Ready to make 2024 a standout year for your telecommunications business? Discover the eight important telecom trends and the key initiatives steering the industry’s evolution.

While 2024 will be an exciting and dynamic year, it will also be a very hard one to predict. The economic downturn and higher inflation levels are expected to continue in the new year, with elections and geopolitical risks playing a major role in shaping the future.

Telcos need to account for those aspects, but they should also focus on the industry’s major trends that will drive growth in the new year. For this reason, we have outlined eight trends that can contribute to the industry’s (r)evolution.

Telco growth trends and strategies for implementation in 2024

Across these eight trends, we can see common themes such as adaptability to economic or market conditions, leveraging technology for data management, and embracing innovation for business sustainability and growth.

1. Inflation and recession management

Facing potential recession and extreme price increases that trickle down value chains, companies still lack the necessary resources to raise prices successfully. However, it’s important to act now given the challenges confronting the telco industry. Inflation serves as a catalyst, accelerating the erosion of average revenue per user (ARPU). At the same time, the need for high infrastructure investments persists for 5G and fiber deployment.

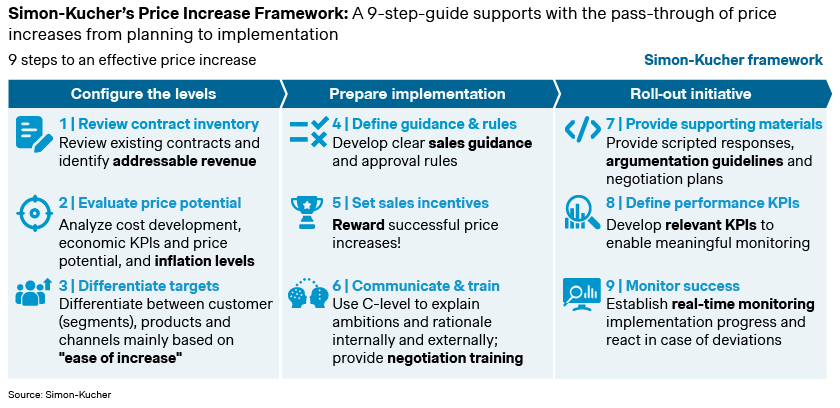

How to do this: On average, companies only achieve one-third of their intended price increase. By using a structured and differentiated approach to raise acquisition and customer base prices, telcos have an opportunity to manage inflation sustainably and even use it to perform ARPU increases. We recognize the difficulties of increasing prices at this time, but our telco experts have developed a nine-step guide to facilitate with implementing appropriate price hikes. This price increase framework enables telcos to capitalize on the existing opportunities and maximize the gains effectively.

2. Aligning sales with the digital era

Online sales channels had already grown before the pandemic, but they saw a surge in recent years. This shift has transformed customer needs, leading to expectations of a true “omni-channel” experience that blurs the lines between different sales channels.

How to do this: Sales organizations must structure themselves to prioritize online channels while still offering a fair, incentivizing approach for other sales channels. With 76 percent of users regularly using telco apps, there is a valuable opportunity to leverage them as sales points. Telcos can broaden the scope of their app services from administrative to include promotions and offers, extending into selling capabilities. As the primary platform for different interactions, expanding services to include proper purchasing options opens up new avenues for sales teams.

3. Business model innovation

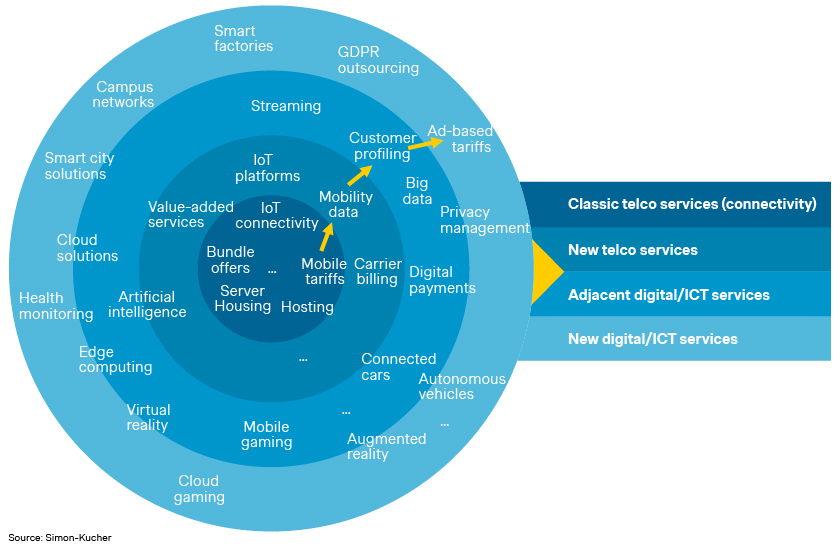

As telcos experience pressure on their financial performance and KPIs, new revenue streams need to be identified that surpass their core offerings. It’s time to invest in innovations – go beyond telco apps and FMC offerings when designing new offers. While a broad range of innovation exists on every level of a telco’s service layers, they should be guided by the business’ capabilities and the possibilities for iteration across various layers.

How to do this: Select value-added services (VAS) that help customers get the most out of their purchases but also mirror customers’ willingness to pay and align with internal costs, reflecting the margin perspective. For example, offering FMC bundles ensures that telcos don’t lose market share while customers benefit from discounts, additional data packages, and OTT-services. Additionally, there is a willingness among customers to pay a premium for green tariffs. This growing demand for sustainable offers provides telcos with an opportunity to differentiate from competition. By providing the right VAS, telcos demonstrate their commitment to customer satisfaction, enrich the user experience as well as increase revenue and profit margins.

4. Master sustainable brand relevance

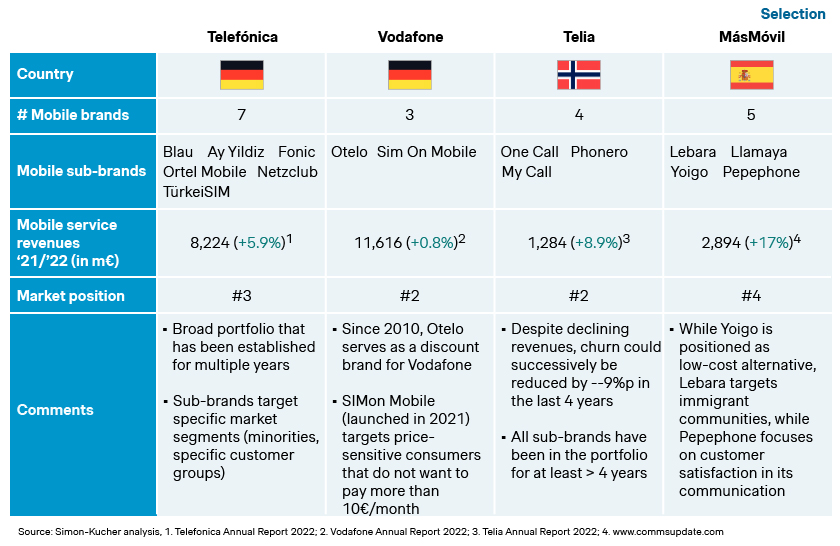

Telcos and their offerings are increasingly perceived as commodity by price sensitive customers. This makes telcos susceptible to customer switching or churning. At the same time, various international benchmarks show that multiple sub-brands are not uncommon and can be managed in a successful way. This strategy helps safeguard the parent brand’s ARPU and margins.

How to do this: A successful sub-branding strategy can help telcos stay relevant. Telcos can cater to diverse customer preferences by establishing sub-brands with offerings tailored to specific needs. But it’s important that telcos find, develop, and integrate new, relevant brand differentiators (e.g. value-added services, hardware) to minimize customer segment overlaps. Consider the market leaders. Many industry leaders are successful in their sub-branding strategy, providing valuable lessons for others. For example, some sub-brands focus on straightforward, no-frills plans for cost-conscious customers, while others resonate with younger demographics or have a focus on customer satisfaction.

5. What comes after Unlimited?

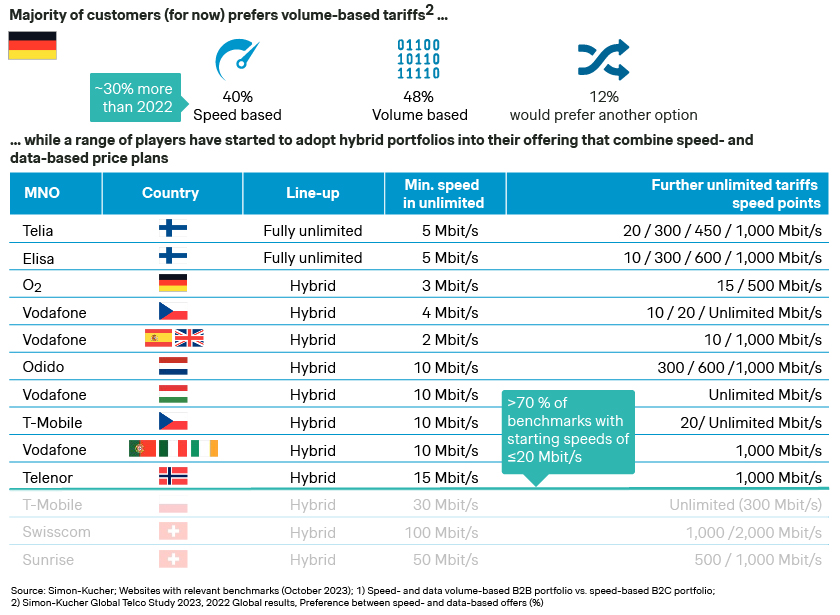

While data usage increases, the price per GB declines and moves data monetization into a dead end. This calls for a reconsideration of pricing metrics. Because even as unlimited data threatens profitability, it coincides with increasing customer interest in speed-based tariffs. While volume-based mobile packages are currently more popular with 48 percent of customers, speed-based offers are gaining traction as 40 percent show interest.

How to do this: This offers telco companies with a viable alternative to use as a monetization lever. Telcos should address this trend in their mobile portfolios, starting with a hybrid approach between speed- and data-based price plans to bridge the gap to an entirely new portfolio.

6. Customer base management 2.0

It’s time to rethink customer management. Our research shows that one-third of customers are thinking about switching. This suggests that revenue and market position are taking a significant hit. This puts a spotlight on the importance of managing the existing customer base carefully, especially when it comes to portfolio and price adjustments. In 2024, the telco industry must swerve its focus from customer acquisition to retention. Customer acquisition costs are rising every year and the acquisition market is slowly shrinking due to telcos’ increasing FMC measures.

Customer retention, on the other hand, offers a range of advantages:

a. Keeping existing customers is five times cheaper than acquiring new ones

b. The probability that new products are tested is 50 percent higher for existing customers vs. new ones

c. Existing customers contribute 95 percent to the profit pool

d. Existing customers spend on average four times more than new customers

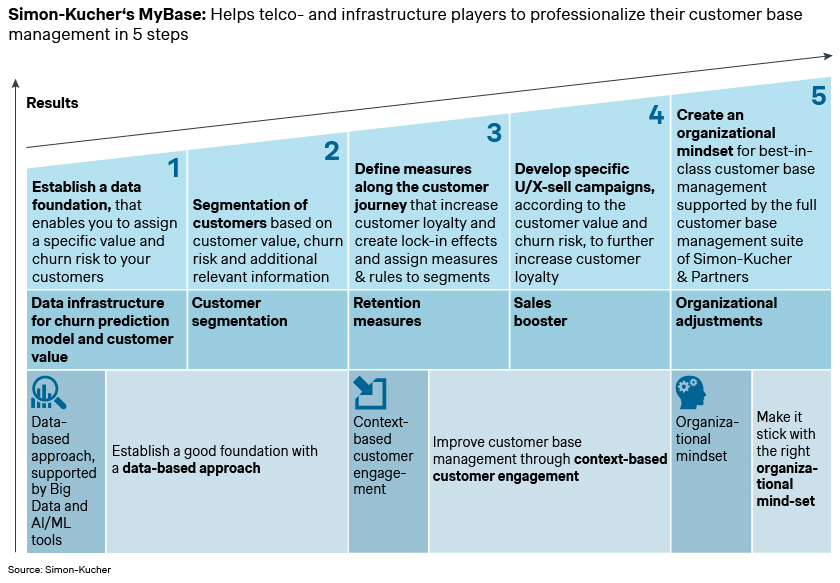

How to do this: Telcos must refine their customer engagement strategy. At Simon-Kucher, we have developed a five-step process to help telcos standardize their customer base management. Through our MyBase platform, telco players will employ a data-driven approach for churn risk assessment, conduct customer segmentation, and engage in context-based customer engagement for lasting impact.

7. The future is FTTH expansion

Monetizing and expanding fiber networks is becoming increasingly difficult, due to intensifying competition and plateauing take rates. The high cost and investment is just one hurdle in Fiber-to-the-Home (FTTH) deployment, while physical and logistical barriers pose additional challenges to extending fiber network access and coverage.

How to do this: With selected growth initiatives, telcos can mitigate the impact of macro-economic developments and competition by addressing four steps:

a. Commercial FTTH expansion strategy: Telcos and infrastructure players can employ micro-market clustering to identify and evaluate expansion areas, combining technical and commercial insights for a comprehensive approach.

b. Product portfolio optimization: To improve fiber take rates, telcos need to drive customized pricing for different segments, optimize price metrics and price points, and invest in improving negotiation capabilities.

c. Optimization of sales efficiencies: Sales targets need to be aligned with the overall objectives, potentially shifting from a volume to a margin focus, and be reflected in incentive schemes.

d. Price optimization program: As a last step, price optimization potential within the existing fiber base should be explored, together with inflation clauses.

8. The FMC 3.0 strategy

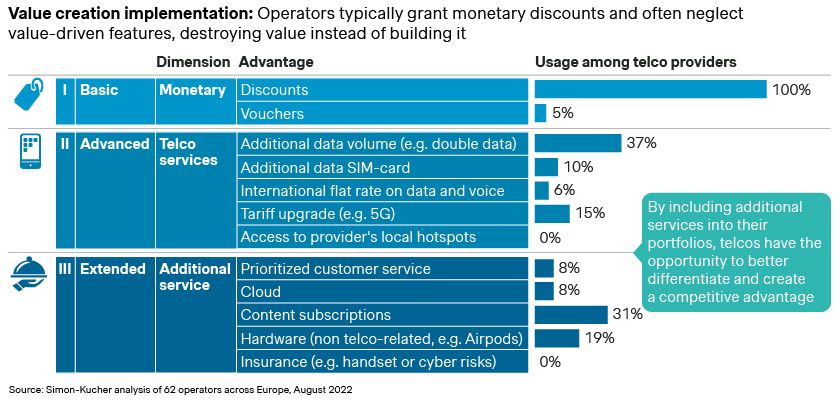

The biggest telcos in Europe have successfully grown their number of contracts by almost 50 percent since 2017. However, this growth has not translated into an impact on ARPUs due to the excessive focus on offering monetary incentives instead of exploring non-monetary alternatives.

How to do this: To drive FMC further and grow ARPU at the same time, telcos need to refine their FMC portfolios. This entails adding non-monetary incentives, such as benefits and VAS, to enhance the FMC bundle. It’s also critical to oversee the integration of fiber into these new propositions effectively. These measures contribute to redirecting the focus toward value creation and implementation, offering telcos the opportunity to establish a distinctive identity and gain a competitive advantage.

Your next move

As telcos navigate the growth trends of 2024, it's evident that a multifaceted approach is key to success. By focusing on – a selection of – these topics

telco companies can not only thrive but also lead the way in shaping the future of telecommunications.

If you’re interested in discussing more about these trends or need help in designing your next growth strategy, contact us today.