As a financial institution in the UK, understanding your performance in relation to Consumer Duty and the perceived price-value relationship of your offerings is paramount.

Consumer Duty lies at the heart of building trust and credibility among customers. Ensuring you meet your obligations to consumers is not only important for ethical conduct and regulatory compliance, but also fosters long-term relationships founded on transparency and integrity.

Furthermore, understanding how customers perceive the price-value relationship of your products and services is crucial for remaining competitive and ensuring a sustainable business model. By aligning your offerings with customer expectations and providing value that surpasses the price paid, you enhance customer satisfaction, loyalty, and ultimately, your bottom line.

In an era where customer feedback can rapidly influence reputation and market standing, it is essential for institutions to monitor and improve these aspects to thrive in an increasingly discerning and dynamic financial landscape. That’s why we at Simon-Kucher recently conducted a comprehensive survey among UK financial services customers. Our goal? To evaluate the relationships between consumers and their service providers through multiple lenses of Consumer Duty.

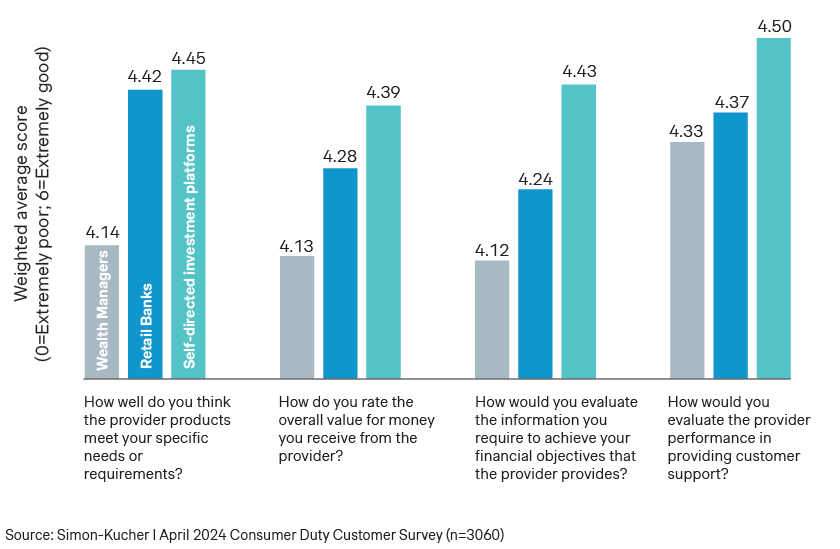

In our survey, we asked over 3,000 respondents to evaluate their service providers. The survey covers four key dimensions of Consumer Duty:

- Meeting customer needs or requirements

- Offering value for money

- Quality of information provided to achieve financial objectives

- Level of customer support

Consumer Duty Report: Results at a glance

Taking a bird's-eye view of the findings from our survey, we observe several key trends emerging, providing valuable insights into the state of Consumer Duty compliance across different financial sectors.

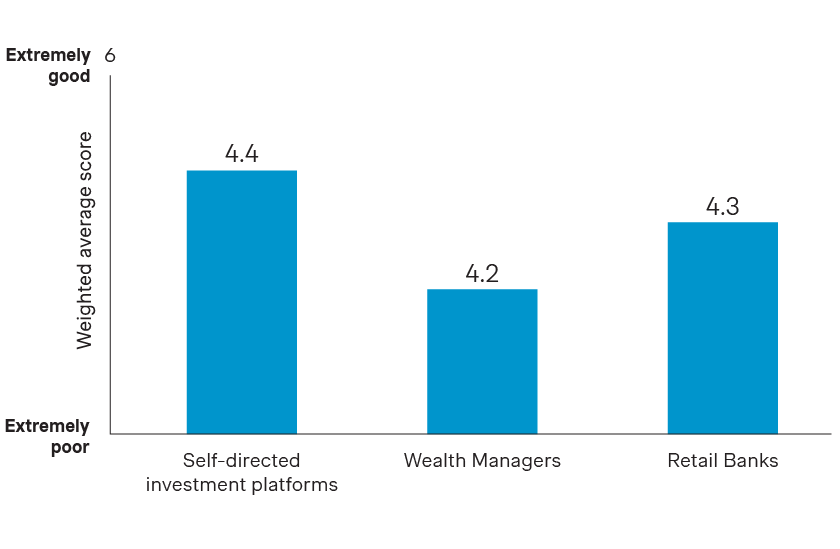

- Overall, all sub-sectors generally perform well. Despite media criticism and much focus on shortcomings, our findings are reassuring in that most consumers are happy with the performance of the UK’s leading financial services firms on the dimensions assessed. Our more detailed methodology sought to understand areas of improvement across various lenses, which is what we will explore here.

- Self-directed investment platforms emerge as frontrunners in our assessment, boasting the highest average score across the board. Their clear positioning as execution-only offerings and technological edge likely contribute to their performance, particularly in areas such as value for money and information provision.

- Wealth managers find themselves at the lower end of the spectrum. Despite being relationship-led businesses, they notably lag behind their counterparts in terms of meeting customer needs, offering value for money, providing quality information, and delivering customer support.

- With retail banks and self-directed investment platforms, there is a much closer alignment of services to customer expectations compared to wealth managers. This underscores the strategic need for wealth managers to re-evaluate and innovate their offerings to better cater to evolving consumer needs.

- A further note: while there may be variations in performance between different firms within each subsector, rankings remain tightly clustered, with no single firm emerging as an outlier.

Meeting customer needs or requirements

Personalisation is key

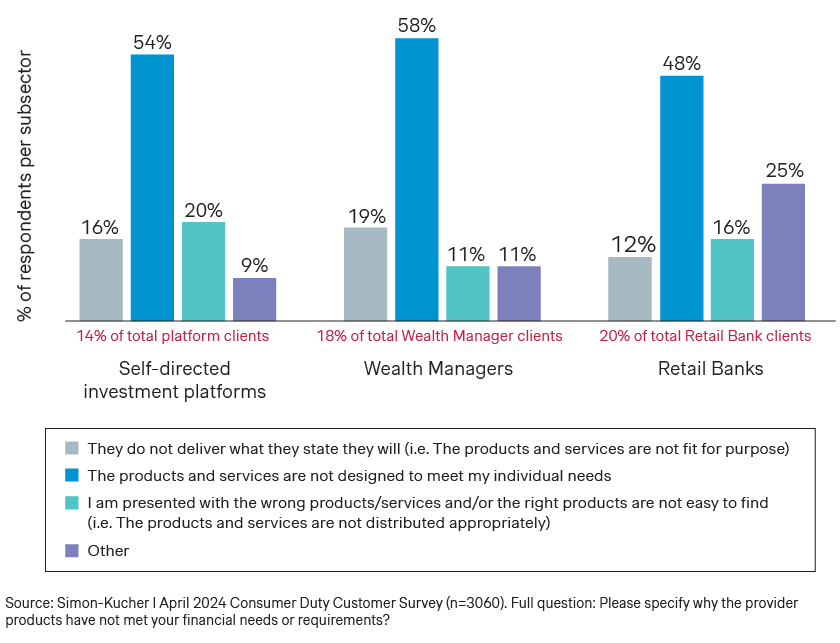

Across all subsectors, a recurring theme around customer requirements emerges: offerings fall short of meeting individual needs. At the heart of this issue lies the need for financial institutions to embrace personalisation.

Our survey reveals that approx. 50% of respondents across each subsector identify personalisation as a significant issue, underscoring its critical role in shaping consumer perceptions. This finding suggests that institutions should consider prioritising and driving personalisation efforts. Improvements in this area will likely enhance perceptions of suitability, value and ultimately, customer satisfaction.

Survey respondents criticise products for their lack of bespoke design and failure to cater to their unique requirements. This sentiment resonates strongly with the trend of mass personalisation seen in other sectors – an area where financial services is still catching up. Although many institutions have launched initiatives to shift their approach to be more customer-centric, there is still much ground to cover in terms of effectively tailoring services to the unique circumstances and objectives of each customer.

With self-directed investment platforms, a notable issue arises: the difficulty customers face in understanding products. While many platforms strive to offer educational resources and commentary, ultimately the complexity of financial products often leaves customers feeling overwhelmed and uncertain.

Wealth managers face their own challenges, with the lowest score in distributing appropriate products to customers. Moreover, a substantial portion of respondents express concerns that products may not deliver as promised. Here, the challenge may lie in managing expectations, calling for better alignment with individual needs and more consistent delivery on commitments.

For retail banks, a range of challenges are presented. Many comments refer to the high number of branch closures – a recurring theme throughout this survey. Furthermore, respondents state that the core product offerings lack personalisation, are often limited to basic services like current accounts, and report a distinct lack of proactivity in offering personalised solutions or recommendations beyond initial interactions.

In markets outside the UK, it is relatively common for personalisation of experience and offer to be delivered through loyalty schemes. However, in this regard the UK is behind many other markets, suggesting potential for improvement.

Read our case study: Personalised recommendations for a bank’s customers

Offering value for money

Disparities across subsectors

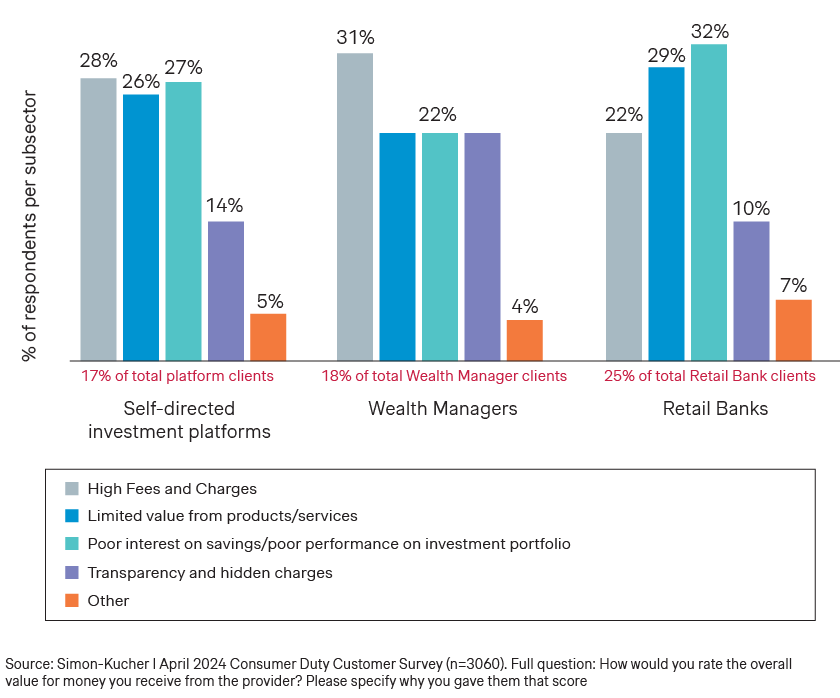

When it comes to value for money, different themes emerge across subsectors. This underscores the need for a tailored approach to addressing customer needs and expectations within each subsector. While all subsectors generally perform well, wealth managers consistently fall behind on all dimensions we measured, facing unique challenges in delivering value for money, and with fees viewed to be high and lacking in transparency.

Self-directed investment platforms emerge as the frontrunners in terms of perceived value for money. However, this positive sentiment is not without its caveats. While these platforms score well in various aspects, including fees and product value, there are still some concerns about transparency of certain fees.

Conversely, wealth managers face significant scrutiny regarding the value they offer. Criticisms focus predominately on high fees, although lack of fee transparency is also a notable concern relative to other subsectors. Together these issues point to a need to revisit pricing and value communication to demonstrate fair and good value.

Retail banks occupy a middle ground in the value-for-money category. Negative customer feedback predominantly centres around interest earned on savings. This comes as no surprise, as savings are one of the most tangible aspects of a banking relationship, and customers are quick to voice their dissatisfaction when returns fall short of expectations. Additionally, concerns about limited value from products underscore a broader theme of missed opportunities for proactive engagement and value-added services.

Again, respondents mention the increasing number of branch closures in this category. Some retail banks might be missing the personalised touchpoint that could potentially enhance value perception and drive customer loyalty. This underscores the need to reassess offerings and prioritise customer-centric value propositions. Here, retail banks could do more to leverage data-driven insights, tailor offerings, and deliver personalised recommendations that resonate with individual customers.

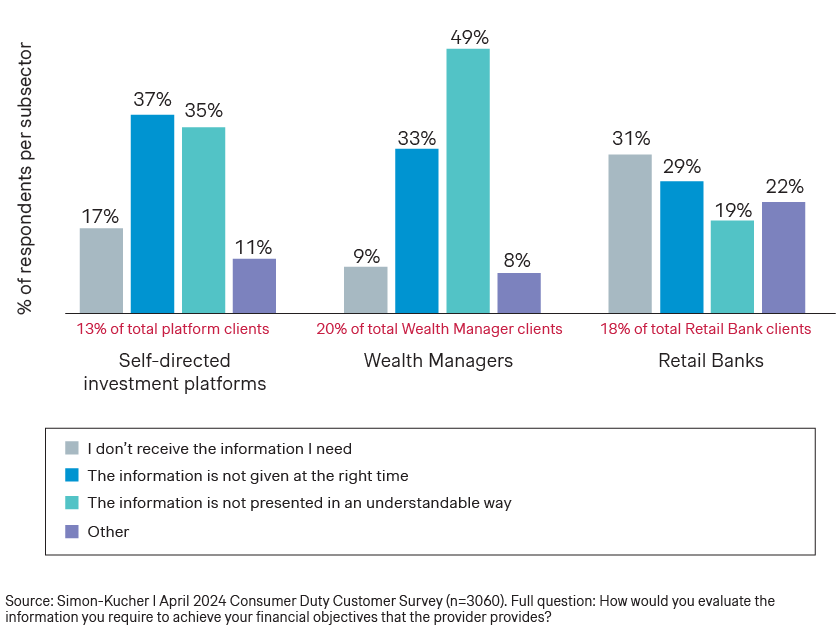

Quality of information provided to achieve financial objectives

Institutions need to place a greater focus on educating customers

Regarding quality of information provided, the overarching message across all subsectors is the critical need to enhance information quality to better serve customers' financial objectives. This involves not only improving the clarity and accessibility of information but also prioritising education and proactive engagement to empower customers to be confident in their decision making when using products and services.

Self-directed investment platforms, while scoring highest overall, face criticism for the timeliness and understandability of information provided. Customers of these platforms may find they need a requisite level of financial literacy to use and understand them, despite the democratisation of investment management that platforms seek to foster. To address this, platforms must prioritise educating customers, ensuring clarity and accessibility of information, thereby empowering customers to feel they are making informed investment decisions.

Conversely, despite their interpersonal service model, clients of wealth managers report they struggle with the presentation of information. This highlights a significant gap relative to personalised advisory services which is a core part of what wealth managers offer. This contradiction necessitates wealth managers to reflect on their service model and whether they are giving their clients a reasonable amount of time or detailed and understandable reporting on their portfolios.

Retail banks, while exhibiting more consistent scores, face challenges related to customer interaction and accessibility. It’s not surprising that the closure of bank branches has channelled customers with the inability or lack of desire to self-serve via telephone channels for customer service, where a long wait time is among the chief complaints. This highlights the importance of maintaining interaction channels and developing service models that accommodate a wider range of customer needs. Moreover, the need for proactive engagement and personalised support is evident, as customers seek more than just basic transactional services from their banks.

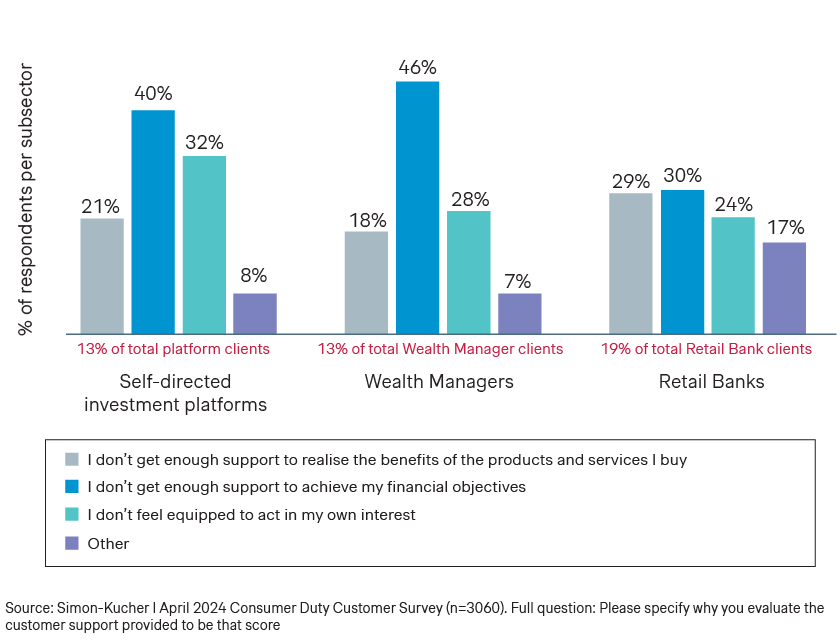

Level of customer support

Customers need support to achieve financial objectives

In assessing the level of customer support provided by financial service providers, a notable trend emerges across all subsectors. While generally positive, there is a shared sentiment of not receiving adequate support to achieve financial objectives. This discrepancy underscores a critical disconnect between customer expectations and the support offered by financial institutions.

For self-directed investment platforms, customer responses highlight concerns about feeling ill-equipped to act in their own interests and achieve financial goals. This issue is intertwined with the need for personalised guidance and education, particularly given the complexity of investment decisions. Despite the wealth of opportunities offered by these platforms, customers may feel overwhelmed by the lack of support and guidance available to navigate their financial journey effectively.

Wealth managers face criticism for not providing sufficient support to clients in realising their financial objectives. This shortfall is particularly striking given the advisory nature of wealth management services, where personalised support and guidance are paramount.

Retail banks encounter a different set of challenges, centring on the lack of human interaction and access to branches. Maintaining human touch points in customer interactions is crucial for the traditional retail banks to differentiate themselves in an increasingly commoditised market. This does not need to be centred around servicing customers on the high street – but rather by prioritising personalised digitally-led hybrid experiences with human touch points at the right moments so that banks can better deliver against customer expectations.

Consumer Duty Study: Key takeaways

Overall assessment:

- Although scores are positive across the sector, wealth managers consistently lag behind banks and self-directed investment platforms in meeting customer expectations across all dimensions of Consumer Duty.

- There is a universal need for financial service providers to prioritise personalisation in their offerings.

Challenges for self-directed investment platforms:

- Self-directed investment platforms are considered to deliver the best value for money but could improve in terms of providing transparency for customers.

- Customers of self-directed investment platforms seek more comprehensive support to achieve their financial objectives, signalling an opportunity for platforms to enhance guidance and educational resources.

Challenges for wealth management providers:

- High fees and charges remain a significant concern among wealth management clients, indicating a demand for greater transparency and value for money.

- Customers express a need for clearer communication and understanding of the services and products offered by wealth managers.

- Wealth management customers emphasise the necessity for more robust support to achieve their financial objectives, highlighting a critical gap in service provision.

Challenges for retail banks:

- Retail banks face criticism for offering poor savings rates, indicating a need for more competitive and value-driven savings products to meet customer expectations.

- Dissatisfaction with the closure of branches underscores the delicate balance banks must strike between cost management and customer satisfaction. While digitalisation offers efficiency and cost-saving benefits, it risks alienating customers accustomed to face-to-face interactions, unless these are also accommodated in the service model.

In summary, the survey reveals a consistent demand across all sectors for improved personalisation and a heightened focus on delivering transparent, value-driven services. Addressing these challenges will be crucial for financial service providers to enhance customer satisfaction, trust, and loyalty in an increasingly competitive market landscape.

Ready to dive deeper into the insights of our survey or want to enhance your customers’ perception of the price-value relationship? Don't hesitate to reach out!

Whether you're seeking the full survey results for a comprehensive understanding or require expert support in refining your strategies, we're here to help. Contact us today to unlock the full potential of your business and elevate your customer experience. Let's turn these insights into action!