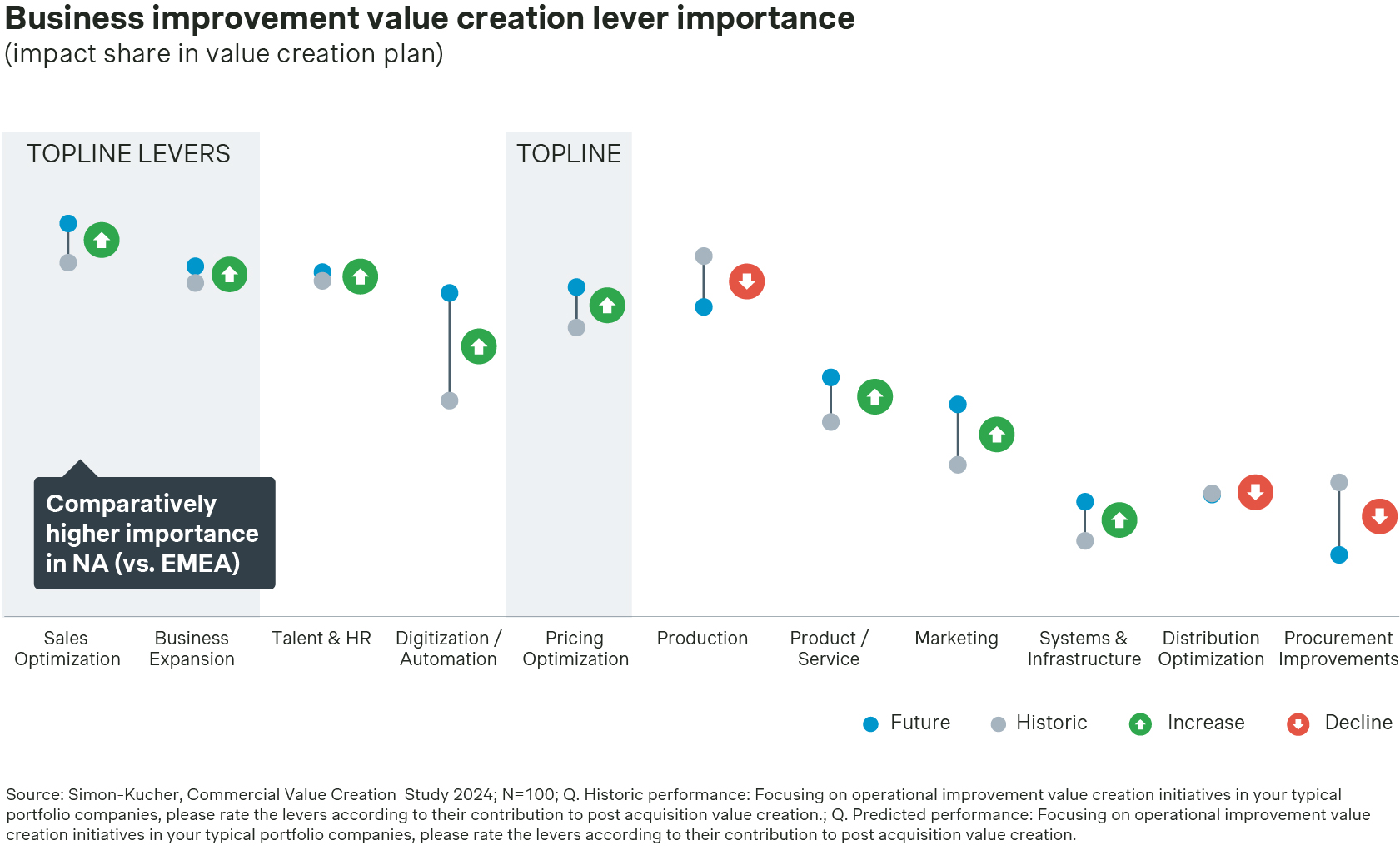

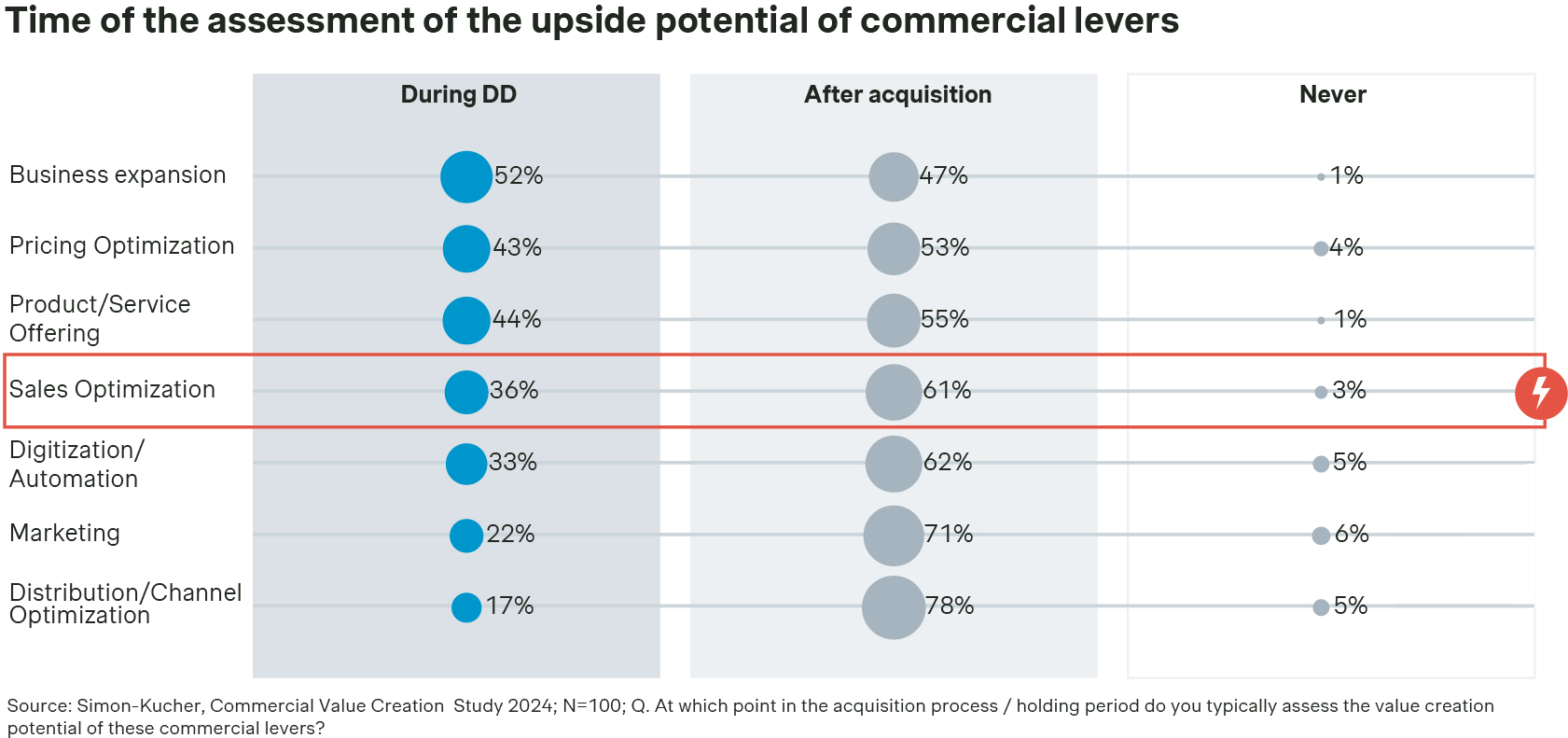

When it comes to the underlying business improvement levers, PE executives focus on sales optimization as the top lever for driving value. Following closely behind are business expansion initiatives. Despite this clear focus, there’s still a notable gap in how firms approach deals. Surprisingly, only one-third of PE firms assess sales opportunities during due diligence (DD)—a missed opportunity for unlocking potential.

While important, pricing ranks as only the fifth most impactful lever and, although it's becoming more prominent during the diligence phase, it's still not addressed in a fully quantitative or systematic manner. Our research shows that pricing is primarily explored through interviews, but there's room for much more rigor on the quantitative front.

The risks of unrealistic business cases

But growth isn’t without its challenges. The study shows that 1 in 3 business improvement initiatives fail, often due to unrealistic expectations or poor focus.

46% of PE firms cite overly ambitious business cases as the primary reason for failure, followed by the wrong focus on initiatives (18%) and poor implementation (15%).

A path forward: Skills for the growth era

So, how can PE firms ensure success in this new era? It comes down to two things: focusing on safe bet levers and building the right internal skills (or external partners).

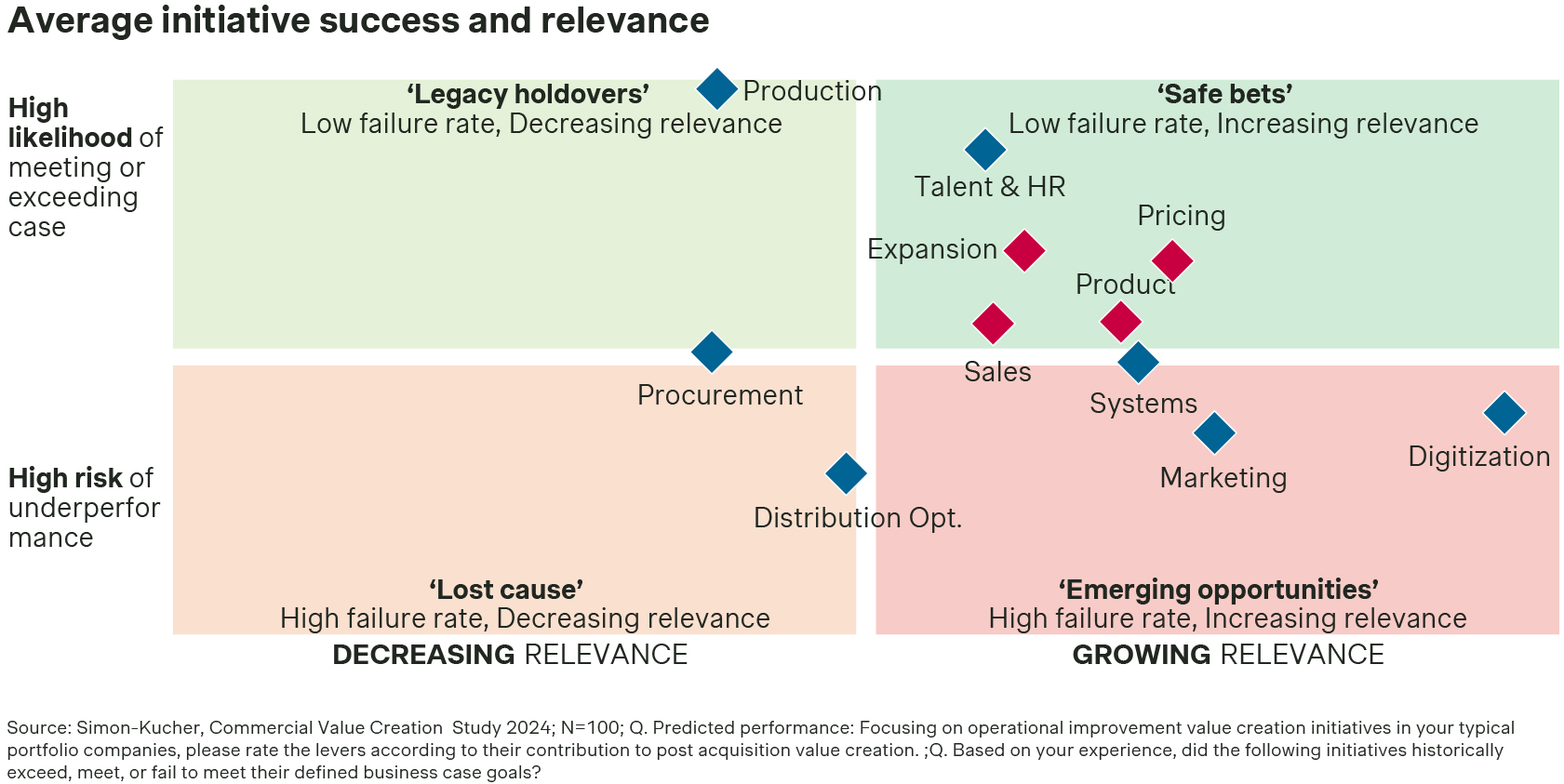

As our study shows, not all business improvement levers (on the revenue and cost side) are seen to bear the same risk profile. Pricing, product, and business expansion are considered to have a higher likelihood of success, alongside talent and HR.

Pursuing these levers, however, requires internal capabilities or external resources, as having the right skills in place can increase the success rate of initiatives by 20 percentage points.

With the right expertise, firms can turn their focus toward unlocking organic growth, expanding their businesses, and—most importantly—delivering on their investment theses.

Closing thoughts: Welcome to the growth era

The private equity Eras Tour has taken us from the days of financial engineering and cost control to a new stage where growth is king. As our 2024 study makes clear, focusing on topline improvements, sales expansion, and smart business development will define PE success in the coming years. In the same way that Taylor Swift’s fans follow her through each era of her career, private equity must embrace this new era of commercial growth if they hope to achieve enduring returns.

Are you ready for it?

How Simon-Kucher can help

At Simon-Kucher, we bring deep expertise in helping industrials and B2B services companies navigate this growth-driven era of private equity. Our proven track record in optimizing business operations, pricing, and sales strategy ensures that PE firms can unlock maximum value from their investments.

We also understand the unique needs of private equity firms, and our tailored solutions in due diligence and post-deal growth strategies have helped numerous PE firms successfully drive returns.

Reach out to us to explore how we can partner with you to achieve sustainable growth in today’s challenging market.