With value and access as a top priority for pharma and biotech manufacturers, advancing US Pricing and Market Access (P&MA) strategies and capabilities is crucial for commercial success in today’s increasingly complex US healthcare landscape. In this blog, we share actionable insights and real-world approaches to enhance P&MA strategies and capabilities to drive meaningful outcomes.

US Pricing and Market Access (P&MA) teams are critical in building a brand’s success throughout the product lifecycle from launch to loss of exclusivity (LOE). Key responsibilities include value demonstration, pricing and market access strategies, contracting strategy, payer marketing, opportunity pull-through, and retrospective success measurement.

Despite their crucial role and the ongoing emergence of innovative therapies, many P&MA teams still rely on outdated methods for decision-making, analytics, and performance measurement. These approaches—spanning people, processes, and technology—impede progress toward more innovative pricing and market access strategies. The urgency to evolve has never been greater. To remain competitive, P&MA teams must purposefully plan their progression of strategies and capabilities in tandem with market evolution and scientific advancements.

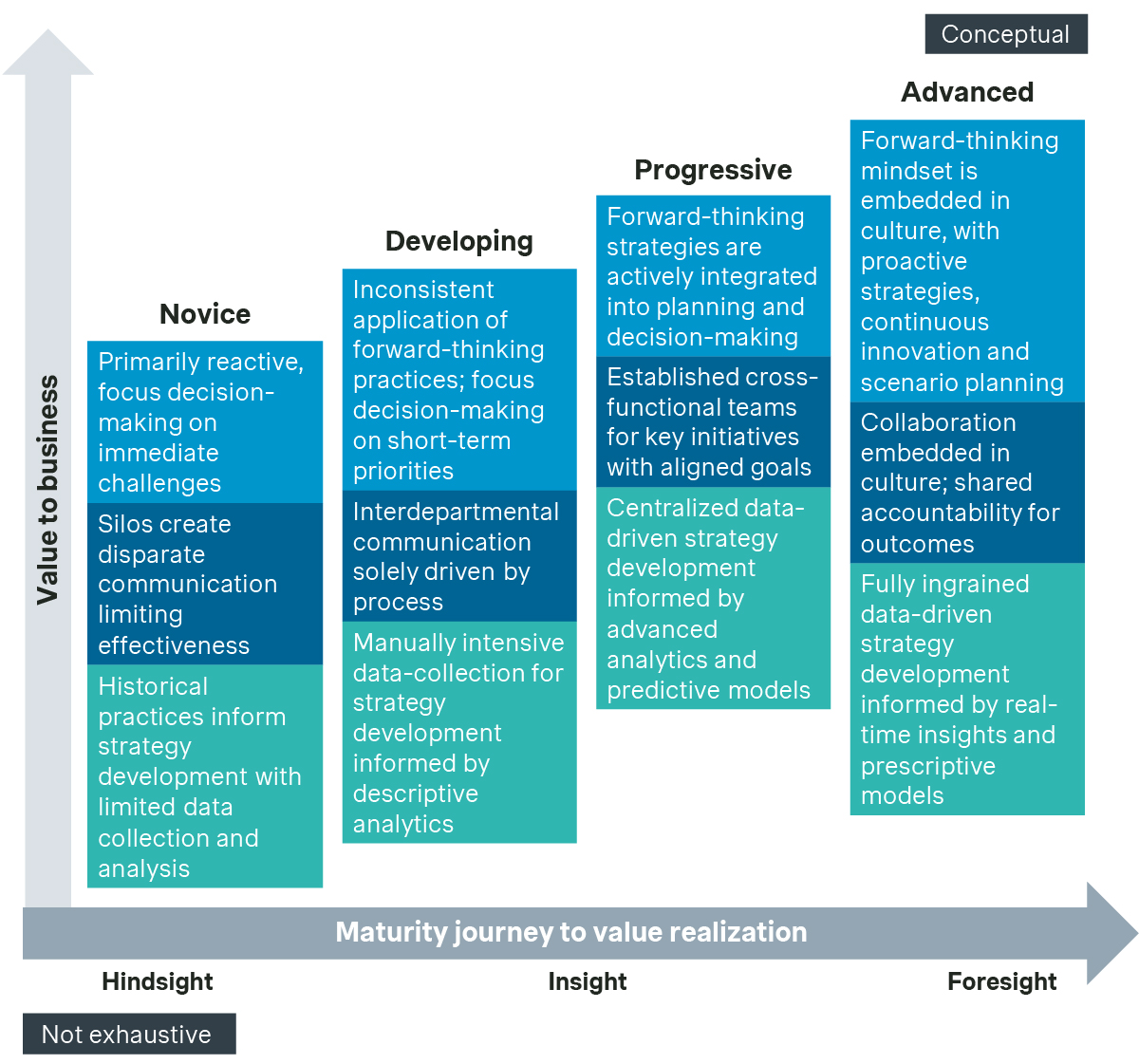

The P&MA maturity journey

When we took a deeper look into the maturity of approaches, we found that Novice teams focus on organizational structure, roles, and responsibilities in the most traditional sense. These teams operate in silos across an interconnected end-to-end process, which limit collaborative thinking and the adoption of innovative solutions for addressing complex P&MA goals.

Even in more Developing teams where collaboration exists through process hand-offs, unclear lines of responsibility and limited accountability hinder timely, informed decision-making. Moreover, these less collaborative structures lack transparency and proactive communication, making it difficult to ensure that decisions are informed and properly tracked—both prospectively and retrospectively—and that market and patient access opportunities are maximized for value and outcomes.

In contrast, Advanced teams actively adopt collaborative and fluid working models. They include stakeholder representation from all core functions, spanning headquarters and customer-facing teams, such as pricing, market access, value and access, payer marketing, account management, reimbursement, clinical, contracting operations, insights/analytics, and legal. These teams leverage real-time data-driven insights to lead the development of strategies that drive brand pricing and market access goals.

Simon-Kucher’s P&MA business agility framework

Our P&MA business agility framework empowers pharma and biotech manufacturers in the US market to adapt to policy shifts, payer demands, and changing market conditions while maintaining sustainable pricing strategies that ensure broad patient access.

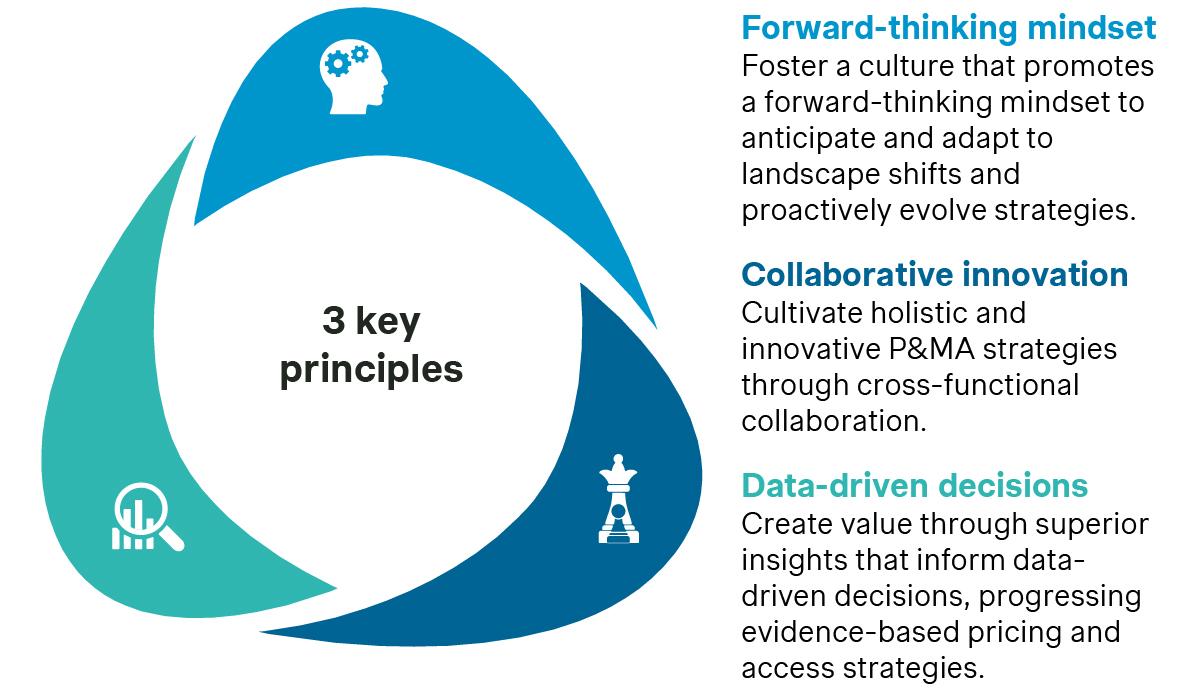

At its core, Simon-Kucher’s P&MA business agility framework rests on three key principles harnessed by our in-depth methodology to collectively assess and transform strategy through people, process, and technology.

Follow our framework to understand key strategies and approaches to assess where your organization is on the maturity journey.

How do we promote a forward-thinking mindset to adapt proactively to change?

A forward-thinking mindset is essential for navigating the evolving complexities of market access. Manufacturers must move away from reactive strategies— i.e., responding to payer demands or regulatory changes after the fact—and adopt proactive approaches that anticipate future trends. Manufacturers that have made this shift tend to be innovators that stay ahead of the curve and gain an advantage over competitors.

Many different strategies can help promote a forward-thinking P&MA mindset. We believe that pharma and biotech manufacturers should begin implementing approaches to:

- Perform proactive market landscape assessments

- Embrace and implement value-based pricing and contracting

- Deploy patient-centric access programs

Let's explore these strategies and related approaches more thoroughly.

| Strategy | ||

|---|---|---|

| Perform proactive market landscape assessments | Embrace and implement value-based pricing and contracting | Deploy patient-centric access programs |

| Approaches | ||

| Monitor landscape shifts: Monitor proposed policy and legislation changes in drug pricing regulations, government pricing strategies, and vertical integration transactions that may impact reimbursement levels and negotiations. | Develop a robust value proposition focused on outcomes: Use health economics and outcomes research (HEOR) and real-world evidence (RWE) data to build models that demonstrate cost-effectiveness and improvement in health outcomes.

| Conduct Patient Journey Mapping: Analyze every stage of the patient’s experience, from diagnosis to treatment, to uncover barriers in access, affordability, and adherence.

|

| Perform simulation and scenario impact modeling: Use predictive models to simulate how potential policy changes (e.g., drug price negotiation laws) may impact pricing, revenue, and patient access. | Implement outcomes-based pricing and contracting strategies: Strategies that are flexible and include risk-sharing, pay-for-performance, and guarantees tied to patient outcomes. | Design holistic affordability, assistance, and adherence programs: Tailor financial support, copay card, reimbursement, cash programs, and adherence plans based on variable patient population needs, improving long-term treatment success rates. |

| Overall | ||

| Conduct continuous outcomes-based research: Run qualitative and quantitative research to understand the real-world challenges and needs of payers, providers, and patients. This can include focus groups, qualitative interviews, surveys, and real-world evidence (RWE) studies to identify unmet needs. Engage with experts: Partner with industry experts, regulatory affairs, and healthcare policy experts to gain early insight into anticipated landscape shifts in policy, customer, and care model. | ||

How do we encourage cross-functional collaboration to cultivate holistic, innovative, and effective P&MA strategies?

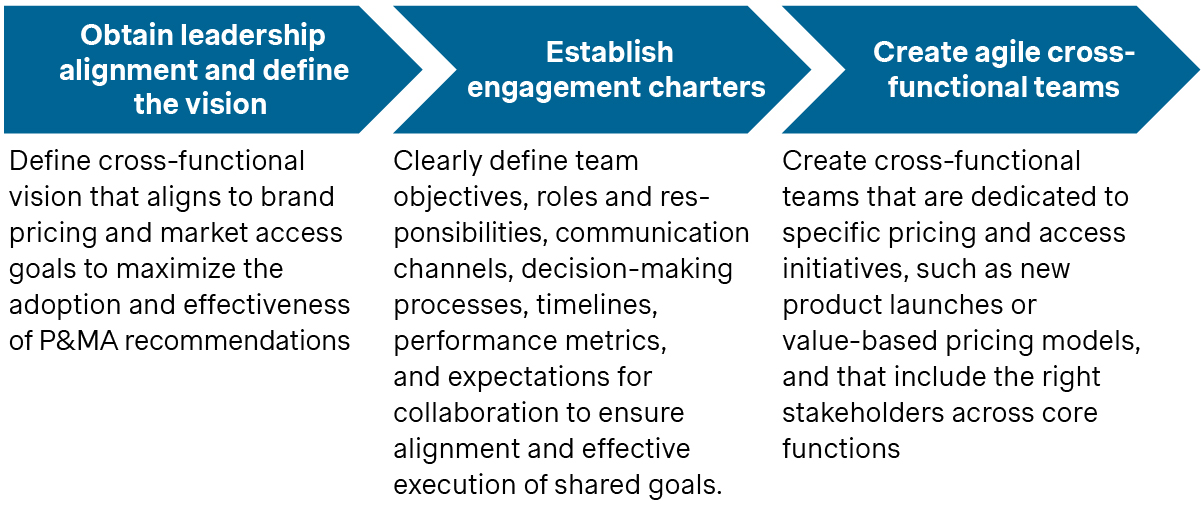

Evolving P&MA demands and strategies require cross-functional collaboration across core functions from both headquarters and customer-facing teams. Silos slow decision-making and prevent the holistic view necessary for addressing value frameworks, payer requirements, and provider-patient needs innovatively. By fostering collaboration, companies can respond faster to market shifts and demands, while ensuring organizational alignment.

Cross-functional collaboration can be established through structural changes, i.e., setting up a dedicated Center of Excellence or simply through cross-functional committees that meet on a continuous basis. The specific forum can be adapted to each organization’s dynamics. The key is to have a structured approach that promotes the sharing of insights, business intelligence, and innovative ideas.

To ensure continued engagement and effectiveness, the objectives should be aligned to a shared leadership vision.

How do we generate valuable insights to make data-driven decisions for evidence-based pricing and access strategies?

The ability to derive data-driven insights is more important than ever relative to pricing and market access decision-making. Payers are demanding more robust evidence to support access and utilization management decisions while regulators are looking for real-world evidence to assess the long-term value and cost of therapies. At the same time, providers want clinically differentiated and cost-effective options for their patients. Data-driven insights will empower manufacturers to develop evidence-backed pricing strategies that improve payer negotiations, optimize access and prescribing, and maximize outcomes value in the US.

The availability of quantitative data sets has increased significantly in recent years. Data fatigue has become a real challenge as organizations struggle to understand what data to purchase, how to make it readily available, and how to use it to address specific business needs. Furthermore, qualitative data is just as important, but many organizations do not capture these insights and harness their power for decision-making. Organizations that integrate both qualitative and quantitative data to inform strategic decision-making develop a competitive advantage that sets them apart.

The most impactful data-driven insights for decision-making start with the right question and are informed with the right data. It is important to ensure the analytics focus is directly related to the key business problem or opportunity that optimizes pricing and market access strategies.

We have identified critical high-impact approaches to utilize data-driven insights for strategic decision-making:

- Leverage advanced data analytics and real-world evidence (RWE): This helps organizations drive P&MA access decisions with actionable insights that reflect true patient outcomes, market dynamics, and cost-effectiveness, ultimately optimizing value-based strategies.

- Conduct dynamic competitive intelligence and benchmarking: These can inform strategic decision-making by continuously monitoring market trends, competitor activities, and performance metrics, ensuring a proactive approach to staying ahead in the competitive landscape

- Utilize market segmentation and stakeholder mapping: Organizations can identify key customer groups and influencers, enabling targeted strategies that address specific needs, optimize engagement, and drive value across diverse market segments

- Retrospective contracting opportunity pull-through: By leveraging historical data and contract performance analysis to identify and capitalize on missed opportunities, ensuring optimized outcomes and increased value from existing agreements.

Explore these approaches through real-life use cases leveraging Simon Kucher’s insights-to-action framework.

The Right Question + The Right Data = The Right Decision at the Right Time

Approach | The Right Question | + The Right Data | = The Right Decision |

|---|---|---|---|

Leverage Advanced Data Analytics and Real-World Evidence (RWE)

| What evidence demonstrates the real-world value and cost-effectiveness of our therapy for patients, providers and payers? |

|

|

Conduct Dynamic Competitive Intelligence and Benchmarking

| How does our pricing strategy compare to competitors, and what will drive payer acceptance? |

|

|

Utilize Market Segmentation and Stakeholder Mapping

| Who are the key stakeholders, decision-makers and influencers, and what matters most to them in assessing value? |

|

|

Retrospective Contracting Opportunity Pull-Through

| Which accounts or payers have underutilized contracted therapies, and what barriers are preventing full pull-through? |

|

|

Act now – Unlock better growth with improved business agility

Agility in the US healthcare market will be essential for maintaining a competitive advantage. Manufacturers must, at a minimum, be ready to react to changing demands. However, they can proactively shape the future by evolving capabilities and upskilling teams using our business agility framework.

Let’s work together to assess and benchmark the readiness of your people, processes, and technology, and set your P&MA organization up for optimal success. One that not only unlocks better growth for your company, but also better health outcomes for patients and society as a whole.

Reach out to Simon-Kucher today.

Better Market Access

The role of better market access is to remove any hurdle that prevents or hinders patients from receiving available treatments. In the right place, and at the right time.

Today, the impact of market access spans clinical development, regional commercial activities, patient engagement, and post-launch compliance. Yet, for many pharmaceutical companies, planning for commercialization only truly begins when a drug has been submitted for approval — far too late in the process.

Get to know our insights on local trends, regional and global developments and global to local excellence.