The consumer landscape is polarizing, with shoppers gravitating toward both cheaper and more premium alternatives. This shift is reshaping market shares for brand manufacturers. Value-for-money products and premium brands gain traction while your core brands suffer. To stay competitive, you need to harness consumer pricing and other revenue growth management (RGM) levers.

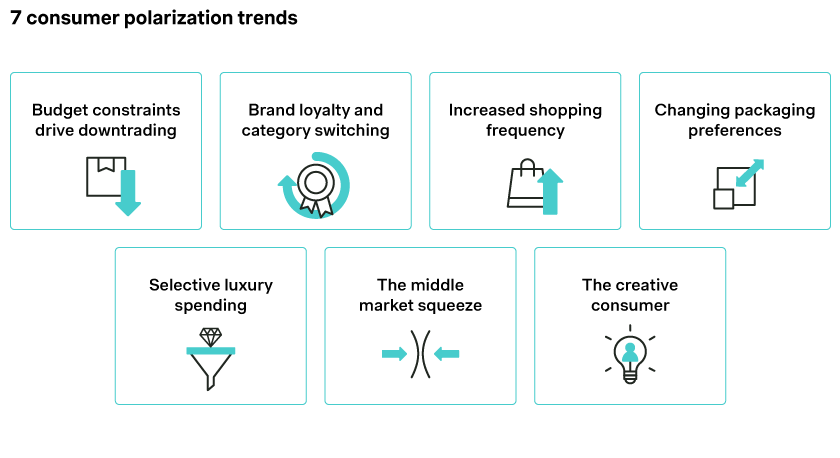

Seven consumer polarization trends

1. Budget constraints drive downtrading

When purchasing power is under pressure, consumers tend to opt for cheaper alternatives (downtrading). Recent inflationary measures amplify the expanding price gap between established A-brands and private label alternatives. To stretch their funds, many shoppers who previously bought well-known brands are now opting for store brands.

2. Brand loyalty and category switching

Interestingly, not all consumers are willing to switch to private labels. Some prefer to stay with national brands but move to a different category entirely. For example, some now choose Prosecco over private label champagne, maintaining their preference for recognized brands. Those finding Coca-Cola too expensive might switch to flavored water rather than a private label soda.

3. Increased shopping frequency

Instead of making large shopping trips every two weeks, many consumers now shop more frequently. Through smaller shopping trips, they feel more in control of their spending, even if the overall expenditure remains the same.

4. Changing packaging preferences

Consumers are also changing how they purchase goods based on packaging sizes. Some opt for larger bulk sizes to save money, while others prefer smaller packages to better control their budgets. This shift leads to a decline in demand for standard-sized packages.

5. Selective luxury spending

Consumers are becoming more selective with their luxury spending. They might still buy high-end fragrances like Chanel or Dior but use them sparingly for special occasions. For everyday use, they switch to more affordable brands. This behavior reflects a desire to maintain a sense of luxury without breaking the bank.

6. The middle market squeeze

"Lidl in the morning, Armani in the evening." Shoppers might buy budget essentials to save money, but then splurge on a designer suit. We observe a trend toward polarization in spending, with consumers saving on everyday items but still buying luxury products. This particularly impacts the mid-range market, as consumers either go for budget or high-end options.

7. The creative consumer

Consumers find creative ways to save money. For example, switching to frozen vegetables rather than buying an entire ready meal. Similarly, there is an increasing acceptance of pre-owned products, especially in the luxury segment, where shoppers maintain their lifestyle through strategic trade-offs. They're happy to buy pre-owned watches or bags to continue enjoying luxury, often selling their own items on sites like Vinted to fund new purchases.

How can brand manufacturers respond to polarization?

Polarization leads to significant shifts in sales volumes across different product segments. As consumers gravitate toward cheaper alternatives and premium products, you risk losing market share to competitors who better meet these new demands. Adapting your strategies is crucial to protect share from both ends of the pricing spectrum.

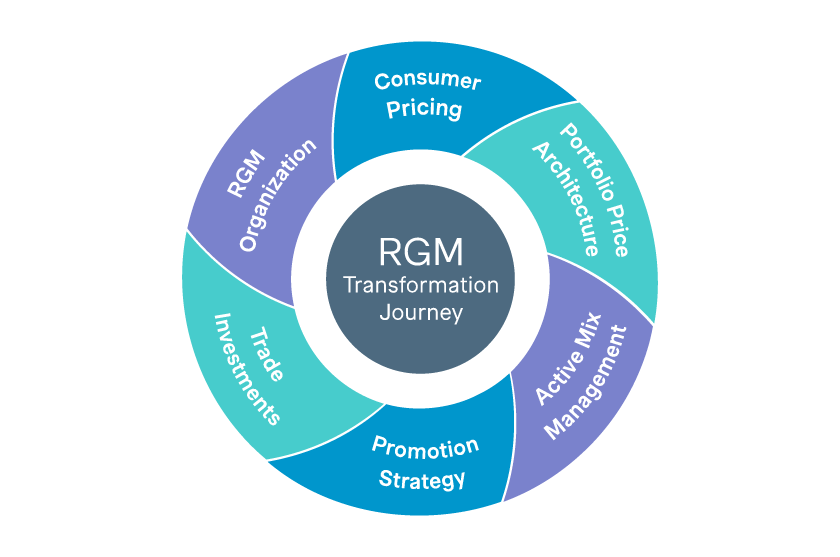

How can you mitigate potential losses in one segment with gains in another, sustaining overall profitability? Our approach to RGM ensures you meet diverse consumer needs while maintaining profitability and market relevance.

Consumer pricing

Understand your price elasticity

To manage revenue growth effectively, you need deep insights into consumer behavior. Polarization compels you to broaden your research scope.

Traditional price elasticity surveys focused on comparing products with main competitors within the category. Today, you must include private labels and national brands across adjacent categories as well. These insights inform your RGM strategies, allowing you to price strategically and defend your revenue growth.

• Knowing the price gap you can afford versus competitors will help position your products more strategically.

• Understanding the volume transfer between your category and cheaper alternatives allows you to anticipate and respond to behavioral shifts.

Find the magical price points

Identifying and leveraging key price points that resonate with consumers is a crucial aspect of RGM. "Magical" price points are those that consumers perceive as offering significant value, prompting higher sales and improved profitability. These prices trigger a positive consumer response, leading to increased purchase likelihood.

However, be wary of shrinkflation. Reducing product size while maintaining the same price can lead to negative consumer perceptions and erode brand trust. If you must reduce product size, be transparent and communicate the reasons to consumers, e.g., sustainability efforts or maintaining affordability.

• Conduct consumer surveys and focus groups to gather insights on pricing perceptions and acceptable price ranges for different products.

• Analyze historical sales data to identify price points where sales volume peaks. This can reveal effective price thresholds.

• Develop new product formats or variants specifically designed to meet magical price points. This could include smaller sizes, different packaging, or alternative ingredients.

• Create bundled offerings that provide perceived added value without significantly increasing production costs.

Portfolio price architecture

Make bold moves with product lines

In today’s polarized consumer market, shelf space is a precious commodity. You must be willing to make bold decisions about your product lines to remain competitive and responsive to consumer demands. Strategic pruning – retiring underperforming or outdated products – can free up resources to focus on high-demand segments.

Retailers prioritize products that move quickly and meet consumer needs. Low-performing products not only take up valuable space but also dilute the impact of your more successful offerings. As consumer preferences shift, maintaining a broad product portfolio of mid-tier products may no longer be viable.

• Focus on products with consistently low sales and profitability. These are prime candidates for retirement.

• Identify any products that overlap significantly with others in your portfolio. Consolidating these can reduce complexity and focus your offerings.

• Assess the risk that retiring certain products might push consumers to competitors rather than other products in your portfolio.

• Ensure that pruning decisions do not negatively impact your brand’s overall perception. Maintain a balance between innovation and heritage.

Promotions

Rethink your promotion strategy

Let's not forget that retailers are now running more promotions on private labels. This reinforces their entry price point offerings and encourages consumers to switch. You must not only compete with these promotions but also find unique ways to highlight the value and quality of your products.

• Emphasize the superior quality, unique features, and benefits of your products compared to private labels. Use marketing campaigns to communicate these differentiators clearly.

• Develop innovative promotions that private labels may not offer. For example, personalized deals based on purchase history, or gamified promotions that engage consumers and encourage repeat visits.

Mix management

Develop entry products with care

Creating an entry-level product could be a strategic move to significantly impact profitability and market positioning but requires careful consideration. One of the biggest risks with introducing an entry-level product is cannibalizing sales of higher-margin products. It’s crucial to fence these products well within your portfolio. If the entry product’s quality is too high, it may divert sales from your core offerings.

And if you introduce an entry product, you’d better simultaneously develop a premium option to maintain a healthy mix. You must ensure a clear distinction in quality, packaging, or benefits to encourage consumers to trade up for better products. This will help stretch demand across different consumer segments and avoid undercutting your core business.

• Deliberately reduce certain features or use lower-cost materials to create a distinct gap between the entry-level product and higher-end versions.

• Use simpler, more cost-effective packaging to reinforce the product’s positioning and manage production costs.

• Ensure the entry-level product aligns with your brand’s overall identity but clearly communicates its value-oriented proposition.

• Market to a distinct consumer segment different from those targeted by premium products.

• Highlight the trade-offs consumers make by choosing the entry-level product.

• Create pathways for consumers to trade up from the entry-level to higher-margin products as their purchasing power increases.

Innovate with new formats and experiences

Product innovation formats can help you reach consumers who aspire to your brand but are constrained by budget. Here it's important to maintain your premium image and ensure the perceived value remains high.

Let's imagine a perfume brand that introduces a refillable bottle. The manufacturer reduces packaging costs and is able to offer a slightly lower price point for consumers. This product also appeals to environmentally conscious consumers by reducing waste. Consumers are more likely to stick with the brand as they know their initial investment pays off over the long term.

Another option is a pocket-sized product. The miniature size is convenient for on-the-go use, appealing to busy consumers. It offers a more accessible price point, allowing consumers to indulge in luxury without a significant financial commitment. Its size is also perfect for consumers wanting to try the product before committing to a full-size purchase, or for those needing a travel-friendly option, tapping into a new consumer occasion.

• Conduct thorough research to understand consumer needs and preferences. Identify gaps in the market where new formats could thrive.

• Launch new formats as pilot programs to gauge consumer reaction and gather feedback.

• Adjust and scale. Based on performance, refine the product offering and scale successful innovations across markets.

Lead the market, or get left behind

Responding to consumer polarization isn’t just about keeping up – it’s about leading the way. Polarization pushes you to develop new products, formats, and pricing strategies, positioning your brand as a market leader rather than a follower. This proactive approach is most likely to meet current demands.

Looking to anticipate consumer choices, respond effectively, and seize opportunities in the polarized market? Our revenue growth management expertise ensures you stay ahead of the curve.