From Election Turmoil to Strategic Clarity

We are heading into the end of budgeting season and the beginning of holiday season with a tumultuous election behind us. What is obvious to us in Simon-Kucher’s Sales Effectiveness practice is that the market has been craving this new sense of clarity. We also have more clarity on the practices and perceptions of top-performing sales & marketing organizations with the publication of the 2024 Future of Sales Survey results. There are distinct things to take away from this year’s survey and compare to themes and emerging strategies we see our client’s embracing.

Driving Growth and Profitability in Sales Organizations

Driving growth and profitability is top of mind for business leaders, however best practices aren't always so clear. Market volatility, inflation, supply chain delays, and contentious elections can leave leadership with limited options for a clear path towards growth and sales team alignment.

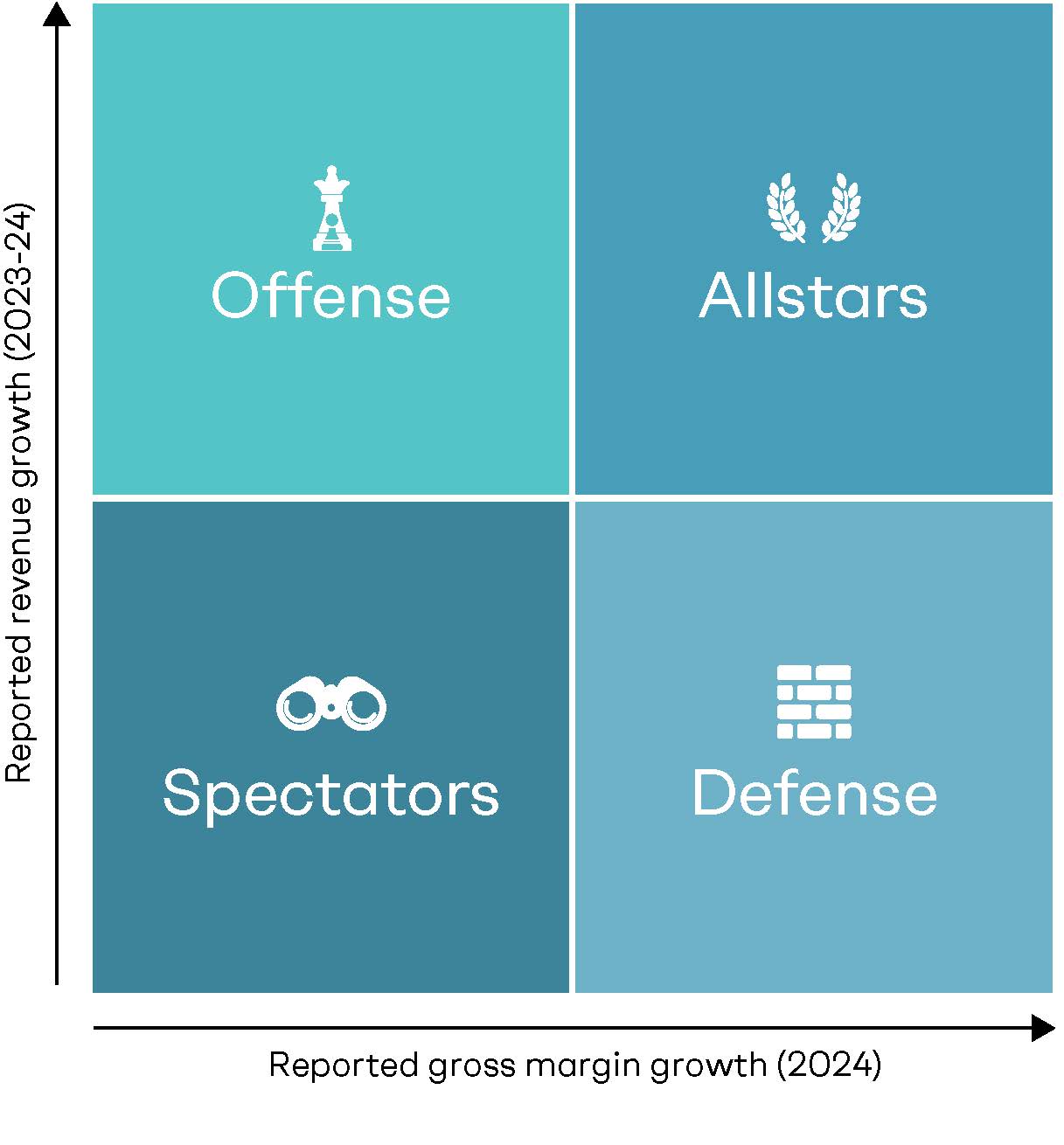

Evaluating sales and marketing performance by categorizing organizations could be the key to prioritizing and optimizing efficiencies into four distinct quadrants. This framework helps us analyze how companies balance growth and profitability, delivering actionable insights into what drives success.

Offense: Leading in growth but lagging in margin

Defense: Leading in margin but lagging in growth

Allstars: Excelling in both growth and margin

Spectators: Struggling in both growth and margin

This distinction is critical because benchmarking often focuses on the median companies’ practices from the previous year rather than the forward-looking strategies of top-performing companies. We want to be able to distill precisely which practices are driving growth and profitability by comparing the quadrants. We now have multiple years of trends to support this. We wanted to make sure the key observations from 2024 make it into our clients’ plans for 2025. Here are the top five:

1. Investment for Growth: Allstars Are Doubling Down

Once again, this year, Allstars and Offense are growing their investment in sales resources significantly faster than Defense and Spectators. The reality on the ground is even more stark. I gave a speech earlier this year titled “No One is Spending What They Should on Sales.” Half of my clients seem to be in the bottom quartile of investment and trying to cut costs while the other half are in the top quartile and piling on more investment. The additional layer of context is that these sometime arbitrary investment levels appear to be based as much on the history (or DNA) of the C-suite as any real assessment of market opportunity or competitive benchmarks. We encourage the CEO, CRO, and CFO to switch chairs for a day and play devil’s advocate on their colleague’s positions to stress-test the business-as-usual approaches.

2. The Sales Talent Shortage: Building a Future-Ready Workforce

By our calculations, there are about 2 million fewer salespeople in the US than there were 10 years ago. Each seismic event like the pandemic, the Baby Boomer “Gray Tsunami” of retirements, or digitalization takes out a million or more salespeople and then the economy struggles to add back half of that in the following years. The addition of sales concentrations in universities has not done enough to attract newer generations into the profession. What we are seeing now is a renewed dedication by leading companies to create compelling career paths, recruitment, professional development, and compensation for sales. These are muscles that require work to build but have high ROI over time.

3. Lead Generation Evolution: How Allstars Leverage Digital Marketing

Speaking of generations, lead generation is now getting quite a bit of attention. Two years ago, I asked a room full of CROs if they could name their company’s marketing automation platform and only half could. Now, the Allstars are leaning heavily on digital marketing to educate buyers, qualify leads, and help salespeople ramp up faster when dropped into new territories. The expense is lower, it allows salespeople to spend their time on higher yield activities, and it creates a culture of value-based content and continual engagement with the market. Spectators are still asking their expensive field salespeople to “smile and dial” because that is what they had to do when they were coming up in the business.

4. Embracing AI: The Competitive Edge in Sales Effectiveness

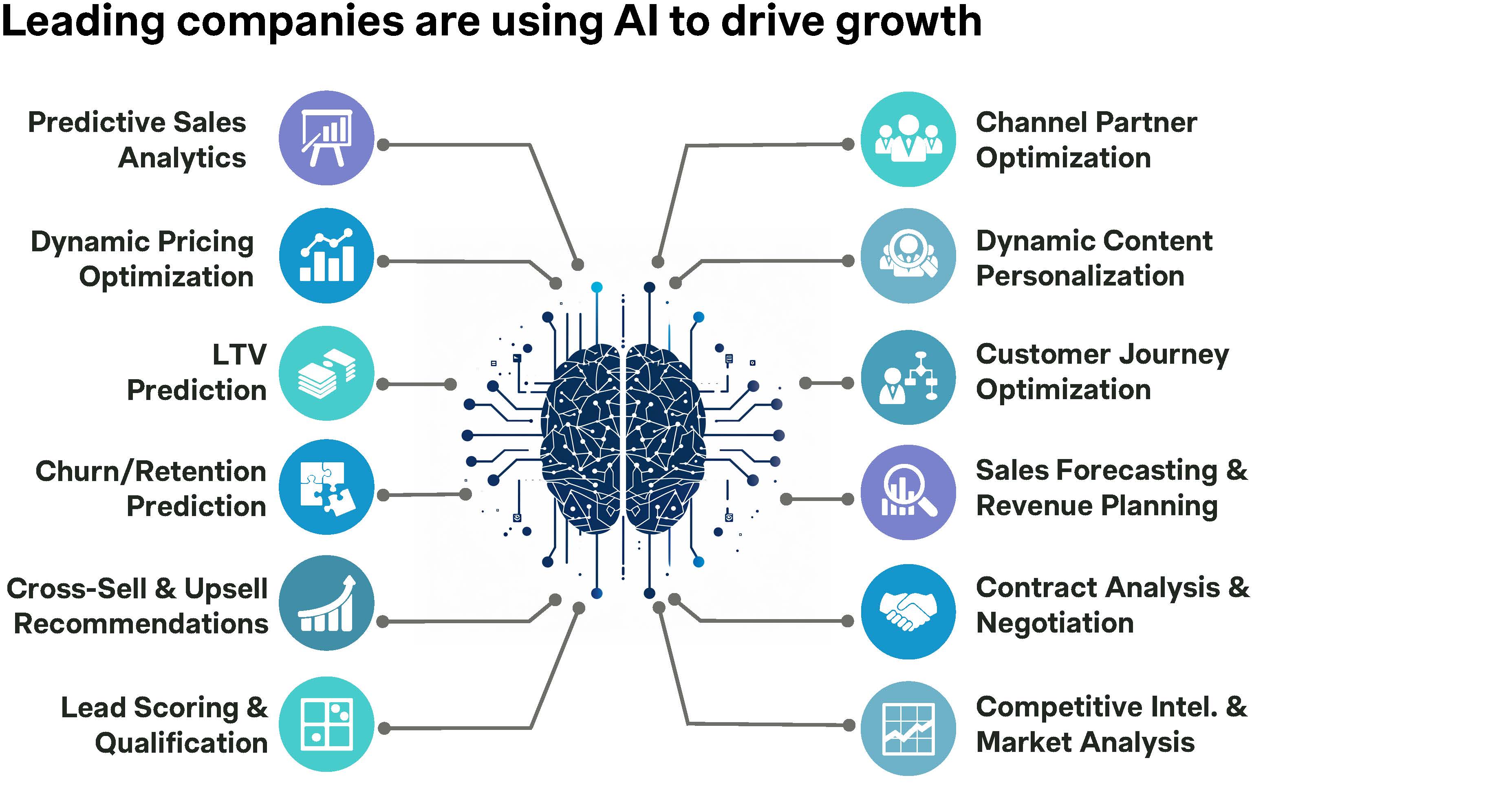

The other distinction that was clear in this year’s survey was that the Allstars are embracing AI much faster than the Spectators. There are many potential use cases:

The ones that stood out included churn prediction, cross-sell recommendations, lead scoring, content/message personalization, and contract analysis. Some of the tools being used are point solutions right now, but the leaders are not waiting to cross the chasm into mainstream applications, they are diving in now and are already starting to realize ROI from their efforts.

5. Voice of the Customer: Proactive Feedback for First-Mover Advantage

Allstars are also actively collecting customer research to identify shifts in market demand and preferences so that they can gain a first-mover advantage. They are not waiting until the end of the year to do postmortems on lost deals, to gather internal best practices on sales messaging, or to guess if their new pricing model is working. They are going to customers more frequently, using more channels, and with more detailed hypotheses to test. They appear to be rewarded for their proactivity, scoring higher customer satisfaction results, higher win rates, and lower churn.

If you are already leveraging these leading techniques, congratulations, you may already be a sales & marketing Allstar. If you want to score yourself against these benchmarks and have a deeper discussion around opportunities to improve your margins and growth, please reach out and we will send you a summary of the new survey results and help your leadership team identify the best path forward in the challenging times.