As sustainability has gained momentum across industries, consumers are adopting diverse approaches to integrating environmental consciousness into their everyday lives. For banks and financial institutions, understanding these behaviors is critical to remaining relevant and aligning their value propositions with customer needs. This is where the concept of sustainable consumer archetypes becomes relevant.

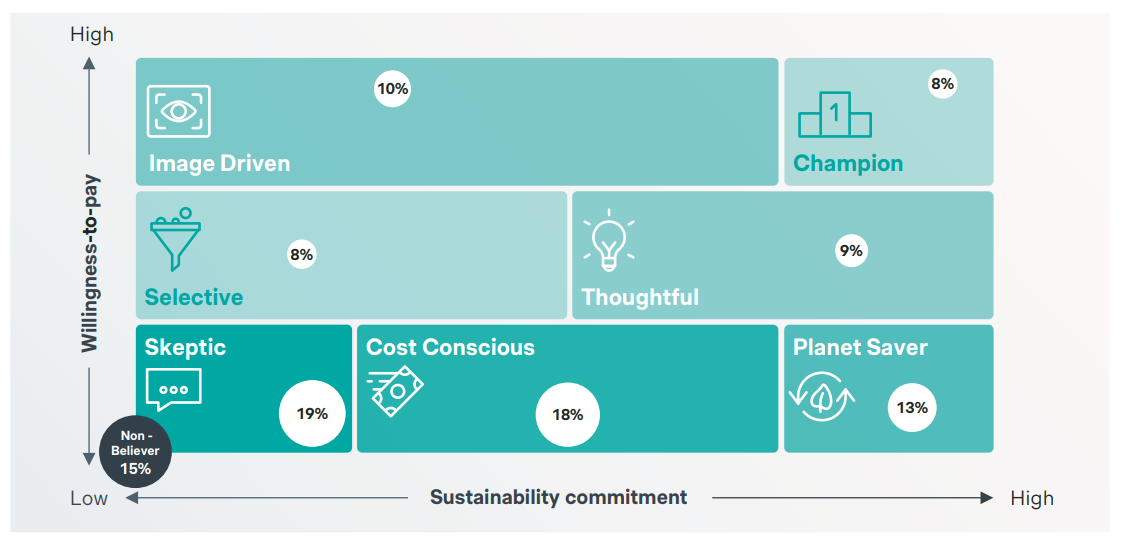

In our recently published book, The Demand Revolution, we introduce eight distinct sustainable consumer archetypes that reflect how individuals navigate sustainability via purchasing choices and behaviors. These archetypes, illustrated below, offer a framework for segmenting and understanding the diversity of consumer attitudes towards sustainability in a way that is both actionable and insightful.

The archetypes are not specific to the preferences toward sustainability in financial services. Yet, we see clear strategic takeaways on how banks and other financial institutions can effectively engage with them.

This article focuses on four of these archetypes, diving deeper into their characteristics and presenting tangible examples of relevant financial services value propositions for each segment.

Champions

For champions, sustainability is a top priority in purchasing decisions and they are ready to pay a premium when necessary. Champions prioritize sustainability over brand loyalty, diligently research each purchase, and hold companies accountable for any misleading claims.

This is evident in our consumer research showing that 23-28% of consumers are willing to forgo a share of their investment returns if assured their investments are environmentally sustainable. While this willingness is not limited to champions, they exemplify this behavior most strongly. For banks and financial institutions, this presents a significant opportunity to engage sustainability-focused consumers by:

- Focusing on offering sustainable investment products, such as ESG funds, green bonds, and impact-driven portfolios.

- Providing transparency on the environmental and social impact of investments or personal spending through detailed performance reports and impact trackers.

Planet savers

This consumer archetype is highly engaged in sustainable lifestyles, consistently researching products, and making eco-conscious choices. They believe that sustainable options should not cost more but be the standard.

Planet savers seek ways to reduce their footprint creatively by choosing long-lasting items, reducing consumption, and opting for secondhand options when feasible. Ultimately, financial institutions can connect with them by:

- Promoting products that reward repair over replacements, e.g., within the insurance product space, thereby encouraging reduced consumption.

- Marketing and advising with transparent and factual gains around sustainability in investments and retail banking solutions.

Image driven

For this archetype, sustainability is as much about optics as it is about actual impact. Image-driven consumers value sustainability for products that impact their self-image and are open to paying a premium in these categories.

They gravitate towards visible, tangible actions they can share with their networks. Financial institutions can engage with this sustainable consumer archetype by:

- Aligning financial products with a sustainable and trend-relevant lifestyle, e.g., engaging social signaling through gamified initiatives, like carbon-offsetting credit cards.

- Building such value propositions for which image-driven consumers are willing to pay even though the environmental impact may be limited.

Skeptics

As the largest consumer segment, skeptics are not dismissive of climate change but doubt their individual impact and companies’ sustainability claims. Price and quality are more influential than sustainability for this archetype.

Consequently, they demand equal or superior performance. For example, skeptics will prioritize financial returns above sustainability. Financial institutions should aim to engage with them by:

- Avoiding sustainability-heavy messaging in general communication. Rather, focus on offering high-quality products, risk/return performance of investment products, low interest for environmental house renovations, etc.

- Keeping sustainable features as a secondary benefit and maintaining simple, concrete, and convincing impact communication.

Tailoring value propositions and offerings to archetype-specific needs

Understanding the nuances of these sustainable consumer archetypes is only the first step. Banks and financial institutions must tailor their offering and value propositions to meet the unique needs and preferences of each segment. This involves:

- Segment-specific communication: Avoid one-size-fits-all approaches. Banks and financial institutions must do a needs assessment and communicate the sustainable profile on all levels — from complex and detailed to simple and concrete. Skeptics demand performance-first offerings, while champions need impact narratives.

- Product differentiation: Offer flexible products that can be positioned differently based on customer needs — from sustainable investment products to repair-friendly insurance.

By thoughtfully addressing the diverse priorities of each archetype, financial institutions can uphold their relevancy and ensure their value propositions align with specific customer needs. With years of expertise, Simon-Kucher guides banks and financial institutions in shaping their value proposition and product offerings to embrace sustainability. Act now to position your business for a sustainable and profitable future. Reach out to our financial services sector today.

Sources:

Simon-Kucher & Partners (2022). Sustainable Banking: How to serve the sustainable customer. Simon-Kucher & Partners.

The Demand Revolution: How Consumers Are Redefining Sustainability and Transforming the Future of Business (2024). Andreas Von Der Gathen, Nicolai Broby Eckert, Caroline Kastbjerg. The MIT Press.

Simon-Kucher & Partners (2022). 3 Strategies to Successfully Implement Sustainable Banking.