As the specter of tariff-driven cost increases arrives on the back of unprecedented inflation, US based companies must address two parallel challenges.

The first challenge is to understand how to integrate tariff costs into pricing strategy. How much of the new cost should be absorbed vs. passed through the value chain, and how will this drive the delicate balance between volume and margins? In a fatigued ecosystem of consumers, competitors, and retailers, identifying a strategy without painful trade-offs will be difficult.

The second challenge is to prepare complex organizations to be nimble. As the global trade environment evolves, it will likely be the case that the tariff landscape fluxes: tariffs may be threatened, announced, altered, withdrawn, introduced again, etc. Companies that emerge as winners will be ones that are able to think with collective clarity and act with collective purpose, quickly.

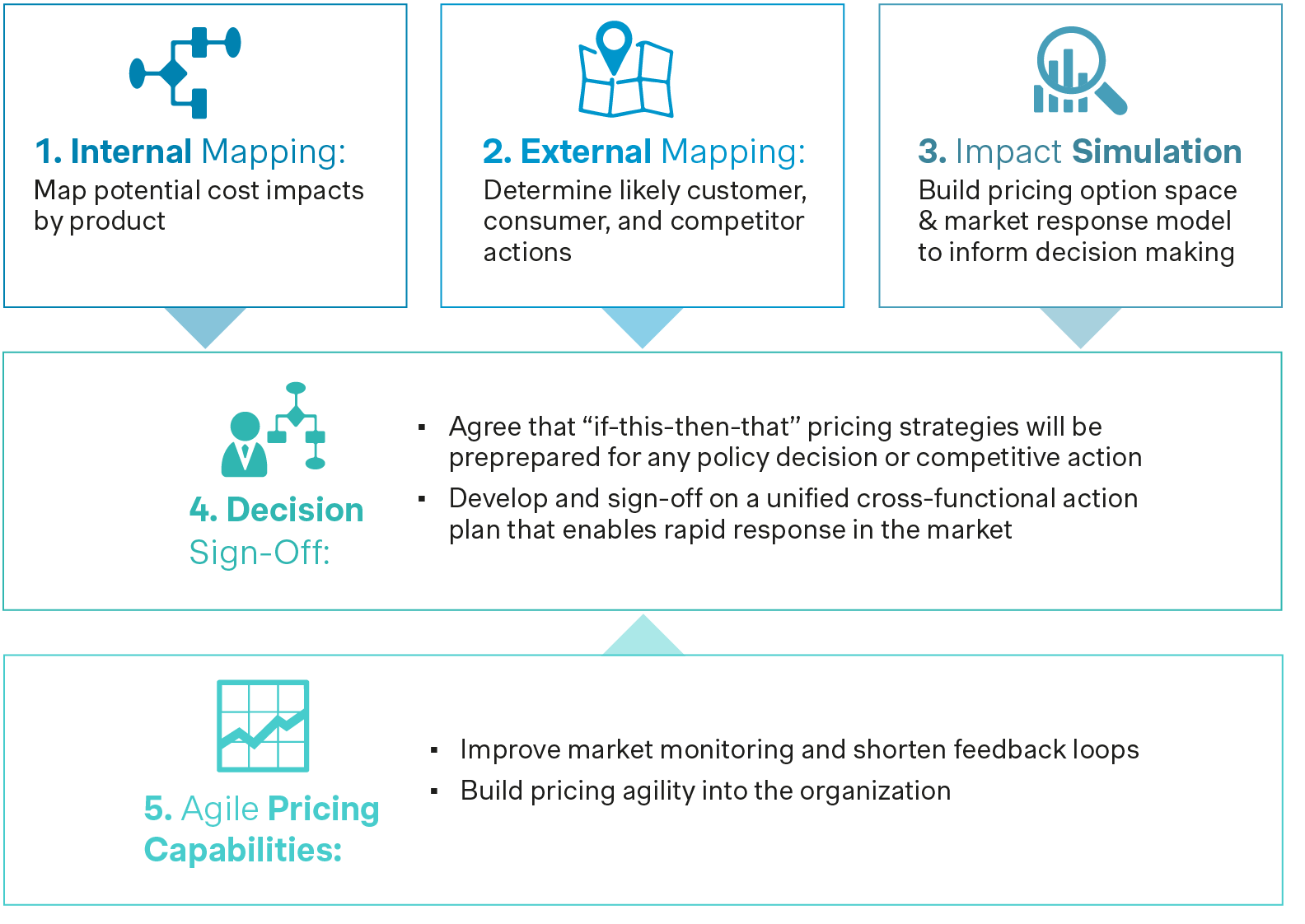

Companies must think beyond reactive measures. Setting or readjusting pricing strategies under this uncertain policy environment will require a balance of flexibility, foresight, and cross-functional alignment (internally across teams and externally across the value chain). By planning ahead and aligning pricing with evolving market dynamics, businesses can navigate these changes while minimizing the impact on both their bottom line and customer relationships. Here’s how:

Internal mapping: Map potential cost impacts by product

Conduct a comprehensive cost (and margin) analysis across the entire assortment. It’s important to understand the potential impact of the new tariffs on both the relative and absolute margin of each product, to identify sources of volume by product vs. channel vs. region, and to have clear alignment on the role of each product in the line-up (which attract new consumers, which drive re-purchases, and which are up-sellers).

External mapping: Determine likely customer, consumer, and competitor actions

Build increased market intelligence around likely customer, competitor, and consumer responses to tariff driven price increases. Communicate early with counterparts at retailers (and distributors) to gather valuable insights about their willingness and ability to accept price action on products impacted by tariffs and begin building the foundation for joint collaboration to address tariffs if they do emerge. Evaluate competitors’ current position and recent price strategy history to forecast how players across the competitive set are likely to respond to potential tariffs. Draw on market research and consumer insights to understand consumer attitudes towards further price increases and estimate their likely elasticity and switching behavior under various tariff conditions.

Impact quantification: Build pricing option space and market response model to inform decision making

This step is about quantifying likely reaction to potential pricing scenarios. Pulling together insights from the first two steps will allow you to run “wargaming” type exercises to play-through different pricing scenarios considering expected customer, consumer, and competitor responses. This exercise is best performed cross-functionally and especially with market facing teams to draw on insights from across the business. Underpinned by a powerful market response model, this step will arm the organization with an econometric understanding of volume, revenue, and profit implications under different scenarios.

The financial lens is just one element of decision making. Beyond this, leaders will need to assess their cashflow and overall financial situation as well as challenges to adjust their production or supply chain capabilities in the short- to mid-term. Other factors to consider:

Strategic prioritization: Is the objective to solve for volume, revenue, or profit dollars? Do we want to capitalize on our competitors rising costs and play for share, or is the imperative to protect shareholder profits?

Competition: What strategy are competitors most likely to pursue? Are they in the same tariff boat as us or are their finished goods or raw materials imported from different countries? Are key competitors likely to absorb costs and try to steal share (and can they afford to do this) or will they be forced to pass costs through?

Duration: Absorbing tariffs to gain market share can be unsustainable if the tariff policies remain in place over a longer period of time.

Brand and consumer loyalty: Companies must think about the right overarching brand strategy and communication and be thoughtful about marketing campaigns that support the underlying price strategy and intended changes.

Customer relationships: Evaluate how various tariff pricing strategies will impact customer relationships, especially if our intention is to ask our partners to absorb further cost increases.

Decision sign-off: Agree that “if-this-then-that” pricing strategies be prepared for any policy decision or competitive action, and develop a unified cross-functional action plan that enables rapid response in the market

Armed with the above information, organizations should pre-emptively take decisions about how they will respond to the most likely scenarios. This decision making must be cross functional and signed-off across all relevant leaders. In doing so organizations will know how to reach ahead of time in a preprogrammed response: “if X happens, we will do Y”. Pre-alignment is key to agility: speed to market is limited if lengthy decision processes must be reopened later.

Once the shortlist of possible responses is outlined, cross-functional action plans should be drafted: the goal is that each team knows what steps to take and is prepared to execute quickly and confidently.

Combined, these preparations allow an organization to respond quickly and clearly to any change in cost structure: the entire organization is ready to act and there is no need to wait for a lengthy decision-making process or cross-functional alignments.Agile Pricing Capabilities: Improve market monitoring and shorten feedback loops to build pricing agility into the organization

To stay competitive in dynamic market environments, leaders continuously optimize end-to-end commercial capabilities.

One element of commercial agility is to develop a proactive product mix management capability. Building on the work above, decision-tree frameworks can be integrated into the pricing process to elevate pricing strategy on an ongoing basis.

Enhanced market monitoring and clear pricing governance can help to shorten feedback loops and reduce the time between a change in consumer behavior / competitor action and the appropriate response. Trigger points and guardrails can be defined to monitor key market metrics (like share or velocity) that once activated an automatic pricing review. Eliminating lag between a change in the market and your competitive response can yield huge financial and strategic gains.

What else can consumer companies do to not fall behind?

Refining Value-based Pricing: Companies using a cost-plus pricing approach to achieve a target margin are at the mercy of changing tariffs and international trade. In contrast, companies with deep insights into consumer’s willingness-to-pay have more levers to pull to smooth cost increases across the portfolio to achieve better volume/margin outcomes.

Revenue Management Process Upgrades: Streamline and optimize revenue management processes to ensure efficient use of resources and data-driven decision-making. By focusing on strategic planning and analysis, businesses can identify new revenue streams and improve profitability. Remaining agile and reacting quickly to changing market conditions and evolving trade policies is crucial.

Sales Organization and Marketing Spend: Ensure that there is clear cross-functional engagement and awareness of mix objectives per customer in place to drive targets across all accounts through your sales organization. To enable them, companies need to tactically align their marketing spend both above-the-line as well as below-the-line with their new pricing strategy. Remaining agile and quickly adjusting to competitive reactions or regulatory changes is crucial.

Discount and Promotion Management: Review promo spend in the short- and medium-term and craft targeted discount and promotion campaigns for the right products that appeal to specific customer segments. Strategic promotions can boost sales during off-season periods and increase customer retention.

Portfolio Strategy: Identify consumer needs and requirements for product and pack adjustments to hit key price points. This approach ensures that offerings are relevant and compelling to each segment, enhancing overall satisfaction.

Cross- and Up-Selling Strategies: Leverage opportunities to offer complementary products and services that complement the shopping experience. Effective cross-selling and up-selling can increase the average order value and improve customer satisfaction.

Customer Loyalty Scheme Strategies: Develop and refine loyalty programs that reward repeat customers, enhance engagement, and foster brand loyalty. Tailored schemes can cater to diverse customer profiles, ensuring a personalized approach that resonates with different segments.

As the US faces potential tariffs, consumer businesses must proactively prepare to safeguard profitability and remain competitive. Creating an adaptive pricing strategy will be key to managing the complexities of increased costs, shifting consumer behavior, and competitive pressures.

Don’t wait until tariffs disrupt your operations—reach out to our team of pricing experts today. We’ll help you develop a tailored, forward-thinking approach to protect your margins, optimize your pricing, and maintain customer trust.