More fast public charging options are crucial as e-mobility grows – but is the EV charging infrastructure ready to keep up? Our Global EV Charging Consumer Study uncovers how consumer preferences around charging access, speed, and pricing are changing and could shape the future of the EV market.

The global electric vehicles (EV) market is projected to grow at an annual rate of 6-7 percent between 2024 to 2029. As vehicle sales increase, charge point operators also face the challenge of ensuring that EV charging infrastructure can meet the rising demand.

Simon-Kucher’s Global EV Charging Consumer Study highlights notable changes in consumer behavior, needs, and expectations as we transition to the next generation of EV ownership. We surveyed over 2,000 current and future EV owners in the US and across Europe, on topics such as charging station availability, optimal pricing models, and loyalty programs. The study insights help identify levers that EV industry stakeholders can use to prepare for long-term growth and profitability in the electric vehicle charging market.

Public charging is expected to increase

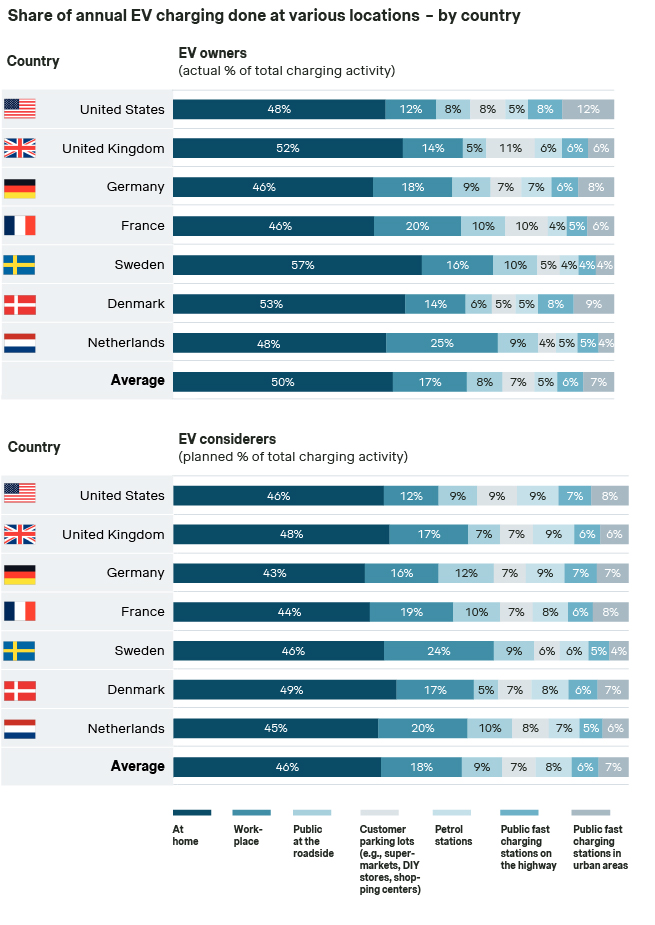

At present, EV owners use home charging to meet 50 percent of their needs. But with the growth in EV ownership, public charging is predicted to rise. Is the EV charging infrastructure ready to handle a surge in demand?

According to our survey, the next generation of EV drivers is expected to rely more on workplace and public charging stations. Therefore, it is imperative that charge point operators (CPOs) and mobility service providers (MSPs) prepare for public charging infrastructure development to accommodate this expected increase in usage.

When it comes to charging their vehicles, current owners use high power charging (HPC) for 20 percent of their needs. Although this highly advanced, fast charging technology can charge cars to 80 percent SoC in less than 30 minutes, it is costly. This may explain why potential owners anticipate using HPC for only 16 percent of their total charging activity.

How consumers search for and locate the nearest available EV chargers is changing. Charging apps from MSPs are the top choice, with vehicle navigation systems and Google and Apple Maps following closely behind for short and long-distance trips. For example, 41 percent of EV owners prefer charging apps for long-range driving while 38 percent of potential consumers say they would also consider using them.

Interestingly, 20 percent more EV owners favor Google and Apple Maps for short trips, and it is often the secondary option for those seeking available charging locations. We see these playing a key role in the future, with more consumers likely to engage as industry stakeholders help to showcase nearby options, availability, and even real-time pricing.

What next: Suggestions for CPOs and MSPs

Prepare for further infrastructure development that prioritizes the needs of the next generation of EV owners

Scale up HPC infrastructure to meet the growing need for quick vehicle charging solutions

Enable third-party systems, such as Google/Apple Maps and vehicle navigation systems, to find charging points easily

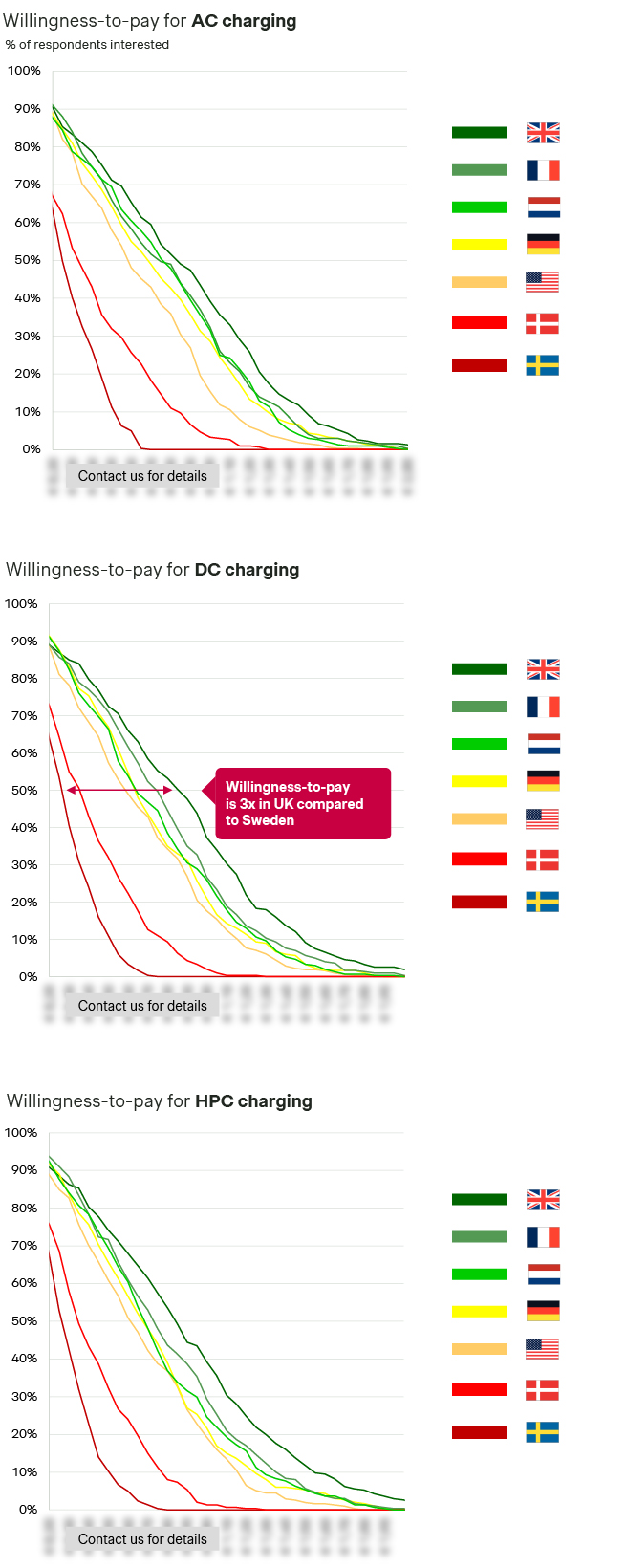

Consumers are willing to pay for a convenient EV charging experience – but there are regional differences

EV industry stakeholders should consider dynamic and region-specific pricing to maximize charge point utilization. CPOs and MSPs need to understand if they operate in a “value market” or a “premium market”. This helps them to address crucial questions: How much can we charge? What are consumers willing to pay? How can we optimize utilization and profitability?

Our survey reveals significant disparities in willingness to pay across different charging types, with premium markets willing to pay over three times the median amount. At the same time, there is a segment of users who are highly price sensitive. For instance, 30 percent of respondents from Sweden state they will not use HPC charging if charged any price premium on top of home energy.

The top three factors for selecting a public charging point, for current EV owners and next generation of buyers, are high charging speed, easy access, and multiple charging points.

Country-specific insights reveal key differences. In the US, 71 percent of EV owners and 62 percent of future drivers prioritize charging speed, especially for long-distance trips. Meanwhile, future drivers in France (48 percent) and Sweden (47 percent) rank easy access as a crucial factor justifying higher prices for public charging in cities, with 50 percent also choosing it for long-distance trips.

What next: Suggestions for CPOs and MSPs

Develop pricing structures by region and market type to effectively capture customer value

Expand charging infrastructure based on regional needs, such as accessible public chargers in cities and high-speed chargers along key rural routes

Flexible and functional payment models are key for electric vehicle charging

While public charging typically follows a pay-per-use model, determined by the network’s kWh tariff, more CPOs are introducing subscription models.

Out of the five different HPC charging subscription options we tested, 74 percent of future EV drivers express interest in a “mini charging subscription”. However, our research shows that CPOs need to carefully calibrate the number of subscription tiers, monthly subscription fees, and kWh-prices in order to succeed with a subscription offering.

More than half of respondents are open to different loyalty programs, including discounts and non-cash bonus points, for public EV charging. Majority of current and future EV owners (56 percent) are interested in integrating loyalty programs with existing rewards, like Miles & More and Payback. Payment service providers like Visa and Mastercard are quite popular in the US, Denmark, and the Netherlands. Overall, respondents are indifferent about which provider offers the program, except in Sweden where EV owners prefer loyalty programs directly from the charging station operator.

Our findings suggest that the next generation of EV owners seeks flexibility through bonus reward points over discounts. 42 percent prioritize partner bonus points as it would enable them to boost their loyalty accounts by utilizing charging activity.

There’s a growing appeal among EV owners in an integrated solution between a charging station and a partner site location. However, targeted incentives will be key in influencing consumer behavior as many still perceive these offerings as “nice-to-have”. But partnerships that allow customers to earn points for charging at CPOs and burned at partner sites, i.e. supermarkets or restaurants, could be the right approach for the future.

Another potential best practice is bundling home and public charging solutions, particularly in the US and Germany where public charging options are highly attractive. Prospective EV buyers (63 percent) especially show a higher interest in a bundle that includes public charging with cost savings being the primary driver.

What next: Suggestions for CPOs and MSPs

Create a multi-tier offer portfolio that includes mini-subscription packages to address all customer segments

Build partnerships with existing loyalty programs to foster strong customer loyalty instead of developing a new proprietary program

Provide a combination of home and public charging solutions that are cost-effective, convenient, and promote sustainable energy

Enable different digital payment methods like Apple Pay, Google Pay, and Plug & Charge for public charging stations

We can help you shift into high gear

EV charging needs are changing, and a more robust network monetization strategy is essential to meet rising consumer demand. Success depends on balancing scalable infrastructure growth with innovative solutions like public and home bundles, tailored pricing packages, and new digital payment solutions.

At Simon-Kucher, our global EV industry experience can help you address market-specific needs while developing optimal pricing models. Together, we can ensure you’re meeting the demands of today’s EV owners and the next generation of EV drivers effectively. Let's connect and explore how we can help you capture the full potential of this fast-growing market.

Form placeholder. This will only show within the editor