A new payment method centered around saving is turning the concept of Buy Now, Pay Later on its head. As interest rates rise, how can banks leverage new digital savings experiences to attract and retain deposits? What is the revenue potential?

Save Now, Buy Later (SNBL) is a new payment experience where customers create savings plans to make purchases with a merchant in exchange for discounts or rewards. It offers a unique opportunity for revenue growth and differentiation at a critical time for traditional retail banks.

With rising interest rates, a looming recession, and job losses, SNBL can be a less-risky payment method compared to unsecured loans like credit cards or Buy Now, Pay Later (BNPL). Consumers are also eager to receive personalized, AI-driven financial wellness experiences, creating an opportunity for banks to leverage SNBL to differentiate themselves, deepen engagement, and generate growth. Additionally, the competition for deposits has intensified, sharpening the need to find cost-effective ways to incentivize bank customers to save.

The concept of encouraging customers to save for a big purchase is not a new one for bankers. Most banks have a range of features to encourage putting money aside including rules for automatic saving, tools to monitor spending patterns, and goal setting. The challenge has always been how to monetize these savings programs and turn them into revenue-generating endeavors.

In the following, we elaborate on SNBL, its potential to help traditional banks drive customer engagement, create new value, and power revenue growth. We evaluate benefits for consumers as well as merchants and offer key learnings from recent project examples.

Emerging models in SNBL and digital savings

SNBL is a payment method that includes a savings experience to help users set aside money to purchase a product or service later. SNBL users are often given attractive cashback, rewards, or discounts to save-and-buy from specific merchants.

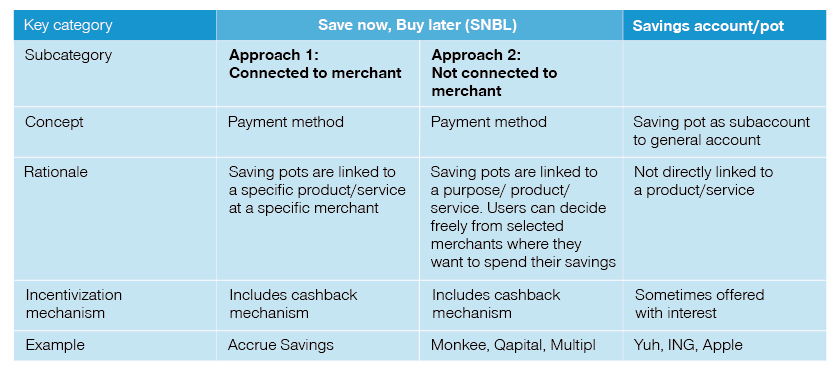

AI engines, digital technologies, and new delivery channels have unlocked more ways for banks, fintech, and payment providers to transform the savings experience and make it easier for consumers to set aside money. In general, these new efforts can be categorized into two approaches (Figure 1):

Figure 1

The rise of SNBL and new savings experiences

In the first approach, the purchasing journey starts at the merchant’s digital point of sale. An embedded SNBL solution at the checkout enables customers to open a saving account for a specific product directly from the merchant’s website. To motivate consumers to start saving, attractive cash rewards are offered when reaching the desired purchase amount.

In the second approach, savings accounts are not linked to a specific merchant or purchase journey and consumers can freely decide where they want to spend their money. Customers are encouraged to save through various incentivization mechanisms. This includes the option to separate money into pots or sub-accounts within the savings account structure, personalize savings frequency and amounts, and earn interest.

Noteworthy SNBL providers include Accrue Savings (Approach 1), a US-based startup that has raised more than 29.7 million US dollars in funding since it launched in 2021. Also prominent is Monkee (https://www.monkee.rocks) (Approach 2), an Austrian based startup established in 2018 as a responsible alternative to BNPL (Figure 2).

Big players with a history of disruptive innovation are venturing into the savings marketplace. BNPL giant Klarna has started offering German users the option to set up “pools” for various savings purposes, that later should pay interest. In late 2022, tech behemoth Apple announced Apple Card users will soon be able to use the Apple Wallet app to set up, manage, and deposit cash into a high-yield savings account provided by Goldman Sachs.

Figure 2

What is the appeal of SNBL?

SNBL offers many benefits for users, service providers, and merchants.

The biggest incentive for consumers is the discount they receive when they use the SNBL payment method to pay for a product or service. Users can also enjoy a fun, gamified experience designed to keep them motivated to save. They will usually have an option to invite friends and family to contribute to their savings goals. By utilizing this type of nudging, engagement and retention rates can significantly increase. On average, users of the Austrian startup Monkee initiate 5.4 "key interactions" per week, resulting in over 50% higher retention rates compared to similar loyalty apps.

Merchants also see value in the SNBL payment arrangement. Offering shoppers more flexible payment options can reduce cart abandonment, improve buyer confidence, and move customers closer to conversion. This is especially the case for certain big-ticket items like fine jewelry, furniture, and home appliances. In such cases, shoppers have higher psychological buying barriers, need more assurances, and undertake advance research and planning of the purchase. Moreover, Monkee reports that affiliated partnering with SNBL providers can result in a substantial increase in customer traffic with purchase intent, leading to 8-10 times higher click-to-purchase ratios compared to all providers in that category.

SNBL service providers have several ways to derive value from an SNBL payment offering. Providers can monetize SNBL data as part of an effort to help merchants more accurately predict revenues, identify customers segments with high purchase intent, and unlock business insights to optimize the purchasing journey.

Figure 3

The appeal of SNBL

For banks and financial institutions, an engaging savings experience can shift the conversation from price or savings yields to the value of the bank experience and relationship. Features like proactive nudges and AI tools that help customers reach savings goals can have a significant impact on loyalty, retention, and engagement. Customers are also increasingly willing to pay for personalized, AI-powered, holistic financial wellness experiences. Based on our project experience, certain enhancements to a savings offering can greatly increase willingness-to-pay and unlock a new stream of revenues for banks. The savings improvements include high-value features, intuitive design, and digital nudging.

What are the key elements of a successful digital savings or SNBL offering?

To optimize engagement, revenue growth, and return on investment (ROI) around an SNBL or digital savings experience, banks and financial institutions should prioritize the following:

- Address the psychological barriers to saving

The discipline required, the temptations of a consumer-driven world, and short-term thinking are just some reasons why bank customers struggle to save. Incorporating nudge theory and behavioral economics principles into the digital savings user experience can go a long way toward helping consumers save more.

Consider the case of SNBL startup Monkee. This Austrian-based fintech recognized its customers' tendencies for mental accounting, a cognitive bias where people mentally separate or sort their finances into buckets like rent money, vacation money, and daily expenses. Mental accounting is the reason why people spend more when paying with a credit card, and mistakenly treat a tax refund as a windfall. Monkee designed a user interface to ensure mental accounting is not leading customers to spend and save in ways that can be detrimental to their financial wellbeing. This provides customers with a better overview of their financial lives. Monkee users are also encouraged to personalize the amount and frequency they want to save, and to earmark funds for specific purposes.

Another important cognitive bias impacting how we save is goal gradient effect where people become more motivated and engaged, the closer they get to a goal. How a goal or reward is presented matters. To keep motivation high, Monkee's digital savings application uses progress bars, and integrates other psychological supports. Monkee's efforts are paying off in spades. Users save, on average, more than 10 percent while consciously buying products at an e-commerce partner. Moreover, the startup's growing customer base of 200,000 users have collectively saved more than 230 million euros since 2019.

- Employ intelligent segmentation to understand customer needs

Another important element is to have a clear understanding of how different user groups will respond to a product's features and packaging. Product features that appeal to one customer segment might not have the same effect on another.

Leveraging data analytics and AI technology, intelligent customer segmentation can unlock critical insights about different customer groups including their value perceptions, differentiated needs, willingness to pay, pricing sensitivities, spending patterns, behaviors, and more.

Our recent project with a fintech SNBL provider showed that onboarded customers had a higher perception of the company's savings product’s value. It was higher by a factor of three compared to customers who have never used the product (Figure 4). Prospects needed to start using the savings features to fully comprehend its value and benefit.

Figure 4

The company introduced a freemium pricing structure, where new users can sign-up for a basic service with limited features. Prospects got a first-hand experience of the product's value, overcame the value perception gap, and became more willing to pay for the service.

- Use freemium pricing strategically

While freemium pricing can help companies sign up a lot of users quickly, it can come with several disadvantages including faster cash burn and high overhead costs. The rate of customers converting from a freemium to a paying tier is also very low. It falls between 2 to 5 percent, according to our research and project experience.

However, freemium pricing can be appropriate in certain circumstances. This includes situations when the primary goal is to acquire customers and the cost to serve them at the basic level is low. Freemium pricing is also appropriate in situations where the value of a product to the customer increases exponentially with use, and where costs are minimally impacted by usage frequency. Freemium pricing should be accompanied by nudges and behavioral economic elements to encourage customers to upgrade.

- Optimize pricing with the right features, attributes, choices

The good-better-best pricing structure can be an effective way to address a digital savings product with multiple, distinct customer segments. In order for good-better-best pricing strategies to maximize revenues, close attention is needed in feature selection and allocation, packaging structure design, the relative value of key attributes, and cognitive biases.

For example, the placement of a gold or premium package to the far right or far left immediately establishes this option as the price anchor (Figure 5). People also tend to avoid extremes and prefer an intermediate choice. This cognitive bias will drive customers toward certain options over others. How packages are presented, and which features should be included must be carefully considered.

Figure 5

To prevent customers from trading down from a premium or intermediate package, high-value features or 'fence attributes' must be strategically identified and included. These premium features can include account screening, or intelligent analytics that recommend lower-cost alternatives to save the user money. After understanding the relative importance of key features, banks must find the right allocation to fully leverage the items’ value.

A well-tested, optimized offer with the right tier design, fence attributes, and high-appeal features, can increase new users by as much as 29 percent and impact revenues by as much as 15 percent (Figure 5).

Six steps to success

Banks and financial institutions have a unique opportunity to build deeper relationships with their customers through experiences that positively impact their financial wellbeing.

Our proprietary six-step process is a systematic, data-driven approach to position digital savings and SNBL offerings for ROI success. The method is centered around qualitative and quantitative assessments, behavioral economics and nudge theory, advanced segmentation, and proven go-to-market strategies.

- Step 1: Conduct interviews and review existing data

- Step 2: Create first hypothesis

- Step 3: Prepare and run quantitative survey

- Step 4: Model potential product offering and price options

- Step 5: Collect recommendations

- Step 6: Initiate concept and implementation

SNBL is still largely an untapped market. And there is great potential to achieve success by taking the right steps now. Every financial institution should consider this as they map out their business strategy.

Reach out to us for more information on this.

Contributors: Victor Obermueller