Due diligence in pharma is emerging as a critical tool for success. Our experts explain why accuracy in due diligence matters, now more than ever, and how it’s shaping the future of the pharmaceutical industry.

Form placeholder. This will only show within the editor

The early weeks of 2024 are a clear sign of accelerated dealmaking, potentially setting the course for growth in the year ahead.

The J.P. Morgan Healthcare Conference in San Francisco showcased important developments:

- Dealmaking is making a comeback: Headwinds for the pharmaceutical industry, such as empty pipelines and a looming patent cliff, result in a heightened need for portfolio diversification. Experts predict that late-stage and therefore lower risk assets will make up large parts of dealmaking in 2024.

- Antibody Drug Conjugates (ADCs) are center-stage: At the end of 2023 and in the early weeks of the new year, many players were strengthening their drug pipeline with the new “star” in the oncology space.

- AI grows in importance: Innovation is central to success in the pharmaceutical industry. For R&D departments, significant changes are on the horizon, with AI expected to become the key partner for boosting the industry’s drug discovery.

The Conference also demonstrated pharmaceutical firms’ willingness to expand their pipelines through inorganic growth. In fact, until February 10th 2024, we witnessed 35 confirmed partnership and licensing deals in 2024 worth at least up to USD 100 million each, adding up to USD 25 billion in total volume, and averaging a deal size of around USD 710 million.

For companies considering engaging in inorganic growth, high-quality due diligences (DDs) and high-quality sales forecasts for targets will be key to evaluating assets and defining the right deal terms.

1. Adapting to a new era: Forces fueling the need for growth

We see an increasing need for pharmaceutical companies to rethink and replenish their pipelines, with two interconnected drivers:

- First, the pharmaceutical industry is facing one of the steepest “patent cliffs” in history: By 2030, up to 200 drugs are expected to lose patent exclusivity. Among the drugs losing their patent are 69 blockbusters, including Ibrance, Trulicity, and Keytruda.

- Second, there is a noticeable decline in the in-house development of drugs by large pharmaceutical companies. Between 2015 and 2021, only 28 percent of drugs that received US Food and Drug Administration (FDA) approval were developed in-house by major pharma and biopharma companies. The other 72 percent were externally sourced via mergers and acquisitions (M&A), licensing agreements, or other forms of collaboration.

The combination of increasingly depleted pharmaceutical pipelines and the necessity for inorganic growth is no isolated case, rather the “new normal” across large parts of the industry. These developments underline the importance of replenishing pipelines with external assets.

Deep-dive: Licensing agreements in pharma

Out of the 35 deals completed in the first six weeks of 2024, 22 represent licensing agreements crucial for companies’ inorganic growth strategies. The heightened relevance of licensing agreements is not new. Our 2023 Global Data Healthcare study reveals that approximately 500 licensing deals, with an average maximum value of USD 375 million, were completed between 2020 and 2023.

Significant growth is evident across various therapeutic areas.

| Licensing deals worth > USD 1bn in 2024 (01-Jan - 10-Feb 2024) | ||||

|---|---|---|---|---|

| Date | Licensee | Licensor | Max. deal value (USD) | Deal objective |

| 02-Jan 2024 | Novartis | Voyager Therapeutics | 1.30bn | Discovery and development of neurogenetic medicines for Huntington’s disease (HD) and spinal muscular atrophy (SMA) |

| 02-Jan 2024 | Roche | MediLink Therapeutics | 1.02bn | Development of a next-generation antibody-drug conjugate (ADC) for solid tumors. The asset, YL211, is currently at the investigational new drug application stage and targets c-Mesenchymal epithelial transition factor (c-Met) against solid tumors |

| 03-Jan 2024 | Boehringer Ingelheim | Ribo Life Science | 2.00bn | Development of novel treatments for nonalcoholic or metabolic dysfunction-associated steatohepatitis (NASH / MASH) |

| 03-Jan 2024 | Roche | Remix Therapeutics | 1.04bn | Discovery and development of small molecule therapeutics modulating RNA processing using Remix’ drug discovery platform |

| 04-Jan 2024 | Roche | Moma Therapeutics | 2.07bn | Identification and development of novel drug targets involved in promoting cancer cell growth and survival by utilizing MOMA’s proprietary KnowledgeBase platform |

| 04-Jan 2024 | AbbVie | Umoja BioPharma | 1.44bn | Development of multiple in-situ CAR-T candidates using Umoja's proprietary VivoVec platform. The collaboration consists of two agreements (1) Exclusive option to license Umoja’s CD19 directed CAR-T candidates (2) Development of up to four additional in-situ generated CAR-T candidates |

| 07-Jan 2024 | Eli Lilly | Isomorphic Labs | 1.75bn | Discovery of small molecules against multiple targets, utilizing the AI models for drug discovery of Isomorphic Labs |

| 07-Jan 2024 | Novartis | Argo Biopharma | 4.17bn | Development and commercialization collaboration in form of two agreements: (1) Development and commercialization of a Phase 1 program and research collaboration as well as the option to add up to two additional targets (2) Development and commercialization of a Phase 1/2a clinical-stage program for cardiovascular disease treatment (ex-Greater China license) |

| 07-Jan 2024 | Novartis | Isomorphic Labs | 1.24bn | Discovery of small molecules against three targets (undisclosed), utilizing the AI models for drug discovery of Isomorphic Labs& |

Source: Simon-Kucher/Company filings/GlobalData Deals Database

2. Due diligence in a dynamic and uncertain market

The global economy continues to face challenges from macroeconomic risks. The pharmaceutical industry appears to face up strong against these uncertainties. As each deal fuels optimism for the next, many players from both the buy and sell-side are willing to join in. To succeed in dealmaking, especially in the current market environment and in light of today’s relatively empty pipelines and a high pressure to fill these, we see two key factors.

- Accurate forecasting. Acquisitions and in-licensing agreements require substantial investments. Therefore, accurate sales forecasts are critical to inform dealmakers’ decision-making. Exaggerated sales forecasts could result in overpaying for an asset. Conversely, underestimating sales could lead to passing over strong assets.

- Avoiding psychological biases and common pitfalls. This is becoming more important in light of mounting pressures on pharmaceutical companies to make acquisitions. Both studies as well as our own experiences show that dealmakers should…

- … engage in primary payer and prescriber research to inform and validate assumptions underpinning the business case.

- … seek out expert advice to stress-test assumptions and preconceived beliefs.

- … remain calm despite the increasing need and incentives to make deals.

3. How trustworthy are forecasts as a foundation for decision-making in M&A and licensing?

As the importance of conducting due diligence for organic growth increases, it prompts a critical question: How accurate are the sales forecasts that inform business decisions in pharma?

To answer this question, we conducted an analysis of prescription drugs approved by the FDA from 2015 to 2017 and their respective sales data up to 2023. This analysis compared actual and forecasted US sales for 50 drugs over the initial five-year period post-approval.

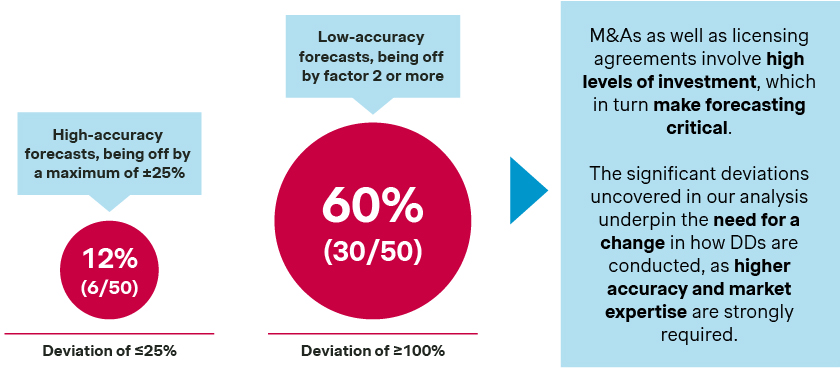

Our research revealed that merely six out of 50 drugs had sales forecasts aligning within a ±25% margin of their actual sales. Moreover, for a striking 60 percent of the drugs, the sales forecasts deviated by more than double compared to predictions. These results are even more surprising as we only assessed sales forecasts after the pivotal clinical trials were published – this means that there have been no “surprises” in trial outcomes and trial failures that could explain some of the forecasting differences.

The full report will be published in the coming weeks. In this report, you will learn more about the accuracy of forecasting in the pharmaceutical industry and the underlying reasons for why these forecasts frequently miss the mark.

Form placeholder. This will only show within the editor

How we can help

Getting the right forecasts for assets is hard.

It requires a robust understanding of the market landscape and the target asset in a short amount of time – ideally supported by robust primary research from both payers and prescribers. Nevertheless, accurate forecasts are critical given the large investment sums involved for M&A and in-licensing.

At Simon-Kucher, our legacy lies in P&MA and commercial excellence. This means that our consultants conduct primary payer and prescriber research daily, and we are familiar with the challenges and opportunities of assets across therapeutic areas. We use this specialist expertise for high-quality price and volume assessments to inform forecasts with more robust insights than generalist firms.

Our transactions teams have conducted more than100 pricing due diligences and over 50 commercial due diligences in the past three years alone. Interested in how we can help you identify new opportunities for inorganic growth? Contact us today!

Thanks to in-depth contributions by Santiago Wochner!

Trending Topic

Better Market Access

The role of better market access is to remove any hurdle that prevents or hinders patients from receiving available treatments. In the right place, and at the right time.

Today, the impact of market access spans clinical development, regional commercial activities, patient engagement, and post-launch compliance. Yet, for many pharmaceutical companies, planning for commercialization only truly begins when a drug has been submitted for approval — far too late in the process.

Get to know our insights on local trends, regional and global developments and global to local excellence.