While account-to-account payments have become the norm for peer-to-peer transactions in the UK, they have failed to gain traction for consumer purchases. In this article, we look into the key players needed to drive A2A consumer payments—and how they are missing incentives to do so.

In the UK, account-to-account (A2A) payments have taken off for peer-to-peer (P2P) transactions, but they are only a small fraction of consumer purchases.

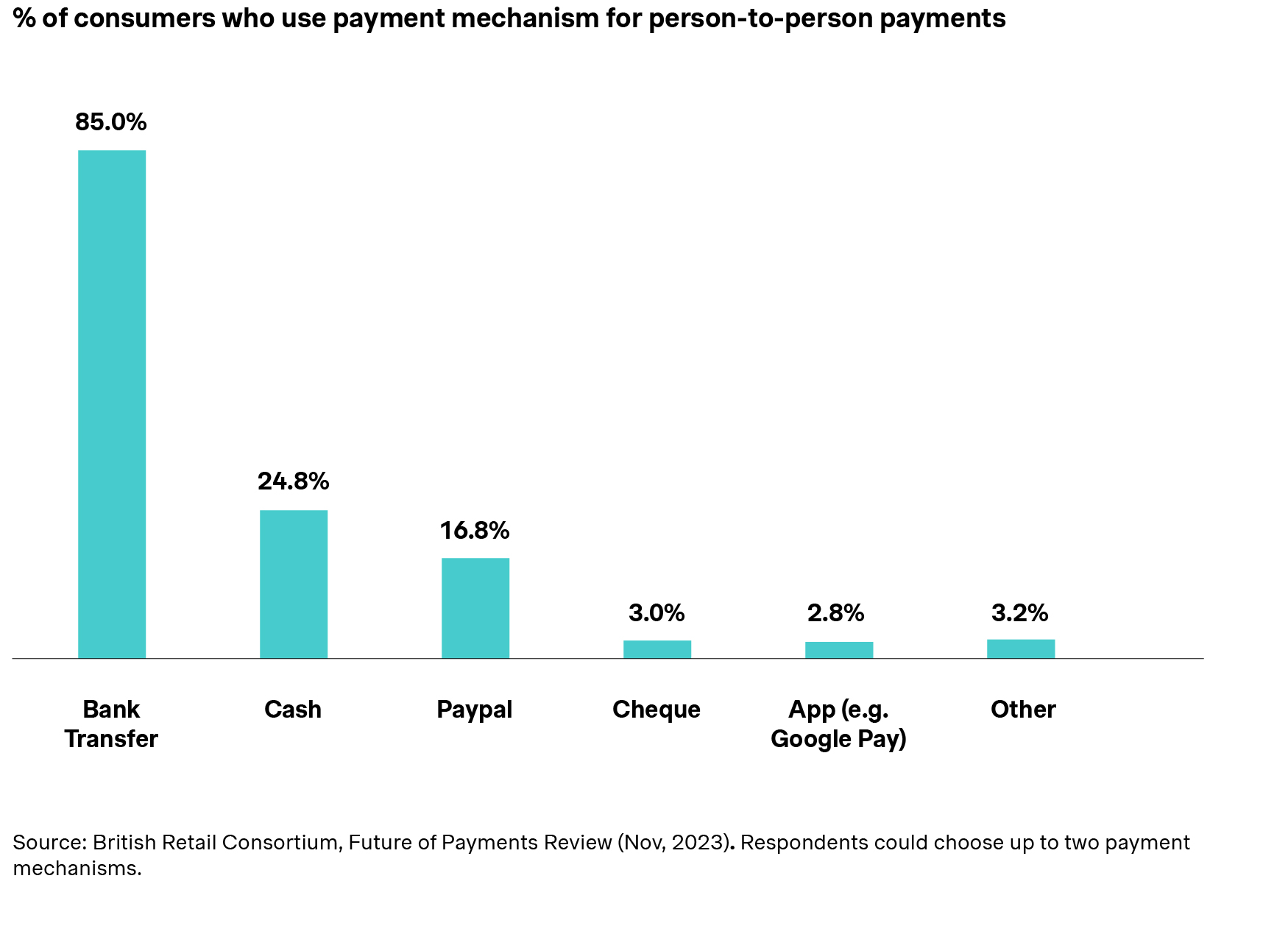

The introduction of Faster Payment System in 2008 and Open Banking in 2017 fueled optimism about the widespread adoption of A2A payments in the UK. Indeed, A2A instant payments have become mainstream for making P2P transactions— 85 percent of UK consumers use bank transfers for these payments.

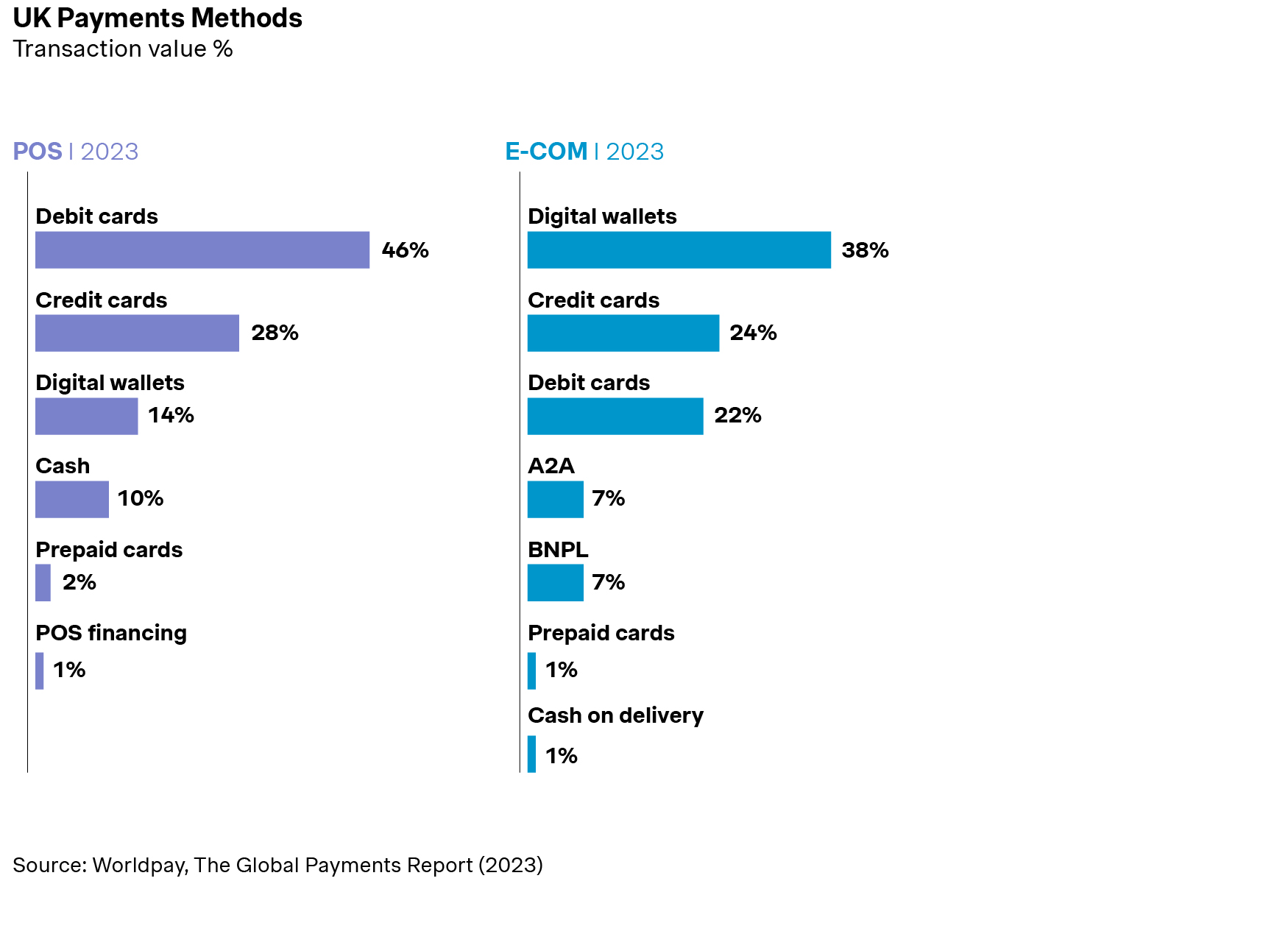

However, for consumer purchases, A2A payments have languished in low single digit share— 2 percent of all transactions value, rising to 7 percent in e-commerce transactions, and almost negligible in point-of-sale.

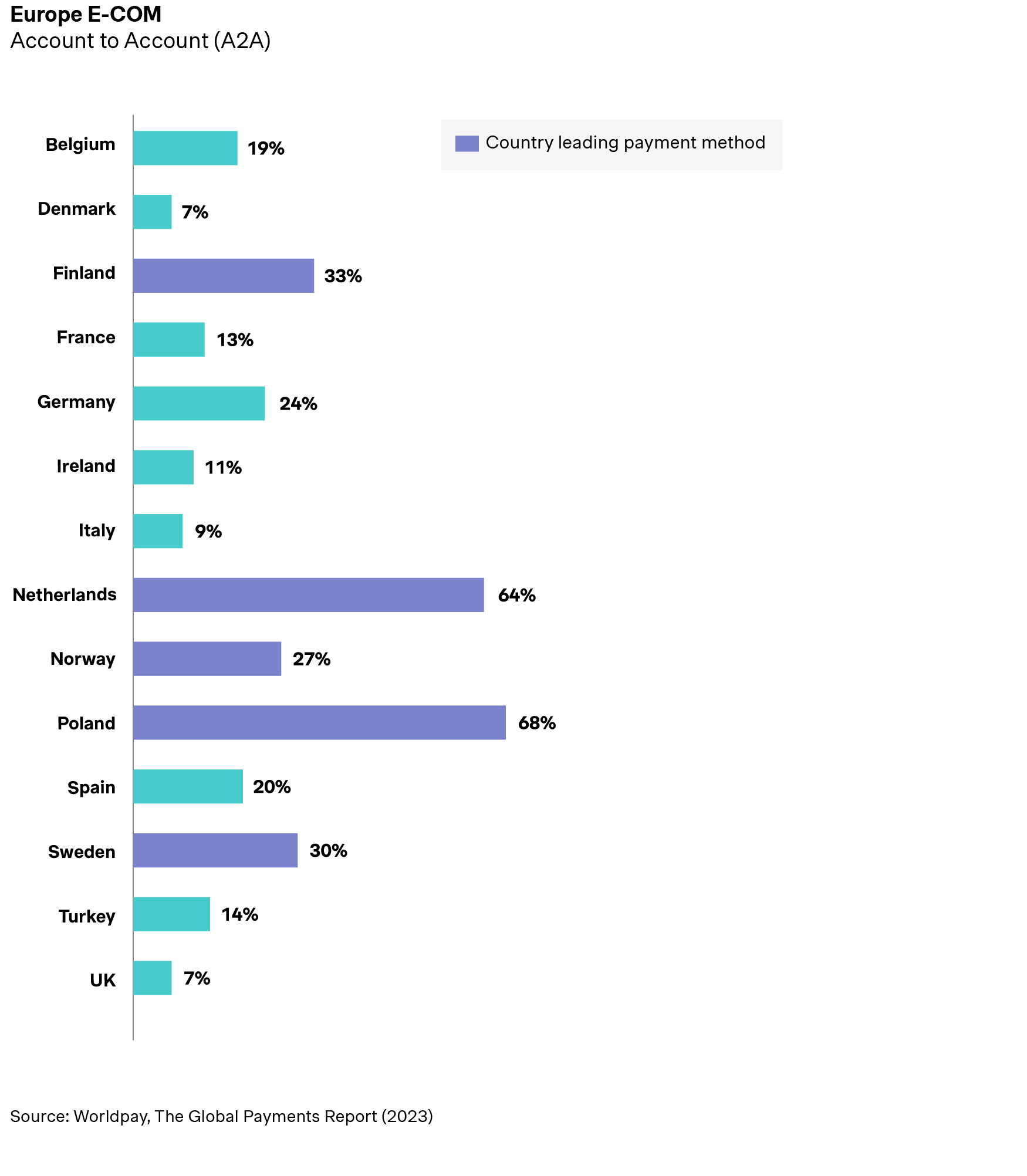

This is in stark contrast with other European countries as seen with the share of A2A in e-commerce transactions in the UK being right at the bottom. In fact, in some of the peer countries, A2A consumer payments have skyrocketed in the last few years and/or are even the leading way of paying for purchases.

Why haven’t A2A payments taken off for consumer purchases in the UK?

A2A instant payments are meant to help businesses receive funds much faster, if not instantly, and generally at lower costs compared to credit and debit cards, providing a distinct advantage over cards. From a consumer perspective, we already see consumers using A2A payment rails for majority of their P2P transactions.

Despite the advantage for businesses and strong consumer usage of A2A payment rails, the natural question arises: why aren’t A2A consumer-to-business (C2B) payments more widespread?

Consumer protection an important factor but not the main reason

Consumer protection, especially absence of chargeback mechanism to protect against fraud, has been cited as a major factor limiting the growth. While risk of fraud is an important factor, it has been largely addressed through safeguards introduced through the APP voluntary code in 2019 and the Reimbursement Rules since October 2024. The latter mandates banks and payment service providers (PSPs) reimburse payments subject to certain conditions. These are in addition to consumers securely logging in to their bank accounts via security codes and/or biometric checks, as well as presence of confirmation of payee before payments are made.

With similar or fewer safeguards, cards—the primary method for C2B payments in the UK—have a chargeback rate of just 0.52 percent.

On account of the fraud prevention protections in place and the observed chargeback rates, fraud prevention represents a valid concern but is not significant enough on its own to account for the lack of traction in A2A consumer purchases.

Consumers see no reason to switch

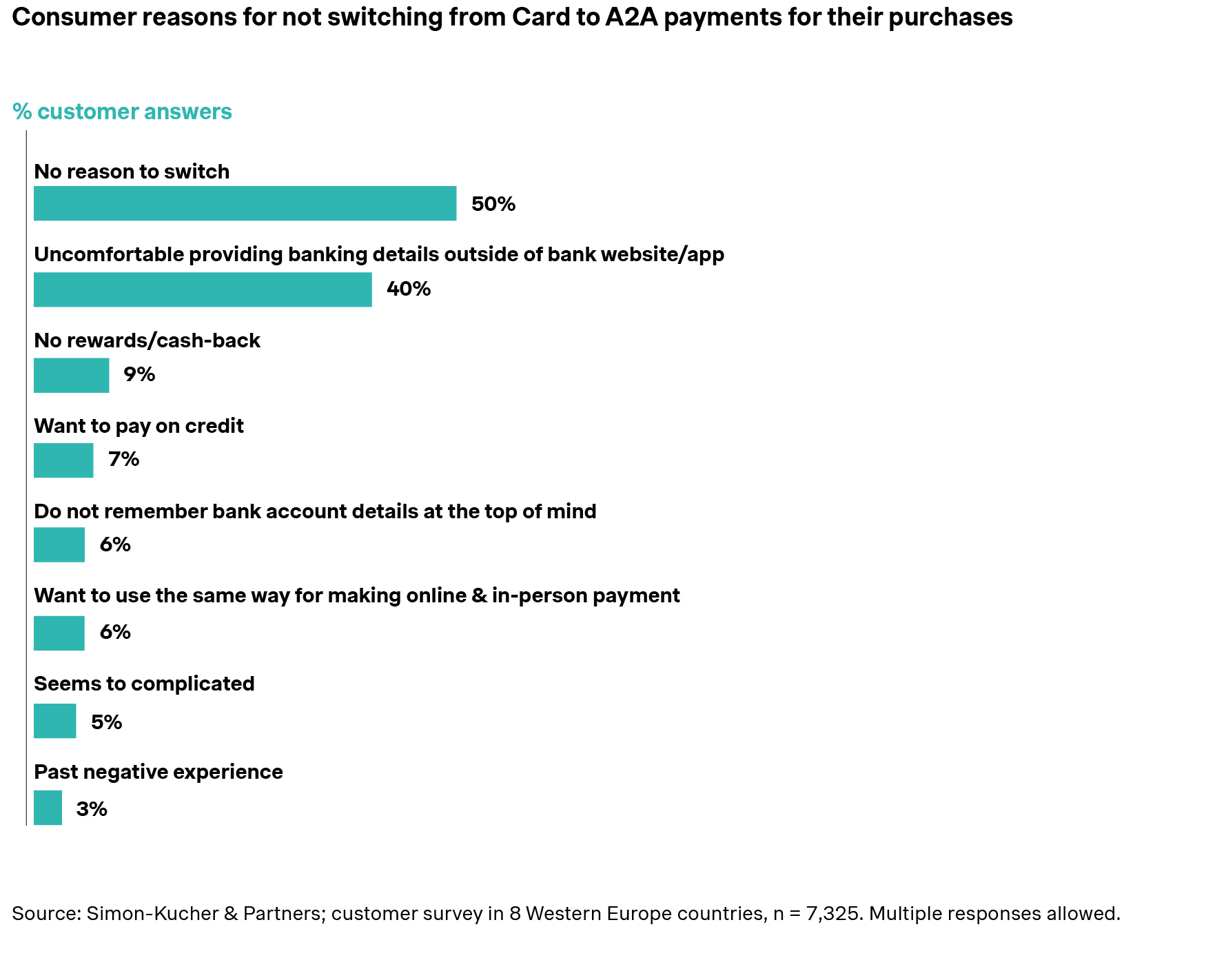

Our survey of European (including the UK) consumer payment habits revealed that cards and digital wallets are popular choices, reflected in the “Great” to “Excellent” NPS scores. These scores were also 50 to 100 percent higher than for A2A payment. Indeed, with “tap to pay” as well as digital wallets, such as Apple Pay, Google Pay, and Link (by Stripe), paying by cards for both in-person and online transactions has become very easy and convenient.

As a result, when we tested the appetite for paying via A2A rails online, it was no surprise that consumers are reluctant to switch from cards. The leading reason for low interest in using A2A payment rails is that consumers see “no reason to switch” from cards, highlighting the lack of perceived value. Another prominent factor identified was consumers being “uncomfortable providing banking details outside of bank website/app”.

To encourage consumers to use A2A rails for purchases, both these obstacles must be removed simultaneously to change their habits.

For the first obstacle, a compelling reason or a set of benefits helps consumers be more agreeable to trying A2A payments and then using them consistently. These reasons or benefits can take the form of cash-back, rewards points, or other distinct advantages such as differed debits (e.g., CB in France or Klarna). In addition, it is critical to ensure a secure and frictionless experience for in-person as well as online payments. Providing these benefits invariably requires a commensurate income stream, which for debit/credit cards is heavily reliant on interchange—an element that does not exist for A2A payments.

Overcoming concerns about banking details requires trust. This can be achieved by banks integrating payment services into a business’s check-out process (e.g., bank buttons in Finland) or developing a stand-alone payment solution that consumers trust (e.g., MobilePay by Danske, Swish by a consortium of Swedish banks). Doing so is an expensive endeavor and any non-government entity undertaking it would need to be compensated sufficiently for it, especially if it also provides consumer incentives.

Banks risk cannibalizing a major revenue stream by promoting C2B A2A payments

In the UK, cards (including via digital wallets) dominate C2B payments and cash contributes to a small share (See Figure 2). With signs of cash as a share of payments stabilizing and showing modest economic growth, the desired big increase in the share of A2A instant payments is expected to come at the expense of cards.

This creates a major problem for banks, which get revenue from cards via interchange. UK banks reportedly earn 10 percent of their personal current account revenue from interchange fees, but this can go over 30 percent for digital banks such as Revolut and Monzo. With more than £1 billion of interchange revenue at stake, banks risk significant losses unless they can monetize C2B A2A payments.

Banks play a major role in overcoming consumer trust issues. But considering the substantial revenue risk involved, they have a natural disincentive to promote these payments.

Payment processors, acquirers, and card schemes support merchants but also risk major revenue loss

PSPs and acquirers play an important role in the payments value chain by equipping businesses with payment methods (including A2A ones) to accept consumer payments. For their services, they make money whenever a card payment is made. For card payments, they also take credit risk (via chargebacks) on the business and make 2x to 3x of interchange revenue on average.

Similarly, card schemes derive the majority of their revenues from card payments processed through their network. Visa and Mastercard have diversified to A2A payments with a series of acquisitions to be on top of the A2A trend. However, a change in the transaction mix from card to lower priced A2A payments poses a revenue cannibalization risk for them.

Unless these players have a monetization mechanism that offsets the expected revenue loss from displacement of card payments by A2A payments, they also have a disincentive to promote A2A payments.

What is required to boost A2A instant payments for consumer purchases?

For a market to successfully grow C2B A2A payments, it needs significant network effects—wherein enough businesses accept these payments and enough consumers pay with them. This requires both businesses and consumers to be equipped and empowered.

With Swish, Twint, Venmo, and a dozen other solutions across the globe, we have seen a consistent formula for success, especially when cards are dominant: build credibility with consumers through P2P payments, before entering C2B payments with the right incentives. They ensured that their monetization model for C2B payments was attractive to at least one type of commercial participant (e.g., PSPs/acquirers), if not more (e.g., banks), to gain market share.

For the UK to achieve A2A consumer payment adoption in a sustainable manner, the right incentives need to be in place to activate the participants in the C2B payments ecosystem—consumers, businesses, banks, A2A payment methods, PSPs, and acquirers. In an ideal setup, the incentives would be centered on monetization models that create alignment across the ecosystem participants and overcome the current dis-incentives to spearhead growth.

About Simon-Kucher

At Simon-Kucher, we bring 40 years of expertise across financial services to help organizations thrive in the rapidly changing payments landscape. As the world’s leading consultancy for commercial growth, our dedicated payments practice helps organizations across the ecosystem—Alternate Payment Methods (including A2A), PSPs/acquirers, card schemes, banks, and infrastructure/software providers, merchants—develop and implement strategies to realize their growth ambitions.

Reach out to us today to start the conversation!