In 2024, the footwear market faces a decline as consumers cut back on both essential and discretionary spending and inflation concerns persist. The average consumer is expected to reduce their footwear budget by approximately $35 in the next year – a more pronounced drop than the $20 decrease in apparel spending.

That said, many consumers – especially Generation Z and millennials – still want to buy shoes (and multiple pairs of shoes at that). However, they are becoming increasingly price-conscious, balking at even minor price increases and comparison-shopping to seek out the best deals. So what are the effective strategies, price discounts, or promotions that will attract consumers’ dollars in a challenging market?

Simon-Kucher's new report, “The Footwear Industry: Consumer Priorities & Industry Insights,” explores the current state of the footwear industry with a focus on consumer spending plans and price sensitivity in 2024.

See here for the full report and methodology.

Consumers are moderating their spending due to inflation concerns.

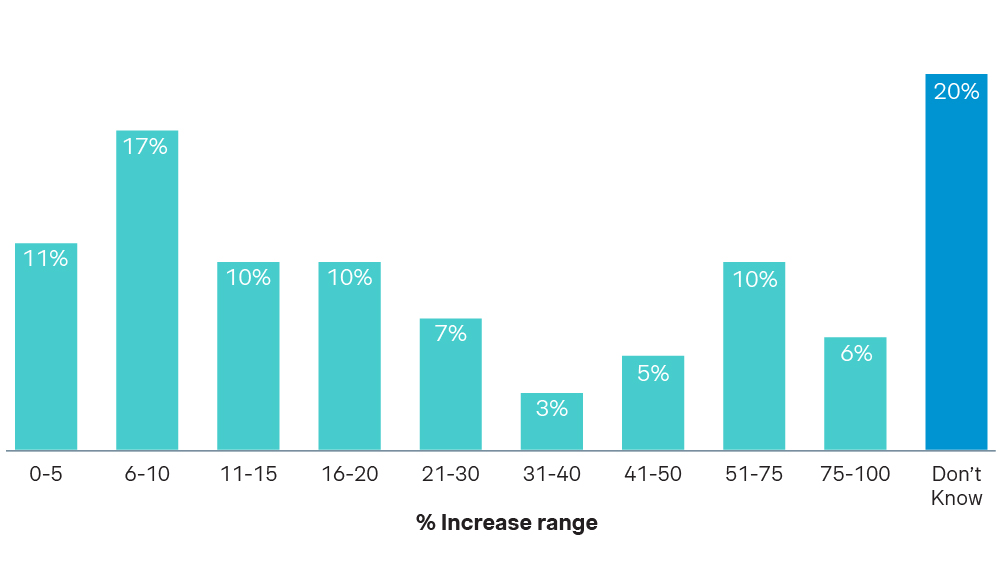

A large majority of consumers (80%) said they noticed price increases over the last 12 months. Of those who did, more than half (51%) said they noticed a price increase over 10%, including 31% who noticed a price increase over 20% and 16% who noticed an increase over 50%.

The average price increase noticed by consumers was ~30%.

However, the Consumer Price Index indicates just a 1.5% overall product price increase during the same time. This indicates that consumers are extremely sensitive to price inflation and may be noticing price increases where there are negligible increases, if any at all.

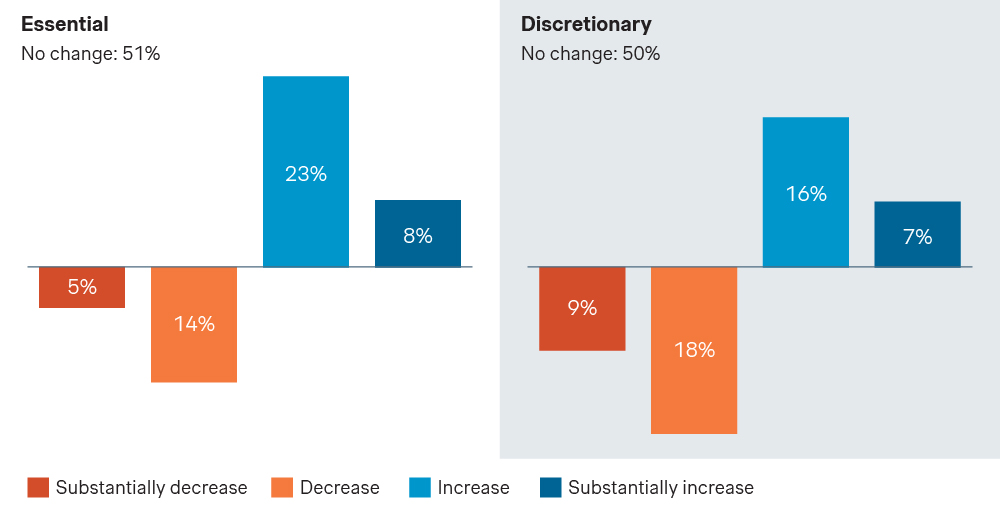

Consumers are cutting both discretionary and essential spending.

Overall, 27% of consumers plan to reduce their discretionary spending in the coming year while 23% plan to increase it; half of consumers (50%) don't plan to change their spending at all.

That said, Gen Z and millennial consumers plan to increase discretionary spending more than decrease it, whereas Gen X and older consumers plan to reduce it.

See more demographic insights here.

Top 10 Categories in Which Consumers Will Reduce Discretionary Spending:

- Dining out

- Clothing purchases

- Travel expenses

- Large purchases

- Out of home entertainment

- Holiday shopping

- Online subscriptions

- Streaming services

- Electronic upgrades

- Footwear purchases

Consumers are cutting footwear spend 3%.

Consumers are planning on buying fewer shoes in the coming year. The average number of pairs of shoes bought per household in the past year was 3.4, compared to an expected drop to 3.3, a reduction of ~3%.

The median budget for footwear is expected to decrease by $35 per consumer in the next 12 months, compared to the median budget for apparel, which is expected to decrease by $20.

Unsurprisingly, consumers are paying increasingly more attention to price. In fact, consumers name price as the second most important criterion for purchasing footwear, after fit/comfort.

Learn more about consumer footwear preferences in 2024 here.

Most consumers will spend less and buy fewer shoes, but a small segment of consumers is dedicated to their footwear budget.

While roughly 20% of consumers do not plan to change their footwear budgets, the majority will make some changes over the next 12 months:

- Invest: More than 1 in 4 consumers (26%) will buy fewer pairs but still increase spending

- Save: A similar amount of consumers (24%) will buy fewer pairs and also spend less on them

- Find deals: 20% of shoppers want more shoes, but will spend less per pair

- Buy, buy, buy: Still about 1 in 10 consumers (11%) will buy more pairs of shoes and increase their spending.

How Consumers Seek Deals in Today’s Economy

No more price hikes. 70% of consumers would change their purchase decision when faced with a 5% price increase, and 85% would change their purchase decision when faced with a 10% price increase. So how do they seek a better deal?

Price comparison

Over 90% of consumers compare at least 2 different stores or websites. On average, consumers visit 3.7 stores and/or websites before making a purchase and they often compare prices from sources from which they do not plan to purchase.

Among Gen Z consumers, ~50% compare 4 or more stores.

Discount expectations

On average, consumers expect a 33% discount during a promotion. Three in four consumers (76%) expect a discount of over 10%, and more than half of consumers (54%) expect 20% or more off retail prices. Some consumers still have higher expectations; 14% of consumers expect a discount of over 50%.

Promotional events

Many consumers are always on the lookout for the next deal day around the corner. Black Friday and Amazon Prime Day are the most anticipated sales of the year, while other “holiday season” sales remain top of mind for a majority of consumers.

Top holidays consumers anticipate for the best sales:

- Black Friday – 75%

- *Amazon Prime Day – 64%

- *Cyber Monday – 56%

- Christmas / Hanukkah – 54%

- Back-to-school – 49%

- Memorial Day – 47%

- Labor Day – 45%

- Fourth of July – 43%

- Tax Refund Day – 37%

- New Years – 27%

*Online-specific event

Note that 2 out of the top 3 sales are online-specific (Amazon Prime Day and Cyber Monday) and 3 out of the top 4 sales are around the holiday season.

Driving Sales in a Declining Footwear Market

As we navigate the declining footwear market in 2024, understanding the dynamics of discount depth, key promotion periods, and multi-channel visibility is crucial for capturing consumer interest and driving sales.

Discount Depth: With price being a top buying criterion, the depth of discounts will play a pivotal role in converting consumer interest into purchases. The average expected discount depth is 33%, indicating that significant price reductions will be necessary to attract budget-conscious buyers who are comparison shopping more than ever.

Key Promotion Periods: Rising list prices across various sectors are pushing consumers to seek out promotions, particularly for discretionary categories like footwear. Online-specific sales events, such as Cyber Monday and Amazon Prime Day during the holiday season, are anticipated to be the busiest times for consumers hunting for deals. These periods will be critical for retailers to maximize their promotional impact and drive sales.

Multi-Channel Visibility: Consumers are increasingly using multiple channels for price comparison and making final purchase decisions. Brands must ensure their visibility across both online and offline platforms. Fast, and preferably free, shipping is essential in online sales; brands that fail to deliver promptly risk losing customers to competitors who can meet these expectations.

By strategically leveraging comprehensive strategies across pricing, merchandising and marketing – and being keenly aware of critical shopping seasons – footwear brands can better navigate the challenges of a declining market and meet the evolving needs of today's price-sensitive consumers.