Navigating Challenges and Opportunities in the Plastic Recycling Market

The plastic recycling industry, an important pillar of global sustainability efforts, is currently trying to navigate through troubled waters. Despite a promising long-term outlook, near-term uncertainties and structural challenges have created a difficult business environment for plastic recyclers. As a result of this, many plastic recyclers have gone bankrupt (examples include Umincorp, TRH, Ecocircle and Ioniqa) and planned investments to expand capacity, including some chemical recycling investments by petrochemical players, are being delayed.

However, new amendments to the Packaging & Packaging Waste Directive (PPWR) adopted by the European Parliament in April 2024, offer a silver lining. They will drive transformative shifts that could unlock significant value for those prepared to act ahead of the curve. This evolving landscape presents a dual agenda for industry executives and investors: handling immediate challenges while positioning for future growth.

This article describes the reasons of the foreseen plastic recycling capacity shortage and outlines strategic investment opportunities in the industry to reduce this shortage, relevant for industry participants as well as external investors.

A Market Under Pressure: Current Developments

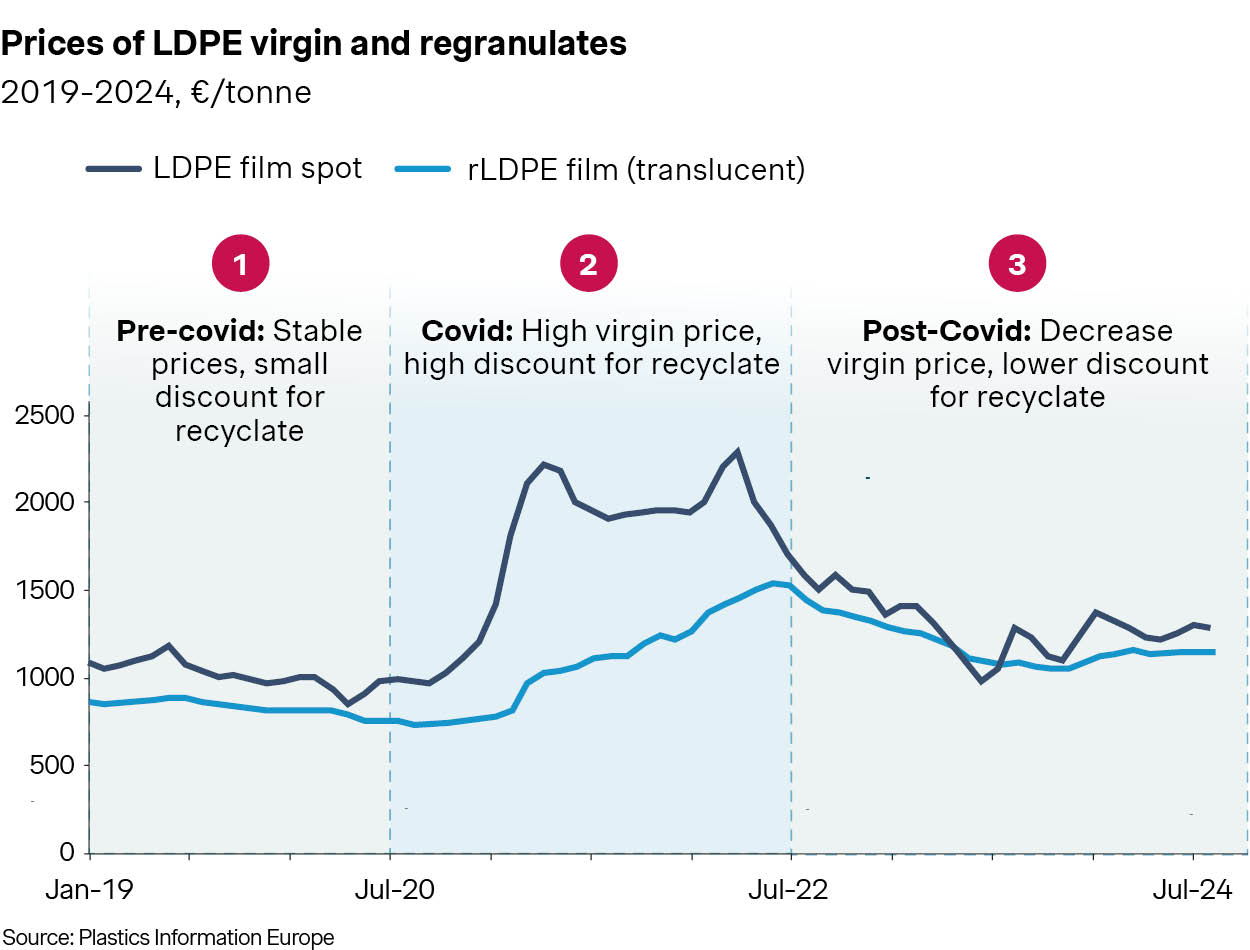

The plastic recycling market offers a promising long-term outlook but is grappling with considerable short-term challenges, driven in part by the volatile pricing of both virgin and recycled plastics.

In the post-pandemic period, virgin plastic prices have dropped dramatically versus the COVID peak, falling to historically low levels in real terms (i.e. net of inflation). As recyclate prices are still closely tied to virgin prices, they too have fallen significantly.

Current low recyclate prices pose significant challenges for recyclers, as the cost base for producing high-quality recycled plastics is higher than that of virgin plastic production, which benefits from higher production maturity and immense economies of scale. On top of that, energy and labour costs have grown dramatically. This dynamic puts pressure on margins across the recycling sector, undermining incentives for investment and expansion.

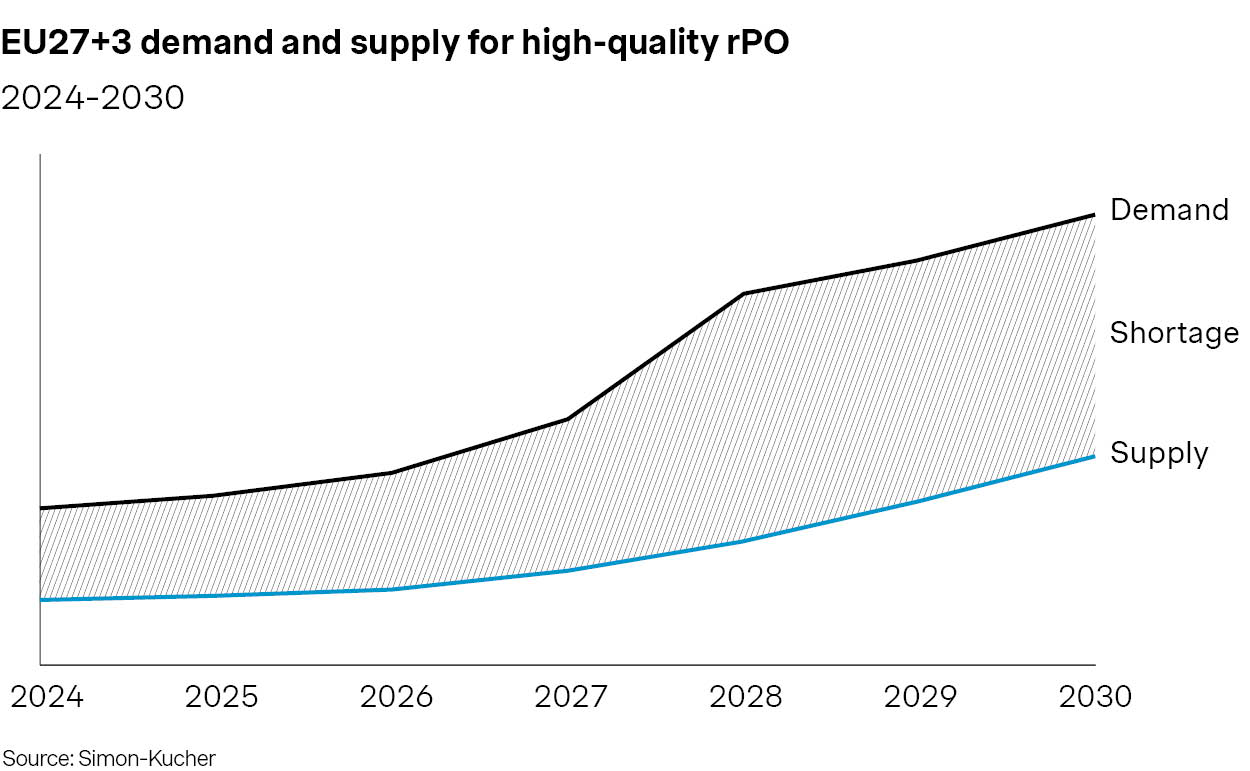

However, the EU’s recently adopted ambitious Packaging and Packaging Waste Directive (PPWR) is set to transform the landscape by driving demand for recycled content. By 2030, 35% of non-food plastic packaging and 10% of food plastic packaging must consist of recycled content (“the mandatory content requirements”), significantly up from the ~9% current use of recycled content in packaging. The PPWR's targets will spur growth in the recycling sector, with an expected increase in demand for high-quality regranulates in particular.

However, we expect this surge in demand to materialize in the years 2027-2028 rather than immediately. Four key challenges are delaying momentum:

Price Disparity with Virgin: Virgin plastics remain more cost-competitive than recycled alternatives, as high-quality regranulates (i.e. transparent) trade at a price premium versus virgin. The EU market is flooded with cheap supply of virgin material from China and the US, driven by low oil prices and less stringent sustainability regulations in these regions.

Regulatory Uncertainty: Ambiguity around the feasibility of the mandatory content requirements targets and the timing and strictness of their enforcement creates hesitation among companies about investing in recycled materials and infrastructure.

Quality Gaps: Despite advances, most recycled materials still fall short of virgin plastics in key attributes on quality, increasing production complexity for plastic converters and brand owners, especially for premium packaging.

Fragmented Market Structure: The plastic packaging market is very fragmented. The absence of a dominant market leader hinders collective action among brand owners, thereby limiting the progress in recycled packaging adoption.

In 2022, recycling capacity was projected to triple by 2030. The challenges, however, have led to an approximate 25% reduction in these projections, either due to bankruptcies of recyclers or delayed investments in capacity expansion, resulting in an even bigger supply-demand gap in 2030. This shortfall is expected to grow substantially from 2027 onwards, as demand for recyclates begins to rise but capacity lags. By 2030, a significant shortage of recycled plastics is anticipated, highlighting the urgent need for strategic action.

Long-term Outlook

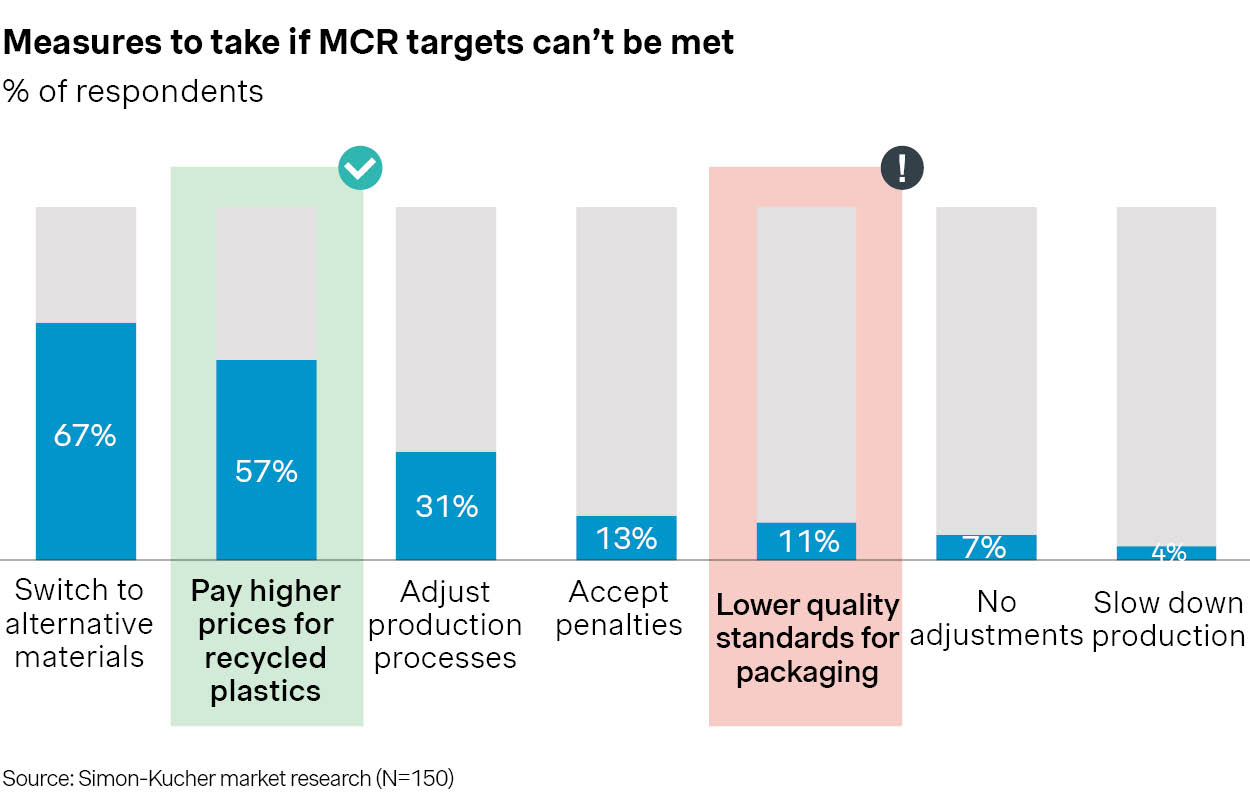

The increasing capacity shortage underscores a highly promising long-term (post 2030) outlook for the plastic recycling market, as both demand and prices for recylcates are expected to increase dramatically. For brand owners, packaging plays a pivotal role in conveying their premium positioning and safeguarding brand equity. As a result, they are often reluctant to compromise on quality of input materials, even as the PPWR introduces mandatory content requirements for recycled plastics.

Simon-Kucher market research among 150 plastic packaging experts (in September ’24) shows that instead of accepting lower-quality packaging or altering production processes to accommodate lower-grade inputs, brand owners are expected to prioritize procuring high-quality recyclates. As the PPWR deadline approaches, this focus on quality will likely lead to a willingness to pay premium prices for high-quality recycled materials. This looming supply-demand gap will drive price up even further. We expect this ultimately leads to significant price premiums for recycled material of c. 25-50% versus virgin material for non-food packaging and even (significantly) higher premiums for food packaging.

For brand owners, transitioning entire packaging operations to alternative materials like bio-based plastics or cardboard can be cumbersome. Bio-based plastics remain in early development and are not yet ready to scale to levels of industrial production, while functionalities of cardboard packaging are limited. Moreover, incorporating recycled plastics offers a substantially greater reduction in CO2 footprint, making it a more impactful and practical solution to achieving sustainability goals than switching to alternative materials.

(Investment) Opportunities Across the Recycling Value Chain

With the backdrop of this positive long-term outlook, the plastic recycling sector remains an interesting area for investment. Opportunities span the entire value chain, from operators (e.g. recyclers, sorting companies, and waste collectors) to suppliers of these operators (e.g. equipment manufacturers, plant contractors & builders, and digital waste management companies)

1. Scaling operators in the recycling industry

Investment case: Brown-field investments in capital intensive operators

The anticipated increase in recyclate demand underscores the urgent need for capacity expansion. All types of operators (e.g. recyclers, sorting companies, and waste collectors) tend to be asset-heavy and require a lot of capital to scale. Investors ready to act strategically should invest now to be well-positioned for the growing demand in 2027-2028.

The operator landscape in Europe is very fragmented, presenting attractive opportunities for buy-and-build and professionalization of operations. With rising recyclate demand, a scramble for feedstock will take place amongst recyclers. As a result, feedstock costs are expected to increase. Since feedstock represent a substantial part of a recycler’s cost base, consolidation among recyclers is inevitable. This trend presents an opportunity for equity investors with a longer horizon to back consolidators that create scale advantages and drive cost efficiencies. At the same time, rising feedstock prices present an attractive potential for waste collectors and sorting companies.

Relevant for:

2. Operator suppliers

Investment case: Brown-field investments in easily scalable suppliers

Operator suppliers, including equipment manufacturers, plant contractors, and digital waste management companies, play a crucial role in supporting operators within the recycling value chain, such as recyclers, sorting firms, and waste collectors. These companies provide the infrastructure and technology essential for advancing recycling capabilities.

Unlike operators, these suppliers typically require less capital for growth, making them more nimble and easier to scale. With the rising demand for high-quality recycling solutions, these businesses are poised for significant expansion. For private equity investors, secondary recycling assets present attractive opportunities, offering potential for high returns with lower capital intensity, aligned with the global shift toward sustainability.

Relevant for:

3. Embracing Technological Innovation

Investment case: Green-field investment capital for asset-heavy operators

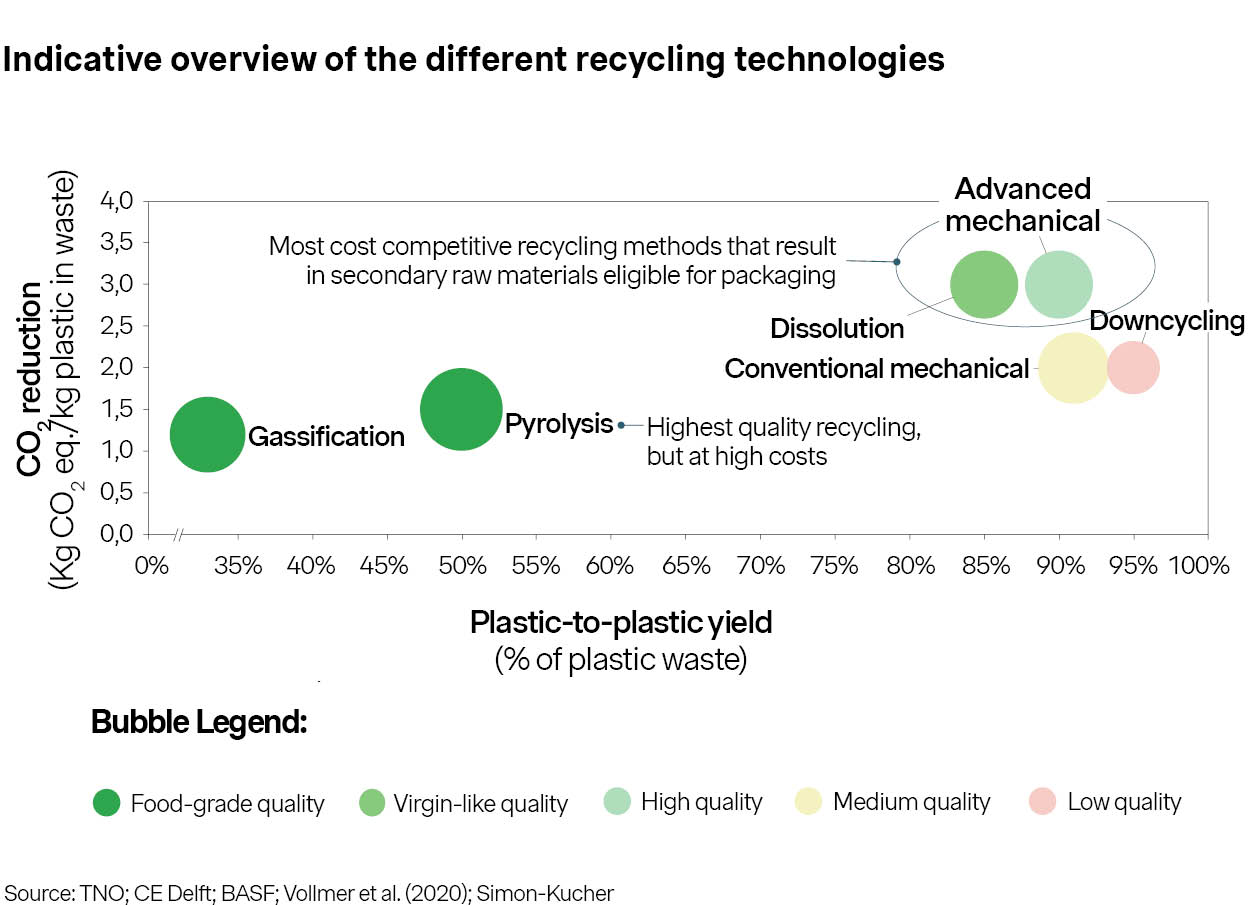

Emerging recycling technologies offer a promising solution to many of the sector’s current challenges. For instance, advanced and innovative recycling methods (e.g. Pyrolysis, Gasification and Dissolution) can process complex plastic waste streams that are difficult to handle through conventional or advanced mechanical recycling. These innovations enable higher recovery rates and open up new possibilities for industries that require specific material properties. Strategic investment in these technologies can position stakeholders as leaders in the next phase of the recycling revolution.

Moreover, these technologies require new and innovative feedstock preparation techniques like pre-treatment and post-sorting. These techniques enhance feedstock quality and, consequently, the quality of recyclates. Pre-treatment processes are pivotal in reducing contamination and ensuring that plastic waste meets the stringent requirements for chemical recycling. Post-sorting, conducted at incinerators, is unlocking substantial opportunities by separating plastics from residual household waste, diverting them from landfills or incineration to advanced recycling streams.

Relevant for:

Conclusion: A Call to Action

The plastic recycling market is at an inflection point. While short-term challenges like low plastic virgin prices, capacity constraints and rising feedstock costs pose significant risks, the long-term outlook remains decidedly positive. For investors and industry leaders, this is the moment to invest in capacity, quality, and innovation and be best positioned to thrive in the PPWR era.

Those who take a proactive approach can not only navigate the current turbulence but also emerge as frontrunners in the sustainable transformation of the recycling sector. Let this moment of uncertainty be the catalyst for bold, strategic action that drives long-term growth and impact.

PE Breakfast Roundtable on Balancing Profit and Purpose

To further discuss the dynamics of balancing sustainability with profitability, join us at our PE Breakfast Roundtable for an in-depth discussion on how businesses can bridge the gap between purpose and profit in today’s evolving landscape.