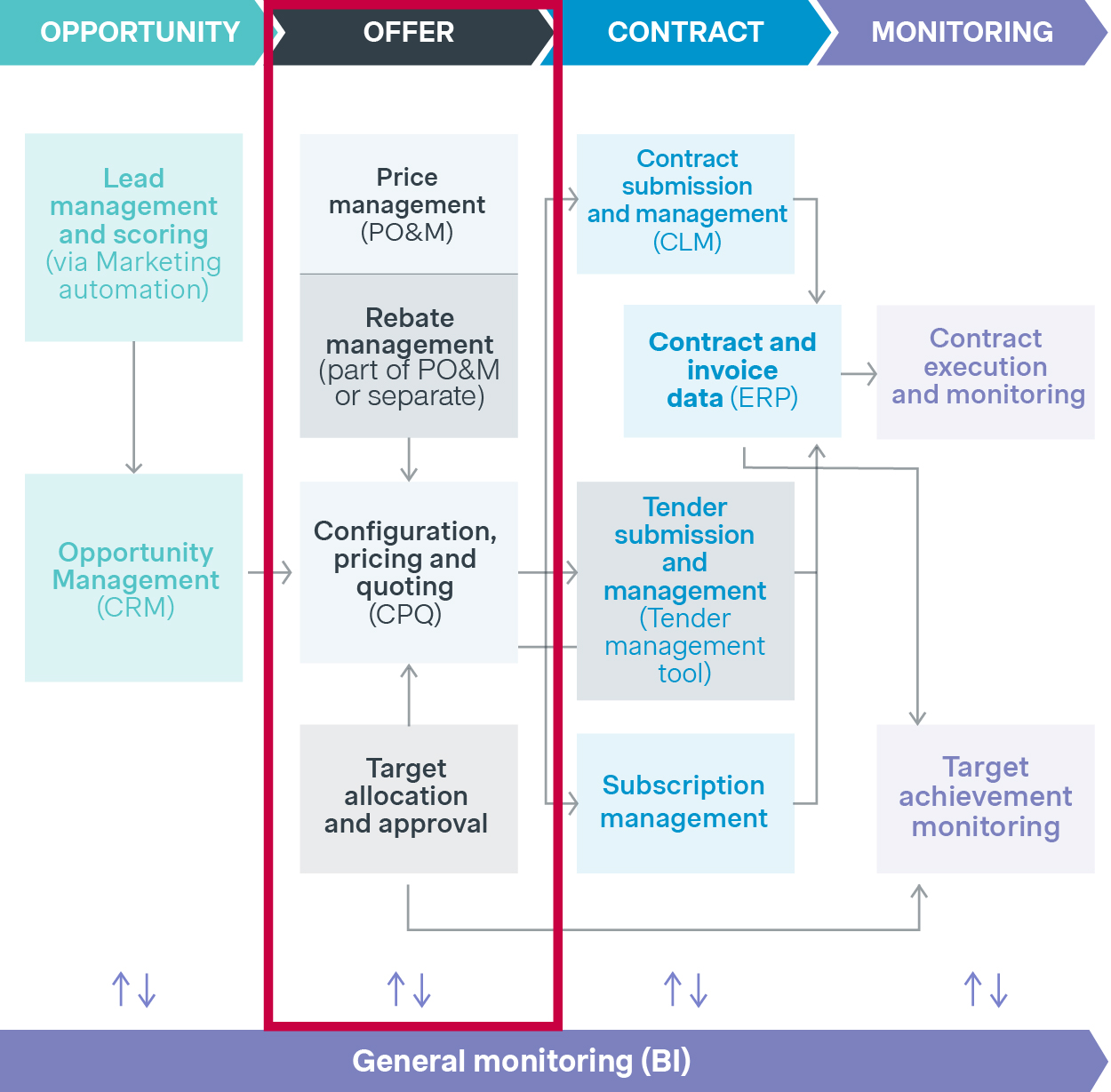

In March, we initiated our new insights series called "Embracing end-to-end revenue management in medtech and diagnostics." Our introductory blog discussed the importance of Revenue Management Systems (RMS) for medtech and diagnostics companies aiming to adapt to economic fluctuations and achieve commercial excellence. The next article in the series shed light on the importance of lead and opportunity management. The third chapter deeps dive into the second of the four pillars of our RMS framework—offer and quote management.

Offering and quoting are the linchpins in the Revenue Management Systems (RMS) journey, bridging the gap between potential opportunities and realized revenue. By aligning offer and pricing strategies with the market reality, organizations can achieve greater implementation excellence and measurable financial impact.

Figure 1: E2E revenue management framework

Why is strategic offer and quote management so important?

The ability to accurately quote prices can make or break a medtech and diagnostics company's profitability. However, despite significant efforts to digitalize the revenue management process, offering and quoting remains the least digitized pillar. Historically, a decentralized quoting approach has supported agile growth and met diverse local market needs. Yet, with increasing market transparency and digitalization, this approach now poses significant challenges for end-to-end revenue management. Several key issues contribute to this complexity:

No global price management model: Countries and business units lack a common understanding on terminology, price points, and governance.

Informal/decentralized pricing ownership: Knowledge and decision-making are localized with limited structural insights elevated to central layers.

Process & methodology inconsistencies: Price setting and execution approaches vary widely and often depend on market-specific capabilities.

Historically driven price lists: Product and portfolio positioning based on outdated cost levels and reimbursement thresholds lacking structural maintenance and steering.

Unsystematic approval processes: Deal escalations beyond the country level lack data-driven insights to inform decision-making.

Poor data access and documentation: Limited data capture during quoting process results in reliance on anecdotal evidence.

Limited system support & shadow IT: Outdated tools, such as Excel solutions, lack integration, hampering scalability and modernization.

These challenges, coupled with rising customer expectations on transparency, speed, and convenience, underscore the need for structural transformation. Unfortunately, most companies fail to address the issues comprehensively, often mis-allocating significant resources. Based on our experience, companies typically approach this in two ways:

IT-first implementation

Companies invest in off-the-shelf solutions, such as CPQ or PO&M tools, but face challenges in adapting commercial models to fit these systems. This results in ad hoc market tailoring, delays, underwhelming value realization.

Project-based implementation

Isolated projects focusing on specific countries or business units generate short-term organisational buy in and quick wins. However, they lack an E2E perspective, overlook systems and data integration, and fail to scale beyond the pilot phases.

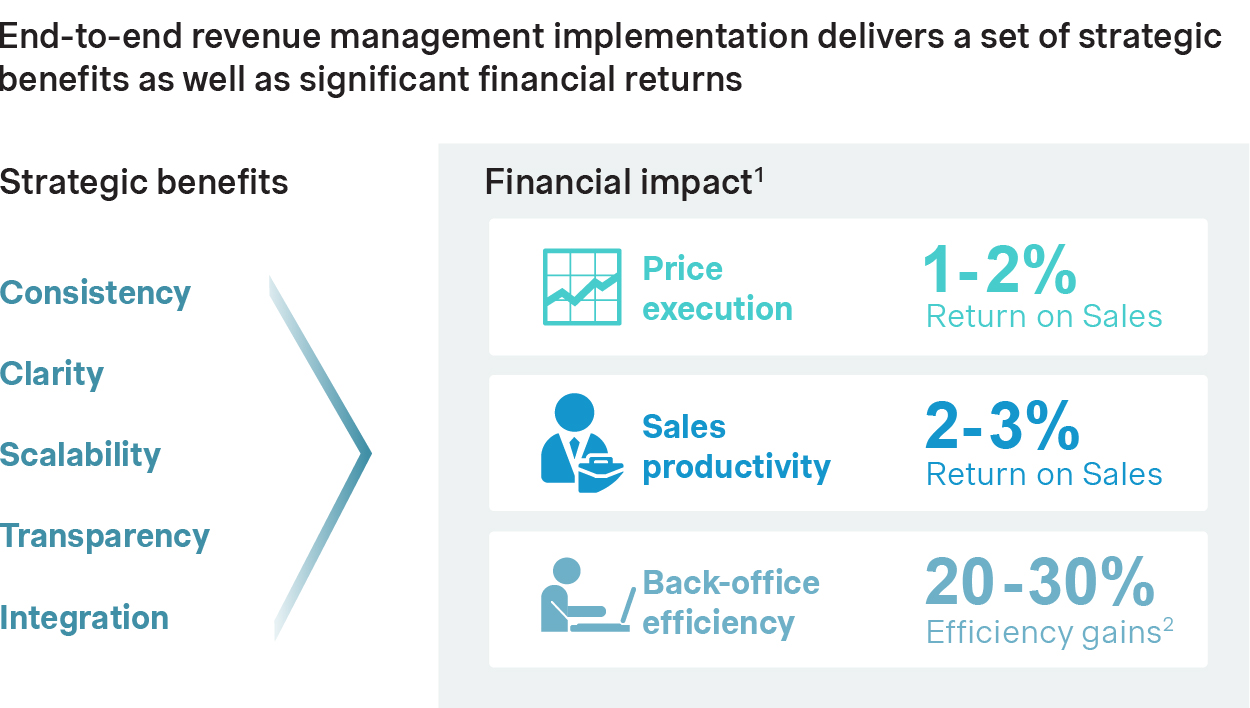

Our experience shows that many companies invest between €5 million and €50+ million in these efforts. Yet, they often fall short of creating scalable and integrated offer and quote management solutions. For those medtech and diagnostics companies that succeed, addressing these challenges presents a unique opportunity to achieve substantial strategic and financial advantages.

Figure 2: Expected benefits linked to successfully deploying the end-to-end (E2E) offering and quoting pillar

How can these benefits be achieved?

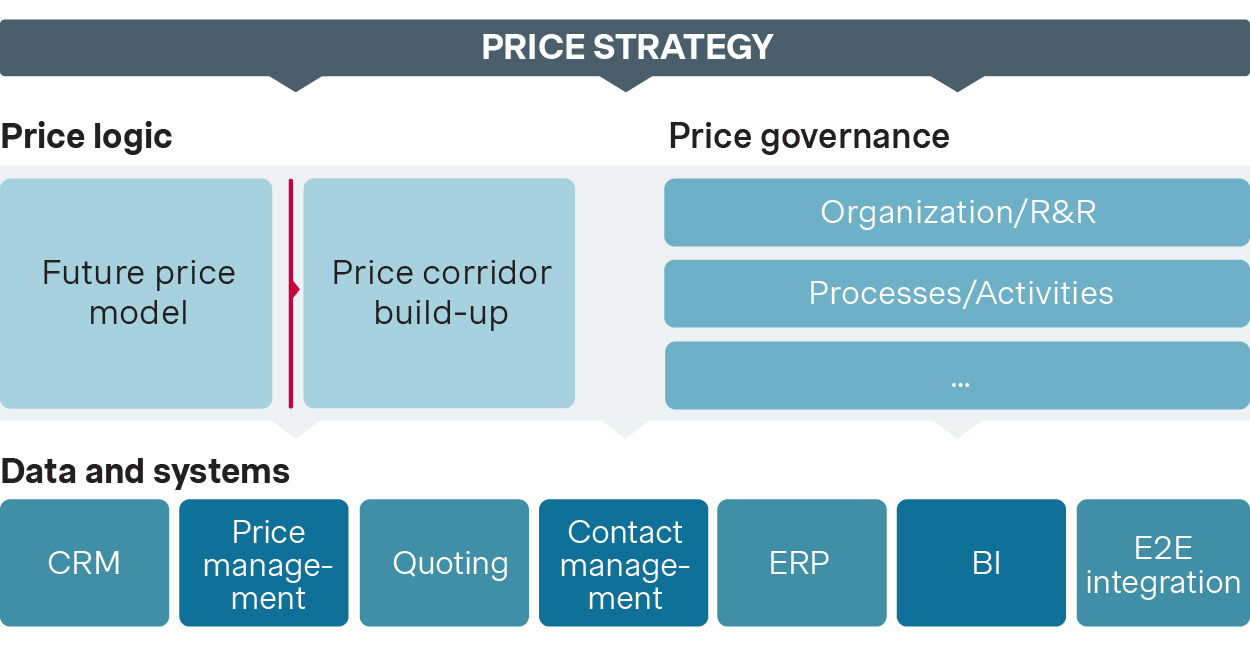

For lasting change, medtech and diagnostics companies need to adopt an integrated, end-to-end approach to price management. This perspective harmonizes pricing across business units, markets, countries, and the global HQ view, while allowing for local flexibility. End-to-end price management hinges on four cornerstones: price strategy, logic, governance, and data & systems. This structured framework has been successfully implemented in globally leading medtech and diagnostics companies.

The key to success lies in both the right content in each of these cornerstones but also in tackling them in the right order. The process beings with defining (or updating) the price strategy, which serves as the foundation for subsequent phases. This strategy establishes guiding principles that inform the development of a suitable price logic, ensuring consistency in pricing decisions. Simultaneously, establishing robust price governance ensures that the price logic can be implemented, setting the framework for decision-making and accountability Finally, the focus shifts to data and systems, operationalizing abstract concepts by embedding them in the IT architecture and integration them into daily operations. These systems enable pricing managers, salespeople, and other employees to implement offer and quote management effectively.

Importantly, this is not a one-off "set and forget" solution. Companies must continuously evaluate outcomes, refine strategies, and feed information back into the quoting process.

Figure 3: Visualization of end-to-end (E2E) offering and quoting concept

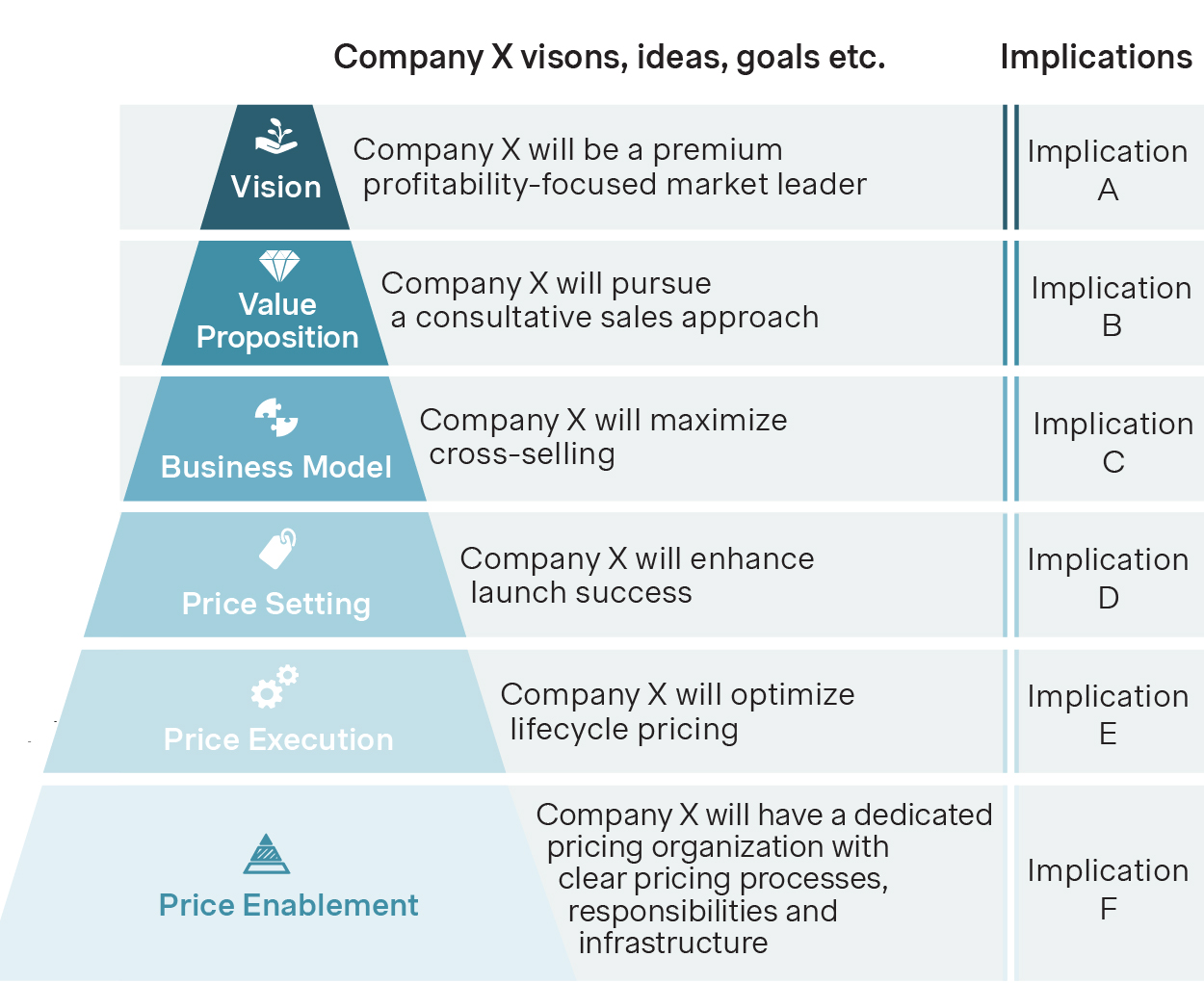

Price strategy

A price strategy serves as the foundational document that defines key elements guiding a company's approach to pricing. It begins with a vision that defines the company's goals and ultimate objectives. The value proposition and business model then detail how this vision can be achieved, followed by steps to bring the value proposition to the market. At this level, the strategy provides a high-level guidance rather than specifying granular business models or processes.

For example, a pricing strategy does not prescribe how to set prices for every product but offers overarching guidance, such as " follow competitor's pricing." This guidance informs both price logic (e.g., defining how to monitor and match competitor prices) and governance (e.g., establishing processes to get competitor price data and apply it to the company's pricing framework).

It's important to emphasize that the elements shown in Figure 1: Exemplary pricing strategy framework with six elements defined are not set in stone and can be adjusted to a concrete situation and a concrete company.

Figure 4: Exemplary pricing strategy framework with six elements defined

Uniformity in strategy helps to achieve scale, but this should not come at the expense of meeting local market requirements and customer expectations. Translating pricing strategy into logic, governance, and data systems requires a nuanced approach that accounts for diverse market conditions.

Pricing and quoting requirements vary significantly based on factors like sales channels, end-customers, and the nature of the product—whether consumables, capital equipment, or solutions. For example, consumable products often involve volume-based discounts, capital equipment requires sophisticated configuration capabilities, and solution selling demands a unique pricing and quoting approach. These variations necessitate adapting pricing strategies to different market archetypes, defined by the interplay between product categories and market characteristics.

Similarly, there is no one-size-fits-all software solution on the market. Different needs and requirements often insist on configured or adapted software solutions for specific product types and markets. As a result, an effective overall solution may involve multiple software systems, each tailored to cover different combinations of product types and markets, i.e., archetypes.

Figure 5: Product/market archetyping approach

Figure 5: Product/market archetyping approach

An archetype standardizes entities with shared characteristics and behaviors, enabling similar pricing logic, processes, and governance to be applied effectively. For example, indirect and tender markets generally have distinct approaches to pricing logic and governance. A system designed for tender markets can cater to all product types, as their pricing approaches share commonalities.

By defining and differentiating archetypes in this way, companies create comprehensive, effective pricing strategies that adapt to varied market and product dynamics.

Pricing logic

Once the strategic intent is established and the market landscape defined, the focus shifts to two core elements of pricing: the management of pricing models and the management of price corridor.

Pricing models: Many medtech and diagnostics companies are exploring innovative business models, often requiring new pricing approaches. These pricing models aim to charge for offerings in new ways, requiring companies to think beyond current structures and consider long-term adaptability. For instance, businesses should consider the share of risk-sharing, per-patient pricing, or per-reportable result pricing in their revenue mix over the next 3 to 10 years.

Too often, pricing models are developed in isolation without considering a link to a standard cash-sale which creates gaps in the overall price logic. To ensure consistency, simplicity, and scalability in the E2E process, each price model should be "apples-to-apples" comparable with the cash-sale baseline. This level of consistency allows medtech and diagnostics companies to offer and quote any deal with all relevant pricing models. This provides customer and business flexibility not constrained by system complexity and supports future analytics and seamless deal comparison.

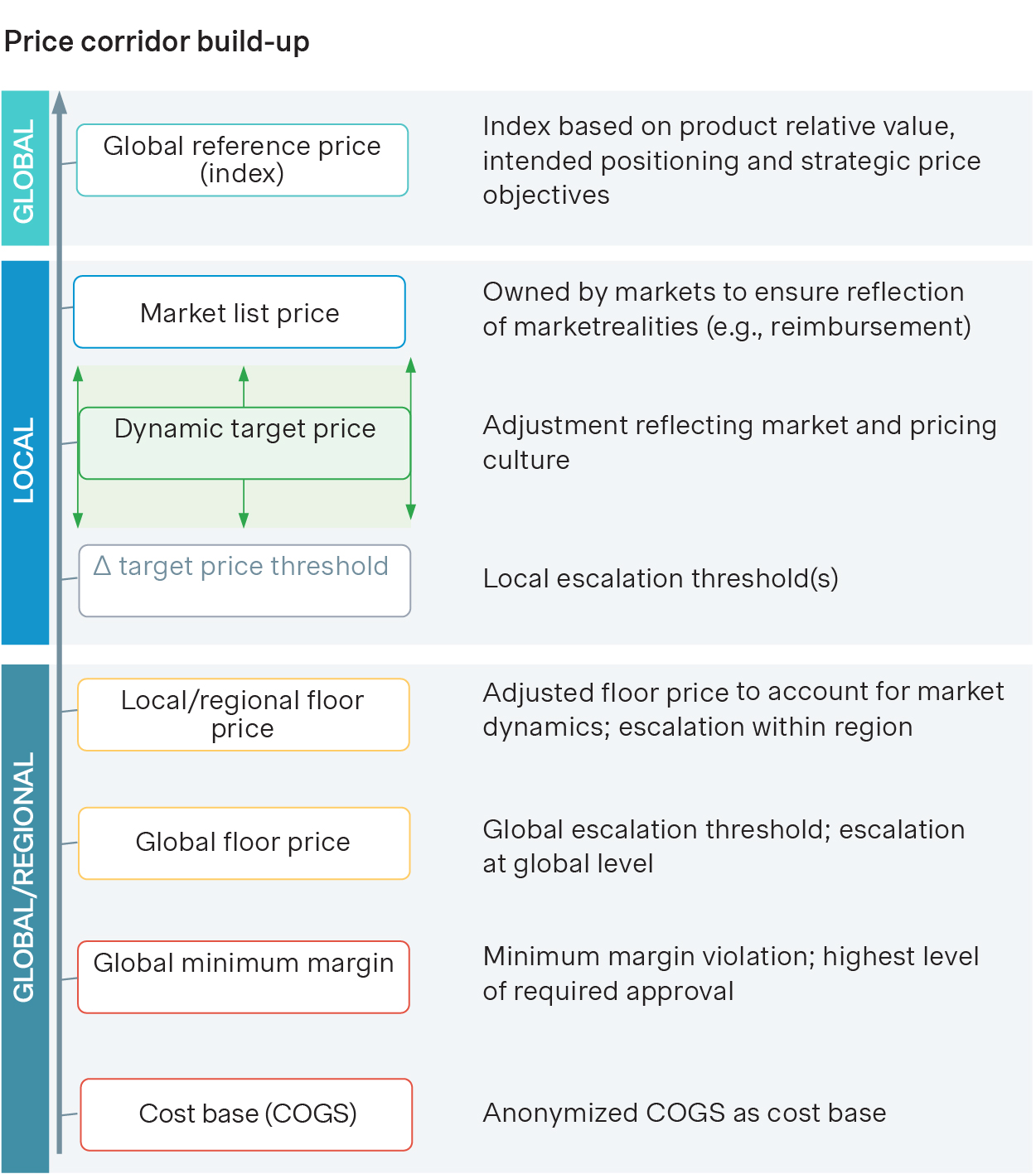

Figure 6: Project example of price corridor build-up

Price corridors: In the current environment, this second component of price logic often remains managed by the local markets with minimal alignment beyond fulfilling floor price and escalation thresholds. This decentralization poses challenges when implementing uniform offer and quote management solutions. Building an effective price corridor involves standardizing terminology, such as list prices, floor prices, and escalation levels, establishing consistent pricing approaches, whether it be list-minus-discount or net pricing. A robust calculation logic ensures clarity across the organization, reducing confusion and aiding easier system integration.

The complexity of price models and price corridors directly impacts system requirements. Simplified, consistent pricing logic across countries and business units reduces system complexity, making implementation and maintenance easier. Conversely, complex models and varied corridors necessitate advanced, often custom-built systems, increasing risk, cost, and implementation time. For non-essential cases, simpler tools like Excel suffice, avoiding investments in customization.

Market landscaping, defined during the pricing strategy phase, directly informs the development of the price corridor. This ensures alignment between both cornerstones of end-to-end price management while preserving the flexibility to address local market needs. Market landscaping plays a crucial role in shaping the price corridor to utilize the smallest common denominator between markets without sacrificing local requirements.

For example, we supported a leading medtech company in streamlining their complex pricing structure. Initially, they were managing ~100 distinct combinations across five business units and 20 markets. By applying a refined market landscaping analysis, we helped them transition to a simplified model built around several pricing archetypes.

This significantly improved their operational efficiency, reduced complexity, and enabled more agile decision-making, all while accommodating market-specific flexibility. This simplified framework also improved resource allocation and accelerated go-to-market timelines.

Price governance

While price logic defines the models and methods for constructing prices, price governance establishes the framework that allows a company to implement these prices towards customers. Price governance typically outlines the necessary pricing organization, its placement within the company, and the roles needed for success. Many medtech and diagnostics companies face the challenge of unclear ownership, often answering the question, "Who owns price management?" with "no one really owns price" or "it is not clear to me."

This ambiguity often stems from poorly defined roles and responsibilities that are not aligned to the price logic. Companies using a structured price logic can delineate responsibilities across three dimensions: price steering (holistic), price setting (product-level), and price execution (customer-level). There is no one-size-fits-all model for price governance, but establishing transparency in pricing decision-making is crucial. Clearly defined responsibilities, processes, and aligned incentives empower efficient approvals and effective price management.

Pricing and quoting processes, especially is global industries like healthcare, are often resource-intensive, inefficient, and complex due to large-scale tenders and intricate contracting modalities. We have found multiple use cases for using Generative AI to automate and optimize these processes across industries.

For instance, Simon-Kucher has recently helped a major oil and gas client improve tender request evaluation efficiency by 30-40%. Learn more about this use case in our article.

Once the ownership is defined, robust processes become the backbone of effective pricing governance. These processes standardize workflows, ensuring pricing strategies and logic are consistently applied across the organization. From price setting to deal execution and monitoring, standardization reduces errors and ensures pricing decisions align with governance structures.

Embedding these processes into daily operations increases transparency, accountability, and agility, driving better alignment with broader business objectives.

Figure 7: Example of pricing areas of responsibility mapped across organization

Figure 7: Example of pricing areas of responsibility mapped across organization

A common challenge arises from disparate teams managing pricing and quoting, often leading to misaligned priorities. For instance, global and local teams might have different perspectives, resulting in suboptimal outcomes. Establishing clear roles and responsibilities ensures everyone understands their part in the pricing process, fostering coherence and efficiency. Aligning organizational structures with well-defined processes creates clarity and efficiency across the board.

An often-overlooked aspect of price governance is incentives. Even with an optimal price strategy, logic, and responsibilities, misaligned incentives can derail pricing success. Since sales teams typically handle quoting, their incentives must encourage optimal pricing. Clear and meaningful incentives ensure sales teams are motivated to achieve the best possible pricing outcomes.

Systems

Achieving end-to-end offer and quote management excellence culminates in the operationalization of pricing within IT systems. This phase is critical because only through the seamless integration of all four foundational elements—strategy, logic, governance, and systems—can true end-to-end price management be realized. The proper order of implementation is just as important as the content: strategy must guide logic and governance, which then determine the system capabilities. Only then can functional requirements for IT systems be accurately articulated.

A phased approach ensures smoother technology implementation. Completing work on strategy, logic, and governance before eliciting and documenting system requirements prevents confusion and delay. Streamlined organizations, with clearly defined roles, responsibilities, and processes, are better equipped to adopt new tools without being hindered by endless discussions, process redefinitions, or shifting accountabilities. A strong PMO, both for business processes and implementation, is vital to avoid costly missteps. Lack of robust governance often leads to failed implementations, forcing organizations to redo their systems to fix foundational issues. Furthermore, a solid governance framework is necessary to ensure ongoing maintenance of tools, keeping price logic aligned with the business's evolving needs.

Once strategy, logic, and governance are in place, theoretical concepts must be translated into actionable software requirements and solution designs. This process, akin to translating ideas into a structured language, is often underestimated but vital. Proper translation ensures that the system aligns with the organization's pricing strategy and addresses specific needs.

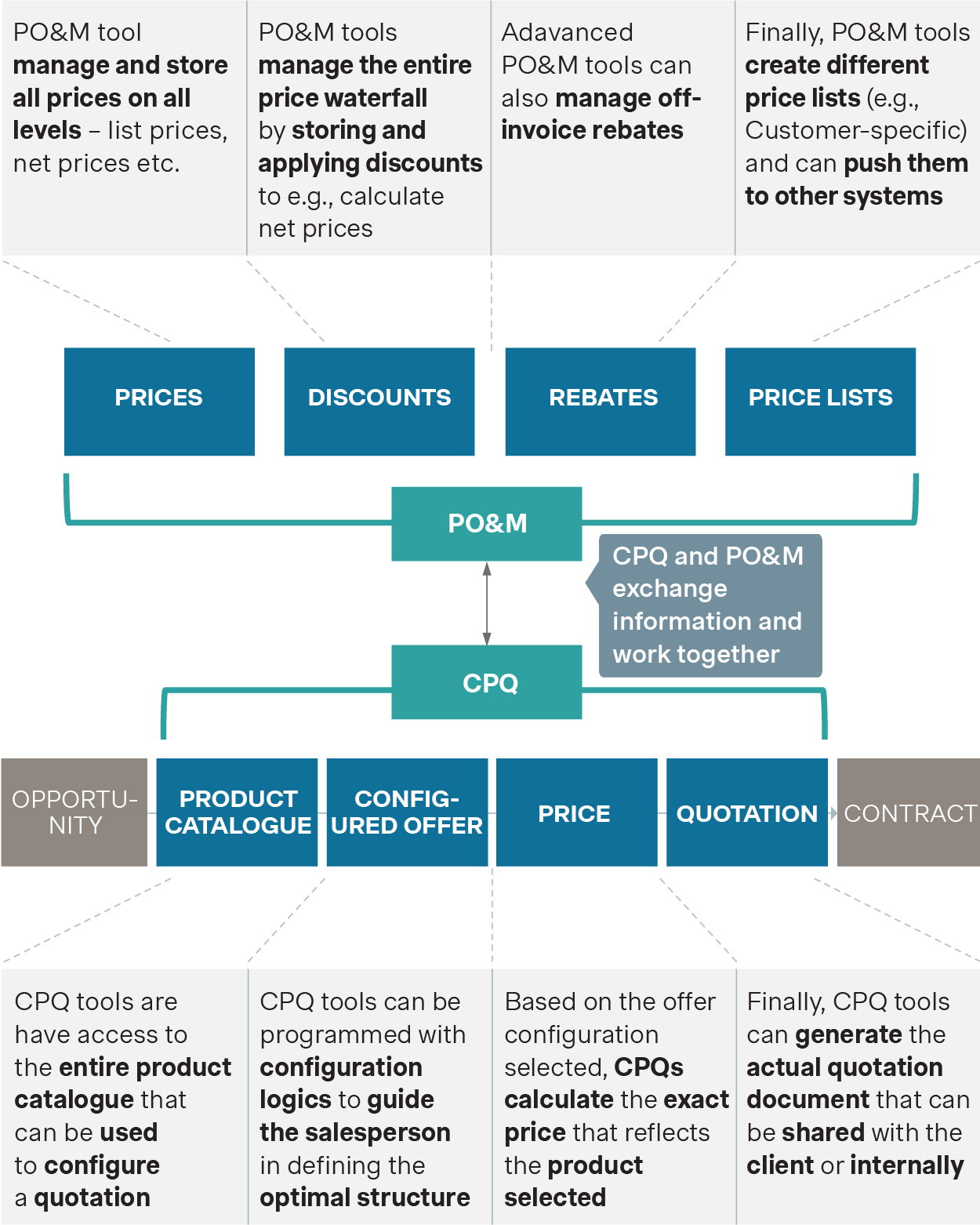

At the heart of price management are the systems that support it, such as Price Optimization and Management (PO&M) and Configure, Price, Quote (CPQ) software.

Figure 8: Typical PO&M and CPQ software capabilities

While these systems are often viewed as solutions to pricing challenges, their success depends entirely on the groundwork laid in strategy, logic, and governance. Systems must follow strategy—never the other way around. Without a clearly defined pricing strategy, it becomes difficult to identify business requirements, leading to frequent changes and resource-intensive implementations. Additionally, misaligned strategy, logic, and governance across an organization require extensive CPQ customization to accommodate varying local approaches. This not only complicates implementation but could result in a system that cannot adequately handle all the organization's requirements.

Lastly, a successful system implementation depends on engaging key stakeholders, such as sales teams, during the requirements definition and solution design phases. Their expertise ensures that the systems are aligned with the pricing strategy and address the organization's unique needs, fostering a successful and sustainable implementation.

For further insights on software implementation, refer to our article from Simon-Kucher Engine on launching pricing software successfully.

Summary

Implementing an end-to-end (E2E) offer and quote management solution requires a holistic approach that balances scalability with local market needs. Critical trade-off decisions must focus on identifying the smallest common denominator rather than focusing on differences, allowing businesses to build a flexible platform tailored to specific archetypes.

This strong foundation ensures business requirements can be accurately derived, enabling the selection and implementation of a system that fully supports organizational goals. Selecting the right software solution is complex, as there is no one-size-fits-all solution. Companies must evaluate whether a single software or multiple integrated solutions best suit their needs. A business-first approach minimizes implementation risks and ensures that the selected solution effectively drives pricing excellence.

Post-implementation, continuous measurement, analysis, and monitoring are essential to refine strategy, logic, governance, and systems. This ongoing process helps companies align with evolving needs, sustain value, and achieve long-term pricing success.

Contact us to explore more offer and quote management best practices and learn how Simon-Kucher can optimize your revenue management for sustainable growth.

Stay tuned for more on RMS.