Discover how high-impact sales enablement tools can revolutionize customer satisfaction, increase sales, and drive business growth in the telecommunications industry. The final installment of our 3-part blog series offers insights from our industry experts on leveraging digital-age sales optimization and expanding fiber optics for telco growth in 2024.

Sales- and service channels typically provide two essential benefits to telcos:

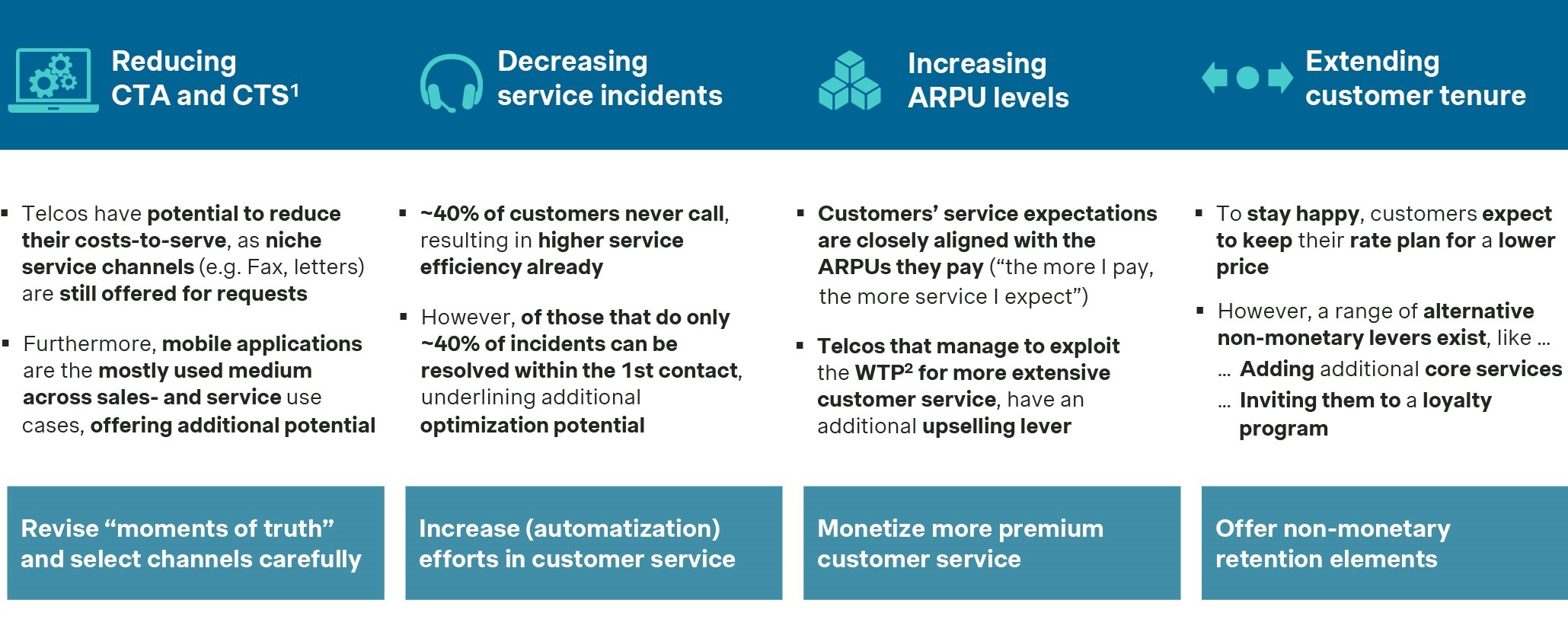

Cost reduction potential: Increasing automatization drives higher efficiency, which helps to reduce costs-to-serve, costs-to-acquire, and the number of service incidents.

Customer value growth potential: These channels, being the most direct link to customers, can improve value perception through value-selling and driving higher customer tenure, if managed the right way

Our 2024 Global Telecommunications Study reveals two sales and service value drivers: effective sales optimization in the new digital age and strategic expansion of FTTH (fibre to the home) infrastructure.

These optimization levers also address important questions for telco leaders: How can we maintain exceptional customer service while optimizing sales channels? What should our sales organization look like to thrive in the future? How can we ensure optimal fiber deployment, supported by our sales- and service channels?

In this final chapter of our 3-part series, we provide insights on how telco providers can utilize sales and service value levers to reduce costs and amplify CLTV.

Why the right sales and service value levers matter

While telcos typically need to maintain a broad range of service channels, this offers potential to reduce costs-to-serve by phasing out “niche” service channels (e.g. fax at 4 percent, letters at 6 percent) that are now only used by a small number of customers.

According to our study results, 86 percent of customers are at least partially covered by mobile applications. Acquisition-related use cases typically involve up to five channels, whereas service-related requests may require up to 11 channels, underlining the potential to phase-out selected channels gradually.

Interestingly, around 40 percent of customers never contact customer service, which contributes to higher service efficiency for telcos. Yet, among those that do, only 40 percent of service incidents can be resolved within the first contact indicating that telcos still have extensive optimization potential to reach exceptional levels of customer service.

Sales optimization in an increasingly digital world

Despite the fast-paced digital shift, not everyone has been quick to fully embrace this transition.

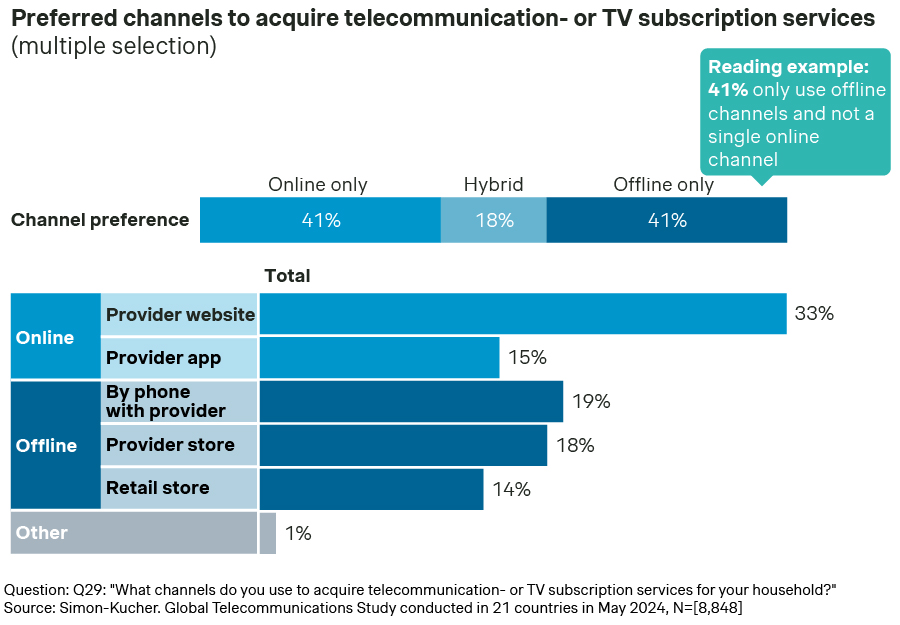

Online services are important, but our study results highlight that they represent just one of several viable approaches for future growth. Approximately 60 percent of telco customers still prefer hybrid or offline experiences. Interestingly, 41 percent of respondents exclusively use online sales channels, while another 41 percent prefer entirely offline channels. Meanwhile, 18 percent opt for a mix of online and offline experiences. This underlines the importance of maintaining a strong presence across physical, online, and hybrid touchpoints to ensure an integrated experience in the new digital reality.

At 33 percent, telco provider websites are the primary channels for customers to purchase new services, followed by phone calls (19 percent) and store visits (18 percent).

When observing the customer journey through a digital lens, we find that most customers compare offers online, particularly on provider (43 percent) and price comparison websites (33 percent).

However, survey findings also show that most customers have limited access to their customer portal which pushes them to compare deals targeted at new clients instead of customized retention offers. Given that apps are the most widely used medium for sales and service (86 percent of touchpoints in the customer journey), leveraging app usage is especially critical. By improving app functionality and accessibility to better engage and retain existing customers, telcos can boost growth.

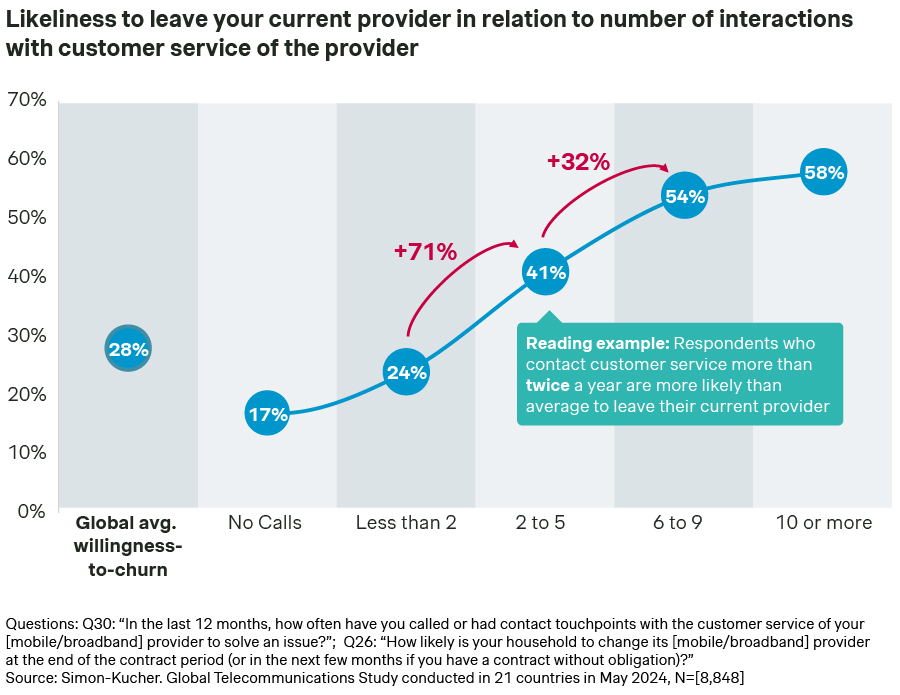

Additionally, our research highlights an important consideration – increased contact frequency correlates with higher churn risk. If a customer engages with customer service more than twice in a year, the churn risk increases by more than 70 percent - and by an additional one-third after the sixth contact.

By identifying key touchpoints in the customer journey and implementing targeted loyalty and retention initiatives (especially after more than two service touchpoints), telcos can enhance satisfaction more effectively.

FTTH expansion in saturated markets

The demand for high-speed internet is growing, and fiber broadband offers a solution by delivering fast, reliable connections directly to customers’ doorsteps.

With 70 percent of urban areas already connected to fiber technology and rural areas showing similar interest, the global FTTH market is projected to grow by over 15 percent through 2030.

But while FTTH network expansion is important for sustainable future revenues, telcos face a range of obstacles because of the volatile macroeconomic environment. In recent years, fiber deployment has become challenging due to increased costs and plateauing take-up rates posing higher investment risks. Moreover, telcos with ambitions of fiber-fueled growth now must contend with the risk of overbuild and ARPU dilution. Our analysis finds that this risk is particularly higher in urban and dense areas, especially across Europe. Many providers are, therefore, reconsidering the expensive FTTH roll-out plans.

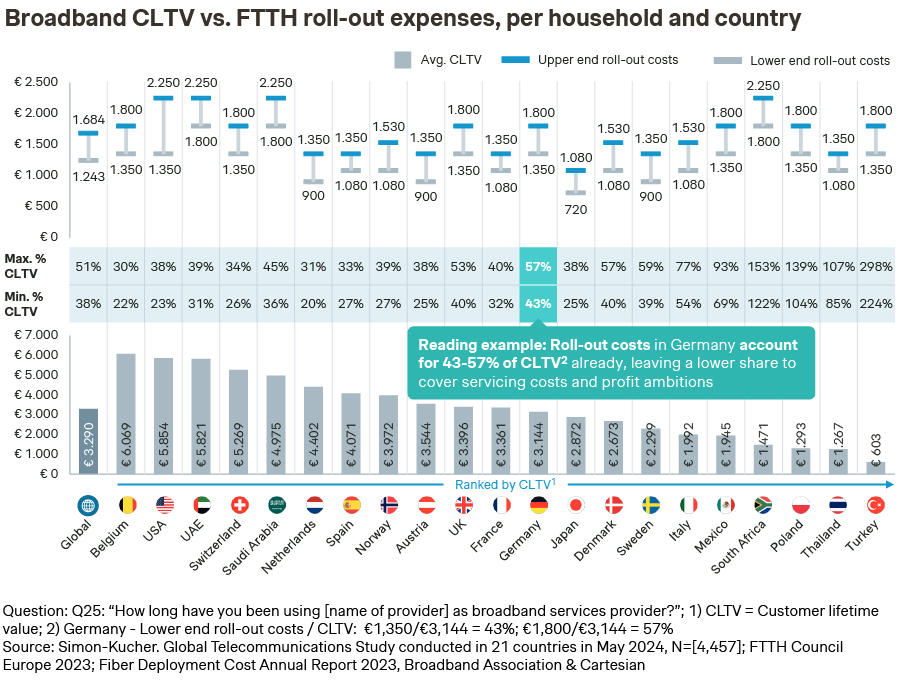

In 2024, fiber deployment costs amount to 40-50 percent of a broadband customer’s average lifetime value, highlighting the importance of driving value selling fiber services. According to our study, identifying the right regions with low deployment costs and high ARPU levels is key to ensuring a cost-effective FTTH roll-out.

In Belgium, FTTH roll-out costs range between 22-30 percent of CLTV, showing promising margins and growth potential for fiber. On the other hand, deployment costs in Germany account for 43-57 percent of CLTV, leaving a lower share for servicing costs and profit ambitions.

According to our study, around one-third of customers don’t have an FTTH connection yet but can be motivated to switch by emphasizing access to higher speeds, higher reliability, and low latency as benefits.

To successfully – and sustainably – leverage FTTH expansion growth, telcos and infrastructure players must develop a strategic fiber approach that optimizes both the roll-out process and the service portfolio to ensure they cover the most attractive areas with the right offers

Simon-Kucher fiber growth framework

In 2024, success in the telco industry extends beyond merely deploying FTTH in every home. With our expertise on fiber initiatives, we can help telcos strategize and secure FTTH growth in the face of economic challenges and increased competition. Our industry experts can identify and evaluate the commercial feasibility of your FTTH expansion strategy and customize pricing for different customer segments to create a compelling value proposition.

Download our free fiber growth framework here.

Read our Global Telecommunications Study 2024 here.

Get in touch today for a more in-depth discussion about our 2024 Global Telecommunications Study.