China’s healthcare payment system is undergoing fundamental reform, impacting all stakeholders across the value chain. Experts Bruce Liu, Justinian Liu, and Ivy Jiang outline how pharma and medtech companies can stay ahead of the curve as the reform unfolds.

China has long been exploring reform in its healthcare payment system to cope with rising costs. In particular, the shift from a Fee-for-Service (FFS) to a Prospective Payment System (PPS) model represents a fundamentally different approach that motivates providers to deliver patient care effectively, efficiently, and without over-utilization of products and services.

What is the Prospective Payment System?

China started exploring PPS reform in 2003, when it launched its Diagnosis-Related Groups (DRG) pilot in Beijing. However, it wasn’t until 2017 that the national DRG system pilot was expanded to around 30 cities.

In parallel, another PPS variant called the Diagnosis-Intervention Packet (DIP) was rolled out in 2020 to serve as an alternative. This program has since gathered strong momentum in over 70 cities across China.

- The DRG approaches classification from a top-down clinical perspective, grouping similar clinical procedures under the same category which receive a similar lump sum payment. A new China Healthcare Security Diagnosis Related Groups (CHS-DRG) system was introduced in 2019 which listed 618 predetermined ‘front-page classification’ groups but had challenges accounting for regional differences in costing

- The DIP, in contrast, features dynamic classification built from a bottom-up approach, which group together procedures with similar cost structures. Big data and algorithms are leveraged for ongoing cost estimates and updates, leading to a more granular classification tailored for the local context

At the end of 2021, the National Health Commission (NHC) officially unveiled a three-year plan, requiring all basic medical insurance (BMI) planning districts to carry out reform based on either the DRG or the DIP by the end of 2024.

Who is affected by this reform?

Besides the obvious impacts to providers and payers, the ongoing reform will have profound implications for pharmaceuticals and medical consumables.

For one thing, rather than be a potential source of revenue (as it was under the FFS) the new PPS model means that pharmaceuticals and medical consumables become cost items. As a result, existing items used in clinical practices come under increasing price pressure, especially from providers as they strive to contain costs and improve margins under the PPS.

In addition, hospital access for new items will come under more scrutiny and may come across different sets of challenges that vary from hospital to hospital.

How can pharma and medtech majors prepare?

To prepare for the unfolding changes, pharma and medtech majors would benefit from addressing the following three key areas early.

1. Upgrade market access capabilities

This involves:

- Mapping out key access processes and stakeholders under the new model for priority market segments

- Exploring effective engagement approaches at different levels

- Communicating value differentiations with compelling evidence and value dossier

2. Explore non-public hospital opportunities

As public hospitals shift toward efficiency, standardization, and cost cutting under the PPS, non-public hospitals, less reliant on BMI, will have the opportunity to pursue higher quality and premium services for those with higher affordability. This is possible either through self-pay or with commercial healthcare insurance.

Non-public hospitals have become significant channels in China, accounting for two thirds of China’s hospitals in number and around 20 percent of patient volume today. They’re particularly strong in sectors such as fertility, maternity, pediatrics, dental, medical aesthetics, and ophthalmology. This is why there are a plethora of opportunities for innovative drugs and medical consumables in related areas that aren’t bound by BMI and the PPS.

3. Innovate to address unmet needs

Finally, innovation is still going to be the name of game toward addressing unmet healthcare needs regardless of payment models.

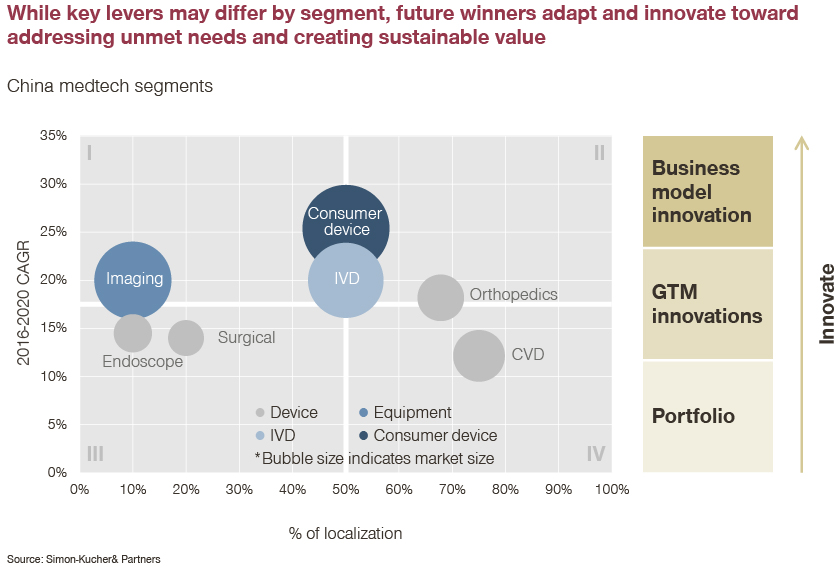

Pharma and medtech companies should continue to innovate across key dimensions. As well as expanding their products and portfolio, they should consider reconfiguring their products and services to help providers create more value and capture more efficiencies. This will ultimately help them afford better disease management and health solutions for patients in need.

As Louis Pasteur once said: “Opportunity favors the prepared mind”. As fundamental changes continue to take place in China’s healthcare space, so do opportunities arise for those who prepare early.

If you have further questions or would like to read the full report on this issue, feel free to contact us!