The Great Wealth Transfer is already underway, and insurers are uniquely positioned to become trusted advisors for intergenerational wealth planning. Discover how to bridge critical gaps, innovate products, and position yourself as a trusted advisor during this crucial period.

The impending wealth transfer, often called the “Great Inheritance,” represents a seismic shift in wealth distribution, not just across generations, but also in how wealth is managed and grown.

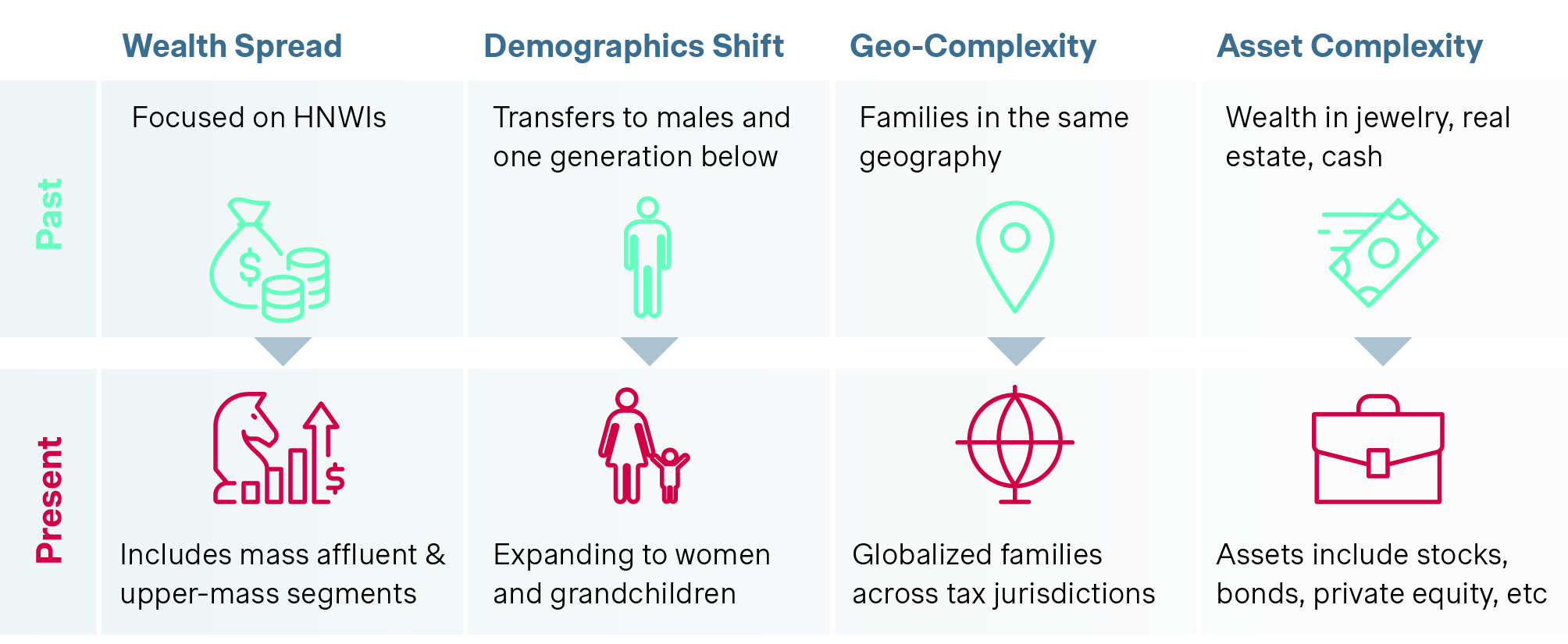

Baby Boomers are expected to transfer an estimated USD $85 trillion over1 the next two decades, with significant portions coming from real estate, family businesses, and a diverse set of accumulated financial assets, including equities, ETFs, REITs, and PE/VC investments. Importantly, this shift isn’t confined to high-net-worth individuals (HNWIs) only; it encompasses the affluent segment as well as a growing mass affluent segment, broadening the landscape of wealth distribution.

But with great wealth comes great responsibility—and complexity. Wealth transfers now involve a wider variety of financial instruments with varying liquidity and tax implications. They must also address the needs of segments across multiple geographies where the family members may be based.

Despite these additional challenges and the large sums of money at stake, many families still hesitate to tackle succession planning, often dodging those sensitive inheritance conversations due to cultural nuances. This hesitation creates a prime opportunity for innovative financial services to step in. Even traditional wealth managers, such as asset managers and banks, need to change their offerings and engage clients meaningfully through advisory services and bespoke wealth solutions. But importantly, this period of flux also offers insurers an opportunity to step in as trusted advisors.

Why insurers are perfectly positioned to lead the Great Wealth Transfer

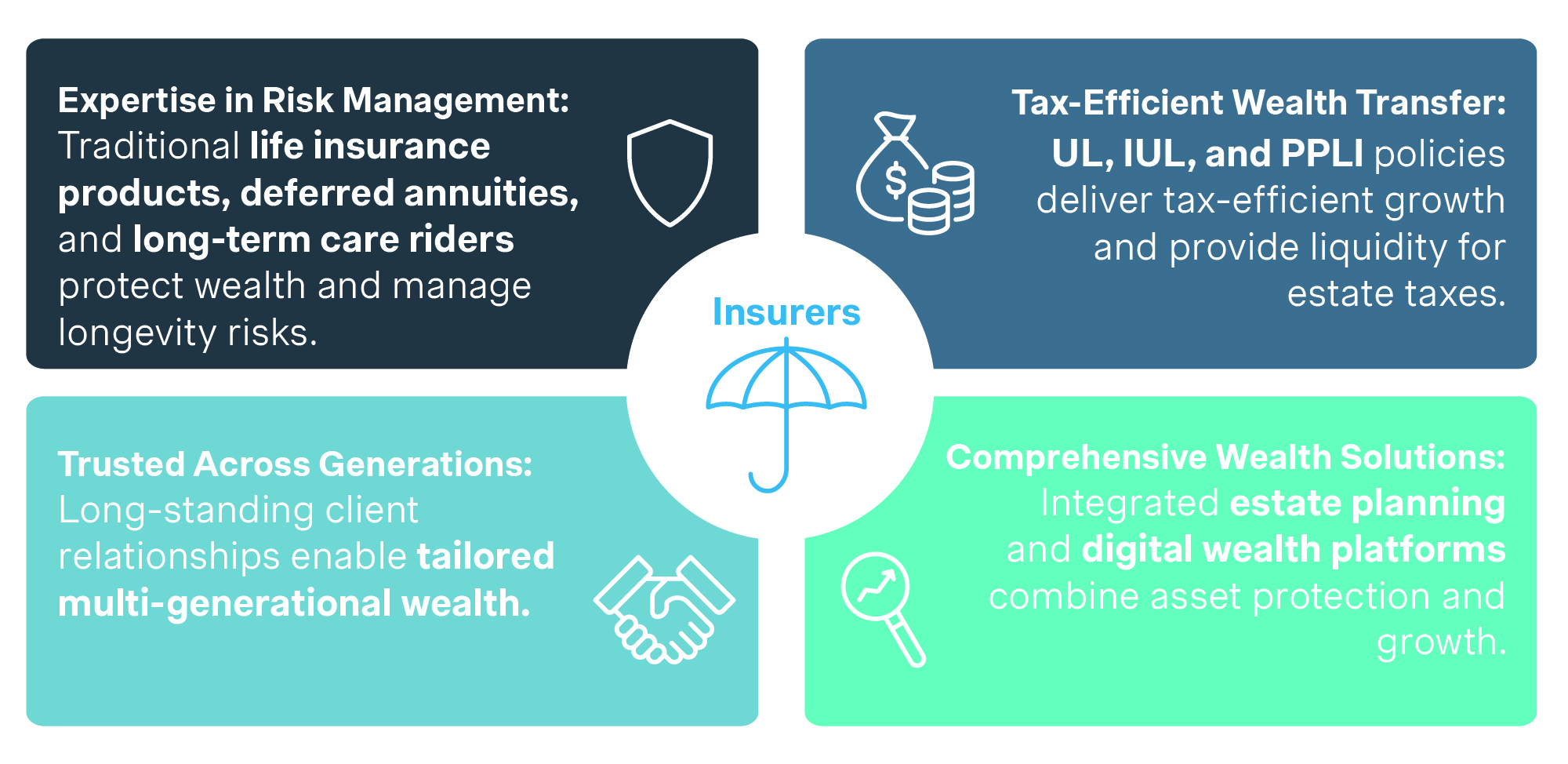

Insurers are uniquely suited for intergenerational wealth transfer due to their expertise in risk management, longevity planning, and flexible, tax-efficient products like UL, IUL, and PPLI. These solutions ensure wealth preservation, liquidity for estate taxes, and seamless asset transfer, often outperforming traditional methods in terms of tax efficiency.

Moreover, insurers’ long-standing relationships with clients across generations position them as trusted partners in wealth planning. By integrating services such as estate planning and digital tools, they can offer comprehensive solutions that combine wealth protection and growth, setting them apart from other financial service providers.

Critical gaps still exist for insurers

Despite their strong positioning, insurers face key challenge that must be resolved to improve adoption for the Great Wealth Transfer. These include:

Complexity and lack of transparency: Insurance products like UL, IUL, and PPLI often have intricate fee structures and options, making them difficult for clients and their heirs to navigate.

Underperformance and market limitations: Caps on returns for IUL and low interest rates for UL reduce the appeal of these products compared to other investment options.

Limited accessibility: PPLI’s high entry barriers exclude many affluent individuals, limiting its broader market appeal.

Lack of integration: These products are often treated as standalone solutions rather than being integrated into comprehensive estate planning.

Educational gaps: Many heirs lack the knowledge to manage policies effectively, risking mismanagement and wealth erosion.

If insurers fail to address these issues, wealth holders may turn to more holistic, tech-driven alternatives from banks or fintechs. However, insurers still have an edge due to their expertise in risk management, estate structuring, and longevity planning.

Four pillars of success for insurers – 4Ps for intergenerational wealth transfer

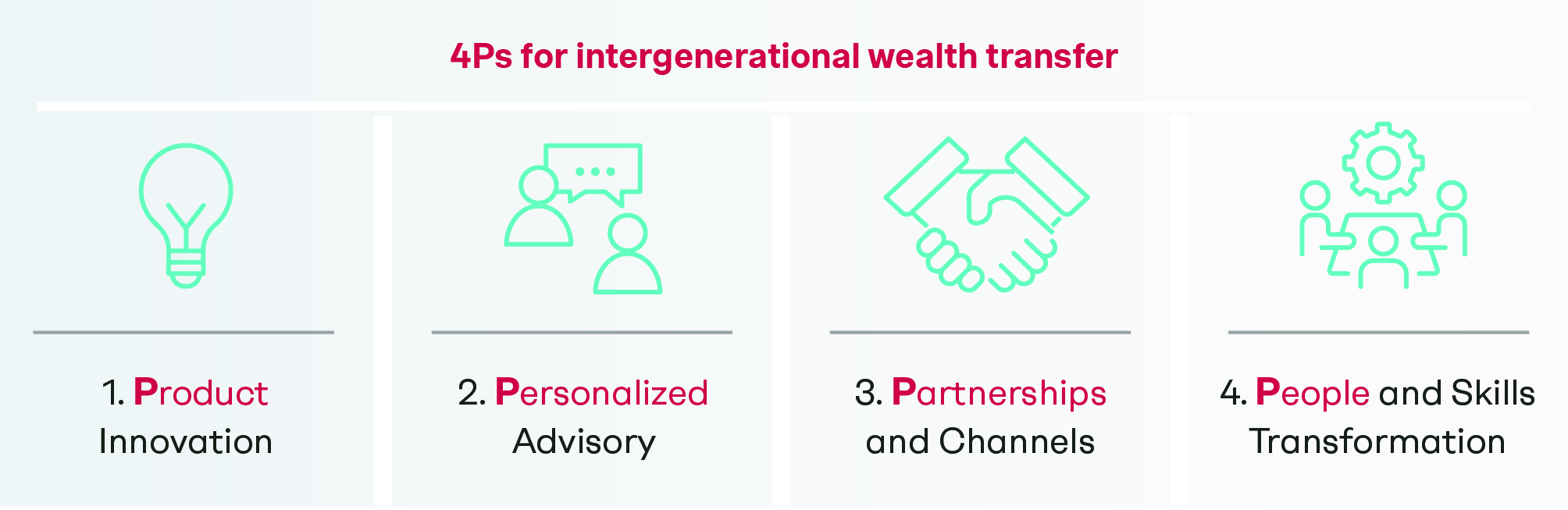

To seize this opportunity, insurers need a strategic, systematic approach based on four pillars:-

1. Product innovation

The wealth transfer market requires tailored insurance solutions that can evolve with the complexities of modern portfolios. Here’s how insurers can innovate:

Expand investment options in UL and IUL: Introduce more diverse investment options, including environmental, social, and governance (ESG)-focused funds, real estate, or private equity-like assets within the UL and IUL structures. This will appeal to heirs with varied investment preferences and sustainability goals.

Raise caps on indexed returns in IUL: Many IUL policies have caps that limit the potential returns, which hinders full participation in market growth. Looking at ways to increase these caps will make IUL policies more attractive, providing better long-term growth for heirs.

Simplify fee structures: Complex fee structures erode trust and understanding. Insurers should provide more transparent and simplified fees, clearly breaking down administrative costs, mortality charges, and other fees. This will allow clients and heirs to better appreciate the value of the policy.

Flexible and automated premium payments: To prevent policy lapses, insurers can offer more robust tools for automatic premium adjustments or reminders, ensuring the policy remains in force even when cash values fluctuate.

2. Personalized advisory

Insurers need to position themselves not just as product providers but as holistic wealth advisors, offering solutions that blend insurance with wealth management strategies. This involves:

Holistic estate planning: Develop advisory services that integrate insurance with other wealth transfer tools like trusts, wills, and tax planning. This helps clients build comprehensive wealth management plans that address estate taxes, liquidity needs, and long-term wealth preservation.

Tailored solutions for key segments:

Women: With a significant portion of wealth transferring laterally to women, insurers can develop products that address the unique financial priorities of women, such as family care, education funding, and lifestyle protection.

Next-generation heirs: Design products that cater to the liquidity needs of younger heirs while preserving the overall value of family wealth. These solutions should provide immediate access to some cash while ensuring long-term growth and protection.

Succession planning for family businesses: Many HNWIs will pass on family businesses. Insurers should provide customized succession planning tools that include insurance to provide liquidity, allowing families to retain control of their businesses while covering estate taxes.

3. Partnerships and channels

Engaging with clients in more innovative ways through partnerships and technology is critical to winning the new generation of wealth holders:

Digital engagement first: Today’s heirs are digital natives. Insurers should develop fully optimized online platforms, offering webinars on wealth transfer, digital tools for financial planning, and easily accessible, personalized advisory content. A strong digital presence is necessary to initiate client relationships and build trust.

Partnerships with Independent Financial Advisors (IFAs): Heirs may have a distrust for traditional family advisors and prefer independent voices. Insurers should build relationships with IFAs, equipping them with the right training and product knowledge to promote their offerings. Providing collaboration incentives and educational support to IFAs will keep insurance products top of mind during estate planning.

Collaborations with fintech: To stay competitive, insurers can partner with fintech firms to create tech-driven solutions like robo-advisors or AI-driven financial planning tools. This helps insurers tap into younger generations who expect personalized, tech-enabled financial solutions.

4. People and skills transformation

Success in wealth transfer depends on the transformation of sales teams and advisors into empathetic, trusted advisors. Insurers must focus on:

Upskilling agents for wealth transfer discussions: Train agents in advanced interpersonal skills such as active listening, empathy, and emotional intelligence to handle sensitive conversations around wealth transfer and inheritance. This helps build long-term trust with clients.

Implementing new KPIs for relationship-building: Shift from traditional sales-focused KPIs to metrics that track the depth and quality of client relationships. Measuring success by long-term client satisfaction and retention is more critical in the context of intergenerational wealth transfer than focusing solely on policy sales.

Leveraging technology for client management: Equip sales teams with digital tools that allow for automated follow-ups, personalized communications, and relationship tracking. This not only improves customer experience but also helps agents manage more complex client needs efficiently.

By evolving product offerings, enhancing segment-specific engagement strategies, and committing to long-term relationships, insurers can become trusted partners in this transformative wealth transfer era. This not only secures their relevance but also plays a pivotal role in shaping the financial futures of generations to come.

Why Simon-Kucher?

Simon-Kucher offers a unique blend of expertise to help insurers capitalize on this historic opportunity. Our strengths are:

Deep industry expertise: With years of experience in the insurance and financial services industries, we offer insights into market dynamics, customer needs, and competitive landscape, helping insurers create tailored solutions that resonate with new wealth holders.

Proven methodologies for product and pricing strategy: Simon-Kucher’s globally recognized pricing and product strategy capabilities ensure that insurers can develop profitable, customer-centric products that balance growth, risk management, and liquidity.

Focus on digital and customer-centric transformation: Our expertise in digital transformation helps insurers build omnichannel strategies that attract and engage younger heirs. We guide insurers in developing the tools and platforms needed to win trust in a digital-first world.

Customized solutions for key market segments: We help insurers develop products and advisory services tailored to high-net-worth women, next-generation heirs, and socially conscious investors, ensuring they are positioned to capture new opportunities in the wealth transfer market.

Salesforce transformation: We work with insurers to shift focus from sales to relationship-building through revamping recruitment, training, compensation, growth, tools and tracking. By fostering long-term client engagement, we help insurers position themselves as trusted advisors throughout the wealth transfer process.