If 2022 was a year of flux, 2023 is set to be the year when financial services firms reset for the new environment; one in which fixed price tariffs are re-priced to pass through cost inflation, and interest rates revert closer to historical norms. It’s also the year in which the FCA’s Consumer Duty kicks in (from July 31) requiring, amongst other things, that regulated firms provide ‘fair value’ in their pricing. 2023 is set to be the year when financial services firms, not unlike other industries, take a long, hard look at their approach to pricing and realize they need to up their game.

Inflation

The economic story of late 2022 and early 2023 is one of inflation. After a decade of low inflation and stable prices, inflation is back and prices are on the move. Short-term supply-side shocks including COVID related shortages and rising energy prices resulting from the war in Ukraine have combined to send inflation to levels not seen for 40 years. Barring further shocks or a dangerous escalation in Ukraine, neither or which can be ruled out, inflation should subside through 2023. However, that’s not to say that inflation will go away. Geopolitical tensions are leading to an unwinding of interconnected global trade, reshoring of jobs and other protectionist measures. Talent shortages are pushing up wages in the private sector and unions are attempting to achieve the same for their public sector members. Eminent economists are pointing to a new era where central banks may need to target 4% annual inflation rather than the current 2%.

An inflationary world is one where prices change more frequently and by a greater amount. At 2% inflation companies may be able to hold prices steady and maintain margins through efficiency savings; at 4% that gets much more difficult. At 10% cost pressures necessitate a rapid change to prices. The effect is not evenly spread; some companies in the service sector with multi-year contracts will have inflation linking explicitly written into their contract while other firms such as fund managers who typically charge a percentage fee for their services will also benefit as prices and asset value rise. On the other hand firms with fixed fees, minimum fees and capped fees will come under pressure and need to push through significant price increases; many may not have the processes or knowhow to do so effectively. In a world where prices are expected to change more frequently and to a greater degree an investment in pricing capability is going to be critical to organizational success.

Interest Rates

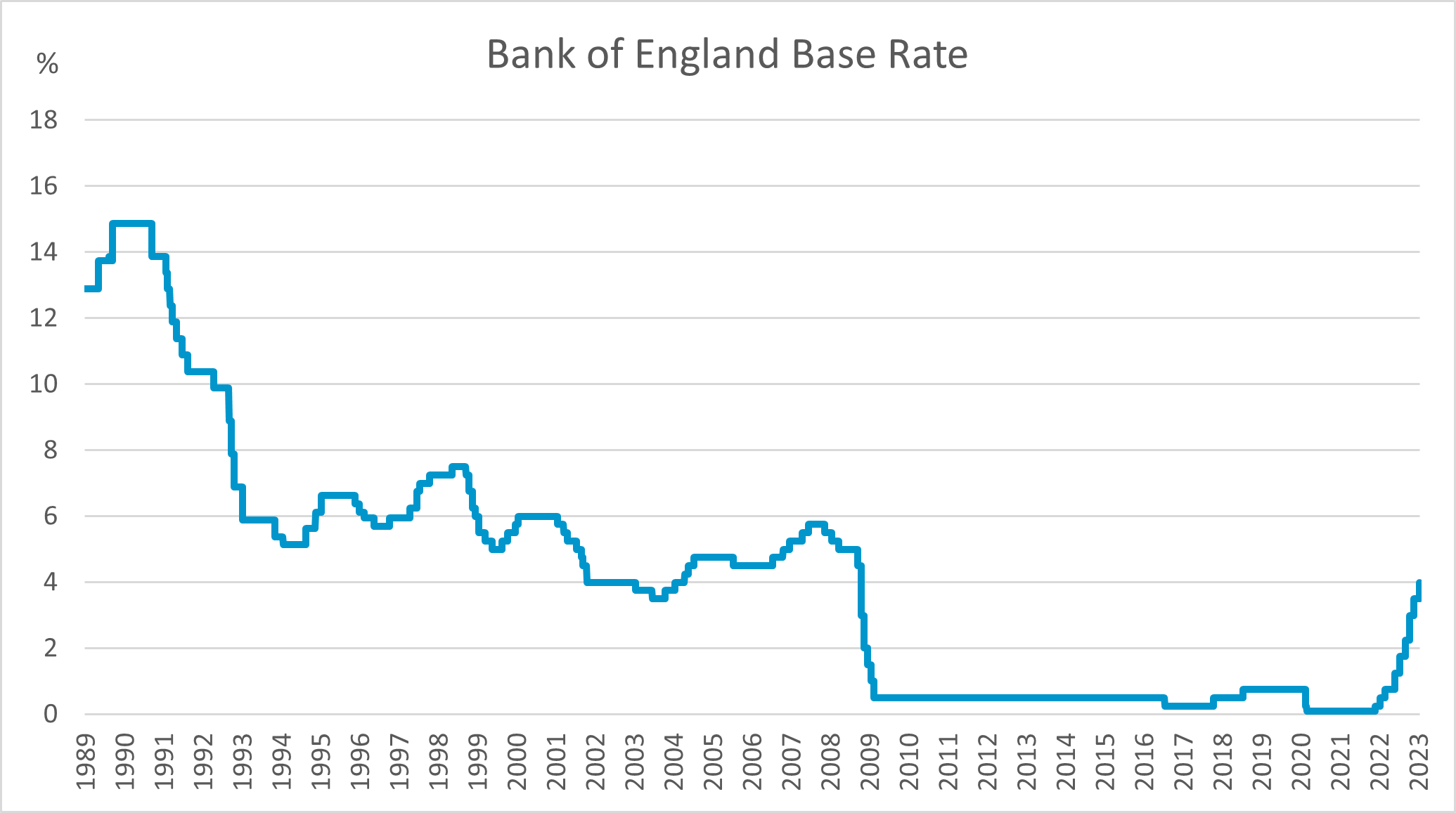

As central banks seek to get a grip on inflation their weapon of choice is interest rates. Rising interest rates are meant to reduce demand by encouraging saving and making borrowing more expensive. At the time of writing the Bank of England base rate stands at 4.0% and is expected to increase further. The increased rates are impacting different sectors of the financial services ecosystem in different ways:

Traditional high-street banks with sticky low-cost deposits are benefitting as they have been able to pass through only muted rate increases and have benefited from margin expansion. Banks without sticky deposits, notably those that compete on price, have had to pass through the increases in full at the same time as they see a reduction in lending volumes and are faring less well, but at least with both costs (deposits) and income (loans) being directly linked to interest rates the impact is somewhat evenly spread. This is not typically the case in the Buy Now Pay Later sector where costs are interest-related and going up whilst revenues are fixed. A lack of robustness in the pricing model is compounding regulatory challenges to the sector.

In responding to the higher rate environment, even those organizations that have benefited so far will need to up their game. For example, in the deposit industry the concept of customer price sensitivity is somewhat of a misnomer in that it indicates a single value at the customer level that does not vary over time. Research by Simon Kucher indicates that sensitivity drops away at interest rates of less than 0.5%. At that level deposit interest is worth so little to most consumers it’s just not worth thinking about. As interest rates rise and the total value of interest payments rises accordingly the importance to the customer increases and so does their rate sensitivity. In such an environment it becomes increasingly important to invest in analytical models and pricing tools regularly re-calibrated to market conditions. Understanding how minor changes in price (or competitor prices) affects volume in totality and between individual products in the portfolio becomes much more important. Also, the ability to model scenarios instantly and with a high degree of accuracy allows firms to optimize returns across their portfolio and respond swiftly and confidently to changes in the environment.

Consumer Duty

FCA regulated firms have until July to comply with the new Consumer Duty under which they are required to offer fair value in pricing. As a new piece of regulation, firms are wrestling with 2 questions:

- What constitutes fair value?

- How can they ensure they always provide it to their customers?

Defining fair value

The FCA defines fair value as a “reasonable relationship between the price a consumer pays for a product or service and the benefits they receive from it”. Although the FCA does provide guidance on factors that should be taken into consideration in defining fair value, firms have considerable discretion as to how they can do so in practice and there is no specific requirement to quantity non-monetary benefits. As a result it becomes a qualitative assessment. Such a result may be sufficient to ensure compliance, but we at Simon Kucher would urge firms to take a step further, beyond compliance and towards pricing excellence.

Assessing fair value is at the heart of our approach to pricing and we define it very simply; it’s whatever a customer says it is! More precisely, and more usefully, it’s a quantification of individual customer ‘willingness to pay’. In reality, measurement can be a little more complicated as self-reported values are not always reliable and values may have to be teased out using analytical techniques, simulations and behavioral observations. Nevertheless, the point remains the same – ‘value’ is in the eye of the beholder – it is customer centric – and it can and should be quantified. It is also not uniform; it varies from customer to customer.

Ensuring fair value

To ensure fair value the price charged must align with the value the customer places on the product or service as defined by their ‘willingness to pay’. In the illustration above that is represented by the ‘corridor of fairness’. Products to the left of the line are priced higher than ‘fair value’ and represent a risk of poor customer outcomes. Action must be taken to re-price or withdraw such products. Correspondingly products to the right are under-priced relative to ‘fair value’ and represent a missed commercial opportunity. If market conditions allow prices can potentially be increased.

Fairness is customer specific

* Assuming a fixed £2000 management fee and an 8% total annual return for investors

Once you accept that value is customer centric, you must also accept that each customer will place a slightly different value on a product or service and will have a different willingness to pay. It naturally follows that a fair price for one customer is not necessarily fair for another, even if the product or service being provided is identical.

For ease of illustration let’s take the example above of an investment portfolio where the value delivered is clearly monetary and easy to quantify. We assume that the investment provider can deliver an 8% annual return for investors and charges a minimum annual management fee of £2000 to cover advice, administration and portfolio reviews. The service provided to each customer is the same, but the value delivered differs dramatically. The customer investing £25,000 receives no annual return as all investment growth is swallowed up by fees, whereas the customer investing £1 million receives £78,000 with the fees swallowing up only 2.5% of the investment growth (0.2% of invested capital).

Whether the value is clearly monetary as in the investment example above or non-monetary, the implications and required actions are the same. Firms must understand how value differs across different customer segments, and either adjust prices, or where not economical to do so, exit customers.

Driving enterprise value

The examples above illustrate areas of concern, where the FCA is seeking to improve customer outcomes. Tackling them will come at a cost, so where firms seek only to comply with the regulation they will see a corresponding drop in profitability. There is, however, an opportunity for firms that embrace the principles of the Duty to recoup and potentially even exceed the costs with additional revenues. There are two main avenues through which they do so:

- Firstly, just as there are pockets of poor value, there are often areas where firms are not recovering as much of the value they create as they could. This can arise for many reasons, but it is usually only when firms really try to quantify that value, and understand how it differs across different customer segments, that they understand the issue and start to take the actions to properly capture it

- Secondly, by using customer willingness to pay as the measure of value, firms have a clear measure through which to guide and value innovation. Price is often considered only at the end of the innovation process as a consideration of how much can be charged for the new product or service. By using willingness to pay as a guide to which products to build and which features to add/remove, companies build products that better meet customer needs and attract premium prices. They create more value. Over time better commercial innovation leads to better growth.

Conclusion

In order to survive and thrive in 2023 and beyond financial services firms will need to improve their pricing capabilities. In particular they will need to:

- Review pricing metrics and develop and implement a regular price increase program to adapt to structurally higher rates of inflation

- Invest in analytical capabilities and pricing tools to better price deposits and loans and respond quickly and with confidence to interest rate changes

- Understand and quantify customer willingness to pay for different features, products and services, and use those insights to reprice products and focus innovation efforts.