In Simon-Kucher's Holiday Shopping Report 2024, we analyze data from 1,000 US consumers, highlighting the factors affecting their holiday shopping preferences and spending plans. Every year, these include their holiday budgets, what gifts they plan to buy, and for whom. It also includes external influences – like current events and the state of the economy.

And every four years in the United States, the holiday season overlaps with and follows what is typically a heated national event – the Presidential election. Why does this matter? How does the outcome of a major election change how consumers might spend during the holiday season? We explore the reasons and the potential impact of this consumer behavior.

See here for holiday shopping insights and complete methodology.

Half of US consumers say the election will affect holiday spending

When asked if the outcome of November’s US Presidential election would affect their holiday spending, nearly half (48%) of respondents said it would.

43% of consumers said they anticipated no impact and 9% were unsure.

Who anticipates financial impact following the election?

Americans of all ages, income levels, genders, and family statuses expressed some trepidation about the election’s impact on their finances.

That said, a clear majority of young consumers said the election will impact their holiday spending, compared to fewer older consumers.

- Gen Z: 63% say the election will impact their holiday spending

- Millennials: 55%

- Gen X: 46%

- Baby Boomers: 31%

Additionally, 51% of men said there will be impact compared to 46% of women who said the same, and 56% of Americans with a child or children anticipate impact compared to 45% of Americans without children.

Why do consumers anticipate financial impact from the election?

Consumers often anticipate financial implications following an election – particularly a major election – due to potential policy changes in areas that influence personal finances and economic stability, such as taxes, healthcare, and inflation.

The reasons survey respondents cited also appear to be economical.

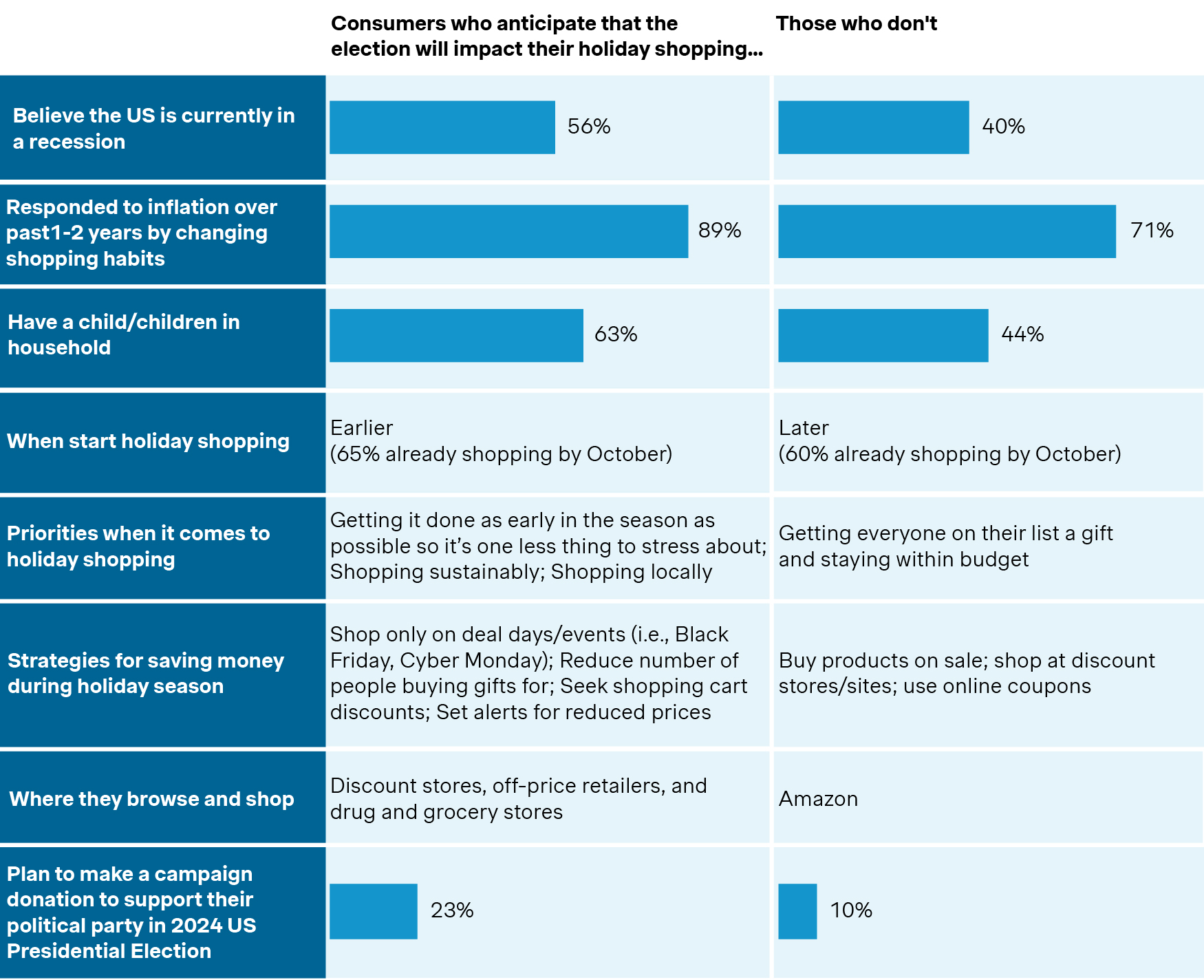

Greater inflation concern: Overall, 89% of Americans who anticipate election impact on holiday spending said they have changed their shopping habits in some way over the past 1-2 years due to inflation compared to 71% of Americans who don’t anticipate impact.

Greater recession concern: Those who anticipate election impact on holiday spending are more likely to say that the US is currently in a recession: 63% say it is vs. 40% of others.

Behavioral Trends Among Election-Wary Shoppers

Election-sensitive consumers plan their holiday budgets and shopping strategies carefully. They are:

- Nearly 3 times as likely to set a holiday spending budget

- Likely to shop early and seek out deals and discounts

- More inclined to shop at discount stores and prioritize spending on essentials

Those who anticipate election impact are also more than twice as likely to make a campaign donation to support their political party in November’s US Presidential Election, and 24% of them will use part of their holiday shopping budget to do so.

After the election

Cutting spending

Of course, we don’t know what the outcome of the election will be, but a portion of Americans are likely to associate the coming Presidential term with negative economic consequences. To mitigate potential future financial stressors, they may cut back on spending during a time of year when Americans typically open their pocketbooks a little extra – the holiday season.

Discretionary and essential spending are less stable among those anticipating election impact: 73% will modify discretionary spending compared to 51% who don’t anticipate any impact, and 69% will modify essential spending compared to 49% of others.

And by modifying, most are cutting spending; 42% of Americans who anticipate election impact on holiday spending will reduce discretionary spending in coming year, compared to 33% of other consumers who will do so.

Increasing spending

On the flip side, many American consumers may feel emboldened by the idea that a candidate’s political promises will be carried out to their benefit. They may not necessarily anticipate a windfall but will be more comfortable spending during the imminent holiday season.

For example, 31% of consumers who anticipate the election will affect their holiday spending expect to increase discretionary spending, including 15% who say they will substantially increase it, compared to just 18% of other consumers who will increase it, including 5% who will substantially increase it.

Considering the demographics of the segment of American consumers who do anticipate that the election will affect their holiday spending is more heavily weighted toward younger consumers, we also note that Gen Z and millennial shoppers anticipate a much higher year-over-year increase in holiday spending than Gen X and Baby Boomer consumers.

(Read more about Gen Z and millennial “doom spending” here.)

In conclusion

Americans’ deep emotional investment in this year’s Presidential election could significantly shape holiday spending. Nearly half of consumers expect the election outcome to affect their budgets, largely due to economic concerns like inflation and financial stability. Following Election Day, we may see a split in consumer moods—some optimistic and ready to spend, others more cautious, focusing on essentials and discounts. While the economy is top of mind for many, other key election issues may also weigh heavily on consumers, impacting their spending sentiment as the holidays approach.

For additional information, including strategic recommendations for retail industry executives and complete report data and methodology, please contact pr-inquiries@simon-kucher.com.