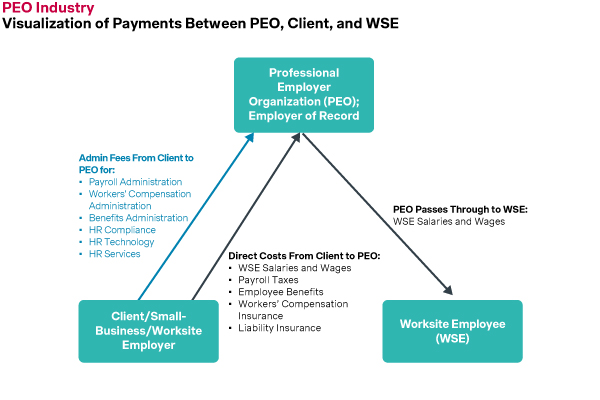

Professional Employer Organizations (PEOs) play a critical role in assisting businesses with managing HR functions, compliance, and employee benefits. A significant portion of the amount a client pays for a PEO consists of the insurance component. Since insurance makes up most of the cost, companies focus their attention there and do not pay as much attention to the pricing of smaller services like administrative fees (e.g., Payroll Processing, Benefits Administration, Workers’ Compensation Administration, HR Compliance, HR Technology and HR Services). As a result, PEOs often neglect a key area where they have pricing power by concentrating predominantly on insurance costs. This oversight can impact their overall profitability, and in our experience working with PEOs, it is a serious and often missed opportunity.

A key aspect of PEO service offerings is the strategic pricing of administrative fees. However, many PEOs fail to optimize this pricing effectively. At Simon-Kucher, we have observed that while administrative fees are not the largest line item, improving pricing in these areas can significantly enhance margins and is typically under less scrutiny by customers, considering its relatively small amount compared to the cost of the insurance. By understanding competitive pricing strategies and the factors that influence pricing, PEOs can increase revenue potential and deliver greater value to their clients.

Pricing Models Used Today

1. Percentage of Total Payroll

In this model, administrative fees are calculated as a percentage of the client’s total Worksite Employee (WSE) payroll. Fees typically range from 2% to 12% of the monthly WSE payroll. This model aligns the PEO’s revenue growth with the client’s payroll expenses, increasing as the client hires more employees or raises salaries.

Advantages:

- Scalability: Revenue increases proportionally with client growth.

- Alignment: PEO benefits directly from the client’s payroll expansion.

Disadvantages:

- Revenue Fluctuation: Revenue can vary significantly with payroll changes, influenced by economic conditions.

- Complexity: Requires continuous monitoring and adjustment based on payroll variations.

Types of PEOs Using This Model: This model is typically used by larger PEOs with clients in rapidly growing industries where payroll increases are frequent.

Missed Opportunities: PEOs using this model may miss opportunities to stabilize their revenue streams, as they are highly dependent on fluctuating payroll amounts. Additionally, they might overlook the potential for optimizing administrative fees that are not directly tied to payroll.

2. Per Employee Per Month (PEPM)

This model charges a fixed fee per employee per month, typically ranging from $40 to $250. PEPM pricing provides predictability for both PEOs and clients, making it attractive for businesses seeking stable budgeting.

Advantages:

- Predictability: Ensures stable and predictable revenue for PEOs and costs for clients.

- Simplicity: Easy to understand and administer.

Disadvantages:

- Limited Scalability: Revenue only increases with additional employees, not with higher payroll.

- Potential Misalignment: May not reflect the true value of services if employee needs vary widely.

Types of PEOs Using This Model: This model is often preferred by smaller to mid-sized PEOs working with clients who value budget stability and predictability over variable costs.

Missed Opportunities: PEOs using the PEPM model might miss out on revenue potential linked to payroll increases, as their income does not scale with salary growth. They may also fail to capture additional value from clients with higher payrolls who require more intensive services.

Recommended Alternative Pricing Models

In addition to the percentage of total payroll and PEPM models, PEOs should also consider alternative pricing approaches:

1. Tiered pricing

Under tiered pricing, PEOs offer different service packages at varying price points. Each tier includes a set of services and features, with higher tiers offering more comprehensive solutions and additional benefits. Clients can choose the tier that best fits their needs and budget, providing flexibility and customization.

Advantages:

- Appeals to a broad range of clients with different needs and budgets.

- Allows PEOs to capture value at different price points and maximize revenue potential.

- Provides clients with options for scalability and growth.

Considerations:

- Requires careful segmentation and package design to ensure each tier offers compelling value.

- Pricing must be transparent, and clients should clearly understand the features and benefits of each tier.

2. Value-Based Pricing

Under this model, pricing is determined by the perceived value of the services provided. PEOs assess the unique needs and requirements of each client and price their services accordingly. This approach allows PEOs to capture the maximum value they deliver to clients, rather than basing fees solely on payroll size or employee count.

Advantages:

- Aligns pricing with the specific benefits and outcomes clients receive.

- Encourages PEOs to focus on delivering high-value services and solutions.

- Likely to be the revenue maximizing option when done correctly

Considerations:

- Requires a deep understanding of client needs and the ability to articulate the value of services.

- Will require more complex pricing negotiations and customization for each client.

3. Usage-Based Pricing

In this model, clients are charged based on their usage of PEO services. This could include metrics such as the number of HR inquiries handled, the volume of payroll transactions processed, or the utilization of specific HR software features. Clients pay for what they use, making this model appealing for businesses with fluctuating service requirements.

Advantages:

- Provides flexibility and cost-effectiveness for clients with variable service requirements.

- Aligns pricing with the actual value derived from PEO services.

- Can lead to more predictable costs for clients with variable workloads.

Considerations:

- Requires robust tracking and reporting systems to accurately measure usage.

- Creates pricing transparency that may make negotiations more difficult.

Conclusion

These alternatives lead to significant revenue generating opportunities for PEOs and will create flexibility and customization in pricing the services. By considering factors such as client needs, service usage, and perceived value, PEOs can tailor their pricing strategies to maximize revenue potential while delivering exceptional value to their clients. However, determining the optimal pricing model requires thorough market research and testing to understand which approach best fits the specific circumstances and objectives of each individual PEO and its clients. Each model presents unique advantages and considerations, and by leveraging market insights effectively, PEOs can enhance their revenue streams and competitive edge in the market.

If you are ready to discuss your new pricing strategy and maximize your PEO’s revenue, please reach out to David Chung and Michael Nadel.