Leveraging customer decision making and behavioral economics to develop mortgage product bundling strategies that stimulate growth

OPPORTUNITY/ISSUE

A European bank found itself grappling with heightened challenges in the mortgage market, characterized by increased pressure on margins and a declining market share.

The landscape was shaped by the entry of new competitors, the influence of brokers, a persistently low-interest environment, and a market that was becoming more transparent.

In this increasingly competitive and dynamic environment, the high comparability of mortgage products and the lack of differentiation contributed to customers perceiving mortgages as commoditized. Consequently, this perception led to a gradual erosion of margins for the bank.

Faced with these pressing issues, the bank recognized the urgent need for strategic interventions. The primary objectives were to reverse the trend of declining market share, differentiate their offerings in a crowded marketplace, and implement effective strategies to enhance price enforcement.

Our client sought solutions that would not only bolster their market presence but also enable them to navigate and thrive in the evolving mortgage landscape.

APPROACH/SOLUTION

Identifying what customers value the most by analyzing our client’s sales funnel

We focused on evaluating the primary factors driving pricing enforcement, while also understanding the specific needs and preferences of various customer segments.

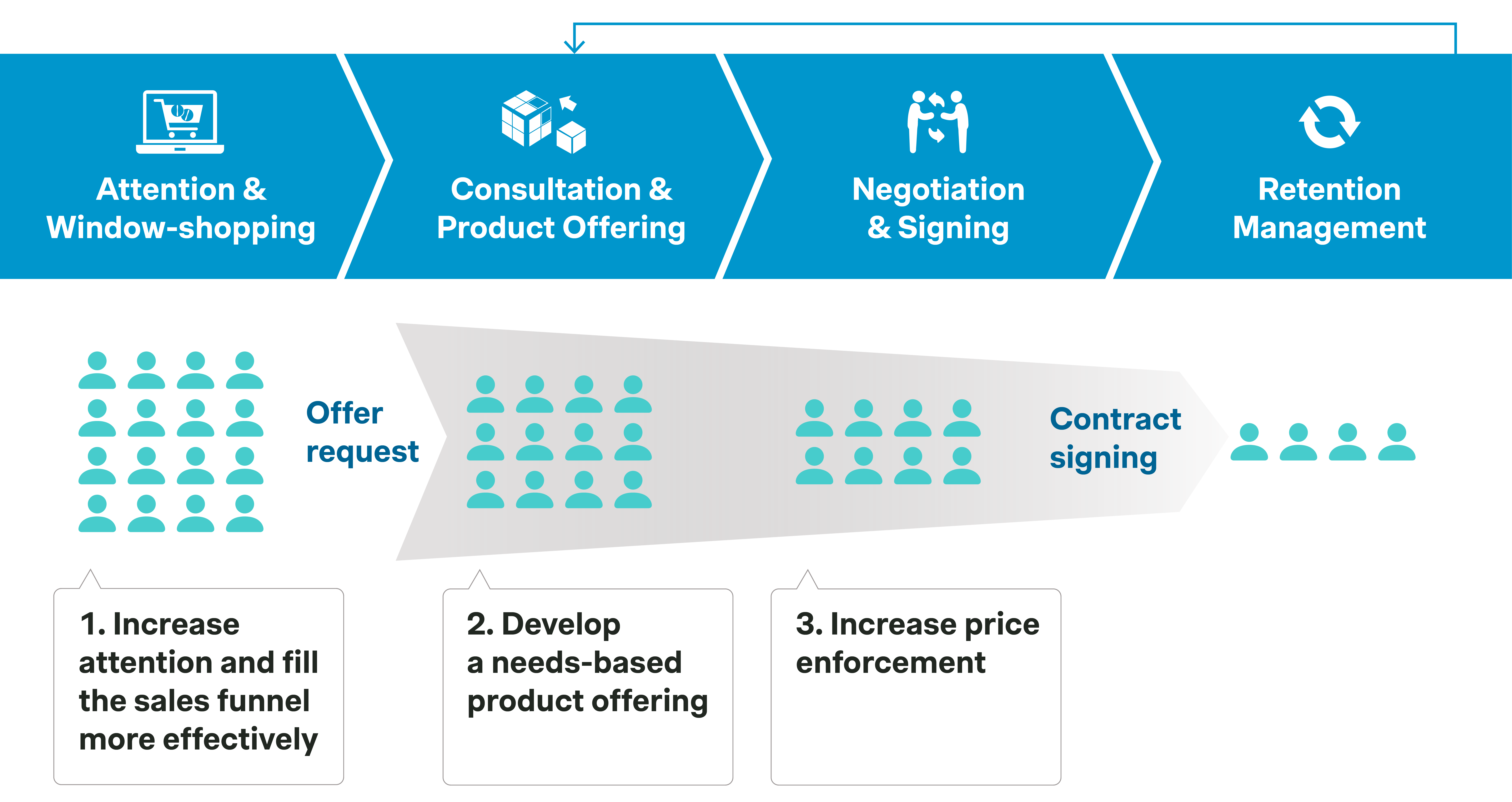

Customer journey analysis

To gain insights into the dynamics of the mortgage market and the preferences of distinct customer segments, we started by conducting a thorough analysis of our client's sales funnel. This involved identifying valuable touchpoints and understanding the customer journey at different stages. By pinpointing the most critical aspects, we aimed to optimize the sales journey for enhanced customer satisfaction.

Figure 1: Main questions on the project along the mortgage sales funnel

Price enforcement analysis

Simultaneously, we delved into the primary drivers influencing price enforcement in the competitive market. This analysis provided a comprehensive view of the challenges and opportunities within the mortgage landscape.

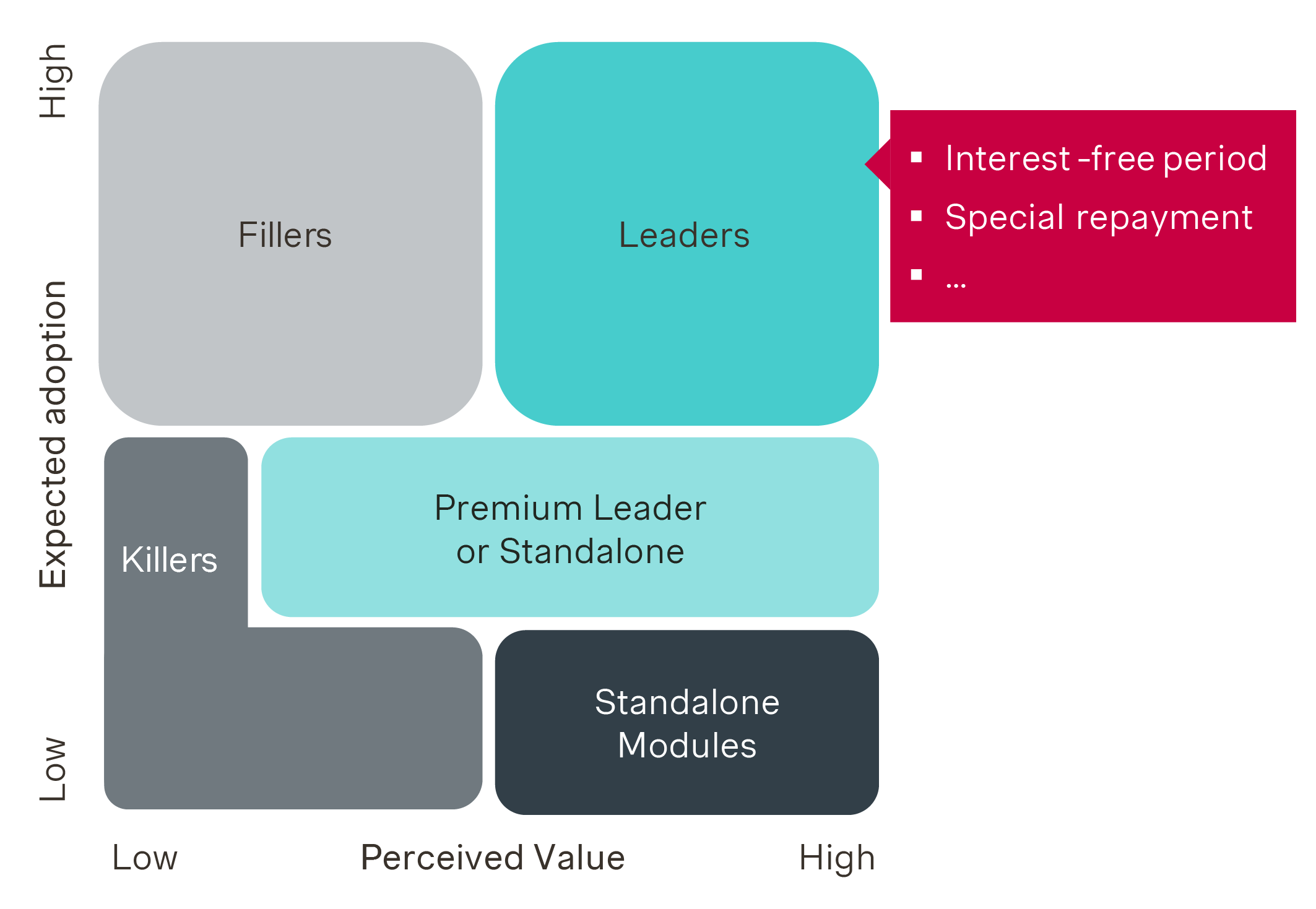

Market study on value drivers

We then validated our hypotheses and identified the primary value drivers for customers through a detailed market study which culminated in a classification termed "Leader-Filler-Killer" where leaders encompass features or services characterized by significant perceived value and a high likelihood of adoption. This enabled us to tailor our client's offerings and product features to align with the diverse needs and preferences of their customer base. This step was pivotal in enhancing the client's competitive edge and differentiation in a market where mortgages were increasingly perceived as commoditized.

Figure 2: Customer survey findings - Perceived value/importance of different product features (project example)

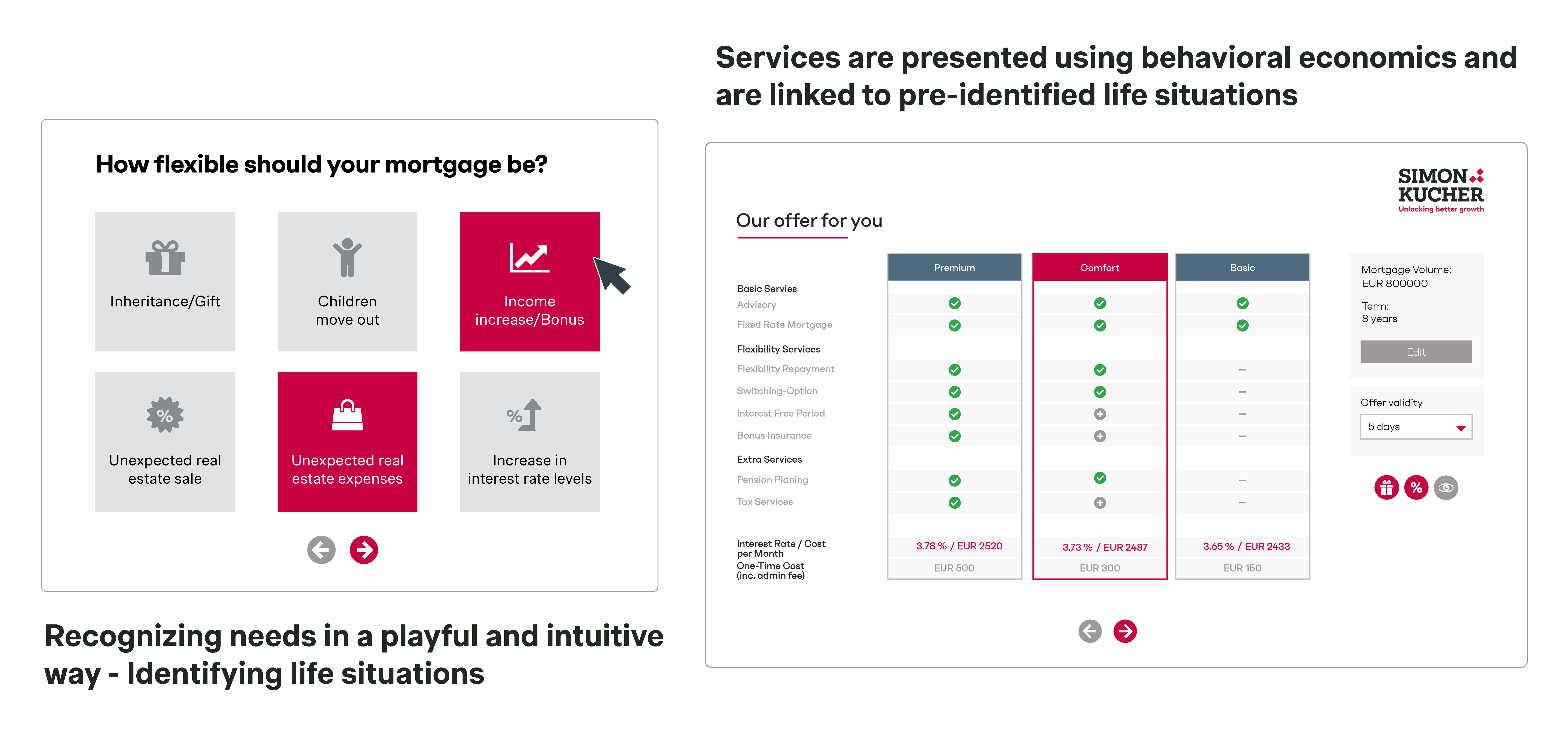

Tailored sales approach including behavioral economics

Taking inspiration from the principles of behavioral economics, we then devised an innovative sales approach specifically tailored for the mortgage domain. This approach aimed to resonate with the target audience, leveraging psychological insights to drive customer engagement and satisfaction. Figure 3: Implementing behavioral economics into your mortgage sales

Figure 3: Implementing behavioral economics into your mortgage sales

Technical concept to implement solution in existing IT landscape

In the last phase of our solution, we ensured the seamless integration of our strategic recommendations into a fully digital end-to-end advisory process. This digital transformation aimed to enhance operational efficiency and provide a more user-friendly and customer-centric mortgage experience.

OUTCOME/RESULT

A dynamic bundling approach and an optimized sales funnel seamlessly integrated into a fully digital, end-to-end advisory tool.

By autonomously tailoring product bundles and facilitating dynamic product configurations, this solution increased our client’s new mortgage contract margins by +10bps.

We achieved the following results by enabling precise customer profiling to identify individual needs and recommending tailored configurations with suitable features:

- Enhanced customer satisfaction: The tailor-made solutions elevated the perceived value of consultations and mortgage products of our client. This customer-centric approach drove up satisfaction levels and conversion rates.

- Margin expansion and improved price enforcement: Increased upselling of product features and a decrease in special discounts resulted in an average margin uplift of +10bps in new mortgage contracts.

- High internal stakeholder adoption: By offering modular solutions, client advisors were able to deliver customized options, while the needs-based selling approach emphasized the importance of product value.

The project not only addressed the challenges faced by our client but also achieved customer-centricity, operational efficiency, and sustained growth in the competitive landscape of the European mortgage market.