In medtech and diagnostics, a significant share of revenue (typically over 80%) is contracted. Yet, few industry players have developed robust frameworks and processes to manage their contracts. This gap can be attributed, in part, to an environment of continuous price erosion and low focus on refining contract terms—adjusted only in conjunction with new product launches and without price increases.

However, changing macroeconomic environment, persistent inflation, and high interest rates have highlighted the importance of contract management for generating shareholder value. Further, the need for active contract management is also driven by contracting complexity. This includes increased product complexity and configurability, growing importance of software and service sales, and proliferation of innovative models such as (reagent) rentals, pay-per-X, risk-sharing, device-as-a-service etc.

Technological advancements also create new on- and up-selling opportunities during the contract lifetime (e.g., related to over-the-air software updates and digital services). And, as B2B buyers increasingly expect personalized, digitally enabled, and seamless experiences (consumerization of B2B sales), self-service contract overview and management capabilities are becoming more and more relevant. As a result, disciplined contract management has become a critical commercial success factor for the industry.

Which contract management challenges do industry players face today?

Offer configuration, pricing and quoting are often complex activities that must carefully consider all the trade-offs of increased control, centralization, and simplification vs. field team empowerment and flexibility to drive profitable growth. Contract management appears to be a simpler process. That being said, we usually see medtech and diagnostics companies struggle with seven common pitfalls of contract management:

- Absence of a central contract repository: According to Journal of Contract Management, 71% of companies are unable to find at least 10% of their contracts. Medtech and diagnostics firms are no exception: In our experience, contracts are typically found on local drives, isolated SharePoint sites, and even in physical archives—not in a centralized contract management repository.

- Inability to capture the “right” data points: Delivery and payment terms, volume commitments, and penalty and liability clauses are often hidden in walls of text and not easily searchable, which makes managing contract obligations tiresome.

- Unmonitored contract performance: While many companies include customer (typically volume/spend) commitments in their contracts, very few monitor contract performance against these and even fewer actively follow up in case of deviations. Due to the lack of formal monitoring methodology, tracking is often Excel-based and market-specific, which blocks opportunities for scalability.

- Overlooking price increase clauses: Surprisingly, many medtech and diagnostics companies forego revenue opportunities by not activating the already agreed upon price increase clauses in time due to data unavailability, lack of accountability, or both.

- Unrealized up- and on-selling strategies: Especially service and software contracts are often “forgotten” as these are routinely tracked in different systems, and managed by standalone teams, which results in extension money left on the table.

- Issues with contract lifecycle events: Backorders, product discontinuations, and other portfolio changes cause a disproportionate amount of manual work and result in frequent customer complaints.

- Inactive management of contract renewals: Many medtech and diagnostics companies dread the end-of-year period due to scattered contract data (including most basic information such as contract end date and customer notification period) and lack of automation supporting the contract renewal process.

Which benefits can be realized by addressing the challenges above?

- Improved coverage: Tailoring contract management systems to meet specific business needs allows all contracts to be centralized in one accessible system. This ensures no agreement is overlooked, improving data quality and completeness, as well as driving accountability. Best-in-class companies aim for >95% coverage within a centralized contract lifecycle management system.

- Increased effectiveness: Contract management automation enables significant efficiency gains for both commercial and support teams as up to 30% of time spent on contract management can be saved through process simplification and automation.

- Improved efficiency: An end-to-end contract management approach also frees up sales time for customer-facing activities and eliminates delays or misses on contract renewals and indexations, ultimately leading to steady margin expansion.

How can medtech and diagnostics companies reap the benefits of holistic contract management?

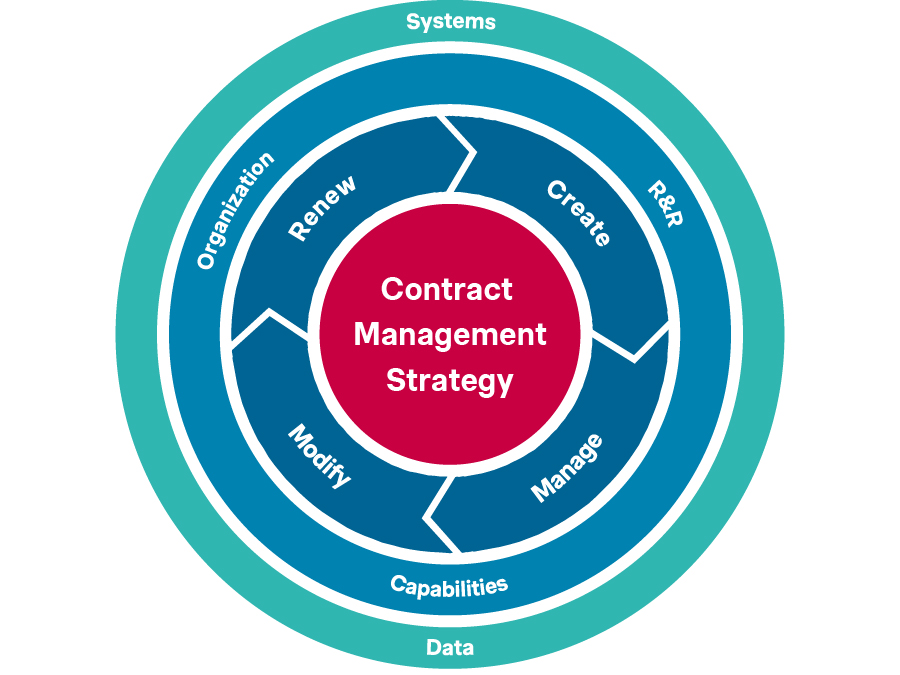

In supporting clients at various stages of their contract management maturity journeys, we put emphasis on the following elements to enable sustainable growth:

- A comprehensive contract management strategy covering different deal types (from one-off cash sales to complex managed service agreements)

- A set of clearly mapped out contracting processes (from contract creation to contract completion)

- A dedicated organization with explicitly defined roles and responsibilities and strong capabilities

- A robust contract data and system backbone that facilitates the process

Figure 1: End-to-end contract management framework

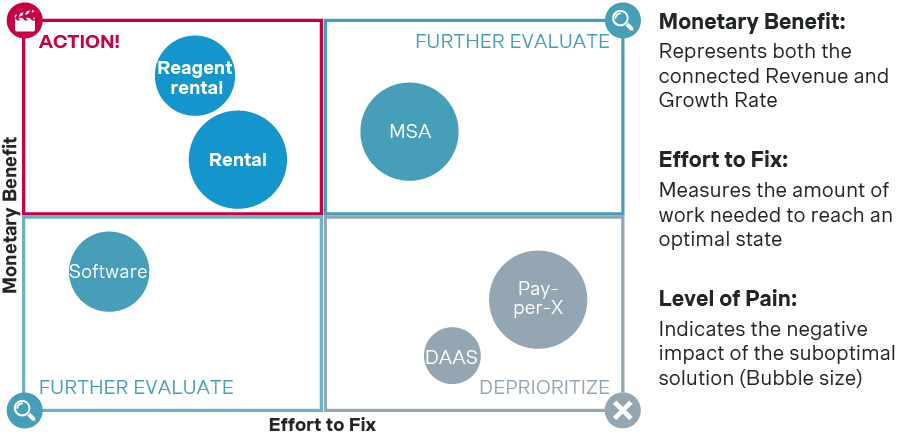

Contract management strategy begins with mapping out different contract types and conducting a thorough evaluation to decide which of these should be considered when determining the requirements for contract management processes, organization, and technology.

“Cash” sale is no longer the only contract type applicable. As both product and customer sophistication increases, medtech and diagnostic companies are increasingly seen engaging in complex contractual agreements such as, for instance, MSAs. Mapping out these contract types, understanding their importance (in terms of current revenue share, growth dynamics and strategic relevance) for your organization, and identifying specific requirements posed by each of them is a good first step towards building a robust contract management approach.

Ultimately, an efficient contract management strategy relies on a set of strategic trade-offs—a process and systems setup must fulfill the requirements of strategically important, large, growing business models to the best extent possible, while aiming for an efficient approach for the “long-tail”.

Figure 2: Example of a contract type prioritization approach

Contract lifecycle process mapping brings clarity and consistency on the execution side.

When working with contract management processes, consistent terminology must be introduced so that all teams are clear on contract statuses (e.g., “draft”, “active”, “expired” etc.). While this seems straightforward, we often see large organizations overcomplicating the status mapping and ending up with 10+ different statuses and little clarity on the differences between those.

Contract creation is a critical first step in the contract management process. We see organizations of different sizes and maturity levels struggle at this stage due to several typical reasons:

- Many organizations lack clear definitions of “quotes” and “contracts”, which causes confusion and misunderstanding between customer-facing sales teams and contract management and/or legal teams.

- Contractual terms are often negotiated offline without receiving necessary approvals. This leads to multiple issues including limited transparency on key terms such as price increase or liability clauses.

- It is not uncommon for medtech and diagnostics companies to overcomplicate the contracting process, asking their customers to sign multiple documents at different stages—and rarely succeeding in getting formal acceptance on all terms in due time.

Given these typical pain points, we believe that medtech and diagnostics companies must pay increased attention to contracting discipline to ensure long-term commercial success. A streamlined process that is transparent for all parties (internal and external) secures the right balance between level of control, flexibility to accommodate customer-specific demands, and execution efficiency. This typically relies on prioritizing critical contractual terms and ensuring these are approved early in the process, while leaving flexibility for contract redlining on the remaining terms to accommodate customer demand.

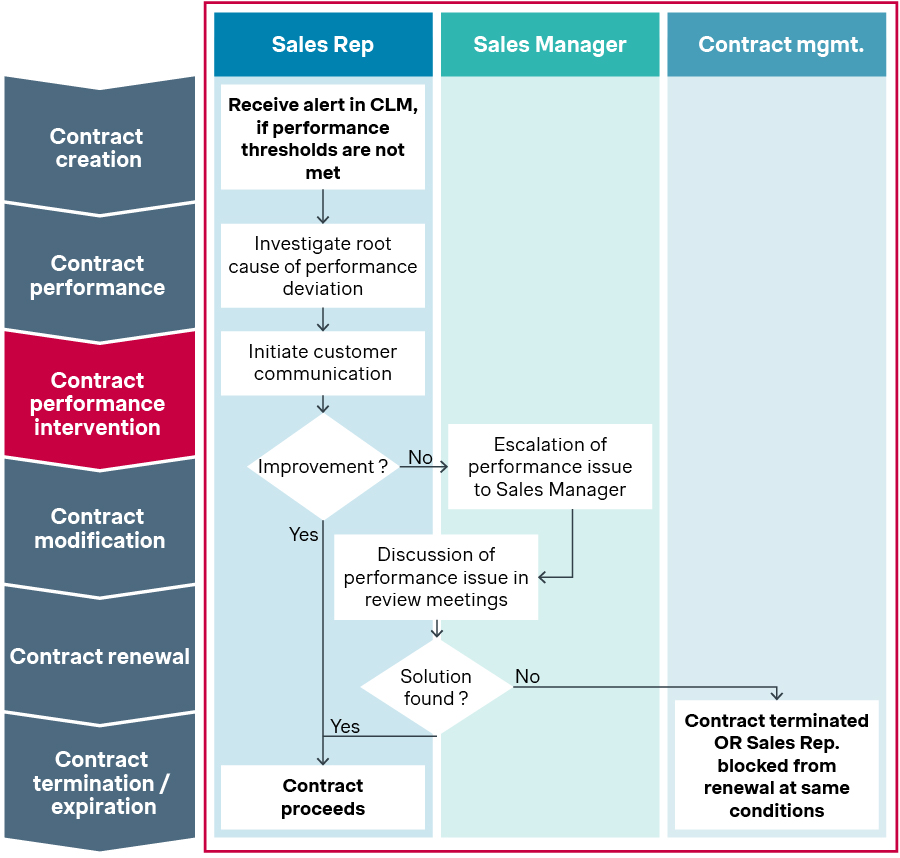

Proactive contract management does not end with getting the signature. More often, contracts in the industry include commitments of diverse types and performance-based clauses. These are especially pronounced for agreements where capital equipment is placed at the customer site for free / at a reduced price in exchange for a commitment to buy a certain volume of consumables (i.e., commodato/RRP deals).

Contract compliance monitoring is one of the most common pain-points we uncover when assessing the contract management process in medtech and diagnostics. Many firms do not have a formal approach to tracking contract performance, others deploy clunky, resource-intensive, and Excel-heavy processes with limited success. We strongly believe that commercial success requires a systematic contract management approach that automates the performance monitoring piece, connects to other parts of the contract lifecycle (e.g., by requiring additional approvals to extend underperforming deals), and allows the commercial teams to narrow down the focus to contracts that require a thorough assessment—as outlined in Figure 3 below.

Figure 3: Exemplary process map (focus on contract performance intervention)

A structured contract modification process frees up a significant share of sales teams’ time and reduces customer frustration.

As a first step, all contract modifications should be clearly classified into changes with material impact on commercial relationship between the parties (e.g., adding a new product line, changing volume commitments etc.) and other changes (e.g., executing upon the agreed price indexation, linking new transactional accounts, adding a substitute produce in case of back-order etc.). Best-in-class companies then follow a guiding principle suggesting that commercially relevant modifications are conducted by customer-facing teams, while all other changes are either fully automated or executed by support teams. These companies also clearly map out the impact of each change on contractual documents, which allows for automatic contract annex / customer notification generation. This stepwise approach helps capture the efficiency gains from automation and minimizes the legal risks related to commercial operations.

The contract renewal process encompasses all activities leading up to contract renewal. We see three pre-requisites of setting up a successful contract renewal process.

- Ensure that all teams are aligned on contract status definitions. Especially at contract end, this is critical as teams frequently get confused with seemingly similar contract statuses such as expired vs. terminated. Deliberate use of contract status mapping can facilitate coordination, prevent confusion, and decrease associated errors.

- The renewal process should be designed in a way that allows the commercial teams to focus on where it matters most. In practice, this means automating and/or allowing mass-updates for simple deal renewals and developing a robust review process for complex deals (linked to contract management capabilities) that ensures maximized revenue.

- A consistent checklist must be used for all deals that end up being stopped. This ensures that all the necessary actions are taken—e.g., sending out the required documents as well as picking up the equipment or consignment stock.

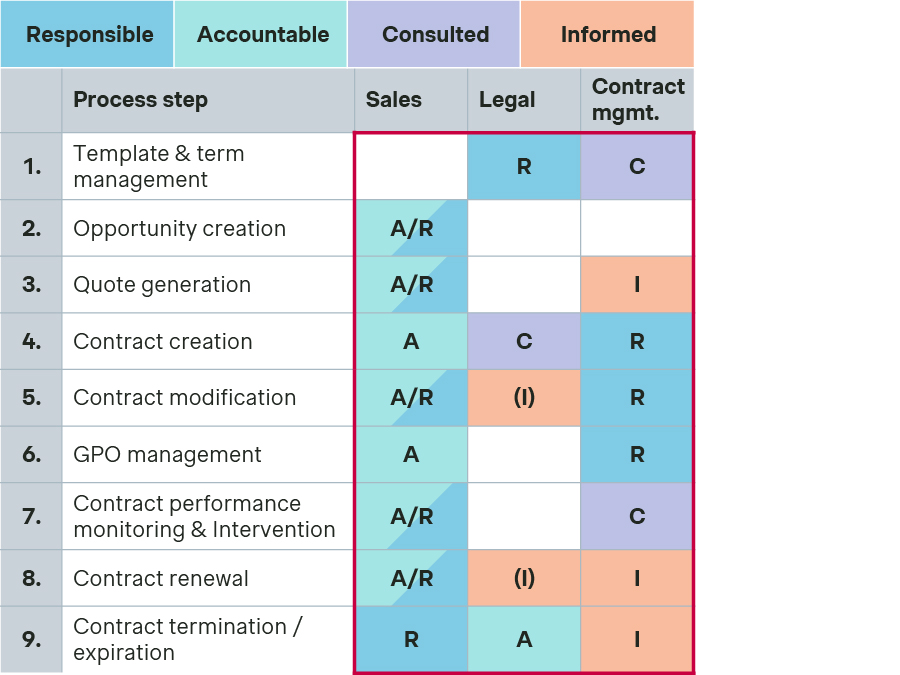

Contract management organization brings processes to life. A top-class contract management team stands on three pillars: organization, R&Rs, and capabilities.

Not all organizations have a dedicated contract management team. Further, contract management is rarely a standalone function. In our experience with medtech and diagnostics companies, we have seen contract management professionals reporting to a broad spectrum of leaders including global commercial, legal, customer service leads, and local managers. While there is no one-size-fits-all solution, establishing a dedicated team typically improves contract management discipline and helps free up sales time. It is important, however, that contracts team is not treated as a “back-office”. An effective contract management organization benefits from a strong link with sales teams as well as the presence of global process owners that can drive process quality and efficiency despite market differences.

A clear mapping of roles and responsibilities is another pre-requisite of contract management success. Once the CLM process is documented, responsible, accountable, informed, and consulted parties should be defined for each taxonomy level - from general level 1 processes (see Figure 4 for an example) to individual tasks (e.g., “create a new contract template request”). Similar to the organizational structure topic, while each company approaches the split of activities differently, there are a few good practices to keep in mind while developing a process taxonomy for contract management:

- A clear split between sales and support roles is needed on all taxonomy levels—this helps avoid duplication and process gaps.

- Sales ownership must be enforced for critical areas such as capturing contract data points and commercially relevant modifications. While these are often seen as “administrative activities” by commercial teams, our experience shows that this is the most effective way of maintaining both commercial excellence and customer satisfaction through data integrity.

- Companies must take an end-to-end quote-to-cash perspective and consider both upstream (e.g., quoting) and downstream (e.g., order management and invoicing) processes when working on CLM.

Figure 4: Exemplary contract management RACI

In the age of automation and AI, team capabilities should not be overlooked. While it is true that many traditional contract maintenance activities can now be effectively automated, increased contract complexity calls for nurturing new capabilities linked to legal and accounting expertise within the contract teams.

Not to forget, a scalable, future-proof approach to contract management requires a strong data and systems backbone. As it stands now, many medtech and diagnostics companies do not use specialized software for contract management. However, industry leaders are shifting from a patchwork of SharePoint/Teams folders, local Excel tools, and homegrown solutions towards professional contract lifecycle management (CLM) software.

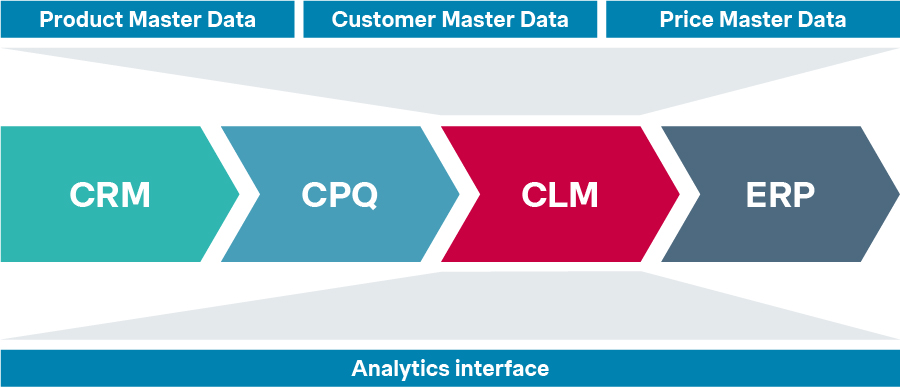

Figure 5: Illustrative contract management data and system architecture

We advise our clients to keep the following aspects in mind when developing their contract management requirements and selecting the CLM vendor:

- CLM system design must follow the CLM process. We often see organizations jumping straight into IT implementation without doing the process groundwork first. Typically, this results in excessive customization further down the line, budget and timeline overruns, and poor user adoption. Best-in-class companies, on the contrary, develop CLM requirements in a way that optimally supports the desired process.

- Mapping key interfaces early on is also worthwhile. A CLM would receive inputs from configuration, pricing, and quoting (CPQ) software and push data into the ERP. CLM data also serves as an input into analytics. Therefore, CLM software decisions should never be taken in isolation. An end-to-end revenue management view should be employed to ensure high performance, seamless user experience, and data integrity.

- A structured approach to requirements definition, which allows to group requirements into capability groups, is recommended. This helps strike the right balance between achieving the required level of detail (typically hundreds of individual requirements) and keeping the big picture in mind, i.e., being able to compare different vendors and implementation options on key criteria such as copy and version control, approval workflow, and redlining capabilities.

- Non-functional requirements must not be forgotten. While these seem trivial, system limitations such as data storage limits, contract line number limits, processing times, etc. can make or break a CLM implementation.

- Different user groups and personas should be mapped, and user roles should be clearly defined. As healthcare contracts become more complex, new stakeholder types (legal, finance, supply chain, etc.) are increasingly involved in both contract negotiation and execution stages. CLM frontrunners create smart approval matrices and workflows to ensure these functions are involved where needed without prolonging the cycle time and overloading the organization.

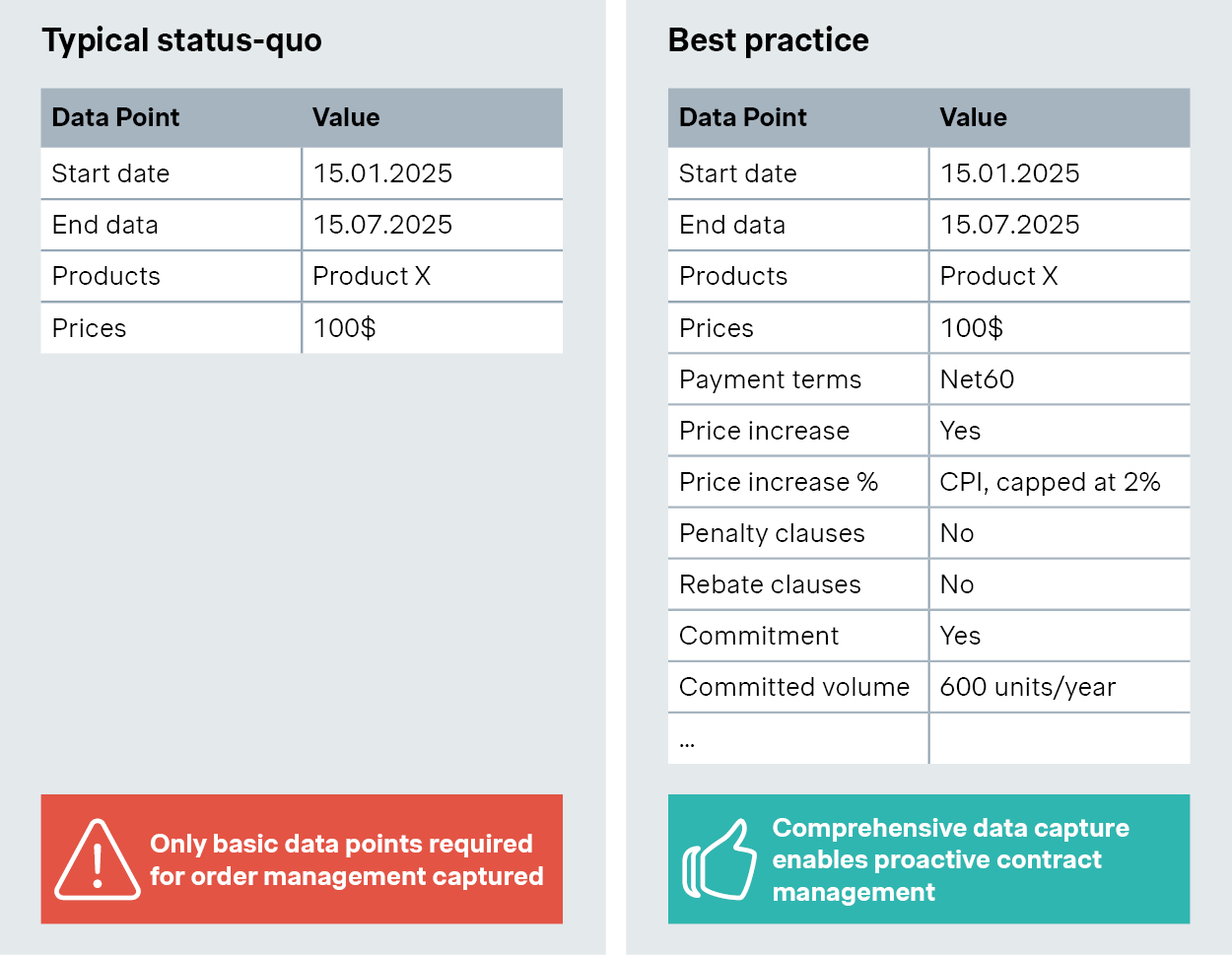

On the data side, identifying the most recent versions of all active contracts and collecting them in a centralized, protected environment is a must. Further, a thorough mapping of contract data points is needed to facilitate efficient and effective contract data analysis, e.g., being able to quickly find all contracts ending next month, all contracts with non-standard payment terms, contracts with penalty risks, etc.

Once the key data points are identified, it is important to capture them consistently. Figure 6 provides a side-by-side comparison of a typical approach to contract data capture in medtech versus a best practice approach. To maximize the utility of a contract database, it is crucial to extract all data points relevant to each stage of the contract’s life cycle. Maintaining this structured approach when adding new contracts to the contract management system not only enables proactive contract management but also advanced contract analytics, e.g., identifying regions / businesses and teams that most frequently deviate from standard contractual terms and taking corrective measures.

Figure 6: Contract data capture: Typical status-quo vs. best practice (illustrative)

It is important, however, that (1) most fields are populated automatically (ideally, sales and contracts team should not be able to adjust terms “offline” as contract configuration is facilitated by the CLM system,) and (2) if mandatory manual input fields exist, their quantity is minimized, and a robust process is put in place to track completion rates. This helps strike the right balance between cycle time reduction and data capture.

Finally, standard contract terms for different contract types must be maintained and regularly updated, as this saves time for all involved parties and enables the use of terms and conditions as one of the instruments to drive commercial strategy.

Multiple medtech and diagnostics companies struggle with contract repository build-up. Contracts are stored on shared drives with limited information captured in a structured way. With contract numbers reaching tens of thousands for major players, lack of resources is often mentioned as a reason for no action. However, with the latest advancements in optical character recognition (OCR) and generative AI, digitizing contract information has become significantly less resource intensive.

Apart from the contract data, high-quality customer, product, and pricing master data are key enablers for contract management success. For instance, management of complex and multi-level GPO agreements relies on a consistent approach to classifying customer accounts, while contract update and maintenance processes are often triggered from product master data updates (e.g., when a product reaches the end of the lifecycle and is replaced by an alternative).

Optimizing end-to-end contract management for long-term growth with Simon-Kucher

Simon-Kucher is a proven thought leader in end-to-end revenue management. We have supported multiple medtech and diagnostics companies of different sizes on revenue management transformations with a specific focus on building robust contract management organization, processes, and technologies.

Contact us to learn more about best practices on contract management and how Simon-Kucher can help your organization drive revenue management excellence and unlock sustainable growth.

Stay tuned for more to come on Revenue Management Systems.