The recent introduction of Wegovy has garnered attention from clinical and economic stakeholders alike, causing a shift in the treatment paradigm for obesity. What can manufacturers learn from Wegovy to unlock better health for patients globally? We share key learnings in our article.

Chronic weight management therapies have captured significant public attention. News channels and social media platforms are abuzz with discussions about semaglutide (Wegovy, Ozempic) and tirzepatide (Mounjaro), namely their long-term impact on body weight in patients with obesity, and how to secure access to these therapies.

Historically, the clinical value and need to reimburse weight management therapies has been challenged by multiple stakeholders, resulting in limited patient access. In our video and article, we explore the key learnings from Wegovy and how they could be applicable to other innovative therapies, e.g.,

In indications that are either perceived to either be lifestyle or cosmetic conditions (e.g., alopecia areata, smoking cessation)

In progressive indications where opportunities for early intervention are often dismissed due to lack of sufficient clarity around disease definition, combined with a potentially large eligible patient population (e.g., non-alcoholic fatty liver disease, mild cognitive impairment, etc.)

Five key learnings for manufacturers to unlock better health in challenging therapeutic areas

No substitute for therapeutic value and payer-relevant endpoints

Compared to previous weight loss therapies (including GLP-1 agonists with the same mechanism of action), Wegovy has demonstrated significant efficacy improvement, reduction in body weight, and an extended duration of effect after stopping treatment. Furthermore, pivotal and follow-up clinical trials for Wegovy have been designed to evaluate outcomes that resonate with payers, linking weight loss benefits to meaningful improvements in health, rather than simply appearance.

Pivotal Phase 3 trial data for Wegovy submitted for marketing also shows an improvement in anthropometric and cardiometabolic parameters such as systolic and diastolic blood pressure, heart rate, HbA1c, cholesterol, and triglycerides. An additional Phase 3 randomized controlled trial is being conducted (SELECT) focused on evaluating reduced risk of cardiovascular-related events, such as heart failure and stroke. Topline results recently showed that Wegovy reduces the risk of major adverse cardiovascular events by 20% in adults who are overweight or obese in the SELECT trial. Payers will be looking into this data to determine if Wegovy is truly transformational outside of the health benefits that come with weight loss.

As an example, PCSK9 inhibitors in cardiovascular disease (Praluent, Repatha) were able to demonstrate an impressive reduction in LDL-cholesterol in clinical trials. However, because this was a “surrogate” endpoint and did not directly demonstrate improved cardiovascular outcomes, initial reimbursement was challenging.

Wegovy trials and evidence of improvement

Efficacy improvement: 14.9% mean loss in body weight from baseline at 68 weeks vs. 2.4% for placebo in its pivotal Phase 3 trial

Reduction in body weight: 15.8% vs. 6.4% with Saxenda

Duration of effect after stopping the treatment: In a phase 3 randomized-controlled trial, 48.2% of participants maintained clinically meaningful weight loss of ≥ 5% from baseline, one year after stopping treatment.

Physician/patient advocacy and policy changes are key drivers of momentum

A robust evidence package helps towards payer openness to reimbursement. However, it isn’t the only factor required to convince payers. This is where physician/patient advocacy and proposed policy changes come in.

Over 100 patient, physician, and health-advocacy-led obesity groups, associations, and organizations in the US alone have contributed to public awareness of obesity as a medical condition and its intrinsic link to other metabolic and cardiovascular diseases. In 2021, a Morning Consult poll conducted on behalf of Obesity Care Now revealed that 70% of US adults supported the need for Medicare to recognize obesity as a treatable medical condition. In the UK, groups such as the Obesity Health Alliance, made up of over 50 health organizations, have drawn attention to the stigma and prejudice associated with obesity, and need for policy-level change to turn the tide.

Significant physician and patient demand in these markets has facilitated access/reimbursement for Wegovy, which is currently reimbursed in the US, UK, and France for individuals with a BMI of between ≥27kg/m2 to ≥35kg/m2. Similar has been observed with alopecia areata, an indication presenting with unexplainable hair loss, where it took broad public attention following the 2022 Oscars to recognize the underlying autoimmune component and validity of the disease along with associated psychological impact on patient health.

Meanwhile, rapidly growing global incidence of obesity has been a catalyst for healthcare departments as well as state and national government bodies to propose and enforce new policies and legislation around treating this condition.

New policies and legislation

California: Evaluating a potential law requiring coverage for weight loss medications starting in 2025.

National US: Treat and Reduce Obesity Act introduced to the US Congress in 2021, aiming to expand coverage for intensive behavioral therapy to support weight loss and allow federal health insurance (Medicare) coverage of FDA-approved weight loss medications. While the Act did not pass due to budgetary implications, its introduction represents a shift in stakeholder mindset.

UK: Call for action through the Department of Health and Social Care’s multi-pronged approach to tackling obesity (2020). Policy paper recognizes obesity as one of the greatest long-term challenges faced in the UK and announces the expansion of weight management services such as diet and nutrition programs and specialist advisors to improve patient access to these services.

One example of a policy change helping secure reimbursement for a “lifestyle indication” is the coverage of smoking and tobacco cessation products under the ACA in the US. Tobacco use is widely regarded as one of the leading causes of preventable death in the US, and that “preventable” aspect allowed US payers to restrict access. Broad national access and reimbursement for tobacco cessation products was only secured after significant legislative intervention demonstrated the challenges facing manufacturers who cannot convince payers of the need to provide patient access.

Certainty around eligible patient population is crucial for payer negotiations

In the case of Wegovy, the rising global incidence of obesity is a double-edged sword. While it helps convince payers to reimburse therapies to manage the condition, it also leads to fears around the increasing budget impact on the healthcare system. Additionally, while Wegovy has a clear definition based on BMI and associated comorbidities, the American Medical Association (as recently as June 2023) has strongly criticized BMI, urging physicians to de-emphasize its use as a diagnostic tool in assessing health and obesity at an individual patient level.

Similarly, the high incidence of comorbidities such as hypertension in some markets further contributes to budget impact concerns. In other indications, there may not necessarily be a growing incidence of the disease. However, any uncertainty around defining the eligible patient population can create concern for payers. Controversy surrounding therapies targeting mild cognitive impairment have faced significant payer pushback given challenges of objectively identifying these patients.Targeting early adopter markets opens the door to success

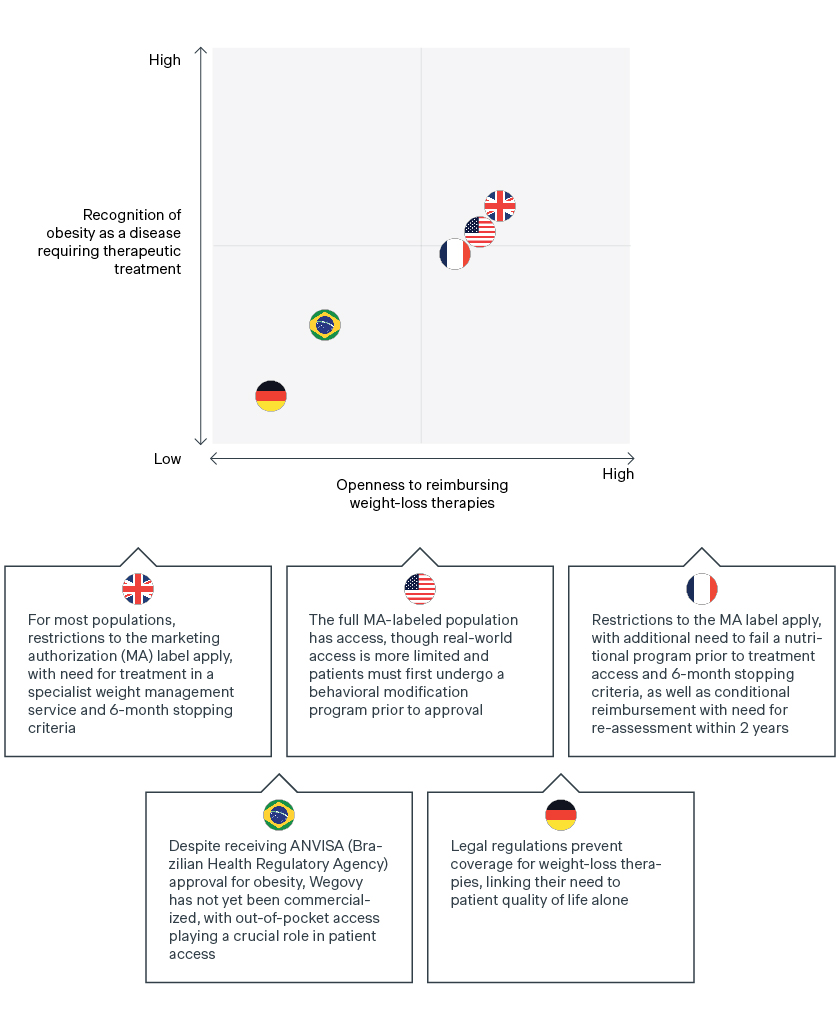

The reimbursement of Wegovy across several key global markets is a clear indicator of payer openness towards treating chronic weight management and recognition of obesity as a disease. Yet payers have defined criteria, with access restricted beyond the indicated label to perceived “highest-risk” patients. Access to Wegovy often requires patients to meet additional criteria such as a defined duration of therapy reimbursed, pre-requisites for additional trial inclusion criteria, specialist use, etc.![graph]()

In the UK and France, a critical review of the initial data package has led to Wegovy being restricted beyond the labelled marketing authorization. While the label indicates use in patients with a BMI ≥ 30kg/m2 or ≥27kg/m2 and at least one weight-related comorbidity, initial access is restricted to patients with (1) BMI ≥35kg/m2 and (2) prior or ongoing lifestyle management activities. Continued access/reimbursement is also restricted to patients losing 5% of their baseline body weight within the first six months.

In the UK, there is an additional pre-requisite for specialist weight management services. In France, a patient’s initial treatment is only possible following failure of a nutritional program. Retention of reimbursement is also conditional on reassessment of Wegovy within two years, following the publication of SELECT study results assessing risk of cardiovascular events in overweight patients. This demonstrates the value of including payer-relevant endpoints to ensure reimbursement.

The US presents a more mixed picture. An estimated 80% of commercial plans offer access to Wegovy (per manufacturer estimates), but real-world access is likely more limited. In the US, weight management is still not considered a “must-have” in terms of coverage. Many plans that offer access to Wegovy will do so through an employer opt-in, requiring the plan sponsor to approve weight management therapies for reimbursement.

Like the UK and France, additional lifestyle restrictions may apply for patients that do have access. This includes required participation in a chronic weight management or behavioral modification program for 3-6 months prior to getting approval for coverage, and requirements to demonstrate 5% weight loss off the baseline to be eligible for reauthorization.

However, Wegovy is typically available in the US to the full FDA-labeled population (BMI ≥ 30kg/m2 or ≥27kg/m2 and at least one weight-related comorbidity), not accounting for the prerequisite of having previously participated in a weight management program. While overall access may be limited by the requirement of employer opt-ins, there is a rise in the number of employers opting in to ensure access for chronic weight management therapies for their employees.The road to unlocking better health for patients globally is expected to be long and winding

In certain countries, legal regulations prevent coverage for chronic weight management therapies like Wegovy, demonstrating the difficult road ahead for manufacturers to secure broad global reimbursement for patients.

In Germany, weight management drugs are only considered to increase a patient’s quality of life and are therefore excluded from reimbursement under the lifestyle paragraph in § 34 SGB V. Future reimbursement will hinge on the Federal Ministry of Health or individual members/parliamentary groups working to remove this exclusion. Manufacturers can work with the clinical community and sick funds to advocate for future reimbursement of obesity drugs, and the inclusion of pharmacotherapy in the disease-management program (DMP) that the G-BA must establish by mid-2023. Positive results from Wegovy’s ongoing cardiovascular trial will be critical in supporting the weight management value story and securing future reimbursement. Meanwhile, patients in Germany and other markets without broad reimbursement will need to continue to access chronic weight management therapies by paying the list price out of pocket.

Out-of-pocket reimbursement also plays a key role in patient access to Wegovy in Brazil, with patients relying on OOP due to a lack of broad public/private access, despite ANVISA approval for Wegovy in early 2023. However, as the OOP market remains a large segment regardless of therapy type, manufacturers of weight loss therapies can still expect relatively “broad” overall access as long as they receive ANVISA approval, even without national or private reimbursement.

Commercializing as an out-of-pocket therapy therefore becomes the primary focus for Wegovy and products in similar positions as manufacturers work to secure reimbursement. Developing bridging strategies that help patients afford these costs will be important to creating a market and establishing products as key players. When weight management (or similar disease areas) then become reimbursed, products will have a built-in market by launch.

How we can help

Manufacturers have multiple levers to unlock better health for patients for indications that are perceived to be lifestyle/cosmetic conditions or lack disease definition combined with a large patient population. It is crucial to understand the country-specific opportunities and challenges.

Levers that manufacturers of analogous indications must consider include:

Proactively exploring payer relevant outcomes in helping demonstrate the clinical benefit offered by a new therapy.

Educating payers around the science behind the disease, the unmet medical needs for patients, and impact of having untreated patients on healthcare resource utilization.

Working with physicians, patients, and policy stakeholders to create demand, supporting payer awareness and recognition of the disease and a necessary shift in the regulatory landscape.

Proactively addressing payer concerns around the eligibility of the target patient population by clearly defining patients that can truly benefit from the product in the clinical trial and/or product label.

Understanding country-specific opportunities and challenges to identify and target early adopters and identify pockets of opportunities or alternative strategies in challenging markets (e.g., with legal barriers or low affordability.)

At Simon-Kucher, we have helped numerous companies in developing market access strategies for therapies in lifestyle indications and have extensive experience in developing commercial strategies. We can help you early on to define the right clinical trial design and identify eligible patients to convince payers.

Interested in learning more? Contact us today to identify and evaluate the growth potential of your assets and portfolio!

Special thanks to Ben Restaino and Sathushi Theivendran for contributing.