Emerging markets are home to 85 percent of the global population but receive less than 10 percent of healthcare resources. The rising healthcare demands and unmet needs in low- and middle-income countries present an opportunity for pharma to align growth with impact. Discover strategies for equitable access and sustainable growth.

Over the past 20 years, emerging markets have been on the pharmaceutical industry’s radar, recognized for their growth potential and unmet medical needs. However, they were often not prioritized over established markets. With ongoing shifts in the global healthcare landscape, companies are now approaching these regions with a renewed focus on equitable access and long-term, sustainable growth.

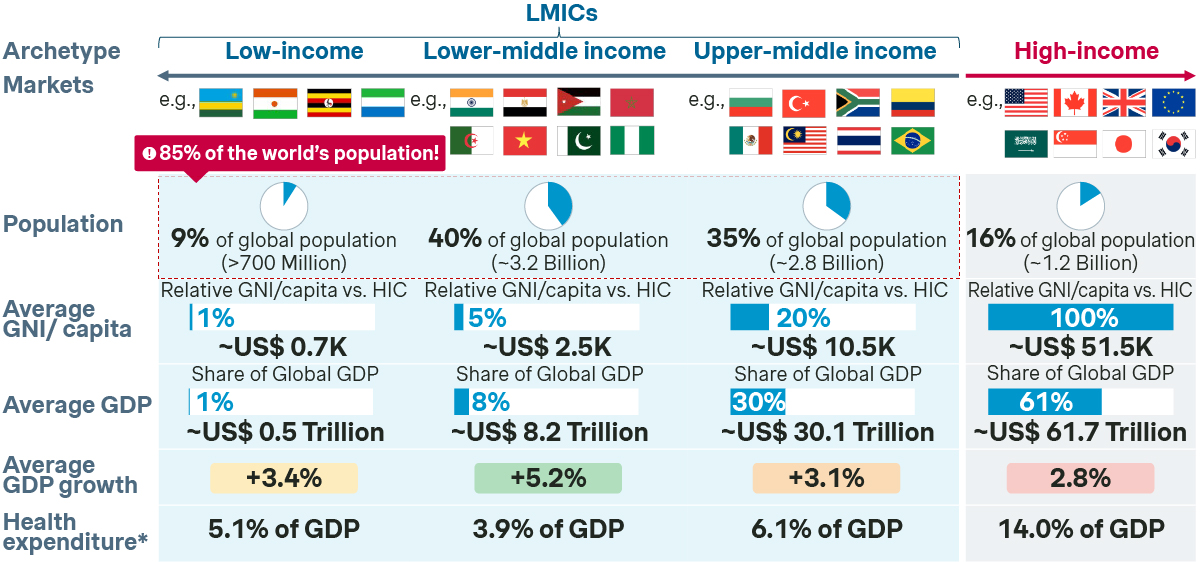

85 percent of the world’s population resides in low- and middle-income countries (LMICs) accompanied by a substantial rise in non-communicable diseases (NCDs) and infectious disease burdens in these regions. However, despite contributing to over 75 percent of the global disease burden, LMICs receive less than 10 percent of global healthcare resources. This demographic shift, coupled with rising healthcare demands, presents both a challenge and an opportunity for the pharmaceutical industry.

This article explores the actions needed for pharmaceutical companies to turn these challenges into the next significant chapter of sustainable growth. It offers insights on how the industry can reshape its strategies to focus on access through pricing innovation, implementing equitable access solutions, driving long-term patient outcomes, and navigating the complexities of emerging markets.

By rethinking affordability, partnerships with local health systems and adopting a long-term vision, the industry can align growth with social impact, bringing the benefits of medical advances to patients with high unmet needs.

Overview on LMICs

LMICs are defined as markets with a GNI of less than $14k per capita and are home to 85 percent of the world’s population (or 66 percent when excluding China). Our analysis shows that, despite its vast size, LMICs (excluding China) contribute between 5-15 percent of global pharma revenue. This is due to complex challenges, such as international price referencing risks, fragile supply chains, and significant gaps in healthcare infrastructure. Access in LMICs is made even more difficult for companies with rare disease or innovative drug portfolios, where healthcare system readiness continues to be a major barrier to patient access. Despite these challenges, LMICs will be a key pillar of the pharmaceutical industry’s growth. Leading PharmaCos are quickly mobilizing to tap into the growth potential of these complex but rewarding regions, looking beyond at-cost strategies and Corporate Social Responsibility initiatives.

Why LMICs matter?

The pharmaceutical industry's reliance on developed markets has driven decades of growth, but signs of stagnation are emerging. Escalating healthcare costs, policy pressures like the US Inflation Reduction Act, threats of patent cliffs for blockbusters, and a decline in population growth rates underscore the need for diversification.

In contrast, LMICs represent a promising frontier for future growth. Rising incomes, an expanding middle class, and increased government budgets have led to substantial investments in healthcare infrastructure, rapid urbanization, and the expansion of universal health coverage. Healthcare reforms and favorable public policies are unlocking access for millions of patients while creating new commercial opportunities.

LMICs are quickly closing the Healthcare Access and Quality (HAQ) gap, and many upper-middle income markets are today at the same HAQ levels as established markets were back in the 1990s. While infrastructural challenges persist, the progress in these regions signals a paradigm shift. Simon-Kucher’s conservative project simulations suggest that adopting equitable pricing strategies in LMICs could significantly boost pharma revenues, driving incremental growth of approximately 60 percent over the next decade through volume-based growth.

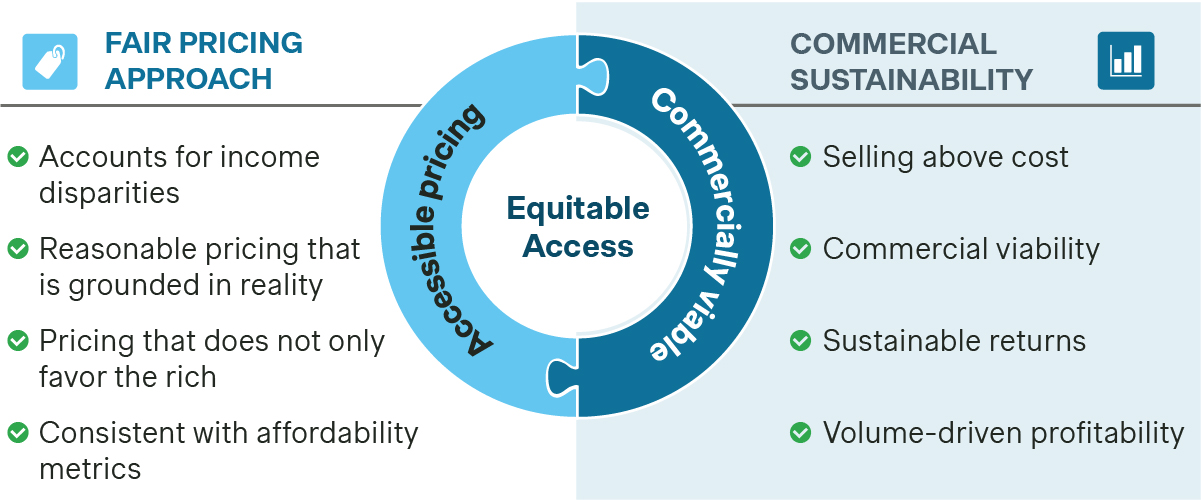

Equitable access in LMICs should be viewed as a crucial priority for the pharmaceutical industry to sustain its relevance in the decades ahead. A fair-pricing approach, as we discuss later, not only diversifies overconcentrated revenue streams but also unlocks access for millions of patients globally—all while maintaining commercial sustainability.

Challenges and strategies to bridge the equity gap

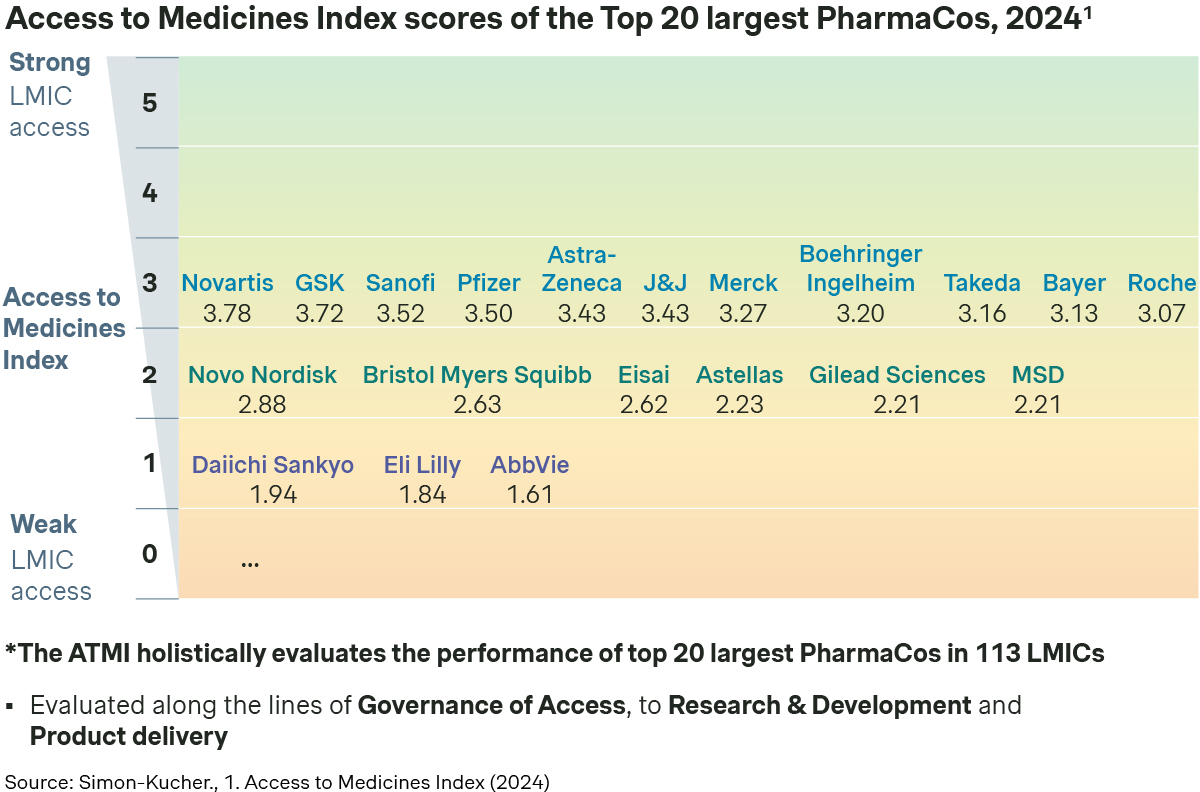

The Access to Medicines Index (ATMI) evaluates 20 of the world’s largest pharmaceutical companies on their efforts to improve access to medicines, vaccines, and diagnostics in LMICs. It assesses companies based on 31 metrics across three areas: Governance of Access, Research & Development, and Product Delivery. The index serves as a critical performance indicator, highlighting how well these companies implement equitable access strategies while showcasing best practices and identifying areas for improvement.

Here at Simon-Kucher, we have partnered with and advised many leading pharmaceutical companies on unlocking access in both established and emerging markets. In the following section, we delve into some of the key challenges to access in LMICs and explore the best practices and strategies PharmaCos have implemented to overcome these hurdles.

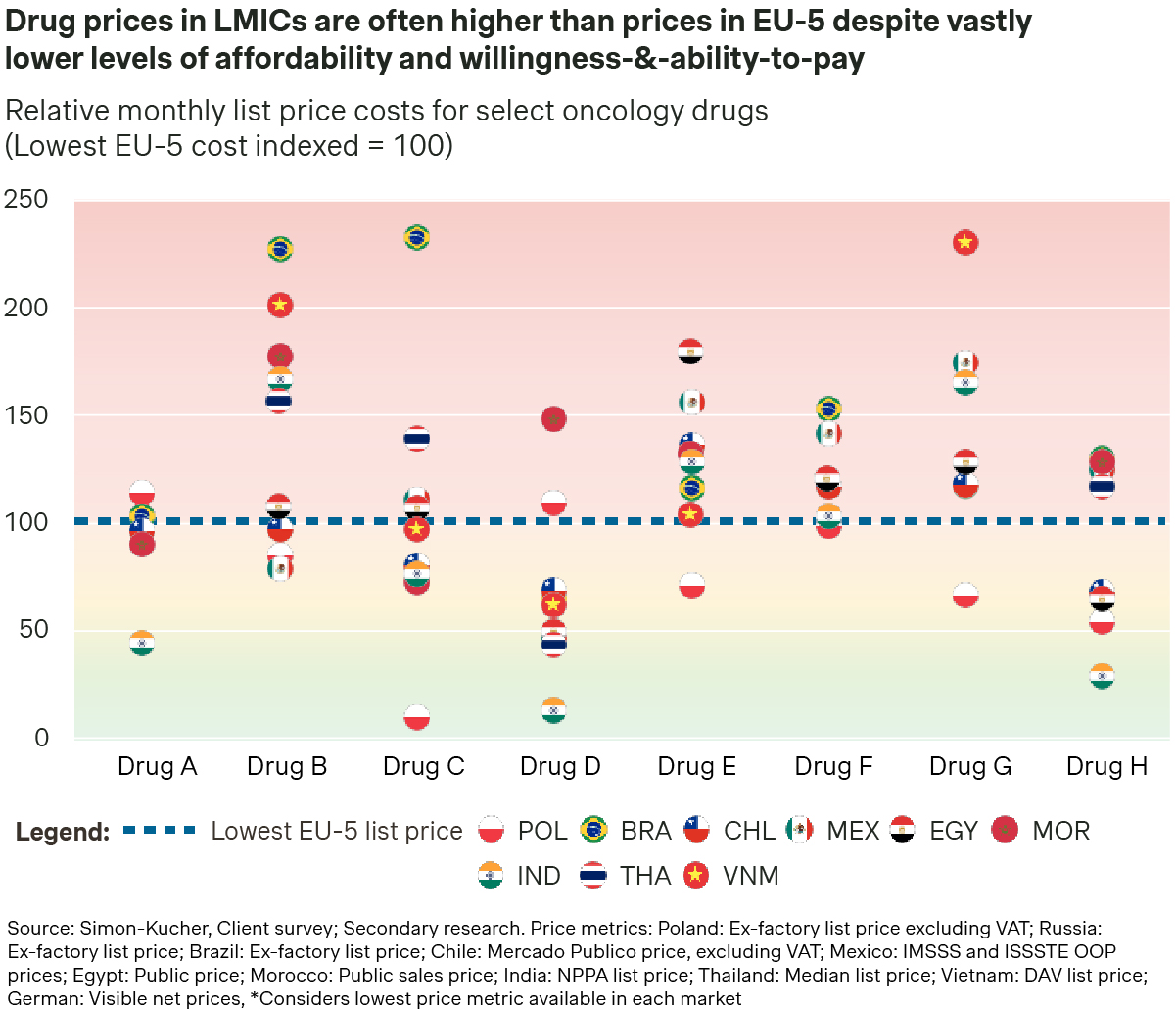

Challenge 1: Access vs Profitability

Expanding access in LMICs remains constrained by high treatment costs, severely limiting patient access due to prohibitively expensive out-of-pocket costs to patients. Our analysis reveals that the average price of a select basket of oncology products in LMICs is often multiples higher than reimbursed prices in the EU-4 + UK. This pricing strategy aims to provide a buffer for the substantial price cuts typically required for national reimbursement. However, even with Patient Access Programs in place, prices in LMICs often remain prohibitively high, delaying reimbursement timelines and limiting access to narrower patient segments.

At the same time, a viable commercial strategy for LMICs requires the pharmaceutical industry to move beyond product donations or selling at (or below) cost. Pharma companies must strike a careful balance between expanding access to patients in need and ensuring commercial sustainability. This balance can be achieved through a variety of strategies.

While expanding access to patients in LMICs is a crucial goal, ensuring commercial sustainability requires a strategic approach to market and product prioritization. This process should go beyond simple considerations of population size and wealth, incorporating a comprehensive evaluation of local epidemiology, disease burden, and healthcare infrastructure. Market prioritization should ideally be conducted at the disease level, factoring in local prevalence rates, diagnostic capabilities, and the readiness of healthcare systems to support treatment delivery. Additionally, assessing the risks to the pharma company’s operations, including regulatory challenges and supply chain complexities, is essential.

By broadening the criteria for market attractiveness and readiness, pharma companies can better differentiate opportunities across regions and disease areas, focusing investments on markets with the highest potential for both patient impact and commercial return. This targeted approach ensures that resources are allocated effectively, helping to maximize the impact of treatments while supporting sustainable revenue streams.

While many PharmaCos have implemented tiered pricing strategies, in-market prices often remain prohibitively high, hindering meaningful expansion of patient access. A more refined tiered pricing approach is needed—one that moves beyond traditional metrics such as GNI/GDP per capita and tailors price levels to the specific characteristics of each disease area and market.

For example, public healthcare expenditure or the Human Development Index (HDI) can serve as proxies for payer willingness to pay and the overall readiness of healthcare systems. These metrics provide a more reasonable approach toward tiered pricing.

For effective implementation, validating the tiered pricing model through targeted primary research or simulations using income distribution data, such as the GINI Index, is essential. This ensures that price points are appropriate for local conditions. Going beyond ‘high-level’ assessments and considering therapeutic area specificities is also crucial in the implementation of a realistic and effective tiered pricing model, given differences in patient demographics and disease burden.

Achieving targeted local price levels does not solely rely on list price reductions; it must be strategically aligned with the nature of the product. For instance, pricing for a new product with multiple indications should be approached differently compared to a mature product needing to pre-empt generic competition. PAPs can be a key mechanism to lower affordability barriers for products with high out-of-pocket costs or limited insurance coverage, thus accelerating access to treatments.

A Simon-Kucher benchmarking study on PAPs reveals that objectives vary across PharmaCos. For some companies, the primary aim is to reduce net prices, thereby enhancing patient access and affordability. In other cases, PAPs are strategically used to improve access by building stakeholder relationships and increasing product familiarity, often serving as a bridge to public reimbursement. However, the design of PAPs must be carefully considered to ensure their effectiveness and to mitigate potential risks for the PharmaCo.

For example, static PAPs (e.g., Buy 2 + Free 1 programs) are simple in their implementation, and provide a fixed discount for all eligible patients, including those who may not face affordability constraints, leading to faster uptake yet potentially cannibalizing revenues.

Alternatively, affordability-based PAPs are more complicated to implement but can provide some degree of tailored financial aid based on an individual’s ability-to-pay, leading to improved duration of treatment. However, affordability-based and tiered-pricing PAPs require robust methodologies due to the prevalence of informal economies in many markets (e.g. unregulated employment contracts or unofficial sources of income). As a result, significant oversight and meticulous financial planning are crucial to ensure program sustainability.

Between static and affordability-based PAPs, there is no one-size-fits all, and manufacturers often need to adapt and optimize PAP designs to balance access and ensure commercial sustainability. For example, in Vietnam, two separate PharmaCos in oncology adopted different strategies, with one transitioning toward an affordability-based PAP and the other rolling back its affordability-based PAP in favor of a static PAP.

Learn more: Strategies for patient affordability programs

Challenge 2: International and local risks

Even with a fair-pricing approach in place, embarking on an equitable access strategy possesses certain risks that need to be managed by PharmaCos. Lower prices in LMICs can theoretically pose a risk to prices in established markets through International Reference Pricing (IRP). While formal IRP rules are visible and can be accounted for, many countries, especially in LMICs, utilize informal price referencing, where rules are flexible resulting in more uncertainty and higher risks for PharmaCos. Parallel imports may also be a risk in certain developing regions, although strict rules from established markets generally curb the influx of lower-priced products from LMICs. Even with international risks mitigated, entering an LMIC with a local entity exposes PharmaCos to regulatory hurdles, escalated costs, and additional challenges including corruption, quality control, and efficient resource management.

Amongst the several discrete mechanisms to lower price levels locally without list price adjustments, GtN strategy can be used to drive meaningful access. Annual rebates, off-invoice discounts, and free-of-charge goods lower the net price of a product across various channels while still enabling a higher (visible) list price. Leading PharmaCos ensure commercial strategies are well aligned with market access goals to effectively steer channel partners and drive sell-out to patients. However, careful monitoring of GtN strategies is crucial to ensure that discounts provided to channel partners are actually reaching end users and maintaining their effectiveness.

Learn more: Driving profitable growth through Gross-to-Net in pharma

EMBs represent an alternative strategy for mitigating international risks. EMBs may replicate the original brand with localized packaging or, where appropriate, include LMIC-specific presentations and SKUs that cater to local market needs. Developing an EMB with differentiated packaging or presentations not only reduces the risks of IRP and parallel import but can be used to de-risk the original brand when coupled with localized production strategies. The advantages of an EMB differ from market-to-market, and its applicability needs to be carefully considered alongside local price referencing rules.

As entering a new LMIC requires significant investment and adds risks to PharmaCos, partnerships and licensing with local distributors can be a way to further de-risk, while enhancing local capabilities. On top of established distribution networks, these local partners possess the expert knowledge required to understand widespread geographies and navigate the complexities of the local supply chain.

Beyond local licensing strategies, direct imports to local institutions can be another way to overcome access hurdles, subject to local regulatory requirements, particularly in countries with no-commercial footprint. However, risks associated with mandatory product registration need to be addressed carefully should product volumes increase over time.

Challenge 3: Access beyond the ‘tip of the pyramid’

Although partially a function of a ‘fair-pricing’ approach, significant price decreases alone may not guarantee widespread access. Factors like a lack of market readiness, broken supply chains, and poor diagnostic and treatment infrastructure can still hinder access. In these cases, PharmaCos can employ tailored programs or initiatives to address bottlenecks in patient access or to unlock access to parts of the market prior to full national reimbursement.

In many LMIC markets, universal health coverage continues to be restricted to low-cost essential medicines or is severely underdeveloped. Beyond out-of-pocket access, PharmaCos are able to typically unlock small but significant segments of the population to expand patient access while still ensuring commercial viability. In Thailand, the Oncology Prior Authorization (OCPA) program under the Civil Servant Medical Benefit Scheme (CSMBS) provides public reimbursement for cancer drugs to 9 percent of the Thai population. The Central Government Health Scheme (CGHS) in India functions similarly, providing reimbursement to government employees treated in CGHS empaneled hospitals.

Beyond niche government funded schemes, microfinancing and pooled finance have emerged as novel funding approaches for patients. Roche Pharma’s partnership with Evrysdi in India provides upfront medical loans to patients, with Roche covering interest payments. Pooled finance distributes the burden of drug funding to multiple parties, increasing affordability for patients.

In established markets, payer contracting is commonly implemented to alleviate financial risk for payers, while granting access to patients. Similar concepts can actively be considered in LMICs, though the feasibility of implementation may not always be possible. Simplified contracting schemes such as price-volume agreements are effective in lowering the net price to payers in return for a larger pool of patients for PharmaCos. Budget cap agreements are effective in addressing payer concerns on escalating healthcare costs, to safeguard future budgets. To a smaller extent, outcomes-based agreements might be applicable, especially in the case of rare diseases, to ensure efficient allocation of resources while providing a guarantee for payers and patients. In some cases, commercial agreements may not only apply to public payers but also private insurers and even patients themselves may be the target of such agreements.

Lastly, LMICs require the support of the pharma industry to meaningfully shape and facilitate access to innovative treatments. Collaborating with local diagnostic providers, patient education programs, and payer engagement are all part of the broader fabric of access, creating an environment that enables access to treatments.

However, PharmaCos must be careful to ensure that external landscape shaping or healthcare system strengthening efforts provide a lasting effect on the landscape and do not only temporarily resolve inadequacies in local infrastructure. Realistically, isolated efforts by individual companies are typically unable to result in meaningful impact, and broader collaboration with other PharmaCos, local governments, and other partners would be needed to ensure long-term viability.

Charting your journey in LMICs

LMICs offer pharmaceutical companies a significant untapped opportunity for growth in the coming decades. By leveraging a "global excellence, local execution" approach, pharma companies can unlock this potential while addressing the unique needs of these markets.

Beyond commercial objectives, access to medicines (and specifically innovative medicines) remains a huge challenge affecting a large, underserved population. This lack of access leads to over 14.5 million preventable deaths from non-communicable disease annually, with 86 percent of global deaths attributed to LMICs. An equitable access strategy provides pharma companies with a commercially viable pathway that addresses patient needs while fulfilling their ESG commitments.

Driving access in LMICs requires a careful balance between patient affordability and commercial sustainability. Strategies must not only be feasible for the organization but also drive meaningful, on-the-ground impact.

Solutions should be built beyond market access considerations. They should be broader, integrating cross-functional perspectives from regulatory affairs, medical affairs, commercial, and global portfolio leads.

At Simon-Kucher, we have helped many of the world’s top 20 pharmaceutical leaders navigate their journey in LMICs. From supporting market prioritization to developing tailored go-to-market models, our team of experts is equipped to support your success story in Asia, Latin America, the Middle East, Africa, and developing regions of Europe.

Connect with our authors, members of our Centre of Excellence: Emerging Markets, to learn more.

Better Market Access

The role of better market access is to remove any hurdle that prevents or hinders patients from receiving available treatments. In the right place, and at the right time.

Today, the impact of market access spans clinical development, regional commercial activities, patient engagement, and post-launch compliance. Yet, for many pharmaceutical companies, planning for commercialization only truly begins when a drug has been submitted for approval — far too late in the process.

Get to know our insights on local trends, regional and global developments and global to local excellence.