How do best-in-class organizations continue winning even in uncertain economic times? What sets these Allstars apart from their competition? Our experts share competitive insights from Simon-Kucher’s 2023 Global B2B Sales Survey.

The world of B2B sales is going through a seismic shift. Shifting demand, prices, and profit increase volatility for most businesses and pressure sales teams to adapt. B2B selling power has become a key factor to consider.

Just as the pandemic subsided and supply chain issues were addressed, macroeconomic conditions like interest rates and labor costs drove inflation and hammered discretionary budgets. Amidst this economic downturn, sales teams had to learn to increase prices at an aggressive pace and magnitude while keeping volume up to reach growth targets. The mergers and acquisitions of the preceding five years were pushed to integrate for OpEx savings and cross-selling opportunities. New talent is needed to sell the value of higher margins to more senior buyers. And it’s evident that a well-defined B2B sales process, attuned to changing market forces, is fundamental for growth and success.

For this year’s Global B2B Sales Survey, we spoke to 1500 leaders in B2B industrials across Europe, Asia, the Americas, and EMEA. We focused our research on hundreds of companies in the three stages of the value chain, from manufacturers to wholesale distribution to service providers.

One key insight emerged from all C-level executives and middle managers: You need to invest to drive profitable growth.

Organizations that grow faster than the median invest resources in enabling their sales talent to drive profitable growth and outperform competitors. And who are these top-level firms? What are they doing differently?

At a glance

- Businesses are categorized into four performance-clusters based on growth and profitability

- The fastest growing companies invest the most in their sales function

- The best selling teams nurture more personal customer relationships

- Companies should focus on the most important strategic and tactical execution trends to continually adapt

Elevate your business from Spectator to Allstar

Access specific recommendations for your stage of the value chain

Best versus the rest

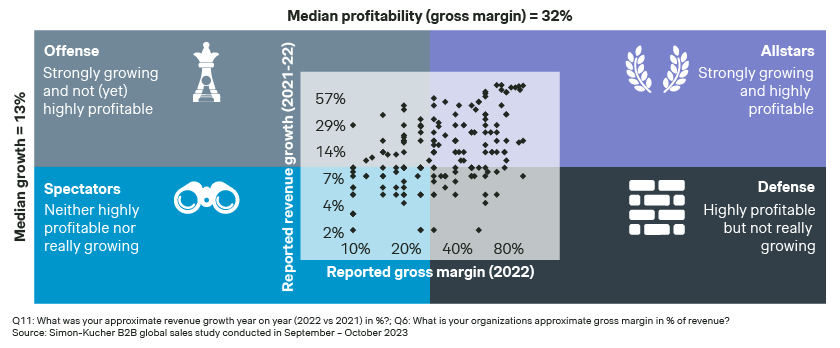

Four distinct clusters of businesses emerge when assessing organizations based on sales growth and profitability. The cohorts show notable disparities in growth and profit despite similar demographics.

- Allstars: Strong growth and highly profitable

- Offense: Strong growth but not (yet) highly profitable

- Defense: Highly profitable but not really growing

- Spectators: Neither highly profitable nor growing significantly

What’s driving this superior performance?

Our research reveals that Allstars - in all stages of the supply chain from manufacturer and wholesaler to service provider – are implementing four differentiated strategies to stand out from the crowd:

1. Paying close attention to customers to understand changes and value

Allstars are always looking for ways to engage better with their customers. They monitor their markets more closely and are two times more likely to recognize changes in the markets than spectators. A closer and more personal relationship with customers helps Allstars adapt better to the changing market dynamics. Our best performing clients are feeding actionable Voice of the Customer (VOC) research into both their marketing and sales teams frequently. Many are re-structuring in more customer-centric configurations.

2. Investing in their sales team to accelerate growth

Best-in-class manufacturers, wholesalers, and service providers understand the value of a high-performing sales team. Continually cutting sales expense to drive higher operating profit can’t last forever. As market challenges evolve, dated strategies are no longer effective. To enable sales teams to bring in new business, it’s essential to invest in headcount, tools, and training for sales resources to leverage talent and achieve profitable growth.

3. Tackling strategic challenges in a difficult environment

Allstars invest more time and effort to excel in key commercial growth levers. In particular, they are determined to actively address their strategic challenges despite an uncertain environment. They have put significant effort into the setup of their sales organization, channel strategy and target customer segmentation more frequently than the other quadrants.

4. Fostering personal and direct one-to-one interactions

COVID-19 forced businesses worldwide to go online and manage remote work. In 2023, the importance of personal sales interactions has rebounded faster than expected. The most successful businesses focused on nurturing these personal connections with customers. In-person and one-to-one interactions saw a significant rise in importance among Allstars. Conversely, selling via virtual sales channels like webchat has declined in prominence.

Sharpening the focus on things that matter

In these uncertain economic times, it’s crucial to channel resources toward the most important growth initiatives. Any asset used for insignificant tasks ties up valuable capacity.

Our research shows that even Allstars in the manufacturing, wholesale, and service provider value chain can enhance their focus on vital growth initiatives, since all tend to overinvest in growth drivers that are designated as less important for today’s market.

Manufacturers demonstrate moderate to low readiness for most important future initiatives, like reorganizing sales structure and reprioritizing target markets while having high readiness level for lower priority initiatives, like new customer acquisition.

Wholesalers demonstrate moderate readiness level for most important future initiatives, such as customer retention and development, but have a high readiness level for lower ranked future initiatives, such as new customer acquisition

B2B service providers demonstrate moderate readiness level for critical future initiatives, such as data driven sales steering, reprioritizing sales markets, etc. Meanwhile, there’s a high readiness level for lower ranked future initiatives like new incentive system.

The strategy here is to keep the focus on the core ideas. Just as the best companies are listening to customers to better align with their needs, frequent internal analysis to realign sales focus and resource investments with strategy is necessary for effective execution.

Key Takeaway

Companies are struggling to find a clear path for the future. Diverting focus to too many growth initiatives limits crucial capacity.

Stage-specific recommendations for the value chain

It might be challenging to elevate a business from Spectator to Allstar, but it’s definitely worth taking the first step. To help with this undertaking, we have a few recommendations based on our Global B2B Sales Survey.

Manufacturers of B2B industrial goods

- Address the strategic challenges for your organization. Best-in-class outgrow their less successful competitors by prioritizing their strategic advantages in key market segments, innovative offerings, and optimal pricing while continuing their investments in tactical initiatives.

- Review the sales organization by segment, region, and channel for profitable growth. Now is the time to adapt the sales organization to changing market dynamics and ensure coverage is right-sized.

Wholesalers of B2B industrial goods

- Grow with a balance of new business, cross-selling, and retention. Creating a dynamic incentive system aligned to specialist role focus has allowed best-in-class companies to drive growth in good times and bad. In the meantime, less successful companies are still in the bunker, hoping to maintain their current market share.

- Emphasize a differentiated strategy. Take calculated risks based on customer intelligence. Firms should rethink their strategy and set up their sales team for success by optimizing channel mix to align with customer purchasing processes and reconfiguring sales roles to secure sustainable growth on multiple fronts.

Industrial service providers

- Prioritize innovation. Best-in-class companies made it their top priority to create and package new offerings driving business by innovation, while less successful companies have not been similarly committed to investment in innovation.

- Emphasize execution. Now is the time to enlist Revenue Operations to support aggressive expansion. Supported by data-driven sales steering, companies continue to drive growth via new sales talent, integrated processes, and more engaged customers for the future.

How Simon-Kucher can help

Simon-Kucher has deep roots in the B2B Industrials sector. Our specialist teams bring a wealth of knowledge and expertise to help manufacturers as well as wholesalers of B2B industrial goods and service providers navigate every kind of commercial challenge. We can help you plan for and achieve long-term, sustainable growth.

You can find detailed B2B Sales Survey reports for each sub-industry.

For more information, reach out to us today.