From setting the right price point to leveraging competitive pricing strategies, many businesses struggle to maximize profits and gain a competitive edge. This article explores the strategies and tactics essential for effectively pricing products or services.

Common pricing challenges

Our experience shows that companies often encounter several common pricing challenges:

- Pricing strategies and targets are not clearly defined and aligned.

- Pricing is more reactive than proactive.

- There is a lack of systematic price communication and competitive messaging.

- Pricing is more experience-based than data- and system-driven.

- The sales force requires more robust guidance on pricing.

Companies can significantly increase their profits by making their pricing more effective. Effective pricing starts with a clear understanding of the price strategy, followed by a structured price determination and discipline in implementation.

How should companies prepare for more profitable pricing?

Three things are essential:

- First, pricing targets must be crystal clear and manage the margin and volume trade-offs.

- Second, you must have price structures and rules to ensure your prices are correct.

- Finally, you must align your price organization to ensure a disciplined process.

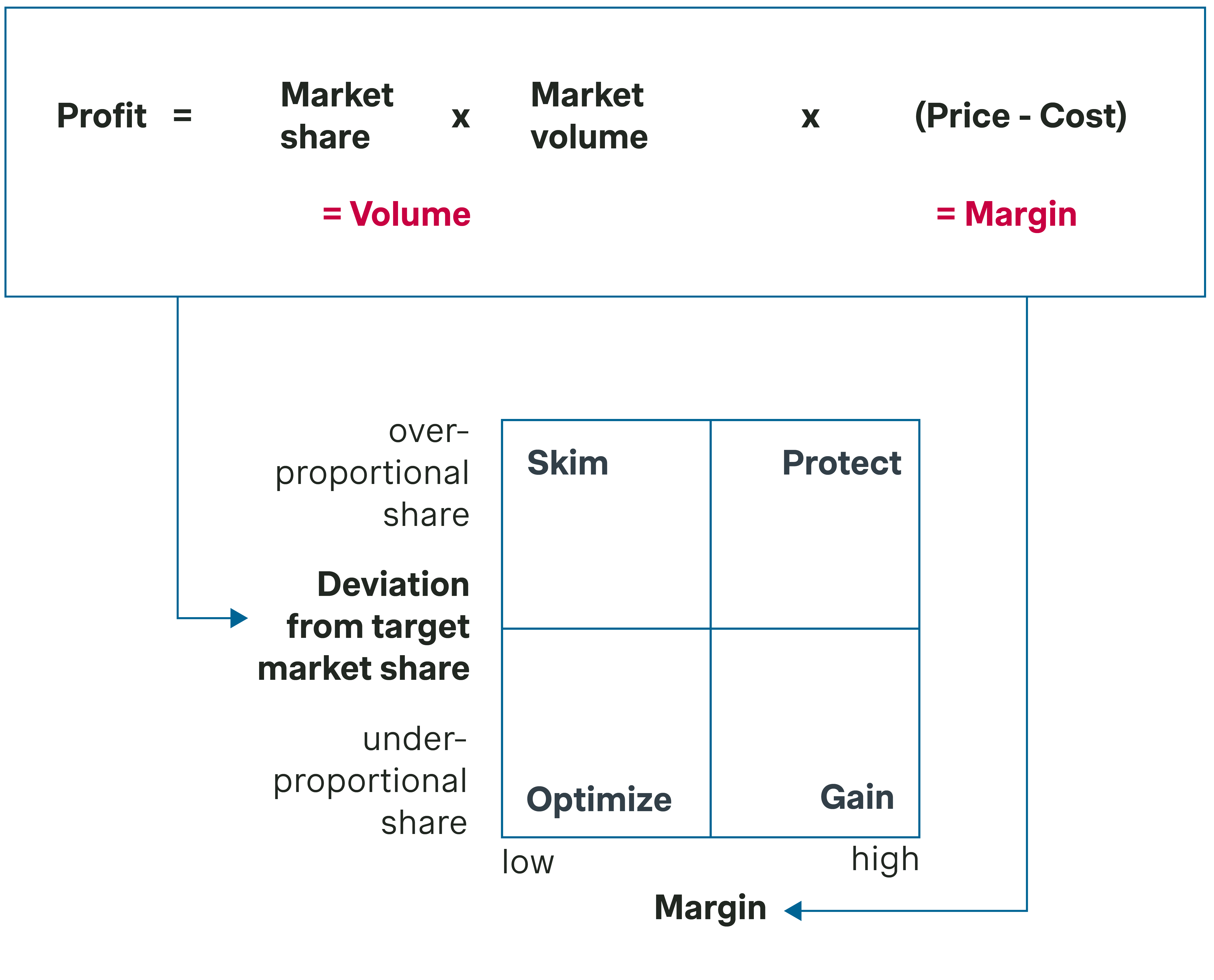

Looking at a basic profit equation, we see that profit is driven by volume and margin. The price strategy has to balance both.

How to define your target market share

Defining market share and volume targets is as important as determining the target price. Depending on whether your company is above or below your target market share and over- or underperforming in terms of margin expectations, the implications for the price strategy are entirely different. Therefore, the first key question is: What is the right target market share?

The definition of target market share is highly market- and company-specific. Target market shares are usually linked to historic market shares. They should not induce major shifts or restructuring in the market except for significant market disruptions like capacity expansions or price wars.

In principle, there are good and bad market shares. The good market shares are those which your company deserves due to performance. The bad ones are those you try to buy for too low a price. Companies should always go for the good shares.

What is the right target for prices?

Too frequently, price decisions are made with a short-term perspective only, focusing primarily on changes in costs. But how should prices develop in the medium and long term?

Companies often don't tap into their full profit potential. However, market leaders have a special responsibility to set and maintain price targets and steer profitability in their industry. They are the ones that need to step out from the crowd and move prices up.

Apart from defining clear volume and price targets, price communication is a key prerequisite for managing prices and the margin-volume trade-off. It is a necessary element of any pricing process and a continuous management task beyond the announcement of price increases.

Apply pricing structures

Are your prices optimized across customers? Do your prices fully capture the value delivered?

Our experience shows that customer prices usually lack systematic differentiation. Typically, customer relations evolve over time, and customer pricing usually mirrors that.

What level of price differentiation is meaningful? At what level does price discrimination start?

Imagine a scenario where a company manages a direct customer base of 150 customers. It does not systematically implement its pricing. Consequently, when a large customer acquires a smaller competitor, the acquirer is surprised to learn that both had similar prices. This creates some challenging price negotiations.

To prevent any further surprises, the company introduces a price differentiation logic that accounts for the customer's value orientation in terms of joint product development efforts, the process quality of customer relations, the technical service intensity, and the customer size. This pricing structure justifies pricing more systematically and convincingly.

Create a price logic and manage price structures

A price build-up helps create price logic and manage price structures. It starts with a base price for a lead or reference product. If there is no such price, product costs might serve as an alternative starting point.

You can then build up prices based on product value and regional market differentials. The result is a product (gross) list price or market price, which is differentiated based on customer value in the next step.

Customer-specific markdowns have to be strictly performance-based and follow a clearly defined logic. This logic can be based on customer size, customer behavior, or product mix considerations.

The price build-up might also include service differentials. These are the charges for the “extras” like small volume deliveries, last-minute order changes, deliveries outside working hours, or high-speed deliveries.

Typically, companies leave a lot of money on the table here because nobody in the organization follows up on these resource killers or has complete visibility into costs.

Having included all these drivers of product and customer prices, the price build-up provides structured price guidance. You can then match the structure with reality, identifying, measuring, and managing price gaps. Pricing is then in steering mode.

Install a disciplined process to achieve your targets

Effective pricing processes require measures and controls. Introducing pricing measures, metrics, and a reporting framework will allow for an in-depth analysis of prices and price changes throughout your organization. Signs that you have a disciplined process include:

- All relevant stakeholders receive price management reports regularly.

- Pricing managers use price monitoring tools to watch differentiated price effects. They can drill down to single product-customer combinations to derive immediate actions.

- Marketing receives detailed reports for new product launches.

- Sales reps can track their price target achievements.

- Sales succeed in their price negotiation efforts.

- You can achieve price increases without incurring any significant volume losses.

The roles and responsibilities in pricing

Pricing is a delicate balancing act. Management has to raise prices to deliver value to shareholders while still selling volume to fill capacities. Sales has to manage customer relations and may have to accept losing some customers when increasing prices. Marketing has to enforce value-based pricing and cope with competitors who use price as a weapon to enter the market or increase their share.

That's why pricing is finding its way into organizational structures. Many companies have dedicated pricing functions to support informed price decision-making. Some install “Pricing Officers” or “Pricing Marshals” to manage broad price information systems and facilitate the pricing process. These “Pricing Officers” are not pricing managers. They are not price decision-makers but support price decision-making. Their responsibility is to ensure that the pricing process keeps on running.

The integration of pricing into organizational structures reflects a recognition of its critical role in driving profitability and sustainable growth. Pricing is no longer viewed as merely a tactical function but as a strategic imperative. It directly impacts revenue, profit margins, market positioning, and competitiveness. Therefore, organizations increasingly realize the need to elevate pricing to a strategic level within their structures.

Effective pricing strategies require collaboration across various departments. Moreover, companies increasingly use data analytics and market intelligence to inform their pricing decisions.

Finally, embedding pricing into organizational structures fosters a culture of pricing excellence across the company. This includes providing training and development opportunities for employees at all levels to enhance their pricing acumen and establishing clear accountability and incentives for achieving pricing objectives.

Unlock your company's full profit potential with Simon-Kucher. Our expert services and strategic insights are designed to optimize your pricing strategies and drive maximum profitability. Ready to transform your pricing approach? Reach out to us, and we will put you in touch with one of our experts.