Mortgage price optimization for better market positioning

OPPORTUNITY/ISSUE

A leading mortgage business sought a transformative pricing approach after recognizing the need to stay competitive.

Our client’s market was dominated by 5-6 major national players, with some competing heavily on price. This situation often leads to price wars that do not create value for any of the market participants. The absence of a well-defined pricing and product strategy, coupled with a lack of analytical expertise, left our client vulnerable in the market.

Meanwhile, the mortgage market was undergoing significant regulatory changes. These included tighter mortgage qualification criteria and the introduction of stress tests for both high-ratio and low-ratio mortgages meant to improve the quality of mortgage lending and to reduce the number of highly indebted borrowers.

It was therefore crucial for our client to develop an analytical and dynamic mortgage price optimization strategy to remain competitive. They aimed to achieve this by integrating demand forecasting and price optimization models into their mortgage portfolio strategy. Our task was to create a robust pricing tool that could respond dynamically to market changes on a day-to-day basis.

APPROACH/SOLUTION

Creating an automated mortgage price optimization tool for portfolio analysis

To address our client’s needs, we devised a data-driven approach to pricing strategy spread across five steps.

- Granular customer segmentation: By segmenting customers according to their price sensitivity, we developed targeted pricing strategies to accommodate the diverse profiles in the Canadian housing market.

- Price response models: We developed sophisticated elasticity models to understand how different customer segments would react to price changes.

- Granular pricing grid development: We established a detailed pricing grid with over 3,000 pricing cells. This reflected on product variations, customer characteristics, and distribution channels, responding to the nuanced and highly regulated Canadian mortgage landscape.

- Price optimization: We developed a fully automated tool that could dynamically adapt to market changes, crucial in a period marked by regulatory shifts and changing market sentiments.

- Knowledge transfer: The client's team underwent comprehensive training and knowledge transfer to empower them with the necessary skills to adapt to future changes in regulations and market conditions.

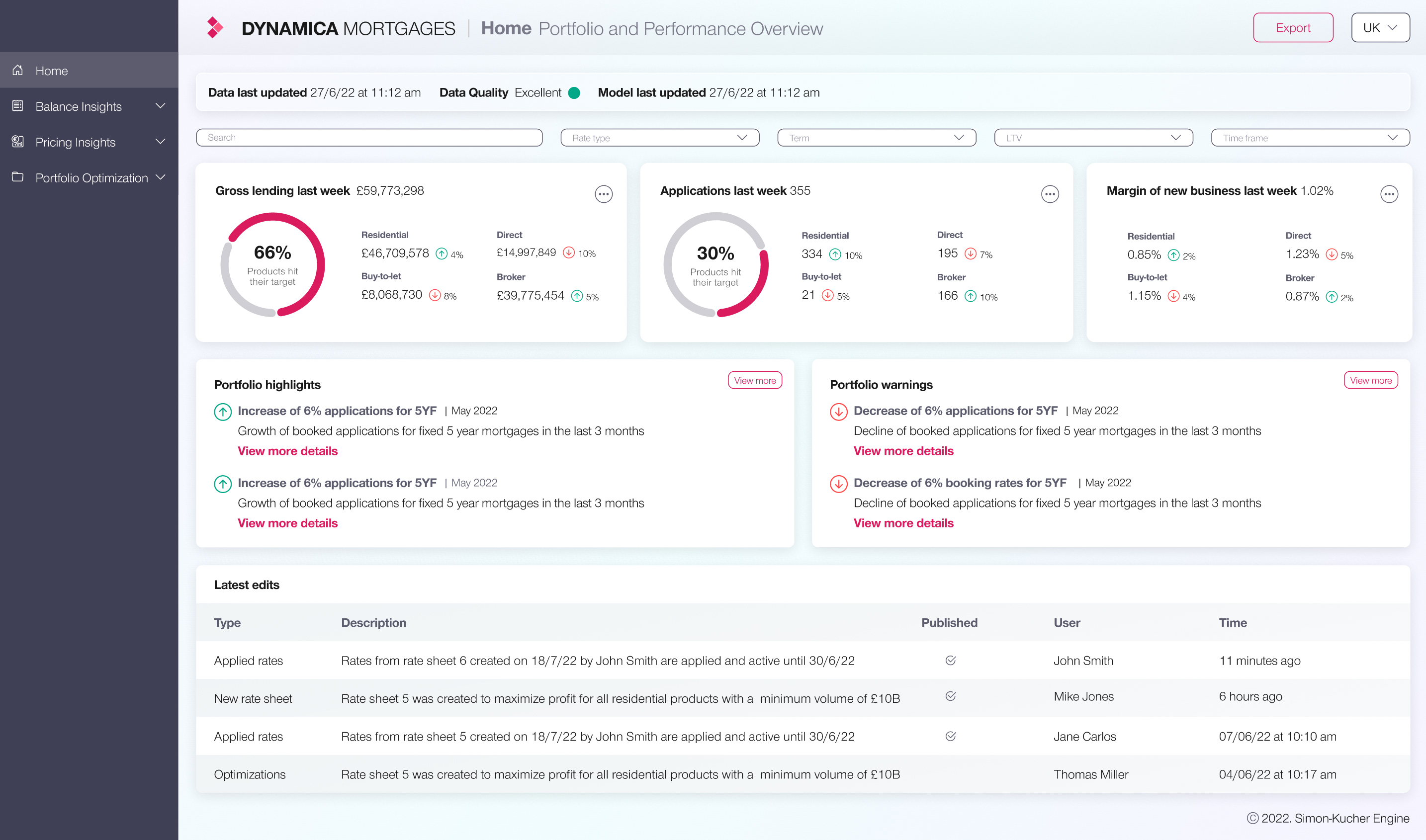

Figure 1: Simon-Kucher “Dynamica” Mortgage tool for portfolio analysis and tracking of performance

OUTCOME/RESULT

By integrating advanced analytics and customer insights, our client was able to navigate through competitive pressures and regulatory changes, positioning themselves effectively within the market.

Our transformative solution not only met our client's objectives but also provided a strategic advantage in the highly competitive mortgage market:

- The granular pricing grid enabled precise adjustments in response to market conditions, regulatory changes, and competitive pressures, enhancing our client's ability to compete effectively.

- The automated price optimization model enhanced efficiency and responses to any challenges posed by new mortgage criteria and stress tests.

- Our client used knowledge transfer to adjust their pricing strategy to ongoing changes in the mortgage market.

Thanks to a strategic mix of advanced analytics and customer insights, our client was able to navigate seamlessly through competitive pressures and regulatory changes.