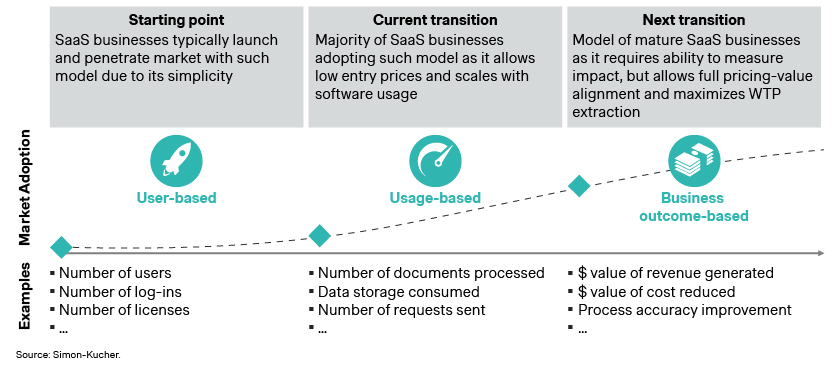

With the tumbling of SaaS growth in 2023, profits have now taken the center stage. Traditional pricing models faced scrutiny, usage-based solutions have seen rapid adoption recently and business outcome-based revenue models could gain traction. Discover how a revenue model transformation can unlock long-term growth.

The year 2023 was a bumpy one for many B2B SaaS companies, given the challenging macroeconomic environment and market dynamics. In our 2023 Global Software Study, we reported a staggering decrease in the average revenue growth of B2B SaaS companies. The median revenue growth dropped by more than half, from above 20% to below 10%.

With SaaS companies needing to focus more on profitability than before, pricing becomes an increasingly important topic. This involves much more than pure price increases. Many SaaS companies have been changing their price models, and we have seen a strong shift to usage-based pricing models. OpenView predicted that over 60% of B2B SaaS companies would have adopted this model by the end of 2023. Zuora reports that nearly 50% of all B2B SaaS companies have implemented usage-based model in the last three years.

Usage-based models have numerous benefits and, in these recent tough times, have supported B2B SaaS companies by giving customers more flexibility. At the start of 2023, we implemented such a revenue model for one of the largest financial management software provider in Finland. Starting from a flat price structure, we designed a tiered model based on documents processed, allowing customers to purchase documents at a pace that suits their business needs, and only pay for what they use.

B2B SaaS companies do not expect growth rates to catch up with pre-inflation levels

So, what’s next? In our Global Software Study, nearly 50% of respondents stated they expect to grow their topline by “up to 10%.” Another third have planned “between 10% to 20%.” Such numbers are still only 50% of what they were pre-inflation, when zero interest rates subsidized growth strategies. Now, B2B SaaS companies need to work harder to make money, and further evolving revenue models is one crucial step in this journey. This type of revenue model transformation offers the opportunity to unlock long-term sales-driven growth .

Growing through revenue model transformation

In recent engagements, we at Simon-Kucher have helped various companies begin their revenue model transitions to new models and increase the long-term growth of SaaS.

For instance, we have supported nShift, a Nordic-based multi-carrier shipping software, in developing their SaaS monetization. They currently charge based on “number of deliveries processed” through their delivery management software. nShift’s customers, such as business retailers, can select various carriers and pay depending on total deliveries ordered, streamlining their operations and costs through nShift seamless and rapid shipping software.

Another company that managed to transition to usage-based model is the automation platform Zapier. They currently charge based on “tasks executed”, a metric that reflects the value each customer gets from the usage of the platform when performing web integrations or complex workflows.

In a 2023 project with a Nordic marketplace, we outlined a revenue model transformation roadmap for implementing such model. This particular client’s customers will be charged on actual transactions generated through the marketplace itself – a development which represents a distinct new wave in their monetization journey.

The industrial technology firms, such as SKF and Siemens, put great emphasis and work vastly through guaranteed outcomes, such as system availability. Such offers are a must for instance steel companies. When interviewing the CEO of a Swedish steel manufacturers around the importance of system availability his response was: “If we have a system breakdown the feed solidifies, and we would go bankrupt. We only hire in outcome-based model for equipment, services and SaaS solutions.”

Why should you consider a revenue model transformation now?

Usage-based and business outcome-based revenue models have the ability to quantitatively determine the concrete value that your solution delivers to your customers. Considering the multiple benefits for both sides, we at Simon-Kucher believe such revenue models can lead to significant long-term revenue boost. And here’s why:

- Increased customer lifetime value and net revenue retention:

The business outcome-based revenue model is a “win-win” as it aligns the SaaS business’ and customers’ goals in a clear way; the more value in the form of reduced costs and increased revenues, etc., the more the customer pays. The mutual interest between a SaaS business and its customers builds the mainstay of a long-term relationship. This impacts two key B2B SaaS metrics – customer lifetime value (CLTV) and net revenue retention (NRR) – leading to superior growth results and a higher EV multiple. - Shorter customer acquisition time and cost

The ability to measure a certain value or the actual usage is what makes these revenue models compelling. Customers are only charged for the value they extract or the actual usage they have, reducing the barrier to purchase and making the product easier to sell. In addition, these models require data that quantifies the usage and the value delivered, helping you to build concrete case studies showcasing the benefits of your solution. - Closer link between product and commercial:

The business outcome-based revenue model relies on the ability to deliver a specific financial result, whilst the usage-based one relies on the assumption that more usage equals more value extracted. Here, SaaS companies create a closer link between their products and commercial success, with the product technology becoming the catalyst for growth. The better, more efficient, and advanced the solution becomes, the more usage and value it generates for customers, which directly translates into higher revenues.

Preparation and testing are crucial for success

When designing and implementing a revenue transition into usage-based or business outcome-based mode, there are several elements to consider and test for. Here are three of the most important ones:

- Measurability: The ability to gauge with a noteworthy degree of confidence that your solution does improve business performance for your customers. Measurability also helps you avoid revenue leakages as customers try to “game the model”.

- Commercial readiness: Switching to a new revenue model requires thorough communication plan and sufficient internal trainings to justify the defined and measured financial output. This preparation also helps you to avoid customer backlash and minimize short-term churn.

- Client onboarding: It’s crucial to ensure that customers effectively use the solution. Slow adoption and erroneous usage will ultimately reduce the impact for the customer, damaging your own profits in the process.

With close to 40 years of experience, we help B2B SaaS businesses with their outcome-based revenue model transformation, enabling sustainable, long-term growth journeys.

Want to learn more about how to design and implement a business outcome-based revenue model? We are here to support you - contact us today!