Heightened budget pressure, increasing competitions and ongoing fine-tuning of the value rating system: NRDL gets tougher this year.

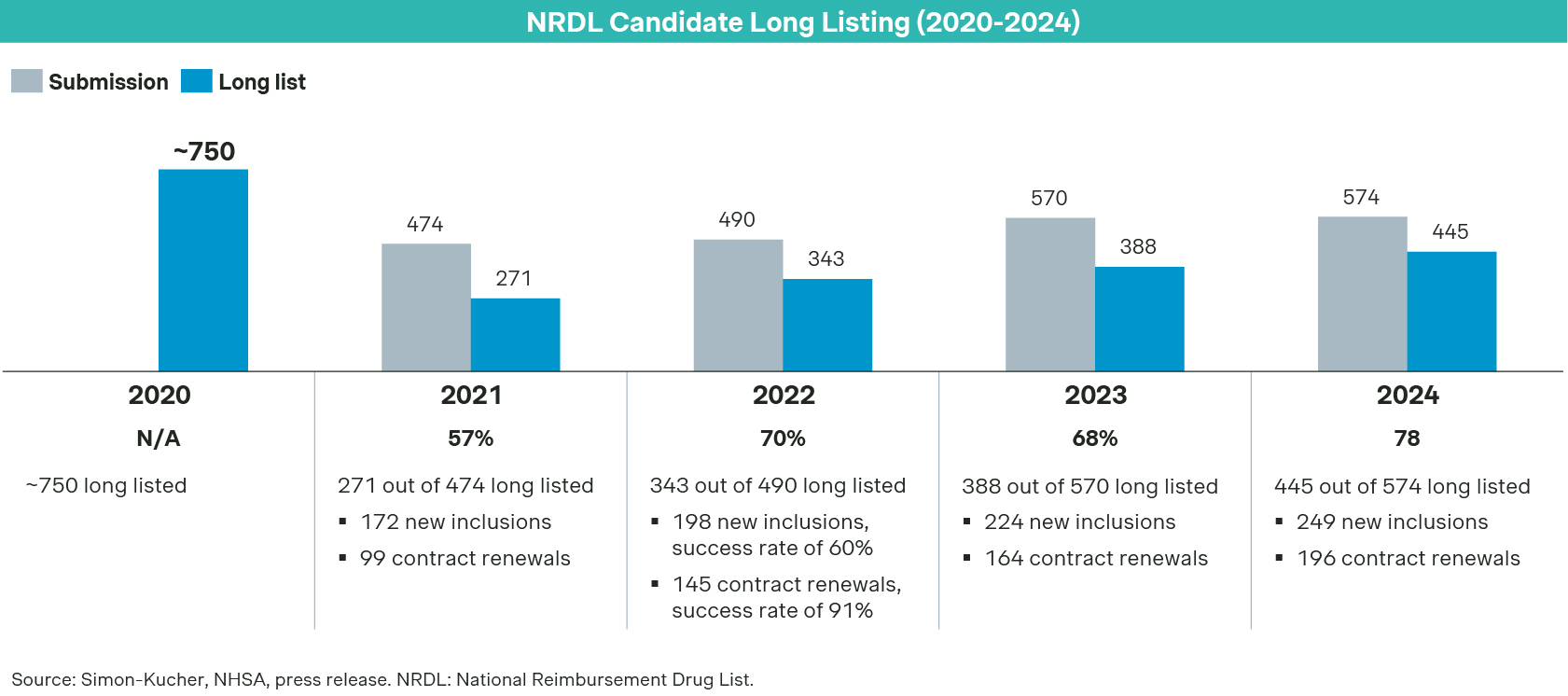

2024 NRDL has been unfolding very much as planned: A total of 574 drug candidates went into the National Reimbursement Drug List (NRDL) formal review process in June, and 445 of them passed the formal review in August, a record high since 2021. Among those, 249 are seeking their initial listing, while 196 are up for renewal or re-negotiations.

It will not be a smooth ride for all to make it to the final though, given the heightened budget pressure, increasing competition and ongoing fine-tuning of the listing criteria, including the value rating system introduced last year. The first revelation came in September after tallying the outcomes of expert review process, as less than half of those seeking initial listing made it to the shortlist for negotiation, compared to 64% in 2023 and 67% in 2022.

Oncology will see stiff competitions across non-small cell lung cancer (NSCLC), cervical cancer and breast cancer, and strategic decisions on positioning and comparator choices will be key.

- Merck KGaA’s Tepmetko, Novartis’ Tabrecta and Avistone’s bozitinib are all indicated for NSCLC with MET exon14 mutations. All three have proposed NRDL-listed glumetinib as their comparator, while striving to highlight their respective differentiations: Tepmetko aka tepotinib emphasizes its outcomes in Asian populations, Tabrecta aka capmatinib focuses on its strengths against brain metastases, while bozitinib highlights its efficacy for glioblastoma besides NSCLC, as well as its positioning as an indigenous innovation.

- Cervical cancer has suddenly become a contested field for this year’s NRDL. Akesobio’s bi-specific antibody cadonilimab had a great run in China’s self-pay market and is now pivoting for NRDL as an indigenous innovation. CSPC’s enlonstobart and Gloria Biosciences’s zimberelimab jumped into the fray after receiving regulatory approvals just in time, that may also go to explain the elements of surprise in their dossiers, including some unusual comparator choices that defy conventional wisdom.

- Enhertu failed its last NRDL attempt targeting second-line HER2 positive breast cancer, and returns this year with a new HER2-low breast cancer indication which may translate into more budget impact and pricing pressure. Meanwhile, Roche seeks to list the subcutaneous injection for the fixed-dose combination of pertuzumab and trastuzumab citing the convenience benefits and saving of healthcare resources, aiming to replicate its success with subcutaneous trasuzumab listing last year.

- In B-cell acute lymphoblastic leukemia, both Pfizer’s Besponsa and Amgen-Beigene’s Blincyto are making comebacks. Besponsa restated allogeneic hematopoietic stem cell transplantation (AHSCT) as its comparator, while Blincyto insisted on its stand of “no comparator”. Different from last year though, both are emphasizing limited treatment cycles as demonstrated in real-world evidence to pre-empt budget impact concern. Polivy went one step further in that regard, highlighting its recent amendment to China regulatory label which limits the treatment duration to less than 6 cycles for both first-line and relapsed and refractory DLBCL patients, an unusual move to improve its chance for NRDL listing.

Immunology represents another much-watch field with both new stars and old rivalries.

- Nefecon appears to be a rising star in IgA nephrology. With formulation innovations and positive clinical outcomes, it was granted Breakthrough Therapy Designation and Priority Review by CDE. How that would fare with NHSA now becomes the all-important question.

- Rezurock from Sanofi highlighted its innovative mechanism as the only ROCK2 inhibitor approved for chronic graft-versus-host disease (cGvHD) globally, further complemented by the real world evidence from its Hainan Bo’ao early access program.

- Sotyktu emphasized its innovativeness as the first and only approved TYK2 inhibitor globally, and the status as Class 1 innovative drug in China. As a small molecule, its choice of a biologic drug Stelara as comparator may be seen as bold but not unreasonable, as it cites a similar mechanism of action while positioning as a breakthrough for the NRDL value rating.

Small molecules and biologics will also duke it out in neurology, an area with significant but much under-recognized unmet needs in China.

- Nurtec emphasized its benefits as an oral small molecule in its value dossier. Compared to the proposed comparator rizatriptan, Nurtec highlighted advantages of its innovative formulation, fast onset, and convenience, arguing that better adherence would translate into better migraine control and patient outcomes.

- Emgality took a different approach, with its positioning as a preventative migraine treatment. As a long-acting injectable biologic, the benefit of once-monthly dosing was highlighted, together with evidence showing that prefilled injections are easy to use with good patient experience.

Rare disease is another area with high interest, with over 30 candidates for new NRDL listing.

- Among the new faces are Iptacopan which positions itself as a breakthrough, and highlighting superior efficacy over eculizumab, as well as tafamidis meglumine for ATTR-PN and tunlametinib for NRAS melanoma, both small indications with significant unmet needs.

- Over 10 rare disease drugs that failed last year are giving NRDL another try, including BeiGene’s dinutuximab for neuroblastoma and Takeda’s Vpriv for type 1 Gaucher disease. Tweaking its approach, Takeda chose to focus on seeking NRDL coverage for pediatric patients this time around, to proactively manage payer concerns on annual cost and budget impact.

Pressure will be palpable for NRDL contract renewal as well, with around 40 candidates up for potential re-negotiations instead of simple renewal pathway, which is typically preferred for more predictability.

- In immunology, for example, Rinvoq is seeking indication expansions into non-radiographic axial spondylarthritis (nr-axSpA) and ankylosing spondylitis (AS), while the AS leading player Cosentyx proposed Rinvoq as a comparator for its indication expansion to PsA. Dupixent seeks to expand into asthma and nodular prurigo (PN) this year, and proposed omalizumab as comparator while highlighting the advantage of its dual-target mechanism and incorporating indirect comparison and real-world data. With more follow-on indications on the horizon and the competitive landscape fast evolving for these superstars, many are holding their breaths for the outcomes from re-negotiations this year around.

2024 NRDL in China will continue to see recurring themes and ongoing fine-tuning, including the value rating system introduced last year. At the same time, with the increasing competitions and budget pressure, articulating clear messages, preparing convincing data, and pre-empting payer concerns will be ever more important for NRDL success this year around.

Reach out to our life sciences experts for more information.

Thanks to contributions by Duo Xu!

Better Market Access

The role of better market access is to remove any hurdle that prevents or hinders patients from receiving available treatments. In the right place, and at the right time.

Today, the impact of market access spans clinical development, regional commercial activities, patient engagement, and post-launch compliance. Yet, for many pharmaceutical companies, planning for commercialization only truly begins when a drug has been submitted for approval — far too late in the process.

Get to know our insights on local trends, regional and global developments and global to local excellence.