New monetization models are a chance for streaming providers to successfully deal with increasing customer price sensitivity and market saturation. What should these new pricing models look like? In part 2 of our blog series, our experts dive deeper into the findings of our 2022 Streaming Study and outline ways for streaming providers to meet customers’ purchase criteria.

Netflix, Prime Video, Disney+, AppleTV – in recent years, the variety of streaming providers has almost become overwhelming, causing increasing competition for viewers’ attention and their wallets.

Which criteria drive consumer choice when subscribing to a streaming service? To what extent do users tolerate price increases? And what does this mean for providers’ options to monetize their services? In part 2 of our blog series, we highlight consumers’ most important purchasing criteria and outline what different willingness to pay (WTP) means for streaming providers’ monetization potential.

Global Streaming Study: Purchase criteria and provider performance

Price is key! Our 2022 Global Streaming Study shows that subscription price is by far the most important purchase criterion, indicating an increasing level of price sensitivity. This is complemented by a high degree of price awareness and knowledge: Varying by streaming provider, between 24 and 51 percent of users expect streaming services to increase within the next year.

However, we must take a closer look to fully understand what is important to consumers. While subscription price is the number one factor, other criteria also play a role in consumer choice. In fact, we’ve identified three distinctive user segments with different preferences and needs.

- Price-sensitive users: For this type of user, subscription price is the most important purchase criterion, followed by regularly new content and the flexibility to cancel anytime. The least important purchase factors include: Recommendations on what to watch next, content that everyone is talking about, and ease of use.

- Price-value-oriented user: Here, subscription price is important but content-related purchase criteria are even more relevant. In addition, an ad-free experience has a positive effect on the subscription decision. Just like price-sensitive consumers, this type of user pays least attention to trending content and recommendations on what to watch next. Availability of discounted family plans also only play a minor role.

- Value-oriented users: This type of user doesn’t consider the subscription price as important. Instead, they focus on content-related purchase criteria, including: Frequency/breadth of new content, exclusive content, and its availability on multiple platforms. The least important purchase factors, apart from subscription price, are availability of discounted family plans and the flexibility to cancel anytime.

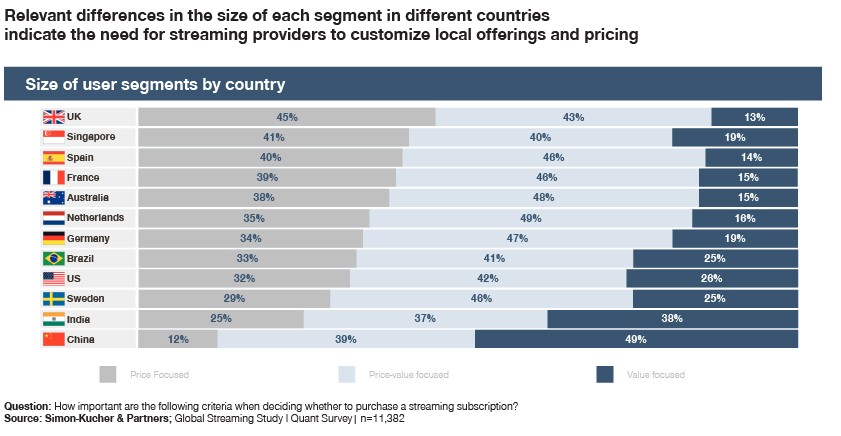

What does this mean for providers? The answer is customization. WTP of each segment can be addressed through customized offerings. This means, for example, that price sensitive customers could be offered a lower price in return for accepting advertisements, a strategy that both Netflix and Disney+ are currently pursuing. Due to significant differences in the size of each segment in different countries, customization also becomes relevant in terms of local offerings and pricing:

When comparing streaming providers’ performance on a global level Amazon stands out in terms of price. However, our study results underline that price shouldn’t be seen as the only criterion to focus on. Relative performance ratings by subscribers show that Disney+ stands out in terms exclusive content and being ad free. In line with the relative performance rating, however, subscribers feel that Amazon offers the best value for money.

Global Streaming Study: Monetization potential

So, what can streaming providers draw from these insights? To what extent is monetization up for grabs?

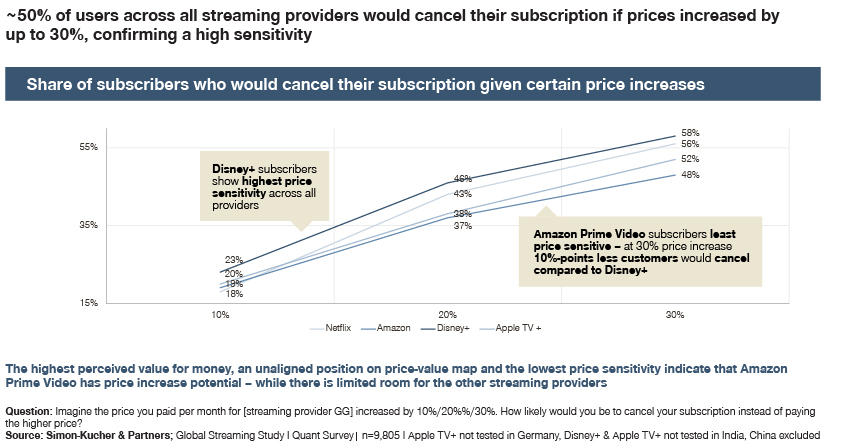

Our price value map shows that Apple TV+, Netflix, and Disney+ are close to the consistency corridor where price and value are aligned. This indicates limited room for higher prices. Amazon Prime Video, however, is still below the corridor, signaling some price increase potential.

This is also underlined by user’s risk of churn. 50 percent of users across all streaming providers would cancel their subscription if prices increased by up to 30 percent, confirming a high sensitivity. Amazon Prime Video subscribers, however, are least price sensitive: At a 30 percent price increase, 10 percent less customers would cancel compared to Disney+.

If we look at a global comparison, German subscribers have the highest WTP of all European countries for all streaming subscriptions.

Unsurprisingly, our study results indicate that the WTP for streaming subscriptions varies significantly by country. Overall, subscribers around the world are willing to pay for approximately 1.8 subscriptions at a time.

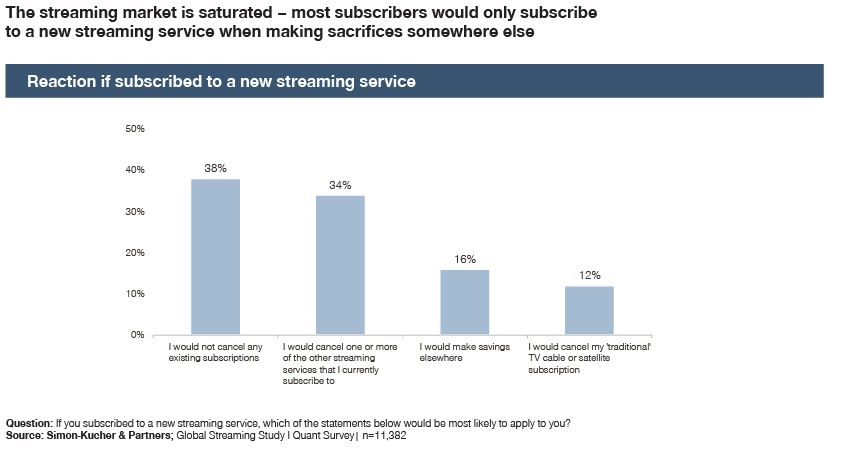

All in all, the streaming market appears saturated, with many subscribers feeling that the total amount paid for their subscriptions is too expensive. More than 60 percent of subscribers would only subscribe to a new streaming service when making sacrifices elsewhere.

Addressing price sensitivity and market saturation: Options for new models of streaming monetization

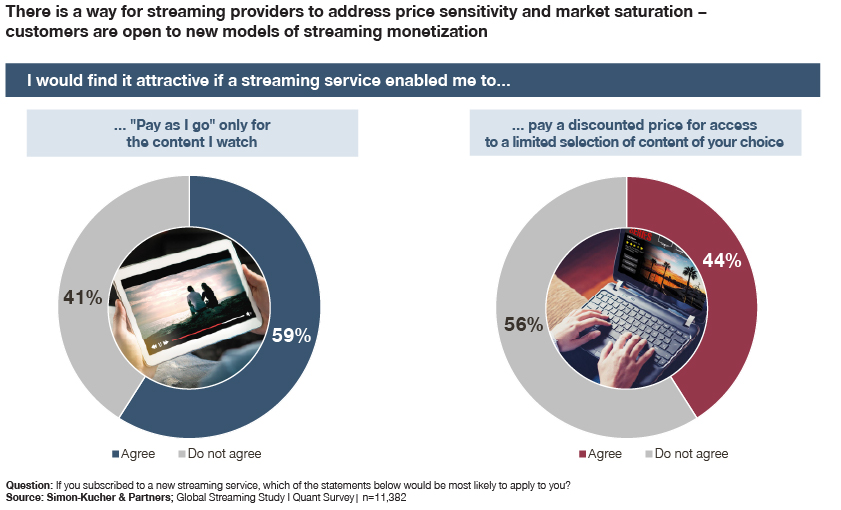

The good news is that there is a way for streaming providers to address price sensitivity and market saturation, as customers are open to new models of streaming monetization. In addition to hybrid models being a viable way to address price-sensitive subscribers, “pay as you go” and special discounts represent additional options for streaming providers to retain customers.

59 percent of subscribers indicate that they’d opt for a “pay as I go” option only for the content they watch. In addition, 56 percent would welcome access to a limited selection of content of their choice for a discounted price.

Rethinking monetization strategies: Usage-based systems or customization of regional streaming portfolios with the help of user segmentation can be a way to improve user experience and retention. New approaches like these are necessary to address price sensitivity and market saturation – and help unlock new monetization potential.

Want to know more about ways to improve your monetization potential? Reach out to our streaming service experts and find out how you can get your transformation started.

Embrace your existing customer base

Are you struggling with negative net retention? Are you using your up and cross selling opportunities systematically? It's time to embrace the potential of your customer base with MyBase, a data-based solution with a focus on customer engagement.